- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Is the AI Bubble Beginning to Show? What Challenges and Opportunities Await the U.S. Stock Market?

The U.S. stock market in 2024 resembles a tumultuous ocean—calm on the surface but teeming with undercurrents. Recent setbacks due to weak U.S. employment and economic data, compounded by a surging yen and escalating political tensions from the U.S. elections, have eroded global investor confidence. This resulted in a significant market drop on Monday, with the Nikkei 225 index falling by 6%, U.S. stock index futures seeing expanded losses, cryptocurrencies and tech stocks experiencing increased declines in after-hours trading, and the yield on 2-year U.S. Treasury notes widening by 11 basis points, reaching its lowest level since May 2023 as recession fears intensified.

This week, most of the “Big Seven” tech stocks, including Amazon, Tesla, Microsoft, and Alphabet’s Google, experienced declines, marking four consecutive weeks of losses. Amazon’s shares fell by 8% this week, after declines of 2.76%, 5.84%, and 0.34% in the previous three weeks, underperforming its third-quarter operating profit guidance. Investment bank TD Cowen also reduced its target price for Amazon from $245 to $230. Tesla followed closely with a weekly loss of 5.52%, marking four consecutive weeks of decline. Nvidia’s shares dropped by 5.12% this week, marking three consecutive weeks of decline, as the company faced an antitrust investigation by the U.S. Department of Justice due to competitor complaints. Microsoft and Alphabet’s Google also recorded weekly declines of 3.95% and 0.2%, respectively. As of now, the total market capitalization of the “Big Seven” tech stocks has decreased to $14.74 trillion from $16.40 trillion on July 3rd, erasing approximately $1.66 trillion (about 11.9 trillion yuan) in value over the past month.

However, one might wonder, how long will this downward trend continue? Is there still an opportunity to find fortune in the volatile waves of the U.S. stock market? These questions call for calm reflection and in-depth analysis. A look back at the long history of the U.S. stock market reveals that even in the most optimistic bull markets, multiple retracements and adjustments occur inevitably each year. On average, there are about three 5% retractions and one larger-scale adjustment of about 10% annually. Thus, expecting the U.S. stock market to maintain an unblemished upward trajectory is undoubtedly an unrealistic fantasy.

Market Fluctuations Triggered by the U.S. Presidential Election

The U.S. presidential election, a cyclical political event, acts like an intermittent storm for the U.S. stock market. In election years, the market’s trajectory is often significantly impacted. Typically, from the end of March, the stock market begins to show a downward trend, which can persist until June when it finally bottoms out.

The key reason behind this is that March marks the important moment when both parties finalize their presidential nominations. In the two months following the nominations, April and May, the candidates intensively release a series of policy propositions covering key areas such as the economy, trade, and taxation. Each policy announcement, like a large stone thrown into a lake, creates ripples and brings substantial uncertainty to the market. In 2024, this uncertainty could reach unprecedented levels.

Taking Donald Trump as an example, the uncertainty of his policies has been a significant concern during his previous administration. Now, as he re-enters the race, his policy directions are even more unpredictable. For instance, his statements about replacing the SEC chairman and opposing central bank digital currencies raise questions: Are these merely campaign stunts, or could they become actual policies in the future? Currently, Trump and his vice-presidential candidate are making frequent appearances, with his campaign team launching a massive advertising blitz in key battleground states. Meanwhile, scrutiny over past criticisms of childless women by his running mate has exacerbated their campaign’s disadvantage among female voters.

Harris’s campaign team is now advertising heavily in many of the states targeted by Trump, including Arizona, which Biden’s campaign had almost entirely written off. Democrats now see a possibility in Arizona, and a record $200 million fundraising effort in just one week has erased Trump’s financial lead. According to the latest poll by Bloomberg News, Harris has eliminated Donald Trump’s overall lead in seven battleground states. The vice president has sparked enthusiasm among young, female, and Black voters. In swing states likely to decide the November election outcome, Harris’s support rate stands at 48%, compared to Trump’s 47%, making it a statistical tie.

Imagine, in the next two months, if policies with significant impact like these are released intensively, their effect on the market could be enormous. Investor confidence could be severely shaken, and rapid changes in capital flows could intensify stock market volatility. For instance, following Trump’s initial victory in the Iowa caucuses, the stock associated with his Truth Social SPAC surged by 239%. This demonstrates how political campaigns can manifest in specific stock performances.

