- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Selling Apple and Snowflake, Buffett Continues to Hoard Cash: Is the US Stock Market Still Playable?

On August 15, Beijing time, the mystery around “Buffett’s US stock sell-off” was finally unraveled—Berkshire Hathaway, sticking to tradition, waited until the last day of the statutory reporting period to release its US stock portfolio report (Form 13F) for the second quarter after the market closed.

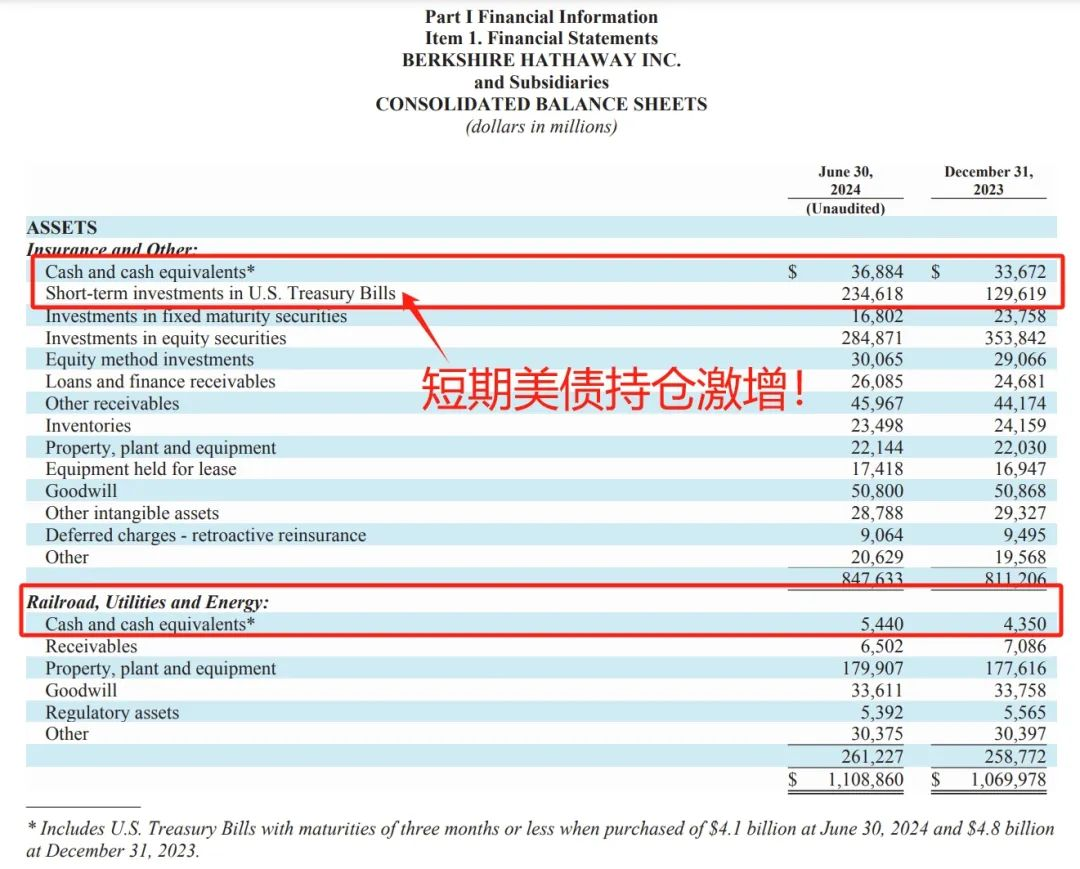

In the second-quarter report of Berkshire Hathaway released on August 3, the company disclosed a “halving of its Apple holdings,” which drew global market attention. In that financial report, Berkshire revealed a reduction of approximately $75 billion in stock holdings, while cash levels rose to a staggering $276.9 billion. Among these, short-term US Treasury holdings with an annual yield of about 5% increased to $234.6 billion, exceeding even the Federal Reserve’s holdings.

Since then, the market has been eagerly awaiting this 13F report to see exactly what moves Buffett had made.

