- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Efficient and Secure: How to Use Remitly for Sending and Receiving Money in Singapore

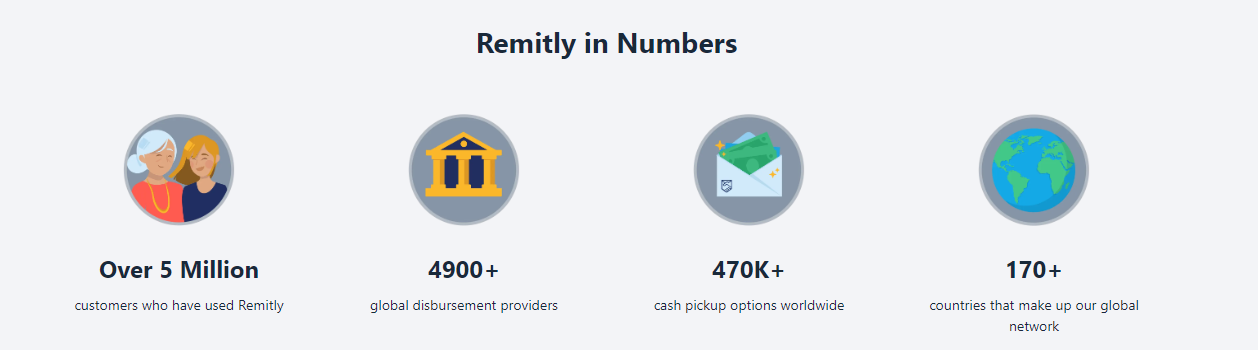

As globalization deepens, international remittances have become a routine part of daily life, especially for those who need to support families abroad or engage in international transactions. In Singapore, Remitly offers a convenient, economical, and secure remittance pathway, allowing users to easily send money worldwide. This article will explain in detail how to use Remitly for international remittances and explore its advantages in meeting user needs.

Introduction to Remitly’s Advantages

Choosing Remitly is not just about speed and cost-effectiveness. The platform also focuses on user security and convenience, offering features such as real-time exchange rates, low-latency transaction processing, and multilingual customer support. Moreover, Remitly’s service network covers multiple countries and regions and supports various currencies, making it an ideal choice for international remittances.

Remittance Tutorial

Adding Recipient Information

- Add a new recipient in your account.

- Enter the recipient’s full name, bank account number, bank name, and contact information.

- Save and confirm the information is correct.

Selecting Remittance Amount and Currency

- Enter the amount you wish to remit.

- Choose the currency type for the receiving country.

- The system will automatically display the corresponding exchange rate.

Reviewing Fees and Exchange Rates

- Review and confirm the total remittance fees and the exchange rate used.

- Check for any additional fees or taxes.

Submitting and Tracking the Remittance

- After reviewing all information, confirm and submit the remittance.

- Use Remitly’s tracking feature to monitor the progress of the remittance.

- Receive transaction updates via SMS or email until the funds arrive.

BiyaPay: A More Convenient Global Multi-Asset Trading Wallet

For those looking to open overseas accounts in Singapore for cross-border remittances or investment finance, BiyaPay offers a more convenient tool than traditional banks and Remitly. BiyaPay provides fast, secure, and low-cost international fund transfer services, supporting local transfer remittance services in most regions and countries worldwide, with same-day settlement, support for large remittances, and fees as low as 0.05%. It is an ideal choice for overseas investors. It also supports real-time exchanges of digital currencies (such as USDT, BTC) to mainstream fiat currencies like USD and GBP, making fund management easier and more reassuring for cryptocurrency traders.

Questions?

Remitly provides comprehensive customer support to ensure that every query users might have while using the remittance service is addressed. Customers can contact the customer service team anytime via phone, email, or live chat, with service available 24/7. Remitly’s customer service team supports multiple languages, catering to the needs of global users.

With these rich service options, Remitly ensures that its users can receive timely and effective help when making international remittances.

Using Remitly to send money overseas from Singapore means enjoying not only fast and cost-effective services but also a secure, reliable, and widely covered international remittance solution. Whether your needs are daily family support, emergency fund transfers, or international business transactions, Remitly provides services that meet your requirements.