- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Micron Is Dirt Cheap After The 45% Drop

Micron (NASDAQ: MU ) is one of the hottest artificial intelligence stocks recently. However, I began to worry about Micron’s overbought technical conditions and rapid valuation growth. Therefore, after Micron’s stock price reached a high point in mid-June, I focused on the stock because it was significantly overbought and could experience a significant pullback.

Micron’s 1-year trend chart

The probability of Micron falling below the $95-$100 support level was low (in my view), and it was a big surprise to see Micron drop to as low as $85. How could this be? One of the market’s AI darlings got beat up badly for no apparent reason, and Micron’s stock became dirt cheap.

To put things in perspective, Micron’s stock dropped by a whopping 45% in just around six weeks, creating one of the most lucrative buying opportunities in the market.

If you think the current situation is a good opportunity, you can go to BiyaPay to buy the stock, or monitor the market trend and wait for the right time to buy. Of course, if you have difficulties with deposits and withdrawals, you can also use it as a professional tool for deposits and withdrawals of US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it into other securities companies to buy stocks. The arrival speed is fast, there is no limit, and it will not delay the market.

First, Micron’s stock clearly overshot to the downside as panic selling and capitulation set in, especially once it broke down below $100, which coincided with the 200-day MA.

The six-week selloff eliminated Micron’s gains from the previous six months, significantly resetting the company’s valuation and bringing the stock into considerable oversold technical territory.

The RSI fell to around 25, its lowest level in at least five years. Yes, even lower than the dark bear market days of 2022. The CCI exceeded -200, and the full stochastic illustrated deeply oversold market conditions.

Most interestingly, fundamentally, nothing had changed - only sentiment, of course. From late 2023 to mid-2024, AI stocks were very hot, and then, they were not anymore.

It seems that while many people were chasing Micron during its nose-bleed run-up in the $150-$155 range, many appeared to be dropping out of the stock when it collapsed below $100.

Several wise sayings apply here. Selling when others are greedy and buying when others are fearful makes perfect sense in Micron’s case. “Buy when there is blood in the streets,” also checks.

How cheap was Micron when it hit its recent low of around $85? Consensus estimates imply that Micron could report around $10 in EPS next year, suggesting Micron’s stock was recently trading at about 8-9 forward earnings. While we’ve seen an initial rebound in the stock, it’s likely trading around 9-10 forward EPS estimates now, still dirt cheap.

Micron’s AI story is alive and well, and the stock has a high probability of outperforming consensus estimates, expanding its multiple, and moving much higher into year-end 2024 and next year. My base-case 12-month price target for Micron is $180.

Micron’s AI Prospects Remain Solid

Despite the “growth scare” that caused its stock price to drop nearly 50%, Micron remains a significant market leader in memory and will likely continue to benefit from AI.

Micron’s industry-leading technology allows the latest generation of faster, more intelligent global infrastructures, making AI models and machine learning training and enabling generative AI solutions.

Micron’s purpose-built memory and storage solutions enable generative AI training experiences, AI artwork, and more. Micron skillfully brings the speed and capacity required to run generative AI applications on endpoint devices.

Micron also utilizes AI in its smart factories, using data to transform operations and reach historical output, yield, and quality levels in its market-leading AI memory and storage solutions. This dynamic could increase Micron’s productivity, improving its efficiency and profitability as we move forward.

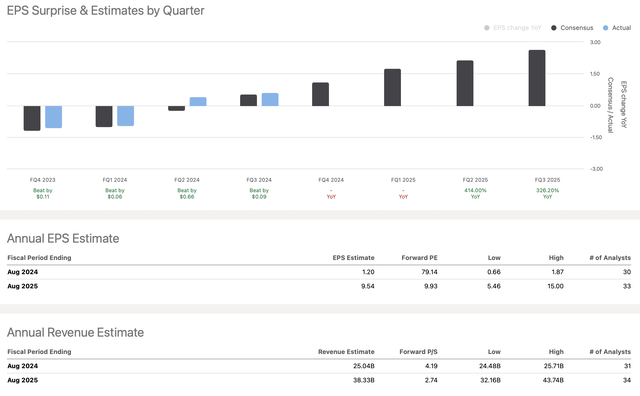

Micron’s Recent Earnings

Micron recently (June 26) released its fiscal Q3 results, which were solid. Micron’s EPS of $0.62 beat the consensus estimate by $0.09, outperforming by 17%. Revenue came in at $6.81B, a $140M beat and a YoY increase of 81.6%. Operating cash flow was $2.48B vs. $1.22B in the previous quarter.