The document released last Thursday showed that at the end of the second quarter, Berkshire’s US stock holdings were valued at $279.969 billion, down $52.1 billion from the end of the first quarter ($332 billion).

As the market’s main focus, in the second quarter of this year, Berkshire sold off a total of 10 securities, with the most significant cuts naturally being Apple, reducing from 789 million shares directly down to 400 million shares. Additionally, the American cloud computing company Snowflake, and media conglomerate Paramount Global were the only two stocks completely cleared out by Berkshire during the reporting period.

This move not only reminded people of his actions before the financial crisis of the '70s and 2008 but also sparked concerns about a potential future economic recession or even crisis. Many investors expressed worry: “Does Buffett’s selling mean that US stocks are no longer buyable?”

Historically, Buffett’s two classic stock sell-off events occurred in the early 1970s and just before the 2008 financial crisis. In both instances, Buffett sold off or cleared out stocks due to high market valuations, not because he predicted an imminent crisis. In fact, Buffett’s investment principle has always been based on the simple yet effective philosophy of “don’t buy overpriced stocks.”

Buffett’s Sell-Off, US Stock Market Turbulence

1970s Sell-Off:

In 1969, Buffett believed that stocks in the market were generally overpriced and found no suitable investment targets, thus deciding to clear out his stock holdings and close his investment firm. Despite a bull market in 1970 and 1972, he chose not to participate until after the market crashed in 1973. This move demonstrated his focus on valuations rather than predicting short-term market fluctuations.

High Cash Holdings Before the 2008 Financial Crisis:

In the mid-2000s, Buffett began significantly reducing his stock holdings and accumulating cash, also due to a lack of reasonably valued investment opportunities. Although Buffett’s performance lagged behind the market during those years, his successful bottom-fishing after the 2008 financial crisis proved that his decision to hold a large amount of cash a few years earlier was wise.

Current Market Operations:

Today, Buffett has once again adopted a similar strategy, selling off a large amount of US stocks and accumulating a massive amount of cash. This indicates that he may consider current market valuations too high, lacking sufficiently attractive investment opportunities, rather than solely based on concerns about a short-term economic crisis. Buffett’s approach reflects his consistent investment logic: preferring to hold cash in an overvalued market rather than risking purchasing overpriced stocks.

From Buffett’s past actions, it is clear that he does not rely on complex market forecasts but adheres to simple yet effective investment principles. Although this approach is straightforward, it requires great patience and discipline to execute. For ordinary investors, while it may be difficult to completely replicate Buffett’s actions, his emphasis on market valuations and maintaining patience in investment principles is undoubtedly worth emulating.

In the current market, Buffett’s behavior may indicate that market valuations are at a high level and risks are accumulating. However, whether to follow Buffett in selling stocks is a decision that each person must make based on their investment goals and patience. As Buffett has said, the key to successful investing is to avoid overpriced stocks and maintain sufficient funds and patience when opportunities arise.

Can the US Stock Market Continue to Be Invested In?

When Buffett begins to massively sell off long-held stocks, such as Apple and Snowflake, and hoards a large amount of cash, investors naturally feel uneasy.

Does this series of actions mean that the US stock market is facing significant risks or even difficulties in continuing to invest?

The editor will analyze this issue from multiple perspectives.

1 What does Buffett’s behavior mean?

Buffett’s sale of Apple and Snowflake stocks is not the first time. In fact, he has also reduced holdings in these stocks in the past, but this does not necessarily mean that he has lost confidence in the long-term prospects of the companies. More often, this is based on portfolio management, risk control, and finding other investment opportunities. Meanwhile, hoarding cash indicates that Buffett may believe the overall market valuation is too high or lacks attractive investment targets, thus choosing to hold cash temporarily. Buffett’s strategy is usually based on long-term considerations and does not fully reflect short-term market trends. Therefore, his actions are more of a defensive strategy, rather than a clear prediction that the market is about to collapse.

2 Can the US stock market still be played?

Whether the US stock market can continue to be invested in should not be solely based on Buffett’s actions. Although Buffett has reduced holdings in some tech stocks, this does not mean the entire market has lost its investment value. On the contrary, there are still many companies in the market with potential for growth. Investors should consider the following aspects:

Industry and individual stock selection: In the current market landscape, although overall valuations are high, some industries (such as technology, green energy, artificial intelligence) still have significant growth potential. Investors can choose industries and stocks with long-term growth potential, rather than just following the overall market trend.

