- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Amazon Shares Falling: What's Behind It? Will It Turn Around?

Amazon (NASDAQ: AMZN ) announced its latest Q2 results, and the market reacted poorly, with its stock price falling after the announcement. Will this downward trend continue? How should we consider our investment behavior? This requires a closer study of its fundamentals to make specific evaluations.

First quarter performance review

The highlight of the company’s Q1 2024 earnings is strong operating income, which is 27.5% higher than the upper limit of the guidance range. Therefore, the operating profit margin looks particularly healthy at 10.7% (Q1 2023:3.7%).

There are obvious risks to Amazon’s future profit margins. Specifically, there are three obvious challenges - the increasingly fierce competition from companies such as Temu under Pinduoduo Holdings ( NASDAQ stock code: PDD ), the slowdown in Amazon’s huge US market growth, and the pressure of rising expenses brought by labor costs. However, in Quarter 1 of 2024, the company clearly performed well in these risks. The healthy net sales growth expectations for the second quarter of 2024 and the Price-To-Earnings Ratio of the stock also make Amazon attractive.

It is in this context that we now look at the company’s latest data to assess whether the price decline will continue.

Why did Amazon’s stock price fall after the release of Q2 2024 results?

From the beginning, there are obvious reasons for the latest price drop, which is evident in the weakness of some data. However, at the same time, there are also reasons to refute these reasons for the decline. These reasons (and their refutations) are as follows.

Sales growth is disappointing

On the downside: Although Amazon’s net sales in Q2 2024 increased by 10.1% YoY, this growth is still the lowest in the past five quarters. This is related to increased competition and risks in the US market. Specifically:

- Although Pinduoduo’s revenue is still a small part compared to Amazon, this proportion may rise to 9.3%. This proportion will be 8.3% in Quarter 1 of 2024 and 6% for the whole year of 2023.

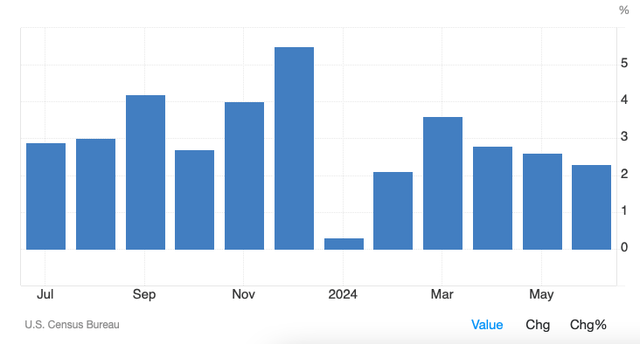

- Although the trend of slowing US economic growth was reversed in the second quarter of 2024, consumers remained low-key in that quarter. The year-on-year growth of retail sales continued to decline throughout the quarter. It is worth noting that even the 2.3% growth in consumer spending calculated by GDP report is lower than the overall economic growth of 2.8%.

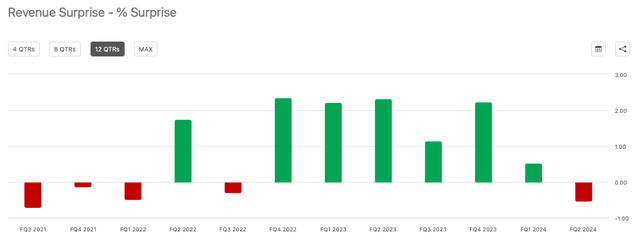

In addition, the company’s revenue growth also fell short of analysts’ average expectations, with a year-on-year increase of 10.7%. This is the company’s first unexpected revenue decline in seven quarters.

The reason for the upward trend: However, there is still room for sales growth in the third quarter of 2024. The guidance range is 8-11%, higher than the 7-11% in the second quarter of 2024. It is worth mentioning that the average analyst expectation is biased towards the upward trend, with a year-on-year growth expectation of 10.1% . This means that growth can maintain the level of the previous quarter.

In addition, even if the growth rate reaches the midpoint of the guidance range of 9.5%, the net sales growth in the first nine months of this year (first nine months of 2024) will still reach 10.7% year-on-year, which is only slightly lower than the 11% year-on-year growth in the first nine months of 2023 and the compound annual growth rate (“CAGR”) of the past three years. In other words, sales growth has actually hardly slowed down.

Operating margin risk

Reasons for the downward trend: From a continuous perspective, the pressure on operating profit margin has become more apparent. It decreased from 10.7% in Quarter 1 of 2024 to 9.9% in Q2 of 2024. Assuming the company’s net sales and operating income both reach the midpoint of the guidance range in Q3 of 2024, the profit margin may further decrease to 8.5%.

