- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

PayPal: Breakout Might Be Imminent (Upgrade)

Second quarter results of PayPal Holdings, Inc. (NASDAQ:PYPL) showed that the fintech is making some minor progress in terms of combating account losses.

PayPal also enjoyed double-digit growth in the important total payment volume metric, and now anticipates $1.0 billion more in free cash flow and share buybacks in 2024. The fintech also defended high operating margins exceeding 18% and forecasted stronger earnings growth than before 2Q24 earnings.

Though I am still a bit skeptical about PayPal’s account challenges, I think the boosted share repurchase, free cash flow and profit guidance are reasons to modify my stock classification to “Buy.”

The market appears to respond favorably to the fintech’s 2Q24 results, which may be indicative of a positive change in investor sentiment.

My Rating History

PayPal previously expected solid profit growth for 2024, but uncertainty surrounding account losses nonetheless made me cautious nonetheless.

Previously, my stock classification for PayPal’s stock was Hold which I am now lifting to “Buy,” primarily because of a stronger outlook for profits, free cash flows and share repurchases.

PayPal’s higher free cash flow will increase the amount of shares the fintech can repurchase, and those repurchases stand to be executed at a low earnings multiple as well.

Account Trend Still Disappoints, But Total Payment Volume Up

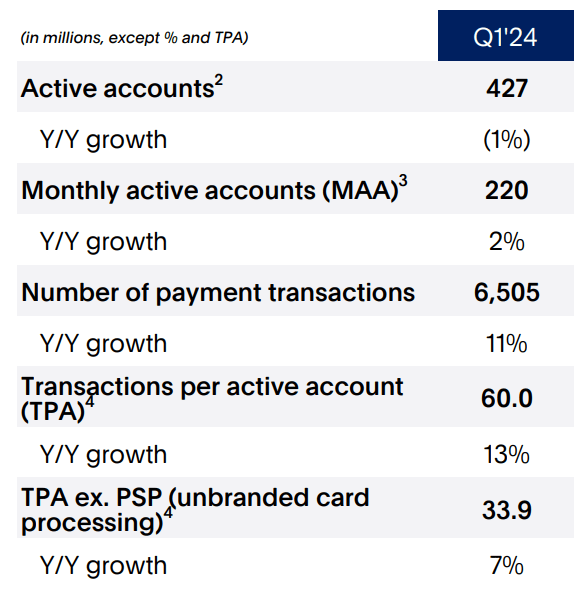

PayPal had 429 million customers using its platform in 2Q24, up 2 million QoQ, but the account total was still below the 431 million users who transacted on the PayPal platform a year ago.

The inability of the fintech to meaningfully grow its customers is the major reason, I think, why PayPal’s stock has substantially underperformed my expectations in the last year.

Active Accounts (PayPal Holdings Inc.)

As is often the case, PayPal’s 2Q24 earnings release showed some promise in other areas, though investors should not make the mistake and underestimate the severity of the fintech’s account issues. If PayPal fails to grow its customers sustainably, I suspect that it will be very hard for the fintech to expand its valuation multiple in 2024.

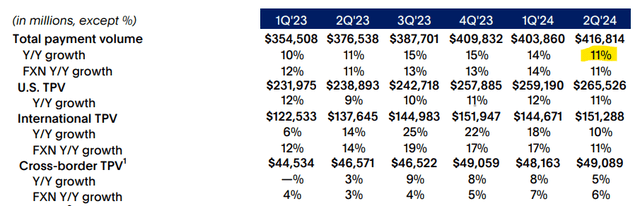

On the flip side, while account growth was not a particularly bright spot for PayPal, the fintech grew its total payment volume, which is the total of processed platform payments, by 11% YoY. Payment volume was robust in both the U.S. and in international markets, growing 11% and 10% respectively. This growth in total payment volume led to 8% sales growth for PayPal on a YoY basis in 2Q24.

Total Payment Volume (PayPal Holdings Inc.)

Fairly Stable Operating Margins, Cost Restructuring Might Aid Margin Expansion

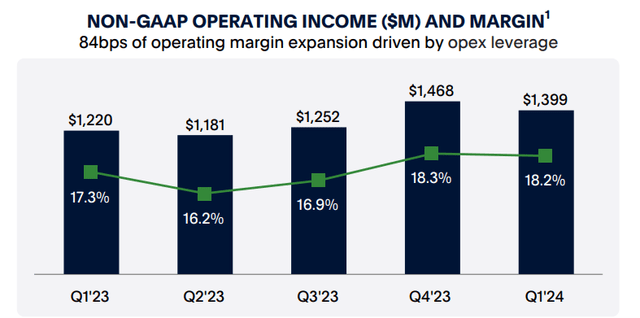

PayPal’s non-GAAP operating income was $1.4 billion in 2Q24, reflecting 15% YoY, primarily because of more transactions, higher total payment volume and an ongoing cost restructuring.