Market volatility and investment opportunities: Market volatility may increase, but for prepared investors, this is also a good time to find undervalued opportunities. Even in a bear market, some companies may perform well, so it is crucial to maintain focus and flexibly adjust your investment portfolio.

Asset allocation and risk management: Investors can reduce single market or industry risks by diversifying investments and appropriately allocating assets. A moderate cash holding ratio can also help cope with market fluctuations and enter the market at the right time.

3 Is Buffett’s action a warning?

Buffett’s actions undoubtedly raise concerns about market valuations. However, the short-term direction of the market is not entirely driven by valuations but also influenced by liquidity, policy, corporate earnings expectations, and other factors. Buffett’s strategy is more of a defensive arrangement, reminding investors to remain cautious at high market levels.

For ordinary investors, the key is not to blindly follow trends, but to adjust moderately based on their own risk tolerance and investment goals. Currently, the market also features many safe and convenient investment channels, like the strong BiyaPay App, a global multi-asset trading wallet, which has obtained financial licenses in the USA, Canada, New Zealand, etc. Investors can monitor stock prices regularly on this tool according to their investment strategy and buy or sell stocks at the right time. Or use other platforms, but it is advised to choose those that are safe and sizable.

Interest Rate Cuts Imminent, Economy Still Solid, US Stocks Offer Plenty of Opportunities

The recent return of optimism in the market can be attributed to the following four key aspects:

1 Softer Inflation Data: Economic Cooling, Not Recession

July’s inflation data came in below expectations, with CPI and PPI year-over-year increases at 2.9% and 2.2%, respectively. In categories such as food, clothing, new and used cars, and airfare, monthly prices showed declines, indicating that consumer prices are gradually falling. However, prices in the housing and rental sectors remain high, as do costs for motor vehicle insurance. Although inflation in these areas is slowing down more gradually, over time, these prices are expected to rationalize further, supporting the overall trend of decreasing inflation.

The slowdown in inflation is significant both for the market and the Federal Reserve. For consumers, lower living costs help boost spending intentions, which will further stimulate economic activity. For the Fed, cooling inflation makes it more feasible to achieve its 2.0% PCE inflation target. Thus, further declines in inflation data over the coming months will be crucial for the Fed to adjust monetary policy, potentially initiating a rate-cut cycle.

2Economic Data Exceeds Expectations: Consumer Spending and Job Market Stability

Despite concerns of a recession following a disappointing non-farm payroll report in July, recent economic indicators have exceeded expectations, alleviating those fears. For instance, July’s retail sales grew by 1%, far exceeding the expected 0.4%, and consumer expectation indices also surpassed forecasts. Additionally, initial claims for unemployment benefits have steadily declined in recent weeks, indicating that while the labor market is slowing, it has not deteriorated sharply.

The improvement in economic data suggests that although the US economy is cooling, it remains on a healthy growth trajectory. The growth in retail sales demonstrates consumer resilience, which is crucial for the overall economy as consumer spending accounts for over 70% of the US GDP. The decrease in unemployment rates indicates that despite a slowdown, there hasn’t been a large-scale unemployment wave. These indicators further support the market’s expectation of a “soft landing,” where economic growth slows but does not fall into recession.

3 Fed Policy Path: Is a Rate Cut Cycle About to Begin?

With inflation data softening and economic indicators improving, market expectations for the Fed to initiate a rate cut cycle at the September 18 FOMC meeting have been strengthening. Although there are speculations about a possible 50 basis point rate cut, current economic data does not indicate the need for such aggressive monetary policy adjustments. Therefore, the Fed may opt for a more cautious approach, gradually adjusting policy through minor rate cuts.

The Fed’s rate cuts will have a profound impact on financial markets, especially under the current optimistic expectations for future economic growth. Rate cuts not only reduce corporate financing costs but also boost market sentiment, driving stock prices higher. However, the Fed’s rate-cut policy could also lead some investors to reassess their asset allocation strategies, particularly for high-risk, high-return growth assets. Therefore, the future direction of the Fed’s monetary policy will be a focal point for the market.

