- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Apple executives change handsome, the first AI iPhone heavyweight attack? Can it push the stock pric

On August 26th local time, Apple announced on its official website that Luca Maestri, the CFO who has served for ten years, will step down on January 1st, 2025, ending his more than ten-year career as Apple’s CFO. After the news was released, Apple’s stock price fell slightly and then rebounded. Overall, the stock price responded relatively calmly. At the same time, the company announced that it will hold a product launch event at the Steve Jobs Theater in Apple Park on September 9th local time. It is worth looking forward to what impact it will have on Apple’s stock price.

However, as Apple is about to launch multiple new products in the fall, this high-level personnel change is also highly anticipated.

However, Apple stated that Maestri will still stay in the company after the handover, responsible for leading the Enterprise Services team, including information systems and technology, information security, real estate and development, and reporting directly to CEO Cook. This decision is a very important arrangement that can to some extent alleviate concerns about Apple’s financial problems.

According to the information released on the official website, the position will be filled by Kevan Parekh, Vice President of Planning and Analysis at Company Finance. In the past few months, Maestri has been cultivating Parekh to serve as Chief Financial Officer. Parekh has been increasingly involved in private meetings with financial analysts and partners, especially considering Parekh’s work experience within the company. This transition is expected to be smooth. It seems that the transition of the new CFO is planned and orderly, which is the most important issue and provides a tendency for future senior management changes, indicating the company’s responsible attitude.

Therefore, the editor greatly appreciates Apple’s approach and believes that it can continue this style in the future, which also enhances investors’ confidence in holding it for the long term.

The new product launch is coming soon, what highlights are worth looking forward to?

This press conference is crucial for Apple’s stock price and performance. The tech giant is betting on these new hardware products embedded with end-side artificial intelligence, trying to revive the sales growth curve of iPhone and wearable devices.

It is expected that Apple will release the iPhone 16 series, AirPods 4 and the new generation of Apple Watch series at this event, in addition iOS 18 and macOS Sequoia will also be officially released.

One of the most eye-catching is the release of the iPhone 16 series. It is reported that the iPhone 16 series will be equipped with custom operation buttons and a new shooting button, with built-in gesture function. With the addition of Apple Intelligence, this year’s four iPhone 16 (standard version iPhone, Plus, Pro and Pro Max) will all use the latest A18 chip. The display size of the two high-end Pro series products is expected to be further increased from the original 6.1 inches and 6.7 inches to 6.3 inches and 6.9 inches, bringing users a more stunning visual experience. At the same time, the series will also introduce new camera functions, including dedicated camera buttons, which will further enhance the user’s photography experience.

According to relevant reports, Apple’s component orders to suppliers show that the sales of high-end models iPhone 16 Pro and Pro Max are expected to account for nearly 70% of the overall sales. Specifically, the shipments of the iPhone 16 series in the second half of the year are expected to be 90.10 million units, an increase of about 10% year-on-year. Among them, the shipments of standard models are 24.50 million units, Plus models are 5.80 million units, Pro models are 26.60 million units, and Pro Max models have 33.20 million units. According to the proportion analysis, iPhone 16 will account for 27% of the shipments, iPhone 16 Plus will account for 6%, iPhone 16 Pro will account for 30%, Pro Max will account for 37%, and the combined proportion of the two will reach 67%. This indicates that the market demand for high-end models is still strong, especially for the Pro series.

In addition, Apple plans to conduct mandatory training for all retail store employees after the event, focusing on the Apple Intelligence feature. These trainings will take place in mid to late September, indicating Apple’s emphasis on new features and are expected to drive sales of iPhone 16.

Although the full functionality of Apple Intelligence will be released with iOS 18.1 in October, Apple’s early training shows its strategic layout of marketing activities and indicates that the new product is expected to further increase revenue.

The first AI iPhone can push the stock price further up?