Though the fintech’s operating margin did not grow in the second quarter, it remained fairly stable at 18.2% (compared to 18.3% in the prior quarter). It was the second consecutive quarter with non-GAAP operating income margins surpassing 18%.

I see margin upside for PayPal on growth in total payment volume and ongoing cost reductions, as far as operating expenditures are concerned.

Non-GAAP Operating Income And Margin (PayPal Holdings Inc.)

Increased 2024 Forecast And Profit Multiple

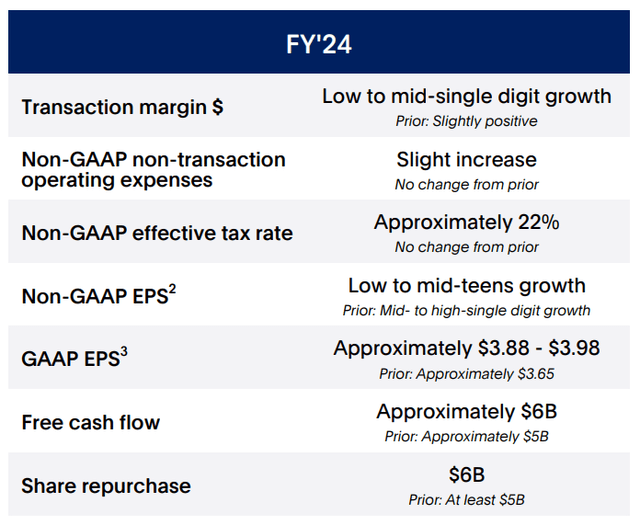

PayPal’s issues in terms of sustainably growing its accounts has not prevented the fintech to increase its profit forecast for 2024. The fintech now sees its GAAP earnings for 2024 trickle in somewhere between $3.88-$3.98 per share, up from a prior estimate of $3.65 per share.

In 2023, PayPal earned $3.84 per share, so the fintech now anticipates to produce at least a bit of profit growth this year (the fintech previously estimated its earnings to be flat YoY).

2024 Forecast (PayPal Holdings Inc.)

It should be noted that PayPal did not only increase its profit guidance, but also its free cash flow expectations and share repurchase guidance: PayPal raised its FCF forecast by $1.0 billion to $6.0 billion. This also means that the fintech anticipates investing 100% its full-year free cash flow into share repurchases.

PayPal’s profit guidance (with a midpoint of $3.93 per share) implies an earnings multiple of 15.0x, and the fintech has a leading (based on next year’s earnings) profit multiple of 12.8x.

PayPal’s profits are anticipated to rise 10% YoY, which may be a conservative estimate if the fintech can keep its TPV growth steady and focus on gutting costs.

SoFi Technologies, Inc. (SOFI) is selling for a 30.7x leading profit multiple, but the company is growing much more quickly and seeing enormous momentum in accounts, which is precisely where PayPal is struggling. Block Inc. (SQ), which is probably PayPal’s closest fintech competitor, is selling for 14.0x leading profits.

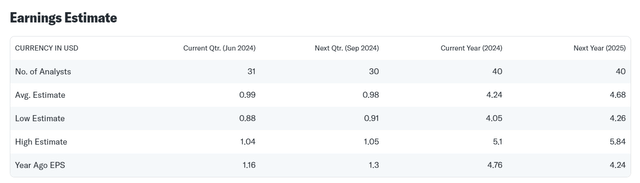

**Earnings Estimate **

If PayPal can manage its account problems and return to stable growth, while maintaining high 18% non-GAAP operating margins and slashing costs, I anticipate the stock to re-rate higher.

My implied intrinsic value estimate is $70. This rests on a 15x profit multiple (and a leading profit estimate of $4.68 per share) which is a more sensible estimate for PayPal, in my view. This is predominantly because the fintech is quite profitable on a free cash flow basis and its cost cuts are starting to make a positive bottom-line contribution.

Why The Investment Thesis Might Disappoint

PayPal has not yet been able to sustainably turn around its account trend, which poses a challenge for the stock, for obvious reasons.

Total payment volume and upside revisions to the key guidance items (profits, free cash flow and share repurchases) have been positive takeaways in PayPal’s second quarter and outweigh the persistent account issue.

Should PayPal, however, begin to bleed more accounts again in the future, and lose market share to other fintechs, then even growth in margins, free cash flow and profits may prevent a re-rating from happening.

My Conclusion

PayPal beat 2Q24 estimates and raised its 2024 profit, free cash flow share repurchase guidance due to momentum in total payment volume and strong margins.

It remains to be seen whether PayPal can recapture some of its customer losses and that have weighed so heavily on the fintech’s performance in the last couple of quarters. Total payment volume growth was in the double digits, supported by transaction growth in both the U.S. and in international markets, and I think the stock is still reasonably cheap with a leading profit multiple (based on next year’s earnings) of 12.8x.

I have more confidence now that PayPal can defend non-GAAP operating margins exceeding 18%. With the fintech poised to repurchase more shares at a low profit multiple, I think that the risk/reward relationship has improved enough to warrant a change in the stock classification to “Buy.”