- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Buffett's company hits a trillion-dollar valuation, with stocks surging nearly 30% this year. What c

On Wednesday morning local time in the US, the “stock god” Buffett, who is about to celebrate his 94th birthday this week, achieved a historic achievement - Berkshire’s market value officially stood at $1 trillion for the first time, highlighting investors’ confidence in the enterprise group built by the well-known investor Buffett in nearly 60 years. What’s more noteworthy is that this is the first non-tech company in the US to enter the trillion-dollar club.

At the close of the day, Berkshire’s stock price has risen more than 28% year-to-date, surpassing the 17.5% increase in the S & P 500 index over the same period. The company’s Class A stock rose 0.75% on Wednesday, closing at $696,500 per share.

The significance of Berkshire’s market value exceeding one trillion US dollars

Berkshire’s market value has exceeded one trillion US dollars, undoubtedly a moment of epoch-making significance. Among the world’s largest companies by market value, technology companies have always dominated, and Berkshire, as a company mainly engaged in insurance and diversified investments, has achieved such brilliant results, fully demonstrating its strong strength and excellent investment vision.

This achievement not only shows that Buffett’s “old-fashioned” business philosophy is still shining in the new era, but also leaves an unforgettable question for the current market: why break through 1 trillion now?

Powell’s speech last week further raised the possibility of the Federal Reserve cutting interest rates in September. This policy expectation has further boosted market confidence, and Berkshire Hathaway naturally benefited from it, with its stock price rising. In addition to the impact of interest rate expectations, the company’s current growth is also related to Buffett’s recent developments and financial reports.

Buffett increases portfolio adjustments to optimize investment portfolio

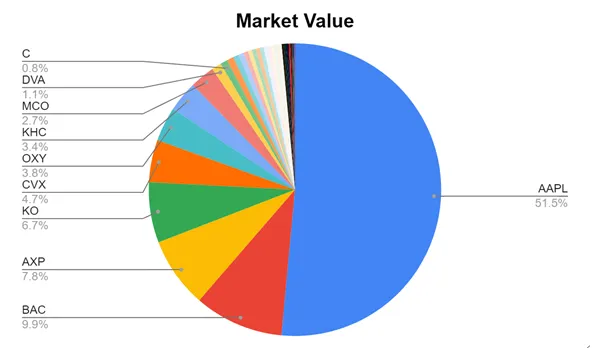

Buffett has been adjusting his investment portfolio recently, and the overall size of his US stock holdings has shrunk, while the proportion of cash held has increased again . As of June 30, 2024, Berkshire’s total US stock holdings were $2799.69 billion, down about $51.70 billion from $331.68 billion at the end of the first quarter, and it has been a net sale of stocks for seven consecutive quarters. Berkshire’s cash reserves continued to hit a new high in the second quarter, reaching $276.90 billion, which will generate stable income in the current relatively uncertain macro environment. At the same time, the company is also buying new positioning and seeking diversified development.

Selling US stocks on a large scale, frequently reducing positions, and increasing cash holdings

According to documents disclosed by the US SEC, Berkshire Hathaway sold about 24.70 million shares of US bank Common Stock on August 23rd, 26th, and 27th, with a transaction amount of about $981.90 million. After the latest round of sales, the company’s holdings of US bank stock fell to 11.6%. Berkshire Hathaway has been aggressively selling the bank’s stock since mid-July this year, but it is still the largest shareholder of US banks.

After the 2011 financial crisis, Buffett bought $5 billion worth of US bank Preference Shares and warrants, and converted these warrants in 2017, making Berkshire the largest shareholder of US banks. In 2022, Berkshire began to reduce its holdings of bank stocks including JPMorgan Chase, Goldman Sachs, Wells Fargo, and began to reduce its holdings of US banks in July this year.

Market speculation suggests that one of the reasons for Buffett’s sell-off of US bank stocks may be that the bank’s valuation is too high. At the same time, Buffett may also be preparing for the Fed’s Monetary Policy shift in advance. In addition, some analysts believe that Buffett’s reduction of US bank holdings may be to adjust his investment portfolio. This indicates that Buffett may be re-examining the allocation of his investment portfolio and adjusting it according to changes in the market environment.

In addition, Buffett’s huge Apple stock holdings have driven Berkshire’s recent earnings growth. Buffett sold more than $85 billion worth of Apple stocks this year, a reduction of 56%. As of June 30th, Berkshire held about 400 million shares of Apple, accounting for about 30% of its investment portfolio. There is no doubt that without the huge valuation growth of Apple and large technology stocks, Berkshire would not have touched a market value of $1 trillion.

Purchase multiple positions and seek new development opportunities

Since the beginning of this year, Buffett has not only withdrawn from the US technology sector, but also increased his investments in the energy, insurance, and beauty sectors.

Berkshire Hathaway established a position in US beauty retail giant Ulta Beauty, during which it bought 690,000 shares. Stimulated by the news, Ulta Beauty rose more than 11% the next day, but the company is still down 24.21% this year. In addition, Berkshire Hathaway also established a position in aerospace company Haike Aviation for the first time.