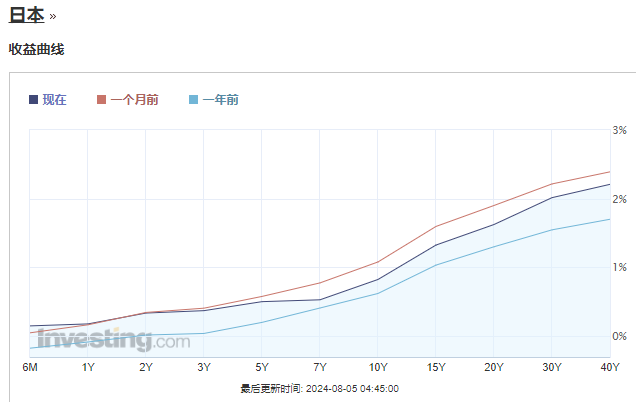

Potential Impact of Normalization of Japanese Interest Rates

The normalization of Japanese interest rates represents another significant risk factor for the U.S. stock market. In March, the Bank of Japan conducted its first interest rate hike in 17 years, adjusting the short-term interest rate from -0.1% to 0-0.1%. In August, there was another increase of 15 basis points, raising the rate to about 0.25%. These rate hikes have had a notable impact on global markets, with the Japanese stock market experiencing its largest single-day drop since the start of the pandemic in 2020, falling nearly 6%.

This market turbulence has increased global investors’ concerns about the U.S. stock market economy. The expected changes signal Japan’s departure from a decade of negative interest rates, marking the beginning of a new chapter in interest rate normalization. Although this is not a positive signal for the U.S. stock market, analysis from professional institutions suggests that the Bank of Japan’s rate hikes could lead to a maximum 9% drop in U.S. stocks. The logic behind this is that as Japan raises interest rates, a significant amount of capital previously floating overseas will be attracted back to Japan, promoting the appreciation of the yen and significantly boosting the yield on Japanese government bonds.

More crucially, this will severely drain the already strained liquidity in the U.S. stock market, with the balance of the U.S. RRP reverse repo account dwindling to a fraction of its former self. At the same time, the U.S. Treasury continues to issue government bonds on a large scale, and the Federal Reserve is steadfastly advancing its balance sheet reduction plan. The liquidity issue, already a major concern for the U.S. stock market in the second half of this year, is further exacerbated by Japan’s rate hike decision.

Additionally, the increase in Japanese bond yields poses a significant threat to U.S. government bonds. If this situation leads to a sharp increase in selling pressure on U.S. government bonds, resulting in higher long-term interest rates, the U.S. stock market will face even more severe challenges. In this situation, investors should closely monitor the dynamics of Japanese interest rate policies and their chain reactions on the U.S. stock market. For investors with lower risk tolerance, it may be prudent to reduce U.S. stock holdings and increase allocations in safe-haven assets. Long-term investors should carefully assess the financial condition of the U.S. stocks they invest in, prioritizing companies with solid fundamentals, ample cash flow, and less susceptibility to external liquidity impacts to diversify risks.

Impact of Federal Reserve Policy Adjustments

The direction of Federal Reserve policies remains one of the key factors influencing the U.S. stock market. Recently, statements from Federal Reserve Chairman Powell and other Fed officials have clearly indicated a significant signal: the narrowing of the number of rate cuts this year is likely to become an irreversible trend.

In July 2024, the Federal Reserve decided to maintain the benchmark interest rate between 5.25% and 5.50%, marking the second consecutive pause in rate hikes. This indicates that the Fed is taking a more cautious approach while monitoring inflation trends and economic data. However, according to the latest Federal Open Market Committee meeting and officials’ remarks, they expect at most two rate cuts this year. In stark contrast, current market expectations remain at a higher level of four to five rate cuts. This significant discrepancy has not yet received sufficient attention or alertness from investors at this stage.

Historical experience teaches us that whenever there is a significant discrepancy between market expectations and the actual decisions of the Federal Reserve, and the market eventually has to compromise towards the Fed’s policy direction, it inevitably leads to a certain degree of market correction. For example, during the dot-com bubble burst in 2000, the NASDAQ Composite index plummeted from a high of 5048.62 points in 2000 to 1114.11 points in October 2002, a drop of over 78%. Many well-known tech companies such as Amazon, Cisco, and Yahoo also saw significant stock price declines, with Amazon’s stock price falling from $113 in December 2000 to less than $6 by the end of 2001, a drop of over 90%.

This has led many investors to increasingly favor interest-rate-sensitive defensive stocks, such as utilities, real estate investment trusts (REITs), and renewable energy yield companies. They believe that the defensive nature of these stocks will enable them to withstand economic downturns. Lower interest rates will reduce their capital costs and make their yields more attractive relative to cash, potentially helping to eliminate the significant barriers they have faced since the Federal Reserve began significant rate hikes in early 2022.