The key factors driving the recent rise in Apple’s stock price are the expected increase in iPhone sales, including the upgrade of GenAI features and the release of iPhone 16 in September. Although new artificial intelligence features can drive accelerated growth, considering the early development stage of this technology, it may not be realized until 2025. Earlier this month, AAPL began rolling out Apple’s intelligent features to developers, allowing them to start integrating these features into applications. AAPL’s recent approach to AI upgrades is to start with limited English features and then expand to other languages and regions. In addition, the technology industry is highly competitive, and Apple entered some artificial intelligence fields later than competitors such as Google and Microsoft, which may hinder its revenue growth and ability to dominate the artificial intelligence market, as Apple lacks a first-mover advantage in this area.

Secondly , the personnel changes mentioned earlier have changed for the second time this month, and the senior management may face a major change, which is also a consideration for whether they can hold Apple for a long time. Last week, as Apple prepared to restructure the App Store to cope with regulatory scrutiny, App Store Vice President Matt Fischer will leave the company in October. After the news was released, Apple’s stock price fell by 1.7% after hours, which also indicates that the changes in the company’s senior personnel have a direct impact on the stock price and are worth paying attention to.

Furthermore, Apple’s previous sales have declined. Due to the continued stagnation of sales of iPhone and wearable devices, its revenue dynamics are not so optimistic. Whether it can achieve a significant increase after the release of new products and alleviate revenue pressure is also an unknown factor. We need to wait for the market response after the release of subsequent products to make more specific judgments.

Finally , it is Warren Buffett’s Berkshire Hathaway company that has significantly reduced its holdings of Apple stock. His company currently holds about 400 million shares of Apple stock. Although Warren Buffett said that Apple will continue to stay in his investment portfolio, he has sold more than 500 million shares in the first half of this year, which has generated negative signals in the market and brought some selling pressure to Apple, which has a negative impact on its stock price.

Although the above factors may cause Apple’s stock price to fall, From an investment perspective, the upcoming iPhone 16 is expected to be Apple’s first device truly driven by artificial intelligence, which indicates further exploration and application of Apple in the field of artificial intelligence. In addition, Apple is also expanding its service business, including Streaming Media, games, and Financial Services, which may become new engines of growth.

