- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

AMD's Stock Drops from Highs: Opportunity or Risk Trap? Evaluating Investment Strategies from Fundam

Advanced Micro Devices, Inc. (NASDAQ:AMD) has been overvalued for a while. Since the last analysis of the stock, its stock price has fallen by nearly 17%. Now, I think the stock valuation is more reasonable, and I think it is expected to achieve high growth in the 2025 and 2026 fiscal years, mainly through its AI-related products. The stock price is expected to increase by more than 50% within 12 months.

However, due to concerns about high capital expenditures and the potential for volatility related to fundamental forecasting errors, the broader AI market may experience bearish sentiment, so we need to evaluate it carefully. Compared with other stocks in the industry outside of NVIDIA ( NVDA ), the stock valuation is still very high, so a smaller allocation may be more appropriate in a diversified investment portfolio.

Artificial intelligence and Data center expansion, product roadmaps, and technology innovations driving growth

AMD’s Data Center division achieved a record $2.80 billion in revenue in the second quarter of 2024 , up 115% year-over-year and accounting for nearly half of the company’s total revenue - thanks to strong sales of the Instinct MI300 GPU and EPYC CPU. The MI300 alone generated more than $1 billion in sales this quarter. The core reason for being bullish on AMD is its business in artificial intelligence, as the rapid development of generative artificial intelligence is driving huge computing demand. AMD’s products focused on artificial intelligence are gaining significant traction, which is why the mid-term outlook is very favorable for the stock.

AMD plans to release new AI chips every year. The MI325X will be released by the end of 2024, followed by the MI350 in 2025 and the MI400 in 2026. This will further drive the growth of the data center and AI markets. AMD also plans to include glass substrates in its high-performance system-in-package (SiP) from 2025 to 2026. Glass substrates have excellent flatness, thermal performance, and mechanical strength, which are crucial for advanced SiP with multiple chips. This helps improve performance and reduce production costs, providing a competitive advantage.

In addition, AMD Client segment revenue, which includes PC sales, grew 49% year-over-year to a total of $1.50 billion. This is largely due to growing demand for AI PCs and strong sales of AMD Ryzen processors. In this regard, AMD is continuing to invest in high-performance processors for laptops and desktops, which should bring significant value-added effects. I believe the market for AI PCs will expand significantly. By 2027, IDC predicts that AI PCs will account for nearly 60% of all PC shipments, and shipments will grow from nearly 50 million units in 2024 to more than 167 million units in 2027. According to Canalys , the market is expected to grow by 44% between 2024 and 2028.

Basic growth estimates, valuation analysis, and 12-month price targets

Due to the growth prospects related to artificial intelligence, the market is generally optimistic about AMD. In fact, AMD is directly competing with Nvidia, and I think AMD’s current valuation is more attractive. As Nvidia’s revenue growth rate seems to be starting to contract, it also faces a higher medium-term exponential growth curve. AMD expects earnings per share to increase by 60% in fiscal year 2025, 35% in fiscal year 2026, and 27.5% in fiscal year 2024. If the valuation is also attractive, then this is an important reason to be optimistic about AMD, and I think the current valuation is indeed so.

Based on the optimistic prospects brought by the current attractive valuation, if you want to seize the opportunity to get on board, you can go to BiyaPay to buy AMD. If you want to find a better opportunity, you can also monitor the market trend on the platform. Of course, if you are troubled by deposits and withdrawals, you can also use it as a professional tool for deposits and withdrawals of US and Hong Kong stocks. Recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it to other securities firms to buy stocks. The arrival speed is fast, there is no limit, and it will not delay the market.