Micron’s data center SSD revenue hit a record high, and Micron continued to gain more share in high-margin products like High Bandwidth Memory. Micron’s CEO said he was excited about expanding AI-driven opportunities and that Micron was well-positioned to deliver a substantial revenue record in fiscal 2025. For fiscal Q4, Micron guided to revenues of $7.6B vs. the $7.58B consensus estimate. Micron also guided to EPS of $1.08 vs. the consensus $1.04 figure.

The Takeaway - We saw better-than-expected results and solid guidance from Micron. While it was not an “Nvidia Moment” nor a home run, Micron provided a very strong earnings announcement with a lot to be excited about in the future. It certainly did not report anything that may have warranted a 40-50% decline in its stock price.

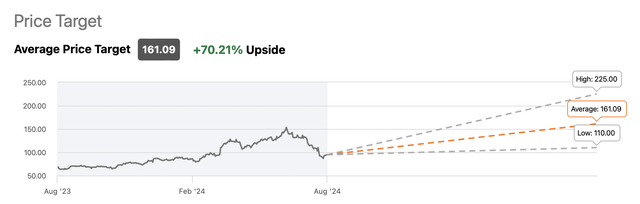

Micron Is Dirt Cheap Relative To Price Targets

Wall Street is bullish on Micron, and given the solid fundamental backdrop, I don’t see a reason why price targets would decline.

Micron’s lowest price target is around $110, roughly 16% above current levels. However, that’s just the very low-end target range. The average price target is around $161, approximately 70% higher from here. The higher-end targets reach $225, implying Micron has approximately 135% upside potential in the next twelve months. My 12-month target remains $180, representing roughly 100% upside from here.

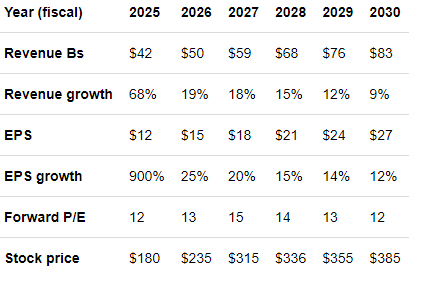

Micron Has Impressive Growth Potential

Micron has not typically been considered a growth company. However, things are changing, especially given Micron’s leading position in memory AI, lucrative server segment prospects, changing competitive landscape, and other factors. Micron’s sales and EPS should increase considerably in the coming years, and the growth could last longer than some market participants may expect.

Micron’s EPS Could Skyrocket

Micron’s EPS could surge to about $10 in fiscal 2025, much higher than the recent depressed EPS period Micron is exiting. Moreover, sales are expected to surge from only about $25B this year to an estimated $38B (roughly) in 2025. This dynamic illustrates a sales growth rate of over 50% and an EPS growth of nearly tenfold. Moreover, Micron’s expansion should continue in future years.

EPS Could Improve More Than Expected

The consensus EPS estimate for fiscal 2026 is around $12.50, but Micron could earn $13-$15 in EPS or higher by then, and higher-end estimates go to around $18. Given the consensus estimate, Micron trades around a 7.5 forward (fiscal 2026) P/E ratio. And if we use a slightly higher $14 2026 EPS estimate, its forward P/E ratio may be below 6.8 here, dirt cheap for a company in Micron’s advantageous, market-leading position. Therefore, we can justify a higher stock price, making Micron one of the top intermediate and longer-term buy-and-hold candidates.

Where Micron’s stock could be in the coming years:

Micron’s stock has considerable revenue and earnings growth potential. Memory AI, data center revenues, and other growth channels could enable Micron to provide double-digit sales growth in future years. Additionally, Micron could benefit from AI-related efficiencies and other profitability-maximizing strategies. Micron’s impressive growth could enable considerable multiple expansion, leading to a much higher stock price in future years. Also, my estimates may be conservative, and Micron’s stock could go substantially higher (especially if the multiple expands more) than my model implies.

Risks to Micron

Micron faces risks despite my bullish assessment. First, Micron has competition, and there are geopolitical risks and other variables to consider as they may impact demand. Micron may also encounter volatility if the economy slows or interest rates remain high. Micron’s business is also quite cyclical, and its products can experience price drops due to oversupply and other market dynamics.

Therefore, in a more bearish case scenario, Micron may not achieve the high growth my estimates imply, and its profitability may not expand as expected. Micron can also experience multiple contractions during down cycles, leading to a lower P/E ratio and a depressed stock price. Investors should consider these and other risks before investing in Micron.