- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Super Micro Computer: I'm Buying The Dip

Investment Thesis

Super Micro Computer, Inc. (NASDAQ: SMCI ) reported fiscal fourth quarter earnings that exceeded revenue expectations but missed earnings per share expectations. As of this writing, the company’s stock price has fallen 20%, reflecting market skepticism about whether the technology industry can sustain growth driven by artificial intelligence.

In my opinion, as an objective investor who did not participate in the initial rise, I think now is not the time to feel nervous. The fundamentals that have driven SMCI to this day are still playing a role. If you invest in SMCI because of the help of AI, these trends still exist. I can even say that in many ways, high-tech AI pioneers like SMCI such as Nvidia (NVDA) have more investment opportunities. They struggle in the constantly changing technological landscape, while SMCI is essentially neutral to semiconductors and operates server assembly lines using chips chosen by customers.

Therefore, the growth prospects of Supermicro computers are still good. If you want to invest in this stock, the current low stock price may be a good opportunity. You can go to BiyaPay to buy. If you want to find a better opportunity, you can also monitor the market trend on the platform. Of course, if you are troubled by deposits and withdrawals, you can also use it as a professional tool for deposits and withdrawals of US and Hong Kong stocks. Recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it to other securities firms to buy stocks. The arrival speed is fast, there is no limit, and it will not delay the market.

Growth is Accelerating

Many market commentators are questioning the ability of public cloud providers to monetize their massive CapEx on generative AI, particularly GPU servers used to train and host large language models. We saw this in the market reaction to Amazon (AMZN), Alphabet (GOOG), and Microsoft (MSFT) most recent earnings calls.

Whether these concerns are justified or not is irrelevant to SMCI. Cloud providers, who SMCI calls data center hyperscalers, can’t afford to not invest in AI, just to stay relevant in this competitive market, where reputation can have a significant impact on earnings. If one cloud provider is perceived to have inferior AI offerings than the other, it will lose market share, even from customers who aren’t heavily reliant on AI public cloud services.

For this reason, through the remainder of this year, and through 2025, I don’t see companies spending less on servers. Moreover, there is a fundamental need to build processing capacity. Historically, data center demand has increased exponentially, and I don’t see this trend reversing. There might be periods of dislocation at some point in the near future, where supply exceeds demand, but these periods are temporary. Companies will continue refining their LLMs forever, to incorporate new data and changes in consumer behavior. The bottom line is that these tailwinds that propelled SMIC’s revenue to the levels we see today are cyclical in nature, and will continue supporting demand for the foreseeable future. It is not surprising that SMIC is forecasting a 100% revenue growth in the next twelve months, adding $14 billion in sales on top of its revenue surge year-to-date, showing accelerating demand.

Cash Balance

I think one of the main questions that comes to mind when looking at the spectacular rise of SMCI is where do we go from here? What is the company going to do with all the cash it accumulated on the back of the AI bonanza, especially given the short technological horizon in the server assembly business?

The company ended Q4 (three months ended June 2024) with more than $9 billion in current assets, including $4.4 billion in inventory, which typically sells in 80 days, and $2.6 billion in accounts receivables, which are typically collected in 37 days. With this massive dry powder, a question that comes to mind is what will the company do with all this cash?

Capacity-building is one option, but this shouldn’t require more than $1 billion in the short run. The current sales levels are being supported by a mere $414 million in property, plant, and equipment ‘PPE’, as of June 2024.

My first instinct is that the company will expand vertically, lessening its reliance on third-party suppliers and increasing its value-added services within the supply chain. I also entertained the thought that Super Micro expands into the consumer electronics business, particularly personal computers, similar to Dell (DELL) and Hewlett Packard before it split its personal and enterprise segments into two different companies; HP Inc (HP) and Hewlett Packard Enterprise (HPE).

To put this cash balance into perspective, if the company decides to distribute it to shareholders, that’s a $155 dividend per share, compared to a current share price of $535, which brings us to the next point; Super Micro is cheap.

