- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

NVIDIA's Growth Slowdown Appears, Stock Price Faces a Test! How Should Investors React on the Eve of

The semiconductor giant NVIDIA, with a market capitalization exceeding $3 trillion, will release its latest earnings report on August 28 (Eastern Time). On Tuesday, the company’s stock price rose by 1.46%. The main debate among investors is whether NVIDIA’s performance will once again meet expectations and whether the stock can hold its ground in the market.

Image source: BiyaPay APP

Currently, all of Wall Street is preparing for this moment, as this chip manufacturer has essentially become the leader in determining the sustainability of the artificial intelligence (AI) boom. Whether NVIDIA’s earnings report impresses investors could influence the entire market in the days following the release.

While enthusiasm for AI has driven large-cap stocks to surge in recent quarters, investors are increasingly questioning the sustainability of this rally. NVIDIA’s upcoming earnings report might provide the answer.

Previously, in Morgan Stanley’s latest report, it was predicted that if NVIDIA’s revenue exceeds expectations, AI-related stocks could see an increase of 3-15%. Conversely, if it falls short, the entire AI stock group could drop by 5-10%, and the priority of stock selection might reverse.

Bloomberg Intelligence’s Kunjan Sobhani stated, “NVIDIA’s performance is likely to significantly exceed expectations and raise third-quarter earnings forecasts, with sales expected to surpass forecasts by a single-digit percentage. However, concerns about delays in the Blackwell chips may affect expectations for fiscal 2025, making management’s comments, especially reassuring outlooks for 2025, crucial.”

Is NVIDIA’s Growth Slowdown Evidence That the Market Has Peaked?

Growth Slowdown

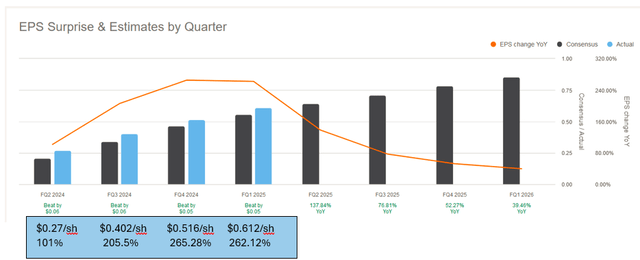

The chart below shows the slowdown trend in NVIDIA’s earnings per share (EPS) growth rate. In the first quarter of fiscal 2025, reported in May 2024, EPS grew by 262.12%, slightly below the 265.28% growth in the fourth quarter of fiscal 2024, reported in January 2024.

In the company’s first-quarter earnings report for fiscal 2025, management forecasted that second-quarter revenue would reach $28 billion, marking a further slowdown to 8%. For comparison, competitor AMD currently has a quarterly sales growth rate of 8.8%, with a valuation of approximately 10 times the sales price. Meanwhile, NVIDIA’s current sales price multiple is 25 times.

Moreover, earnings reported for this quarter, expected to be announced on August 28 (Eastern Time), are projected to grow 137% year-over-year, a noticeable decline from the growth rates of the previous two quarters. The third quarter of fiscal 2025 is expected to further decelerate to a 76.81% EPS growth rate, followed by 52.27% in the fourth quarter and 37.46% in the first quarter of fiscal 2026. This deceleration in earnings growth should lead to a significant reduction in the price-to-earnings ratio.

Reasons for the Growth Slowdown

First, the law of large numbers is starting to manifest in NVIDIA. With a market capitalization exceeding $3 trillion, making it the world’s most valuable semiconductor company, it has become increasingly difficult to maintain the previous high growth rates as the company grows larger. Over the past few quarters, NVIDIA’s EPS growth rate has shown a noticeable slowdown, reflecting the impact of the law of large numbers.

We often have a recency bias, assuming that NVIDIA will continue to grow at a high rate of 265% per year. However, if this growth rate were maintained over the next two years, its market capitalization would reach a staggering $11.6 trillion in one year and even $42.36 trillion in two years, which would be absurd and exceed the U.S. gross domestic product.

Second, the market’s demand for AI is gradually reaching saturation. NVIDIA’s growth has largely depended on the explosion of demand in the AI sector. Although AI remains a rapidly developing field, the market’s growth rate may not be as astonishing as it initially was. As more companies enter the AI market and competition intensifies, with competitors like AMD and Intel gradually enhancing their AI product competitiveness, NVIDIA’s growth space is further compressed.

Additionally, market expectations for future uncertainties have a significant impact.

NVIDIA’s growth is heavily reliant on investor expectations for its future. If enthusiasm for the AI boom begins to cool, or concerns about overinvestment in AI arise—such as “Is AI overhyped?” or “Are large tech companies overvalued?”—investors might become more cautious, leading to a slowdown in NVIDIA’s stock price growth.

Can NVIDIA’s Stock Price Maintain Its Upward Trend After the Earnings Report?

