- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Google's Battle To Maintain Supremacy

Investment Thesis

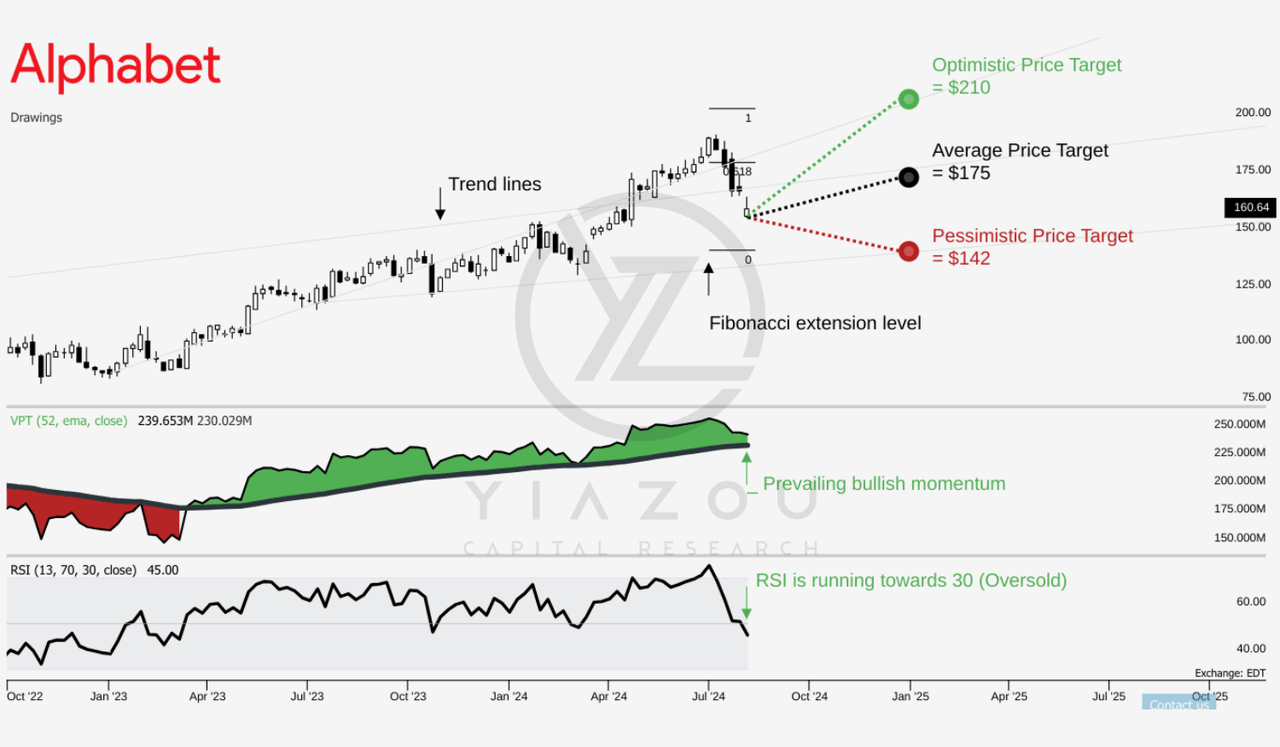

Our previous analysis two months ago for Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) included a bearish divergence warning, with an RSI fast approaching 70, signaling it was overbought. GOOG has dropped 7% since then, against our cautious view, despite the positive outlook for the long term.

However, the overall bullish thesis remains intact. The recent decline has brought the RSI down to 45, signaling that GOOG is approaching oversold territory, though not fully there yet. Ideally, a clearer oversold signal would occur around an RSI 30, which could present a more compelling buying opportunity.

As it stands, GOOG is getting closer to a potential new bull run, making it a stock to watch closely in the near term. Investors should consider this dip a potential entry point, especially if the RSI continues to decline towards more oversold levels, which would align with a more robust bullish setup.

If you want to invest in this stock, you can go to BiyaPay to monitor the market trend and wait for the right time to buy. Of course, if you have difficulties with deposits and withdrawals, you can also use it as a professional tool for US and Hong Kong stock deposits and withdrawals. You can recharge digital currency to exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it to other securities firms to buy stocks. The arrival speed is fast, there is no limit, and it will not delay the market.

Resistance at $175 or Rally to $210?

GOOG’s price of $165 sits below the average price target for 2024 of $175, which aligns with the Fibonacci retracement level of 0.618, suggesting potential resistance. The optimistic target of $210 corresponds with the Fibonacci level of 1, indicating strong bullish momentum if this level is approached. Conversely, the pessimistic target of $142 aligns with the Fibonacci level of 0, indicating strong support if the price declines.

