- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Super Micro Computer: A Textbook Strong Buy Opportunity

Super Micro Computer, Inc. (NASDAQ:SMCI) has become another victim of the tech carnage. Last week, the AI hardware company’s stock plummeted more than 20% after 4Q24 earnings that were not bad at all, but the margin development caused some concerns about profitability.

I think the 20% drop is way overdone and not justified based on Super Micro’s considerable strength in growing its server system sales. Super Micro is also profitable and was recently included in the S&P 500 which will give the company more visibility for investors moving forward.

Furthermore, Super Micro announced a ten-for-one stock split as well, which is set to take effect at the start of October, and which could make the stock more compelling as an investment.

The market chaos that played out last week creates a textbook ‘Strong Buy’ opportunity for investors, in my view, as Super Micro will continue to grow quickly moving forward.

Sales Explosion Is Creating A ‘Strong Buy’ Opportunity

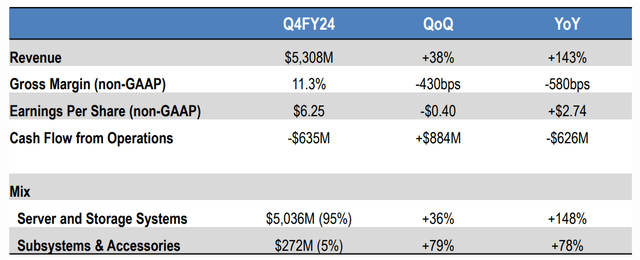

The AI hardware provider’s sales are going through the roof this year as the sector is profiting from accelerating investments into data centers. Super Micro produced 143% YoY growth in 4Q24 and generated total sales of $5.3 billion.

The hardware company is specialized in servers, particularly those that can handle AI processing, which makes Super Micro obviously a winner in the AI race. All of Super Micro’s sales growth is due to the Server and Storage Systems segment, which benefited from 148% YoY sales growth in the last quarter.

Revenue Growth (Super Micro Computer Inc.)

Super Micro’s growth comes from the IT industry that is scaling up investments in data centers. With AI-powered tools like ChatGPT taking the market by storm, hardware and software companies have ramped up their investments in IT systems that can handle artificial intelligence processing.

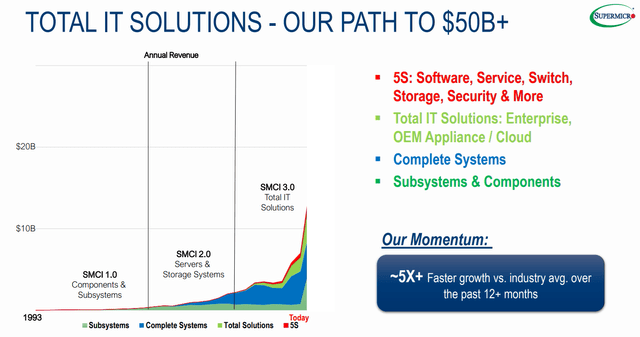

The consequence of this unbridled spending on AI is a substantial increase in the IT solutions market size, which Super Micro pegs at $50 billion.

Increased spending on IT solutions is also why the hardware company guided for $26-30 billion in sales next year, reflecting 87% YoY growth, meaning Super Micro anticipates the present spending wave in the AI hardware market to last at least until next year.

Annual Revenue (Super Micro Computer Inc.)

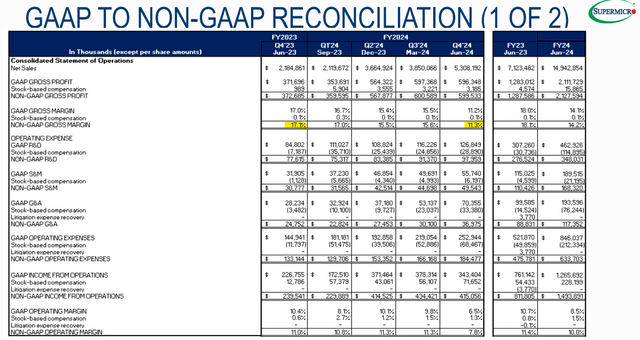

Though Super Micro did reasonably well in the last quarter in terms of sales growth, gross margins are a potential weak spot for the hardware company.

