- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

PDD: Growth Caves In, As Competition Intensifies (Rating Downgrade)

PDD Holdings Inc. (NASDAQ:PDD) reported their earnings report for the second quarter of 2024 and cast a gloomy outlook on their growth forecasts.

PDD’s Q2 earnings report showed a miss on their total sales figure, underwhelming the lofty near-2x expectations markets had for PDD. However, management was further surprised with commentary now warning of slower growth ahead.

These comments have heavily weighed on the company, with the stock losing almost a quarter of its market cap already since the earnings results were issued this morning.

Exhibit A: PDD Market Trend,Chart By BiyaPay App

For PDD, a quarter such as this one, will make it extremely challenging to justify its business model of rapid spending on online customer acquisition to boost sales.

The company’s management will have to work through fundamental issues until it can demonstrate resilience. For now, I have downgraded PDD Holdings to a Hold.

Management’s Forward-Looking Commentary Harms More Than Its Revenue Miss

I had last covered PDD in March, when I issued a Buy rating on the company after the company had been consistently delivering +50% CAGR over the past 8-12 quarters. PDD was unable to move anywhere close to my $200 target, and its seemingly unlimited spending strategy would max out in the face of risks that may start to eventually play out.

One of those risks that have appeared to pan out for PDD is competitive pressures that are intensifying and are capping growth for the company.

In Q2, PDD reported total sales worth $13.36 billion, growing a massive 86% y/y but still underwhelming as it missed the ~$14 billion sales target that markets had set for the Chinese low-cost e-tailer.

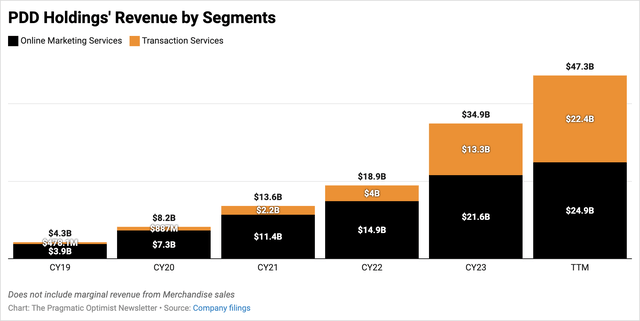

The slowdown was already more prominently felt in their Online Marketing Services segment, one of two revenue segments for PDD. The company’s Online Market Services, which help PDD’s merchants boost their online visibility on its platforms and search results, grew just 29.5% in Q2. Revenues in the segment grew to $6.8 billion, a far cry from the 86% total growth the company demonstrated in the same quarter. The company was supported by robust growth in its Transaction Services segment, which more than tripled y/y to $6.6 billion in sales. PDD collects merchant fees for transaction-related services that it provides to merchants and records them under the Transaction Services segment. As can be seen below, Transaction Services has been a bigger deal for PDD over the years, accounting for almost half of the company’s revenues on a TTM basis.

Exhibit B: Revenues in the Transaction Services segment for PDD Holdings surged more than 3x in Q2 and now accounts for almost 50% of PDD’s revenues (Company filings)

However, the growth seen in its Transaction Services also appears to be its Achilles heel, as merchants have been pushing back against the company, lately.

A growing number of merchants on the platform are frustrated by the surging fees PDD charges them as it pursues global expansion. This also led to many merchants protesting at Temu’s China offices last month.

Admitting to troubles rising from its merchants, a key supply dynamic of its global expansion strategy, PDD’s management said:

"While encouraged by the solid progress we made in the past few quarters, we see many challenges ahead. We are committed to transitioning toward high-quality development and fostering a sustainable ecosystem. We will invest heavily in the platform’s trust and safety, support high-quality merchants, and relentlessly improve the merchant ecosystem. We are prepared to accept short-term sacrifices and a potential decline in profitability."

Management further reiterated their stance on allocating more capital towards its merchants by warning that “profitability will also likely be impacted as we continue to invest resolutely.”

Profitability Now Comes Into Question As Relative Growth Slows

PDD has been known for selling low-cost items on its marketplace, with discounts or subsidies on almost anything from groceries to tablets, along with the added benefit of fast shipping. The hard-hitting subsidies on items that are already priced at deep discounts started a price war, which PDD looked to be winning due to its massive customer acquisition strategy, where it would spend billions on search & social media ads. Temu, its shopping app for global users, grew at a rapid pace as a result, consistently being the number one downloaded app, as recently as May this year.

But PDD’s peers, Alibaba (BABA) and JD.com (JD), appear to have entered the price war by offering some subsidies of their own, as mentioned on their earnings calls. PDD’s management revealed that while revenue growth slowed sequentially, they expect it to slow further since “revenue growth will inevitably face pressure due to intensified competition and external challenges.”

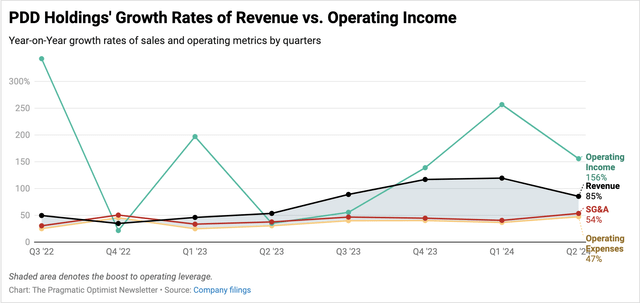

This is certainly going to put pressure on PDD’s operating leverage, which over the past few quarters was built on spending more on marketing budgets to acquire more revenue. This can be seen in Exhibit C below. After growing at breakneck speeds, operating income now looks set to slow further, after slowing down to $4.5 billion in operating income, representing 156% y/y growth.