The Relative Strength Index (RSI) is at 45, showing no bullish or bearish divergence, with a downward trend indicating waning momentum. A long setup is identified at an RSI of 30, suggesting a potential buy signal if the RSI continues to decline. The Volume Price Trend (VPT) line is also trending downward, with the current VPT at 239.69 million and the moving average at 230 million. The VPT is approaching a bottom touchdown on its moving average, hinting at a possible reversal.

Based on the last ten years of monthly seasonality, August 2024 has a 45% chance of a positive return, indicating moderate seasonal strength. Overall, the technical indicators suggest caution with potential buy opportunities if key support levels are reached.

Alphabet’s AI Revolution: Powering Growth and Dominance in Cloud and Search

Alphabet’s strategic investments in AI are crucial to stimulating future growth. The company has injected AI technologies into all its services, which help raise more revenue and increase user engagement. The AI enhancements on Google Search have also tried to boost user activity, especially among the young generation.

Adding AI solutions to the part of Google Cloud has been the center of the segment’s growth. Cloud revenues jumped 29% during the second quarter to over $10 billion, and the cloud is fast emerging as the other big revenue generator for the behemoth. Over 2 million developers already use Google’s Gemini, including Alphabet’s robust AI strategy comprising infrastructure and apps.

Google’s Search Fortress Faces AI Showdown: Can It Maintain Its Dominance?

Google Search has long been the backbone of Alphabet, maintaining a stable market share even amid growing competition. However, the company’s stronghold on search has been continuously disputed for the last year due to improvements made in the frontier of generative AI, especially from Microsoft Corporation’s (MSFT) Bing.

Even with all the fierce efforts Microsoft is making to replace Bing as a credible alternative, Google’s market share does not seem to have taken a serious hit. Sundar Pichai’s approach of sticking to Google’s core strengths rather than retrofitting a response to competitors indicates that the company is assured of its products.

According to Deepwater Asset Management, Google Search remains strong due to its habitual nature. Almost 8.55 billion searches are hosted daily. This habit-based usage is further entrenched with continued AI enhancements underpinning Google’s position against potential disruption.

Takeaway

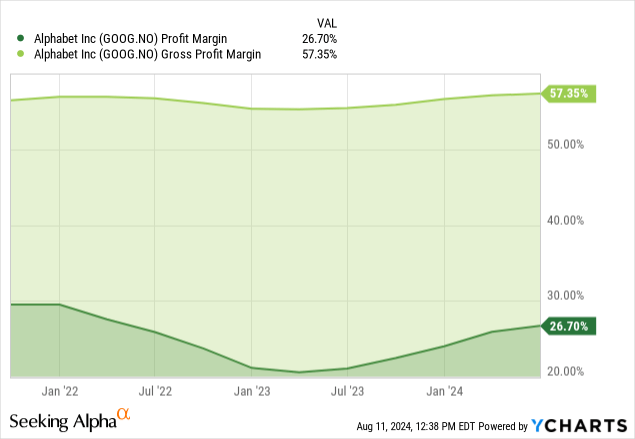

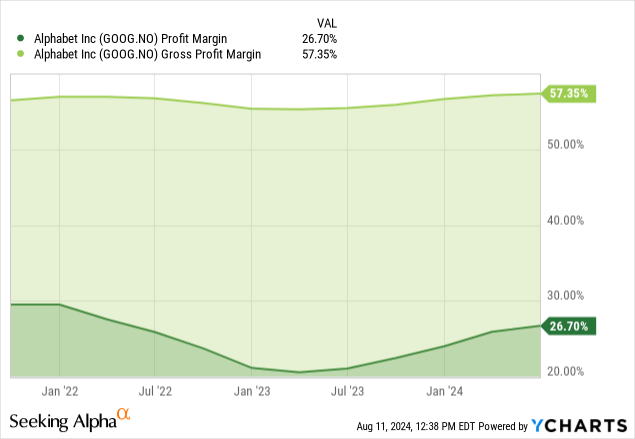

Alphabet is one of the strongest technology firms, perhaps primarily due to heavy investments in AI and cloud services. While some remain concerned about high CapEx levels and near-term pressure on operating margins, Alphabet has long positioned itself for long-term growth through innovation and investment in its infrastructure.

For this reason, investors seeking sustained revenue growth should monitor developments in Google Cloud and AI integration closely. Nevertheless, Alphabet remains a solid investment due to its sound financials and leadership in important technology sectors-even as the market is likely to remain volatile.