Over the past six months, NVIDIA’s stock price experienced a significant decline, dropping by as much as 23.5%, which made some investors uneasy. However, since August, the stock has rebounded nearly 25%, showing a strong recovery momentum.

Analysts predict that NVIDIA’s stock could fluctuate by as much as 10.4% when the U.S. market opens on Thursday, the day after the earnings report is released.

We analyzed the possible technical levels the stock might reach.

Using NVIDIA’s closing price on Monday in the U.S. market ($126.1) as a reference, we can make the following predictions:

If earnings exceed expectations (EPS and total revenue), NVIDIA’s stock price could reach $139.25, hitting the June 20 high. Conversely, if earnings fall short of expectations, the stock price could drop to around $113 (the lowest level since August 13).

However, the growth momentum in August is expected to continue, and the stock price is likely to rise significantly after the earnings report, driven by the following three key factors:

1. Strong Second-Quarter Earnings

During the first quarter of fiscal 2025, NVIDIA forecasted that the company’s second-quarter revenue would reach “approximately $28 billion, plus or minus 2%.” However, Wall Street analysts believe that the company may have intentionally set a low market expectation, with their average estimate for second-quarter revenue at $28.6 billion. NVIDIA’s second-quarter report is expected to not only exceed the company’s guidance but also surpass Wall Street’s expectations, with adjusted EPS likely to exceed the analyst consensus of $0.64.

Why such optimism? Because both NVIDIA and Wall Street have underestimated the demand for the company’s graphics processing units (GPUs). Former Google CEO Eric Schmidt mentioned in a speech at Stanford that major tech companies need AI chips worth $200 billion, $500 billion, or even $1 trillion.

In NVIDIA’s fourth-quarter earnings report for fiscal 2024, the company forecasted first-quarter fiscal 2025 revenue to be $24 billion, with a similar “plus or minus 2%” range. As a result, first-quarter revenue reached $26 billion, 8.3% higher than the forecast, and earnings exceeded market expectations by 9.8%.

Therefore, barring unforeseen circumstances, second-quarter earnings are likely to continue this trend.

2. Impressive Earnings Guidance NVIDIA is expected to once again provide impressive earnings guidance for the next quarter, with an even higher probability than the second-quarter outperformance.

This confidence comes from the four major U.S. tech giants: Alphabet, Amazon, Microsoft, and Meta Platforms. These major NVIDIA customers indicated in their latest quarterly reports that capital expenditures for expanding AI infrastructure will increase in the coming quarters.

During the earnings calls of these tech giants, one statement from Alphabet’s CEO Sundar Pichai was particularly noteworthy. He said, “The bigger risk for us is underinvestment rather than overinvestment.” This statement undoubtedly excites NVIDIA shareholders.

If Alphabet recognizes the risk of underinvestment, it can be assumed that Amazon, Microsoft, and Meta share the same perspective.

3. Clarification on Blackwell Chips

In recent weeks, the biggest “cloud” hanging over NVIDIA has been concerns about a significant delay in the release of the new Blackwell GPU. Clarification does not mean that the Blackwell chip shipment won’t be delayed, but rather that NVIDIA will do its best to ease market concerns. Whatever information is released, once investors digest it, they will quickly adjust their expectations. Most importantly, any delay is likely to be temporary.

Earlier this month, The Information reported that the company’s production process encountered some issues, leading to a high probability that large-scale deliveries would be delayed until the first quarter of 2025. However, the official company statement is that production is “on track.” Any optimistic news regarding Blackwell is likely to further boost the stock price.

However, Morgan Stanley analysts believe that the timing of Blackwell’s impact is not significant. Many customers have already purchased NVIDIA’s H200 chips. According to their survey, NVIDIA’s major customers indicated that while the ideal scenario is to have Blackwell’s computing power to train the next generation of AI models, they are buying whatever is available now. In other words, if Blackwell is indeed delayed as reported, as long as the H200 can fill the gap, the impact on the stock price will be limited.

Impact on the U.S. Tech Sector

1. Market Sentiment Guidance

As a leader in the AI field, NVIDIA’s earnings report has strong market guidance.

If the earnings data exceeds market expectations, especially in terms of revenue, profit margins, and future outlook, it could drive up the stock prices of the entire tech sector, particularly companies closely related to AI, such as Alphabet, Microsoft, and Amazon. These companies are all heavily investing in AI technology, so NVIDIA’s strong performance would boost investor confidence in the entire AI sector.

2. Sectoral Divergence

If NVIDIA’s earnings report shows a slowdown in growth or lower-than-expected market demand, it could lead to divergence within the tech sector. Companies with high valuations and high growth expectations may face greater selling pressure, while companies more associated with traditional technology businesses might be less affected.

Investors might reassess the valuations of AI-related stocks, leading to a shift in capital towards more reasonably valued or lower-risk tech companies.

