- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The July CPI Inflation Preview: Stagflation Could Be The Main Risk

The pivotal July CPI report

The Bureau of Labor Statistics is set to release the CPI inflation data for July on Wednesday. The consensus expectations are that:

- The Core CPI would increase by 0.2% MoM, which is above the 0.1% rate in June, and by 3.2% on an annual basis, which is below 3.3% in June.

- The Headline CPI would also increase by 0.2% MoM, which is above the -0.1% rate in June, and by 2.9% on an annual basis, which is below 3% in June.

Trading Economics

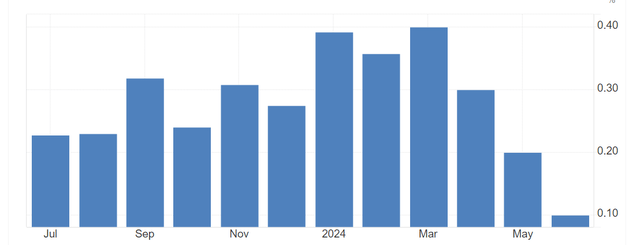

To put the July CPI data within context, it’s important to note the recent trend in the Core CPI inflation.

- Last summer into the year-end, the monthly Core CPI was generally elevated at 0.22% and 0.32%. This was consistent with a 3-3.5% annual core CPI inflation.

- Then, unexpectedly, during the first three months of 2024, the core CPI accelerated to the 0.4% monthly rate, which was consistent with the well above the 4% annual inflation.

- Since March 2024, the Core CPI has been falling, reaching only a 0.1% monthly rate in June.

- Overall, it seems like the “inflation bump” during the first quarter of 2024 has transitioned to a disinflationary trend, which is consistent with a slowing economy and a weakening labor market.

Here is the chart of monthly Core CPI inflation:

Trading Economics

The Fed’s easing cycle implications

If, in fact, the consensus expectations are correct, a 0.2% core monthly CPI inflation in June would be consistent with an annual core CPI of around 2.5%, which is consistent with a 2% core PCE inflation, and thus, it would signal a return to the Fed’s 2% price stability target.

Thus, if July turns out to be the third month in a row where the core CPI is in the 0.1-0.2% range, and this is followed by another month in the same range in August, the Fed should be able to start cutting interest rates in September.

The bond market is currently pricing the Fed to:

- cut by 75bpt by December 2024 to 4.5%

- further cut to 3.75% by December of 2025.

This is consistent with a mild recession, possibly starting in Q1, 2025.

However, the Cleveland Fed Inflation Nowcast is predicting that the core CPI will be higher for both July and August at 0.27%. On an annual basis, this would be consistent with 3.3% core CPI.

Thus, the Cleveland Fed inflation model does not predict the return to the targeted price stability level yet - it’s still predicting the sticky and elevated inflation well above the 2% target. If the Cleveland Fed Inflation Nowcast model is correct, the Fed might not be able to start cutting interest rates in September as expected.

Cleveland Fed Inflation Nowcast

The focus on Shelter and Energy

The key issue for the market is now, thus, whether the recent disinflation is just a temporary relief, as the Cleveland Fed model seems to predict.

The recent disinflationary trend has been driven by these two key factors:

1.a sharp fall in energy prices (this caused the fall in the headline CPI inflation), and

2.the moderation in shelter inflation (this caused the fall in the core CPI inflation).

Shelter

The shelter inflation is the most important variable with respect to the core inflation and thus, the Fed’s policy.

Shelter inflation spiked during the post-covid era due to the pandemic-related housing demand, and the statistical measure of the core CPI is still reflecting this housing dynamics (with a lag).

At the same time, the market rents (this is what’s currently happening) are falling, and this has to eventually be reflected in the official core CPI data. In June, shelter inflation moderated from 0.4% monthly rate to 0.2% monthly rate. If this is the signal that shelter inflation is starting to reflect the reality, then the recent disinflationary trend is likely to continue.

However, if the shelter inflation, especially the Owner’s Equivalent Rent, is correlated with the housing prices, the moderation in shelter inflation is still questionable, as housing prices are still rising. The recent data showed that the National Housing Price Index is still 5.7% higher in May of 2024 compared to May 2023.

Furthermore, if the Fed actually starts cutting interest rates prematurely, the housing market could continue to soar due to lower mortgage rates, which could accelerate the shelter inflation.

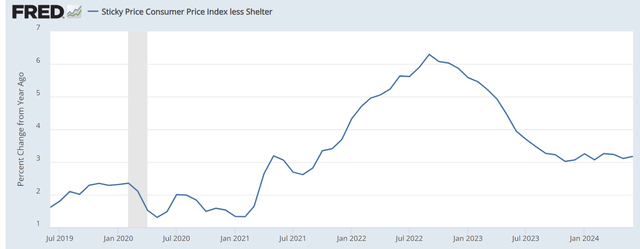

Another issue is that the Sticky Price Consumer Price Index excluding Shelter is still elevated at above the 3% level since November 2023, and it actually increased in June. Thus, the broad inflationary pressures are still present.

Trading Economics

Energy

The key input in the Cleveland Fed Inflation Nowcast is the weekly price of gasoline. Given that the falling price of energy has been the key reason behind the recent disinflationary trend, it is important to note the trends in the energy market.

On the demand side, the price of crude oil has been pricing a slowing US economy, as evident by the weakening US labor market. A slowing US economy would be consistent with lower energy prices, and thus, the continuation of the disinflationary process.

However, on the supply side, we have the major geopolitical situation in the Middle East unfolding, which could cause a supply shock and boost energy prices. Specifically, the potential direct conflict between Iran and Israel could spark a regional war, which could push the price of crude oil (USO) towards $150/barrel and higher.

Obviously, the spike in oil price would cause the spike in the US headline CPI inflation, similarly to what happened in the 1970s.

Implications for investors

The US economy is slowing and the US labor market is weakening to the point where there could be an imminent recession, at least based on the Sahm Rule. In this situation, the inflation should fall drastically, and the Fed would be forced to ease the monetary policy accordingly. In fact, this is what some analysts expect from the July CPI report - the confirmation that the US economy is entering a recession.

However, we are in the process of unfolding de-globalization, facing potentially an imminent geopolitical escalation in the Middle East - and this could be inflationary.

Thus, we are in a situation where the demand is slowing, but the supply shocks are real - and this is a stagflationary environment. In other words, we could get into a recession, but inflation can still remain elevated well above the 2% target.

Obviously, this is the worst-case situation for the stock market, as the Fed would not be able to respond to the slowing economy by cutting interest rates aggressively.

The S&P 500 (SP500) is facing a recessionary bear market, as earnings estimates must be revised lower for 2025. At the same time, the S&P 500 is facing the Gen AI bubble burst, as the Gen AI hype seems to be fading. If the Fed is unable to come to the rescue due to the supply shocks, the total drawdown in S&P 500 (SPY) could be substantial.