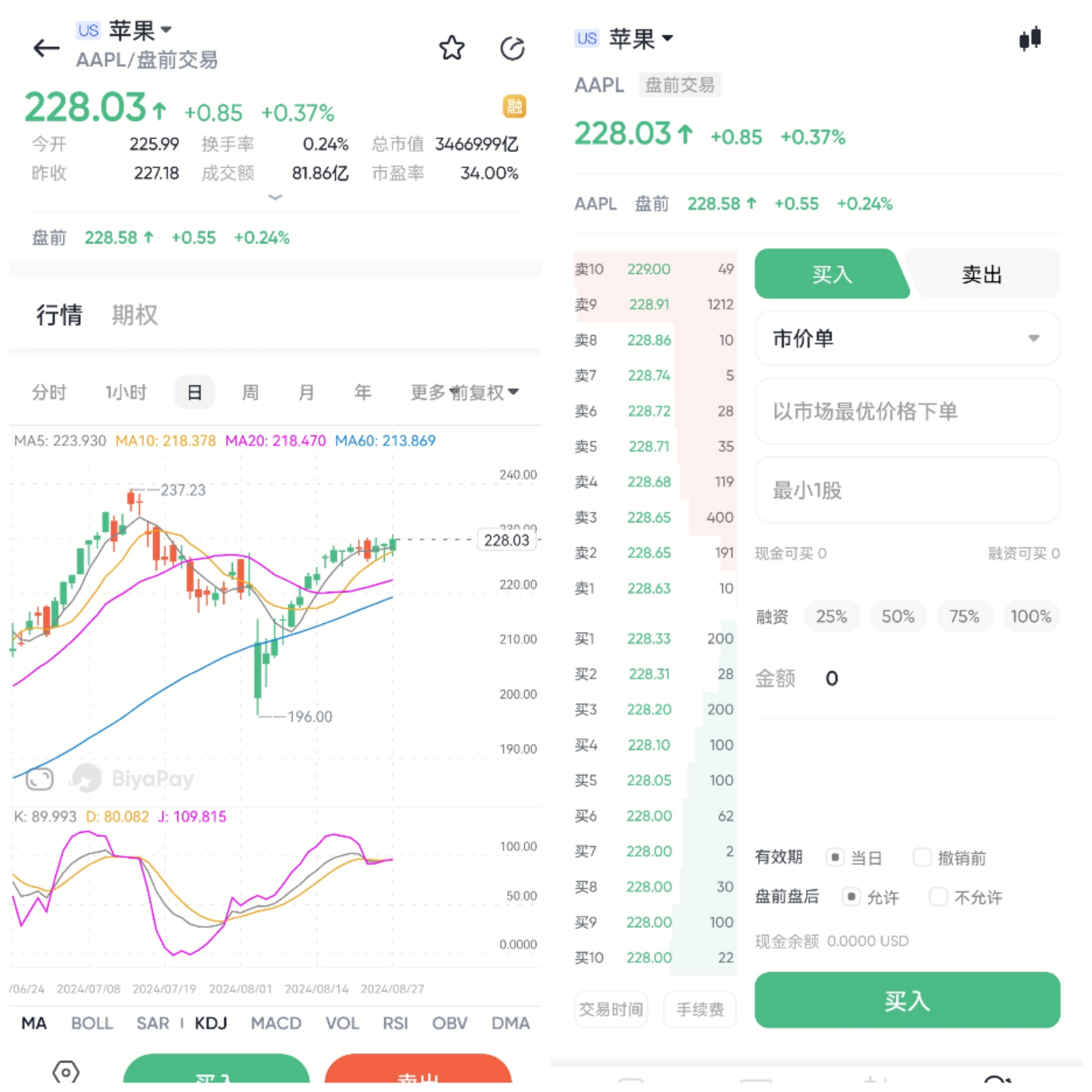

Currently, Apple’s total market value is as high as $3.46 trillion, firmly sitting on the throne of “the world’s highest market value Listed Company”. Wall Street institutions are generally optimistic about Apple’s stock price trend in the next 12 months, among which Wall Street analysts give the highest target stock price of $ 273 and reiterate the “buy” rating. This means that Apple, the “market value giant” with a market value of up to $3 trillion, has a general upward potential of nearly 10% in the eyes of Wall Street analysts.

Therefore, friends who want to invest in Apple can go to BiyaPay to buy Apple, or monitor the subsequent market trends to find a suitable buying opportunity. In addition, if you have difficulties with deposits and withdrawals, you can also use it as a professional tool for depositing and withdrawing funds from US and Hong Kong stocks. You can recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to your bank account, and then deposit funds to other securities firms to buy stocks. The arrival speed is fast, and there is no limit, so you will not miss investment opportunities.

How do investors consider their investment behavior?

When considering investing in Apple’s stock, investors need to comprehensively evaluate several key factors. In addition to the unfavorable factors mentioned above, the following issues should also be considered.

If the iPhone 16 series can introduce market-leading technology and new features that attract consumers, it may drive up the stock price. However, the uncertainty of the global economic environment, including consumer spending power and global supply chain issues, may affect product sales and company performance.

In addition, Apple is facing increasingly fierce industry competition. Although Apple maintains its lead in product innovation and brand loyalty, other tech giants such as Samsung and Huawei are also constantly launching competing products. Apple needs to constantly innovate to maintain its market leadership position.

Finally, when considering investing in Apple, one should also evaluate its financial health and market valuation. Apple’s financial performance has always been stable, with ample cash flow, but high valuation may limit the upward space of the stock price. Therefore, investors should pay attention to its profitability, cash flow status, and relative industry valuation to determine investment timing.

Overall, the change in Apple’s management is a small episode. This press conference is the top priority for Apple. The many highlights at the conference are expected to boost consumer confidence, bring new growth points to Apple, and promote further growth in stock price and market value. However, whether Apple’s expectations can be achieved remains to be seen. As investors, we should pay attention to relevant information in a timely manner and look for suitable investment opportunities.