Investors tend to expect sales growth to translate into higher operating or gross margins, and this turned out to not be the case for Super Micro in the last quarter.

As a matter of fact, Super Micro’s non-GAAP gross margins fell from 17.1% in 4Q23 to 11.3% in 4Q24 due to higher cost of sales.

Non-GAAP Gross Margin (Super Micro Computer Inc.)

10-For-1 Stock Split

Super Micro said that its stock will be split ten-for-one in October, with the stock expected to start trading on a split-adjusted basis on October 1, 2024.

The lower price tag for Super Micro will not make the stock cheaper from a fundamental point of view (the company’s valuation ratios will stay the same), but Super Micro could become more affordable for investors regardless as the stock price is set to drop down from $500 to $50.

Very Low Profit Multiple Given The Potential

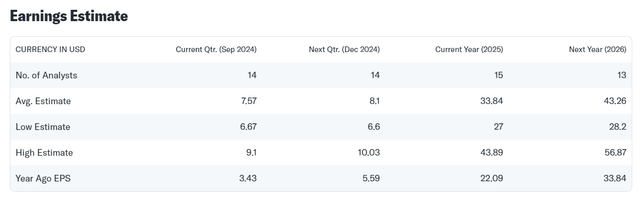

The market presently models $43.26 per share in profits for Super Micro in 2025, reflecting a YoY growth rate of 28%. Sales, which is where the server maker is particularly crushing it right now, are anticipated to grow 18% next year. This year, they are anticipated to skyrocket 75% YoY.

Super Micro was added to the S&P 500 index in March, which requires that companies must have four quarters of positive earnings in the preceding four quarters. Super Micro is profitable, widely so, and is presently selling for a leading (2025) profit multiple of 11.8x.

Earnings Estimate (Yahoo Finance)

Taking into account Super Micro’s sales growth, recent inclusion in the S&P 500 and upcoming ten-for-one stock split, I think that Super Micro’s correction presents a quite unique and compelling Strong Buy opportunity. In the first quarter, Super Micro sold for twice the price that the stock is selling at today and the outlook, as far as I am concerned, has not deteriorated in the least.

Nvidia Corp. (NVDA) is anticipated to about double its sales this year, and the company’s stock is selling for a 27.9x profit multiple. Dell Technologies Inc. (DELL), a direct competitor to Super Micro, is selling for 10.0x leading profits, but expected to grow its sales only 9% this year and 7% in 2025.

Given these alternatives, I think that Super Micro is a compelling deal in the AI hardware market.

Why My Investment Thesis Might Be Off

Super Micro’s 4Q24 profit report resulted in a 20% correction, even though the company’s forecast for 2025 was quite positive. What might be considered a weakness is Super Micro’s margins, which admittedly came in weak in the last quarter, but due to investments in research and development.

If Super Micro’s margins further deteriorate, I do see some headwinds for Super Micro’s valuation multiple.

My Conclusion

Super Micro is a complete steal, in my view. Rarely have I seen a company that is growing its sales at 143% YoY and costs less than 12x leading profits.

Super Micro’s profit multiple decompressed last week, primarily due to the concerns about the company’s margin growth, which I think overshadowed Super Micro’s 2Q24 earnings release quite a bit.

Since March, the stock is down by about half, and that’s despite Super Micro releasing a solid forecast for 2025 sales and Super Micro being profitable.

Furthermore, the stock split could make the stock more attractive from a price-tag point of view, and the inclusion in the S&P 500 will only help to give Super Micro higher visibility. I think that Super Micro is in a textbook buying setup, primarily because of the unreasonably low profit multiple of 11.8x.

The risk/reward relationship is extraordinarily compelling, particularly as the market appears to overreact to Super Micro’s earnings release. Strong Buy.