Opportunities and Challenges Arising from the AI Bubble

After exploring the aforementioned series of risk factors, we cannot ignore a potentially once-in-a-decade massive opportunity precipitated by the AI-induced speculative bubble.

Historical Patterns of Technological Revolutions and Bubbles

A review of history shows that disruptive technological revolutions like AI almost invariably trigger financial market bubbles. Examples include the electric power revolution of the 1920s and the internet revolution of 2000, both of which created substantial stock market bubbles. There are three core reasons why technological revolutions foster bubbles:

- Short-lived and unsustainable boost to corporate earnings: Technological innovations can enhance corporate profits in the short term, but an influx of capital leads to increased competition, leveling out extraordinary profits and often leading investors to be overly optimistic based on short-term earnings.

- Investor overgeneralization: Investors may infer that the success of one company will be replicated across similar companies, which is not always the case. For instance, in the electric vehicle industry, investors believed that successful models could be replicated, leading to inflated stock prices.

Between 2020 and 2021, Tesla’s meteoric rise, with its stock price increasing tenfold within a year, also lifted many emerging small electric vehicle companies. Some of these companies hadn’t even produced a single vehicle yet saw their stock prices multiply dramatically, as investors assumed Tesla’s success could be easily replicated.

- Policy missteps by the Federal Reserve during technological revolutions: Under normal economic conditions, monetary policy should adjust according to the state of the economy. However, the special economic boom brought about by technological revolutions leads the Fed to maintain low interest rates due to the absence of inflation and layoffs, thus creating conditions ripe for bubble formation.

This unusual combination of economic prosperity and loose monetary policy undoubtedly provides the perfect environment for the creation and expansion of bubbles.

From the current progress of the AI revolution, we can already observe signs similar to those seen in past technological bubble eras. For instance, Nvidia, a darling of AI, increased its market value by a trillion dollars in just two months, with more extreme cases abounding. Peenteer’s stock surged 60% upon a single earnings report, and Supermicro’s stock quintupled in two months. These exciting stories were almost a weekly occurrence during that period.

Even though a comprehensive AI bubble has not yet fully formed, various signs indicate that the bubble’s inception is already visible. According to FSMOne’s research department portfolio manager, although tech stock valuations are currently high, they are still supported by strong profit growth. Whether these valuations can be sustained largely depends on whether these companies can meet or even exceed earnings expectations.

Given the existing concentration risks associated with AI in the U.S. stock market, investors concerned about this may consider diversifying their risk by investing in equal-weight S&P 500 index funds (ETFs) or other defensive assets like gold.

Investment Considerations Under the AI Bubble

Even with foresight of the AI bubble, it’s difficult to predict the trajectory of U.S. stocks before the bubble forms, especially since this AI bubble might form more quickly and have a broader impact, indicating that investors may not have much time to position themselves. Thus, any short-term risks could be seen as an opportune moment to capitalize on this rare opportunity. As a long-term value investor, how should we engage in this so-called opportunity that we know will entail a bubble?

Investment decisions during this time vary. During the dot-com bubble, Warren Buffett stood by idly, firmly opting not to participate—a decision that was initially mocked by many but ultimately proved correct. At this point, I still believe that good companies can weather bull and bear markets, much like Apple, Microsoft, and Amazon did during the internet era.

In fact, there is already a slight divergence between current market sentiment and actual risk signals, with a possibility of a short-term pullback. At the same time, investors should also see the bigger picture: the opportunities brought about by the future AI bubble. I believe that without the AI bubble, it would be difficult for the U.S. stock market to experience a significant downturn. Any pullback due to short-term risks should be seen as a good opportunity to position for the upcoming technological revolution.

The U.S. stock market has always been a significant barometer for the global financial market, influencing not only the development of the American economy but also the asset allocation and wealth management strategies of global investors.

If you are also interested in investing in U.S. stocks, you will need to open a U.S. stock account. We can choose reputable brokers, such as Charles Schwab, a globally recognized investment broker. Opening an account with Charles Schwab also provides you with a bank account under the same name. You can deposit USDT into the multi-asset wallet BiyaPay and then withdraw fiat currency to Charles Schwab to invest in U.S. stocks.

In conclusion, we currently need a clear and comprehensive understanding of the risks facing the U.S. stock market from the presidential election, normalization of Japanese interest rates, and adjustments in Federal Reserve policy, while also keenly capturing the potential enormous opportunities brought by the AI technological revolution. By analyzing and preparing in advance, making wise investment decisions, we can achieve asset preservation, appreciation, and long-term stable returns.

Only through thorough analysis and adequate preparation can we make wise and rational investment decisions in this complex, challenging, and opportunistic market environment, thereby achieving the preservation and appreciation of assets and long-term stable investment returns.