4 Market Outlook: A Diversified Leadership Pattern May Emerge

Against the backdrop of easing inflation and improving economic data, the market has seen a significant rebound recently, particularly in technology and growth sectors. As the Fed may begin a rate-cut cycle, market leadership could expand from the previously dominant large tech stocks to more industries, such as industrials and utilities. Over the next 18 months, diversified market leadership could become a new theme, providing broader opportunities for investment portfolios.

Historical experience shows that if the Fed begins rate cuts and the economy achieves a soft landing, markets generally perform well. Investors may diversify their investments from overly concentrated tech stocks to other value and cyclical industries. Thus, investors should focus on diversified allocation opportunities during future market fluctuations, especially in sectors that benefit from economic recovery and inflation easing, such as industrials, utilities, and finance. As market uncertainties gradually diminish, a diversified investment strategy will help mitigate future risks and capture potential profit opportunities.

Through in-depth analysis of these four key points, it is evident that the current market optimism has a solid foundation. With ongoing improvements in inflation data, steady economic growth, and decreasing uncertainty in Fed policies, the market may enter a new recovery cycle.

In the current environment of imminent rate cuts and relatively stable economic conditions, the following types of ETFs are worth noting:

1 Large Value ETFs

As the rate-cut cycle begins, a stable economic environment with lower interest rates will benefit value stocks, especially those with robust earnings and stable cash flows. These companies usually demonstrate strong resilience throughout economic cycles.

Value ETFs, such as Vanguard Value ETF (VTV) or iShares Russell 1000 Value ETF (IWD), could benefit from this trend.

2 High Dividend ETFs

In a low-interest-rate environment, investors often favor assets that offer stable dividend returns, as these assets can provide reliable income when rates decrease.

High dividend ETFs, such as Vanguard High Dividend Yield ETF (VYM) or iShares Select Dividend ETF (DVY), are worth considering.

3 Real Estate Investment Trusts (REITs) ETFs

Rate cuts typically benefit the real estate market, especially Real Estate Investment Trusts (REITs), as lower interest rates can reduce financing costs and enhance property values.

REITs ETFs, such as Vanguard Real Estate ETF (VNQ) or Schwab US REIT ETF (SCHH), may perform well in a rate-cut environment.

4 Technology and Growth ETFs

Although value stocks might perform well in this environment, technology and growth stocks could also continue to benefit, especially with lower financing costs due to rate cuts.

Tech ETFs, such as Invesco QQQ Trust (QQQ) or Vanguard Information Technology ETF (VGT), can continue to benefit from long-term growth trends.

5 Cyclical Industry ETFs

Stable economic growth often also drives the performance of cyclical industries, such as industrials, finance, and materials. These sectors’ performance is closely tied to economic cycles and typically excel during periods of economic expansion.

Cyclical industry ETFs, such as Industrial Select Sector SPDR Fund (XLI) or Financial Select Sector SPDR Fund (XLF), may be worth noting.

In the backdrop of an imminent rate-cut and a stable economic environment, investors can choose a credible brokerage to allocate investments in value, high dividend, REITs, technology and growth, and cyclical industry ETFs. Charles Schwab is a globally recognized investment broker that allows opening an account which can also link a bank account for transferring digital currency (USDT) to the multi-asset wallet BiyaPay, and then convert fiat currency to invest in US stocks through Schwab. Investors can also directly search its ticker on the BiyaPay platform to invest in these asset classes. Not only can this provide potential returns during rate cuts, but it can also benefit from a stable economic growth environment.

Lastly, although Buffett’s sell-off has raised concerns about the US stock market, this does not mean that US stocks are no longer worth investing in. Opportunities still exist in the market; the key for investors is to identify these opportunities and manage risks appropriately. Buffett’s strategy reminds us to stay calm and cautious when the market is overvalued and also highlights the importance of cash. However, each investor’s situation is different, and decisions should be based on individual investment goals and market understanding, rather than simply following in Buffett’s footsteps.