Exhibit C: PDD will be forced to re-allocate its budgets from marketing if it needs to invest in building its merchant services. (Company filings)

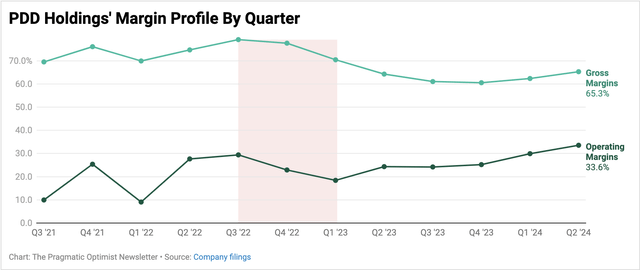

This puts a cap on PDD’s operating margins at 33.6% in Q2, which in the past has appeared to cap out in a similar range as well, as gross margins expanded by a percent to 65.3%.

Exhibit D: PDD’s margin profile by quarter (Company filings)

For the quarter, PDD reported earnings growth of 144% to $4.4 billion, or $3.2 per share, beating consensus estimates by 41 cents.

The company’s balance sheet is still strong, with ~$1.34 billion in debt and lease liabilities and ~$7.8 billion in cash & equivalents.

Valuation Points to Fair Value For PDD

Until Q1 of this year, PDD’s revenue growth was poised to continue to grow at a record pace. Per consensus estimates, PDD was expected to deliver 86% of earnings growth on a per-share basis, while revenues per set were expected to grow 70% y/y in FY24.

However, with the company facing competitive pressures, I believe growth for the back half of the year will significantly decelerate over the remaining two quarters of the year. Plus, the company will have to spend more on restoring platform trust among its merchants, which means scaling back merchant fees, its largest source of high-margin revenue. This also puts a big dent in its operating leverage. I expect earnings to slow drastically.

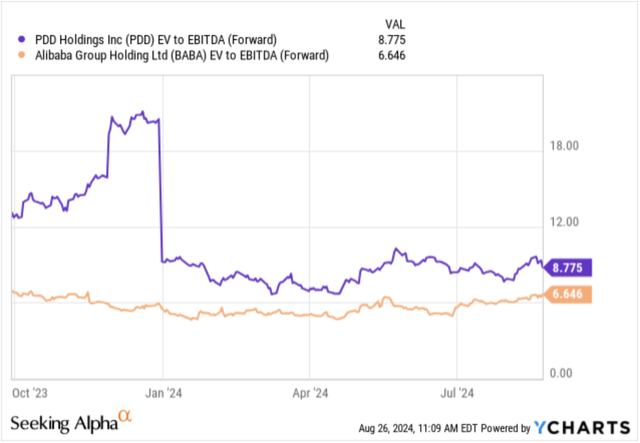

Heading into earnings, PDD was already trading at ~8.8x forward EBITDA estimates versus the 6.6x forward estimates that PDD’s peer, Alibaba, was trading at. This was assuming that PDD’s EBITDA was supposed to grow by a massive 75% versus Alibaba’s 20% expected EBITDA growth in 2024, suggesting PDD was already trading at some discount as compared to its peers.

Exhibit E: PDD’s valuation versus its larger peer Alibaba (YCharts)

But with PDD now pointing to a relatively deteriorating margin outlook, this would indicate PDD should trade at a valuation at least below Alibaba, implying a 24-27% downside from Friday’s close, which shows PDD is currently fairly valued.

Although the valuation is reasonable, given the current situation, it is recommended that people with investment needs should not blindly enter the market. They can go to BiyaPay to observe the market trend and find a suitable buying opportunity. In addition, if you have difficulties with deposits and withdrawals, you can also use it as a professional tool for depositing and depositing US and Hong Kong stocks. Recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to a bank account, and then deposit to other securities firms to buy stocks. The deposit speed is fast, and there is no limit, so you will not miss investment opportunities.

Risks & Other Factors To Watch

As I had noted in the red-shaded area in Exhibit D earlier, PDD has been in this situation before, where growth topped out and margins took a hit. Meanwhile, PDD’s management doubled down on adding tools and services to aid its merchant network and support the supply side of its platform. It took management about two quarters for the company to resolve issues before moving higher. I would expect a similar timeline for management to work through its current set of issues, chief among which will be winning back merchants’ trust on the platform.

It will also be important for investors to watch global macro factors and geopolitical pressures as they weigh on management’s decisions to navigate the company through a challenging time.

Another threat to PDD would be increased regulatory pressures, not just from global entities, but also from the local government. I believe this would be especially high due to the protests by Chinese merchants. If management does not demonstrate any ability to pacify its merchants, the government could step in to reign in the company’s management, as it has demonstrated in the past with other companies such as Alibaba.

Takeaway

PDD Holdings Inc.'s Q2 quarter put a lid on the fast-paced growth that the company demonstrated for the past many quarters, bringing into question the extent to which their growth-at-all-cost model would help. With intensifying pressures from competition, and rising geopolitical tension, PDD’s management has some key challenges to navigate through.