- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Super Micro Computer: Buy The Meltdown While Others Ignore

Super Micro: Investors Fled From The Stock

Super Micro Computer, Inc. (NASDAQ:SMCI) (NEOE:SMCI:CA) investors were likely disappointed as the company headed into its recent earnings release with headwinds in NVIDIA’s (NVDA) Blackwell architecture. As a result, the early optimism of a faster-than-anticipated ramp cadence quickly dissipated as investors reassessed Super Micro’s near-term growth inflection. As a result, SMCI has underperformed the S&P 500 (SPX) (SPY) significantly since my previous update in late July 2024.

While the relative underperformance is impactful, I have not assessed red flags in Super Micro’s fundamental metrics or price action. In my previous bullish Super Micro article, I emphasized the need for investors to be patient. I indicated that SMCI remains well-positioned to capitalize on the opportunities from the industry shift to direct liquid-cooled AI rack servers.

However, I didn’t expect the delay in Nvidia Blackwell AI chips. As a result, the anticipated slowdown in revenue ramp attributed to Blackwell has likely tempered Super Micro’s outlook for FY2025. In addition, a slower-than-expected production cadence could also affect its adjusted gross margins outlook, hurting its free cash flow profitability further. As a result, I’ve determined that the recent valuation de-rating in SMCI is justified, as the market narrowed the valuation bifurcation between SMCI and Dell (DELL).

SMCI: Valuation Premium Against DELL Closed Considerably

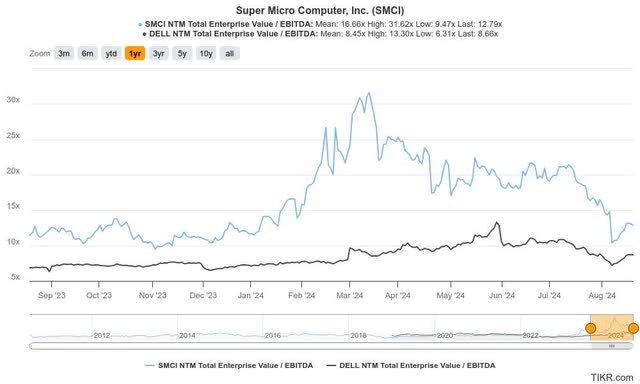

SMCI Vs. Dell forward valuation multiples (TIKR)

As seen above, SMCI’s valuation relative to DELL has closed markedly since early 2024. As a result, the market seems to have refocused its attention on Dell potentially catching up with Super Micro as they compete for high-performance AI server leadership. Super Micro’s rapid deployment advantages and quick adoption of DLC server solutions have allowed it to scale its capacity for the arrival of Blackwell. Given the significant CapEx committed by big tech and hyperscalers in their bid to maintain their Generative AI leadership, SMCI is well-poised to capitalize.

Super Micro Needs To Justify A Profitable Production Ramp

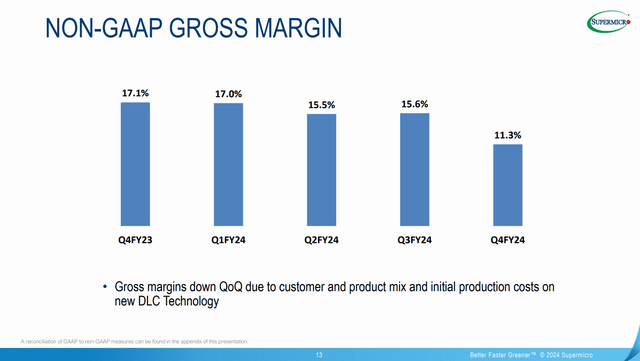

SMCI adjusted gross margins by quarter (Super Micro filings)

However, I assess that SMCI’s relative underperformance against DELL suggests the market may be concerned about the cost of such a rapid deployment strategy. Accordingly, Super Micro’s adjusted gross margin has fallen significantly to 11.7% in FQ4, down from last year’s 17.1%. Hence, even as it aims to scale its DLC solutions quickly, a slower-than-anticipated build-out could significantly impact Super Micro’s ability to lift its profitability.

In addition, Super Micro reported CapEx spending of almost $137M for FY2024, a significant increase from last year’s $37M metric. For FY2025 and FY2026, Wall Street estimates CapEx spending of $121M and $139M, respectively. Super Micro’s FQ1 CapEx guidance of between $45M and $55M suggests a notable CapEx ramp cadence in the first fiscal half as the company looks to gain market share quickly.

The company’s commentary of having garnered “at least 70% or 80%” market share for DLC solutions in June and July has likely helped to assure bullish SMCI investors of its go-to-market strategy. However, DELL’s relative outperformance over the past six months suggests the market is palpably concerned about Super Micro’s execution risks against its profitability as it increases its DLC production.