3. Signal for the Overall Market

As a company with a market capitalization exceeding $3 trillion, NVIDIA’s earnings report carries signal significance not only for the tech sector but for the entire market.

If the report shows strong performance, it could enhance investor optimism about the economic outlook, further driving up major U.S. stock indices. Conversely, if the earnings report fails to meet expectations, it could trigger concerns about high valuations in the tech sector, potentially impacting the performance of the Nasdaq 100 and S&P 500 indices.

4. Adjustment of Long-Term Investment Trends

The market reaction following the earnings report may prompt investors to reassess the long-term value of AI investments.

If the report indicates strong and sustainable AI demand, it could attract more long-term capital into AI and related technology fields. Conversely, if the report shows weakening demand or slowing growth, investors may gradually adjust their portfolios, reducing exposure to high-risk, high-valuation tech stocks.

Impact on the U.S. Stock Market

1. Direction of Economic Growth

As a leader in the tech industry, NVIDIA’s performance is seen as a barometer for the entire high-tech sector and even economic recovery.

If the report shows strong growth, especially in revenue and future outlook, it would boost market confidence in tech-driven economic expansion. Investors might expect that the strong performance of the tech industry will drive overall economic growth, pushing up the stock market, particularly in tech-dominated indices like the Nasdaq and S&P 500.

Conversely, if NVIDIA’s growth slows, the market may worry about weakening demand in the tech industry, which could dampen confidence in future economic growth and potentially trigger a broader market adjustment.

2. Indirect Impact on Federal Reserve Monetary Policy

NVIDIA’s earnings report will also indirectly influence market expectations for Federal Reserve monetary policy.

If the report is strong, the market might believe that the risk of economic overheating has increased, leading to expectations that the Federal Reserve may continue or intensify its tightening policies, such as raising interest rates. This expectation usually puts pressure on interest rate-sensitive sectors and the overall stock market, as higher interest rates increase financing costs and squeeze corporate profits.

Conversely, if NVIDIA’s performance falls short of expectations, the market may believe that economic growth is slowing, inflationary pressures are easing, and therefore, the Federal Reserve may slow the pace of interest rate hikes or adopt more accommodative policies, which could support the stock market, especially growth-oriented stocks with high valuations.

How Should Investors Respond to Market Volatility After the Earnings Report?

1. Diversification Is Key

While NVIDIA and its related tech stocks may cause short-term market volatility, diversification can effectively reduce the risk associated with the underperformance of individual stocks or sectors. Investors can diversify across different industries, asset classes, and geographic regions to balance risk and return.

2. Focus on Long-Term Fundamentals

If NVIDIA’s earnings report shows short-term volatility, avoid overreacting.

Investors should focus more on the company’s long-term growth potential and industry prospects. If the long-term demand for AI and high-performance computing remains strong, temporary market corrections may present buying opportunities.

Therefore, investors confident in NVIDIA and the tech sector may consider buying on dips during market fluctuations, rather than rushing to sell. This can be done using multi-asset wallets like BiyaPay, which allows investors to buy low and avoid missing out on investment opportunities due to market timing.

Alternatively, BiyaPay can be used as a professional tool for depositing and withdrawing funds between U.S. and Hong Kong stocks. Investors can recharge digital currencies, exchange them for mainstream fiat currencies like USD or HKD, and then withdraw them to bank accounts for deposit into other brokerages to trade stocks in different industries and asset classes, thereby diversifying risk. Funds can arrive safely in just a few minutes, with no limits, ensuring that investment opportunities are not missed due to delays in fund transfers.

3. Pay Attention to Macroeconomic and Policy Changes

NVIDIA’s performance may influence market expectations for Federal Reserve monetary policy, which in turn affects the entire market. Investors should closely monitor the Federal Reserve’s actions and changes in market interest rates.

If the market expects the Federal Reserve to accelerate interest rate hikes, it may be necessary to adjust investment portfolios to reduce exposure to interest rate-sensitive sectors and consider increasing allocations to defensive assets or high-yield bonds.

Overall, NVIDIA’s current price-to-sales ratio is as high as 39.45 times, indicating that its stock price has been highly valued ahead of its second-quarter fiscal 2025 earnings report. However, due to strong demand for H100 products, NVIDIA is expected to release a report that satisfies the market, likely continuing to push the stock price higher.

Although NVIDIA’s trading multiple is higher compared to its industry peers, such a valuation is justified considering the company’s expected significant growth in the coming years. Moreover, if more companies begin converting their traditional computing data centers into AI-driven high-speed processing centers, NVIDIA’s high valuation could be sustained.

Given the company’s historical trading multiples, future sales projections, and related AI demand, NVIDIA remains a promising investment despite its stock price being at a critical point. When the company announces its earnings on August 28 (Eastern Time), its earnings momentum may temporarily slow down, but there is still considerable growth potential for the company in the future.