First, the sixth largest holding was Western Petroleum, which Berkshire added 7.2634 million shares in the second quarter. Second was Anta Insurance, which added more than 1.10 million shares in the second quarter. In the first quarter of this year, after three consecutive quarters of secrecy, Berkshire Hathaway revealed for the first time that it had invested heavily in the insurance company Anta Insurance. As of the end of the second quarter, Berkshire Hathaway held 27 million shares of Anta Insurance, worth about $6.90 billion, and Anta Insurance ranked ninth among Berkshire Hathaway’s largest holdings.

The adjustment of this investment portfolio also indicates that Buffett is constantly looking for new investment opportunities. These new positions may bring more surprises to Berkshire in the future and push the stock price further up.

Berkshire’s second-quarter earnings were strong, and market expectations were raised

Berkshire Hathaway’s latest second-quarter financial report demonstrated the benefits of its diversified business model. Although some business units performed poorly in revenue, most of them performed quite strongly. This quarter, the company’s revenue reached $93.70 billion, an increase from $92.50 billion in the same period last year. Manufacturing revenue increased from $19.10 billion to $19.84 billion. But perhaps the most impressive was its insurance business. Total insurance revenue surged from $23.48 billion to $26.03 billion.

Part of the growth in this quarter was driven by an increase in investment income, which increased from $2.92 billion to $4.08 billion. Another part was the improvement in underwriting performance of insurance business groups, including GEICO. As the group continues to increase the pricing of insurance products after the epidemic, insurance stocks have performed quite strongly this year.

Analysts have raised their earnings forecasts for 2024 and 2025 based on the above information. The strong earnings and bullish outlook have also brought positive sentiment to the market, which is conducive to further increases in stock prices and market value. Earlier, some analysts predicted that Berkshire’s market value would far exceed $1 trillion. He set a target price of $759,000 for Berkshire’s Class A stock in the next 12 months, which is nearly 9% higher than Wednesday’s stock price level.

Nowadays, the market value has successfully exceeded one trillion, indicating that BRK’s stock has strong appeal. Its initial Class A stock was one of the highest-priced stocks on Wall Street. Today, the selling price of each stock is 68% higher than the median price of US houses, demonstrating great potential.

What is the future direction of Berkshire?

Berkshire has risen about 135% over the past five years; it is up 29% so far this year, while the S & P 500 Index is up only 18%.

From some indicators, Berkshire Hathaway seems to be an expensive stock. Berkshire’s main businesses include insurance, investment, and dozens of companies in fields such as railways, energy, chemicals, food, and retail. The complex business makes it difficult to express the company’s valuation simply and clearly.

One of the characteristics of the company is that there are 277 billion dollars of cash and equivalents on the Balance Sheet. This provides unparalleled financial flexibility for the company; at the same time, it has generated billions of dollars in interest income for Berkshire.

The total market value of Berkshire’s stock portfolio is about $318 billion. Simply put, nearly $600 billion of the trillion-dollar market value belongs to the fair value part, and the valuation of the remaining operating assets corresponds to the remaining $400 billion.

Although the current stock price is high, overall, the company’s development prospects are still worth looking forward to, considering Buffett’s optimized investment portfolio and strong revenue mentioned earlier. As a diversified investment holding company, Berkshire Hathaway has strong strength and competitive advantages in multiple fields such as insurance, railways, and energy. With the recovery of the global economy and the continuous changes in the market, Berkshire Hathaway is expected to continue to maintain a steady growth trend.

If you believe in the judgment of the stock god and have confidence in the company and want to invest, you can go to BiyaPay to directly buy the stock. If you think the current price is too high, you can also monitor the subsequent market trends and look for good opportunities.

In addition, if you have difficulties with deposits and withdrawals, you can also use it as a professional tool for deposits and withdrawals of US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it into other securities firms to buy stocks. The deposit speed is fast and there is no limit, so you won’t miss investment opportunities.

What are the reference significance of Buffett’s achievements for investors?

Berkshire Hathaway’s success is attributed to multiple factors. Firstly, the company has a professional and efficient investment team that continuously explores potential investment opportunities with keen market insights and rich investment experience. Secondly, Buffett has always adhered to the Value Investment philosophy, which seeks to invest in companies with long-term competitive advantages, stable cash flow, and good management teams, laying a solid foundation for the company’s steady development. In addition, it values diversified investment and effectively disperses investment risks.

For investors, Buffett’s investment principles provide an investment framework that values fundamental analysis and long-term holding. Investors need to deeply analyze the financial situation and market performance of potential investment targets, including detailed examination of key financial indicators such as revenue, profit, debt, and cash flow of the company, understanding the company’s business model and industry position, and evaluating its long-term growth potential.

Secondly, after finding stocks of companies with stable cash flow and competitive advantages, it is important to focus on long-term investment, avoid frequent trading, thereby reducing transaction costs and avoiding the impact of short-term market fluctuations.

Finally, investors should learn how to build and maintain a diversified investment portfolio, preferably covering multiple industries and markets, to reduce the risk of relying on a single economic sector or market and increase the potential for returns.