Furthermore, Dell’s ability to catch up quickly with Super Micro shouldn’t be understated. Its more diversified server solutions beyond AI servers for hyperscaler workloads could mitigate a slower-than-anticipated and potentially more costly DLC ramp. We need more confidence from Super Micro over the next two fiscal quarters before a more sustained bullish reversal could pan out. Given the free cash flow impact and the potential for a working capital raise, I believe investors are justified to be concerned.

SMCI Stock: Still Best-in-Class For Growth

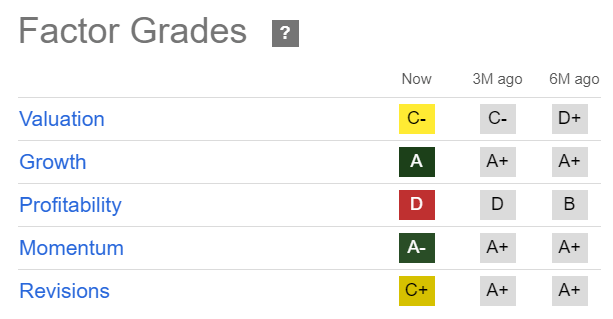

SMCI Quant Grades (Seeking Alpha)

Its valuation bifurcation against DELL has narrowed markedly. The valuation de-rating is demonstrated in SMCI’s “C-” valuation grade, which improved from a “D+” grade six months ago. Despite that, SMCI’s “A” growth grade underscores the market’s optimism about its ability to benefit from more robust Blackwell ramp prospects. However, valid concerns over its profitability must be considered, also reflected in its “D” profitability grade.

As discussed earlier, a slower-than-expected ramp profile could hurt Super Micro’s ability to deliver an inflection in its gross margins and free cash flow trajectory. As a result, the market will likely place SMCI in the penalty box in the short term, as it assesses the company’s performance in the next two fiscal quarters.

Furthermore, Wall Street has turned less optimistic about the company’s performance, as SMCI earnings downgrades have also increased. Given the caution over SMCI’s profitability and production cadence, should investors consider the current weakness to add more shares?

Is SMCI Stock A Buy, Sell, Or Hold?

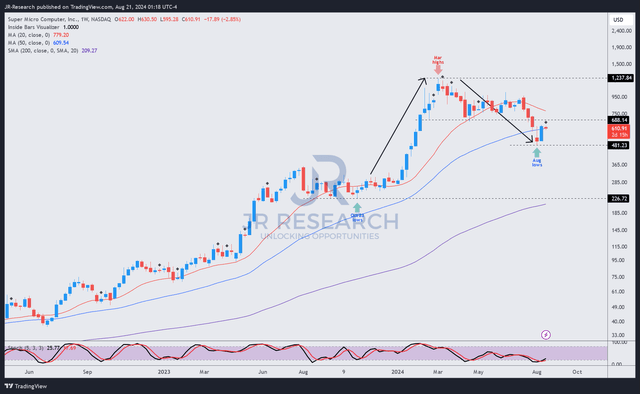

SMCI price chart (weekly, medium-term) (TradingView)

As seen above, SMCI’s sellers have digested its surge as the stock topped out in March 2024. As a result, it has also plunged into a bear market, declining more than 60% through its August 2024 lows.

However, I assessed buying support close to the stock’s 50-week moving average (blue line), which is pivotal to helping it maintain its uptrend bias.

Buyers have attempted to hold above the $500 zone, although I determined that a decisive recovery might not be possible unless the $700 support zone is retaken resoundingly.

SMCI’s $700 critical support level was breached in the decline toward its August lows, likely shaking out weak holders. While I think near-term caution is justified, I assess the stock’s risk/reward profile remains attractive from a medium- to long-term perspective.

Super Micro has bolstered its capacity to undertake higher AI production needs as it looks to dominate the DLC server market. Therefore, unless Nvidia’s Blackwell architecture faces a significant delay, caution about SMCI’s profitability impact has likely been priced in. The stock doesn’t seem to be expensive, and its valuation premium against DELL has narrowed considerably.

Hence, I see the opportunity to remain bullish in SMCI as appropriate, suggesting investors should capitalize on its near-term bear market to add more shares.

Risks To SMCI’s Thesis

As highlighted earlier, Super Micro’s ability to ramp quickly is critical to achieving market leadership in DLC server solutions. The company’s rapid deployment strategy has been fundamental to gaining market share quickly with the leading hyperscalers. A slower-than-expected ramp cadence could hinder the company’s competitive edge against more well-diversified peers, impacting its profitability.

In addition, Super Micro’s focus on its hyperscaler partnership indicates a potentially higher concentration risk in the AI upcycle. Therefore, SMCI could be more vulnerable to a valuation de-rating if the AI infrastructure investment cadence isn’t as fast as expected.

Rating: Maintain Buy.