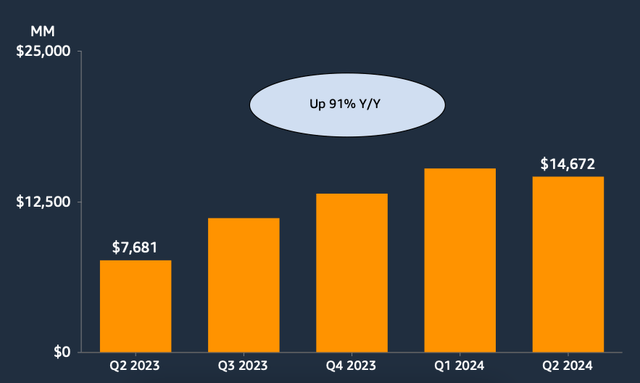

In addition, the operating income data showed the slowest growth in five quarters. However, in itself, it increased by 91% year-on-year, which is nothing to complain about. However, it is worth mentioning that even the absolute operating income of $14.70 billion is lower than Quarter 1 in 2024 (see figure below), which is the first consecutive decline in seven quarters.

Although the company has issued such a warning in its guidance for the second quarter of 2024, it is still frustrating.

The reason for the upward trend: At the same time, from a larger perspective, the operating profit margin actually looks quite strong compared to the same period last year. The operating profit margin for the second quarter of 2023 was 5.7%, while the latest quarter’s operating profit margin was 9.9%. The operating profit margin for the first half of 2023 was 4.8%, while the operating profit margin for the first half of 2024 was 10.3%.

In addition, if the operating income in Q3 2024 reaches the top end of the guidance range, the figure will reach 9.7%. This is not much different from the previous quarter’s figure and significantly higher than the profit margin of 7.8% in Q3 2023. Considering that the profit margin in Q2 2024 is slightly higher than the top end of the guidance range of 9.8%, as the operating income exceeds the guidance, this is entirely possible.

It is encouraging that all three departments of Amazon have contributed to the improvement of profit margins. Of course, AWS is still a key department, with a profit margin of 35.5% in Q2 2024 (Q2 2023:24.4%). In contrast, although the North American and international departments are far behind, their profit margins have also increased. In Q2 2024, the profit margin in North America increased to 5.7% (Q2 2023:3.9%), while the profit margin in the international department was about 1% compared to last year’s loss.

The profit margin is also supported by operating expenses, which increased by 5.2% YoY in the second quarter of 2024. This number is higher than the YoY growth of 14.4% in Quarter 1 of 2024, but significantly lower than the YoY growth of 7.5% in the second quarter of 2023. In addition, considering the possibility of rising labor costs, even a relatively mild continuous acceleration is positive.

Attractive market multiples

The growth of operating income is also reflected in Net Income. The company’s diluted earnings per share (“EPS”) increased by 95.5% YoY in the second quarter of 2024 and 137.1% YoY in the first half of 2024.

Even though the full-year figure only doubled from $2.3 in the first half of 2024, and the annual earnings per share growth slowed significantly to 58.6%, the expected Price-To-Earnings Ratio (“P/E”) still looks good at 36.5 times. This is lower than the 41.3 times level a few months ago and the five-year average of 46 times.

However, if EPS continues to grow at the rate of the first half of 2024, the expected Price-To-Earnings Ratio may be better. The EPS number will reach $6.9, and the Price-To-Earnings Ratio will reach 24.4 times. But even if this number is in the middle of the two possibilities, AMZN still has more than 50% room for growth.

Based on this prospect, people with investment tendencies can go to BiyaPay to monitor market trends and find opportunities to buy. Of course, if there are difficulties with deposits and withdrawals, it can also be used as a professional tool for depositing and depositing US and Hong Kong stocks. Recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to a bank account, and then deposit to other securities firms to buy stocks. The arrival speed is fast, there is no limit, and it will not delay the market.

Summary

In short, although there are reasons for the stock price drop after Amazon’s financial report, its upward potential is also very clear. The biggest advantage is that overall, sales growth and operating profit margin are very good, and they can still maintain this state in the next quarter.

This supports the view that even if the growth rate of EPS slows down from the first half of 2024, EPS will continue to grow strongly until the full year of 2024. At least, AMZN now has a 25% upside potential and still has room for growth in the future.