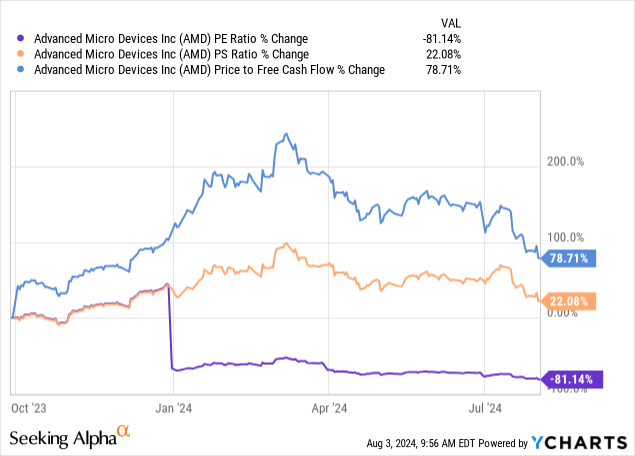

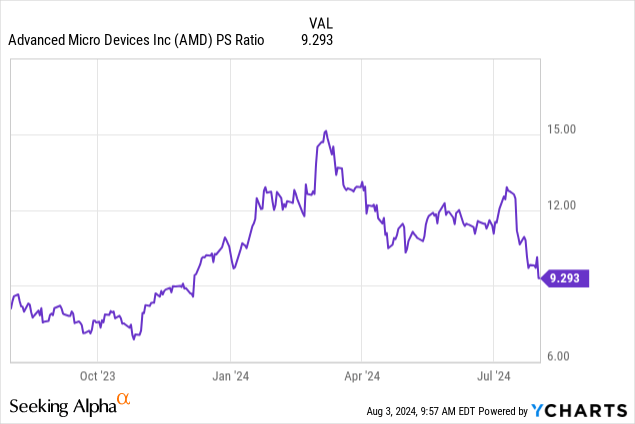

I believe that due to the high growth reported by the company, the market sentiment is high, and by the mid-2025 fiscal year, the Price-To-Sales Ratio may expand to 10. I also believe that, as is generally the case with popular technology stocks, its full-year growth in 2025 will be reflected early on. Therefore, my goal for August 2025 is to reach a market value of $328 billion, which means that the market value will increase by more than 50% from the current $214.50 billion within 12 months.

Despite this bullish view, AMD’s valuation is still very high, with an expected Price-To-Earnings Ratio GAAP ratio close to 100. However, its PEG ratio is only 0.91, which compensates for the value risk here. This is certainly not a Value Investment, and I would not consider it a GARP investment; on the contrary, it is a purely growth investment. If AMD fails to achieve its guidance or general expectations, the stock is prone to downward fluctuations. In addition, its investment in artificial intelligence may have adverse effects, even as a company, it should not be affected by this.

It can be imagined that Nvidia’s bear market will also affect AMD’s stock, even if AMD maintains strong basic growth, which may reduce market sentiment. If the latter situation occurs, it can better indicate that the current situation is a good investment opportunity.

Objections and Risk Analysis

Although AMD has its advantages, NVIDIA, a major player in the artificial intelligence and data center markets, poses a significant long-term threat to it, especially its CUDA ecosystem and GPU. Although I think this is unlikely to hinder AMD’s expansion capabilities in the medium term, it may bring significant resistance in the coming years. Intel (INTC) is also recovering, including its GPU and dedicated hardware product lines, so AMD is facing fierce competitive pressure. Nevertheless, the markets for artificial intelligence, data center, and high-performance computing are large enough for many major players to profit from. However, AMD’s Competitive Edge won’t be as deep as Nvidia’s, so we can’t expect to see the same growth as Nvidia in AMD’s next bull market.

AMD, like NVIDIA, relies on TSMC ( TSM ) for most of its chip manufacturing. As a result, it is more flexible, but also loses the potential economies of scale that Intel may grasp if its 18A “beyond” strategy succeeds. However, AMD’s fabless model provides opportunities for free cash flow growth, which is more difficult for foundries such as TSMC and Intel because manufacturing is capital-intensive. This provides AMD with greater strategic adjustment space, further bringing growth space, because I attach great importance to agility in this era of technological change and innovation, which may trigger new technological demands.

The success of MI325X, MI350, and MI400 largely depends on effective execution and technological innovation - product line delays or technical challenges (including recalls) may seriously affect revenue forecasts. NVIDIA currently accounts for about 80% of the artificial intelligence server semiconductor market share, so AMD faces monopolistic competition, which may lead to shortcuts for cost efficiency and increase the likelihood of technical difficulties. Negative factors such as these may mean that AMD’s stock price will fluctuate significantly due to its already high valuation multiple.

Conclusion

Based on my previous research and analysis of AMD, it has been overvalued for a considerable period of time. Now, after the recent price drop, its valuation is more reasonable. Therefore, I believe that based on its high growth forecast for artificial intelligence and data center businesses in the 2025 and 2026 fiscal years, this stock is a worthwhile investment choice. I expect a compound annual growth rate of over 50% in the 12 months. However, due to the high volatility caused by revenue or earnings that may be lower than expected, caution is still needed. As Nvidia’s growth rate slows and companies and Investment Banks begin to question the return on investment of artificial intelligence capital expenditures, the entire artificial intelligence stock market may also become weak.