Valuation

SMCI’s EPS might have disappointed the market because margins narrowed significantly in Q4, but its forward revenue guidance for FY '25 is by no means a disappointment. The company expects FY '25 sales to range between $26 - $30 billion. That’s doubt what it made this year at the midpoint!

Super Micro attributed its margin decline to a set of factors, some of which seem more fleeting than others. It sold more servers to hyperscale data center customers, who, given their bargaining power and bulk purchases, can command higher discounts. The company also incurred extraordinary costs related to supply chain disruptions related to their new Direct Liquid Cooling system. Specifically, they had to pay more to expedite the procurement of essential equipment and parts to meet their deadlines for their customers. Naturally, as in any new production line coming online, there are initial startup costs which typically ease as production ramps up and economies of scale are reached.

Still, even if we assume that margins never recover, settling at a net income margin of just 8%, this still would translate to mind-blowing figures based on the company’s FY’25 revenue estimates. An 8% margin would result in $2.1 - $2.4 billion, which, based on the current diluted share count of 61 million, translates to an EPS of $34.5 to $39.3 per share, and a P/E ratio between 13x and 16x, which hardly screams overvalued, even for a cyclical stock, notwithstanding that a downturn is likely a few years away, short-lived, and not as deep as many expect.

Q4 Results, and How I Might Be Wrong

What stood out in SMCI’s Q4 earnings was the dip in margins. As mentioned above, some of this decline is attributed to high competition, and the bargaining power of data center hyperscalers, which are factors that SMCI has little control over in the short run. (Eventually, they could find ways to differentiate their products and services, a good use for their $9 billion dry powder.)

On the other hand, part of the challenges in the last quarter were attributed to challenges that could be fixed, namely the supply chain challenges. To resolve this issue, SMCI is investing in capacity, signing new supply contracts, and building a new ecosystem in Malaysia to support its new facility in the Southeastern nation. The Malaysia facility will come online later this year.

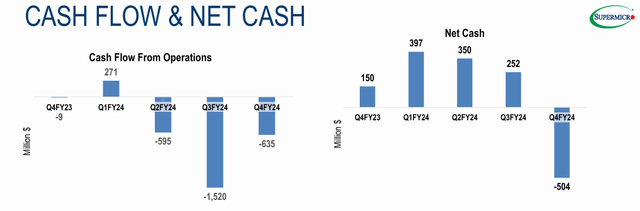

Another concerning trend that prevailed not only in Q4 but throughout FY '24 is the operating cash outflows. Cash outflows in Q4 stood at $635 million, compared to the $9 million operating cash outflow in the prior year. Its net cash balance declined as it funded a portion of its operating expenditure through debt.

These dynamics were propelled by increased inventory supporting big orders by hyperscale data center customers and higher accounts receivables.

Still, with reliable customers with healthy credit ratings, I believe that the company’s inventory, which typically clears within 82 days, and its accounts receivables, which are typically collected within 37 days, provide a reliable source of liquidity in the short run. These variations in cash inflows and outflows are normal in this industry.

In the future, however, given the unhealthy monetization trends within the public cloud sector, the rapid technological advancement in semiconductors, and the need to stay on top of these changes, one can imagine a new scenario. This is where competition pushes the likes of Microsoft, Google, Amazon, and others into uncomfortable Free Cash Flow “FCF” positions. Even a hint of this happening would lead to a decline in SMCI’s shares, contrary to our bullish stance.

Finally, while net cash turned negative in Q4, I believe that Super Micro still enjoys a healthy balance sheet. The total asset-to-debt ratio was 2.2x. Term loans and convertible notes issued in Q4 stood at 1.8 billion, with interest standing at a modest $80 million annualized.

Summary

The recent volatility has certainly made many of us nervous, but I think it is time to make decisive decisions. The broad sell-off opens an opportunity for those who missed the initial rallies, including myself, in tickers with compelling growth stories, such as Super Micro.

Despite margin pressure in Q4, Super Micro Computer, Inc.'s outlook remains very positive, with revenue expected to double in the next twelve months. I expect margins to gradually recover in the coming year, driven by supply chain initiatives and new production lines ramp-up. Still, even if this doesn’t happen, the company is still attractively valued, even for a cyclical business.