- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Tesla's Earnings Shock, Stock Price Plummets, How Should Investors Respond?

After the bell on Tuesday, we received second quarter results from Tesla, Inc. (NASDAQ:TSLA). The electric vehicle (“EV”) giant has seen its shares surge recently after a Q2 delivery beat and optimism surrounding the upcoming robotaxi reveal. Unfortunately, the Q2 earnings headline results did not impress investors enough, sending shares down a few percent in the after-hours session.

My previous coverage

When I covered Tesla a few weeks ago, the company had just announced second quarter delivery figures that were well ahead of street estimates. To be fair, analysts had been cutting their expectations for pretty much the past twelve months as Tesla sales growth had slowed, but the numbers were not as bad as some were fearing. Additionally, the company reported a record quarter for energy storage deployments, showing massive sequential growth.

Part of the rally started after the company changed its plan at the Q1 report, looking to accelerate its launch of more affordable vehicles. As a result, plans for the so-called “$25,000 car” seemed to be pushed back a bit. I upgraded shares from a sell to a hold at that report, and the stock has soared more than 50% since, compared to about a 9% gain for the S&P 500.

The Q2 report

While Tesla estimates have been coming down over the last couple of quarters, the Q2 numbers did bounce recently after the delivery beat. Since that July 2nd announcement, the average revenue estimate had gone from $23.96 billion to $24.74 billion, with the latest number representing a year-over-year decline of about 0.75%. The non-GAAP EPS average over that time has risen by three cents to $0.62, although that represented a nearly 32% decline due to falling margins as Tesla has cut prices multiple times.

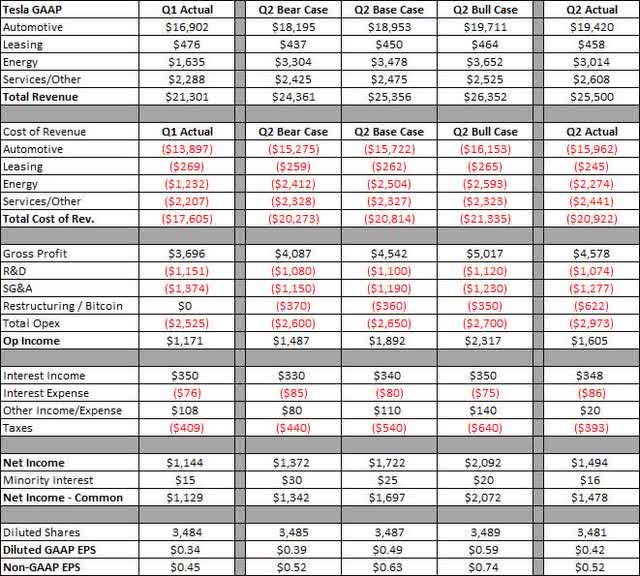

The second quarter report on Tuesday was also expected to be a bit messy, thanks to a large restructuring charge Tesla took to improve its near term operating expense base. In the table below, you can see how Tesla fared against the usual three cases I provide, with dollar values in millions except per share amounts.

When it came to revenues, I was fairly close overall, although some components varied a bit. Tesla reported automotive revenues per vehicle delivered that were down about $150 sequentially, which was much better than I expected. However, this was due to regulatory credit sales more than doubling from Q1 levels to almost $900 million, a quarterly record for the company. Energy revenues fell a bit short of my expectation, likely meaning Tesla had a few more bulk storage system discounts. The company handily beat overall street estimates, coming in with about 2% year-over-year growth, although the quality of the beat will be in question thanks to that credit sales boom.

On the operating side, the main issue was the restructuring charge. Tesla had previously called for at least $350 million here, but that number jumped substantially in the end. Between that and not as much other income items coming in as positive as Q1, net income fell a bit short of my prediction, although things were a bit closer without that one-time charge. In the end, the bottom line came in a bit short of the street, even if you exclude the extra restructuring charges that were booked.

For the quarter, Tesla did generate over $1.3 billion in free cash flow, a dramatic swing from the more than $2.5 billion that was burned in Q1 of this year. Total cash on the balance sheet jumped by almost $4.0 billion, however, as debt and finance leases rose by about $2.4 billion sequentially. The company’s balance sheet is in solid shape and I have no concerns here.

When it comes to guidance, there wasn’t much of an update. The delivery growth rate this year is expected to be much lower this year than last, and the bear camp is still hoping for an annual delivery decline. Management expects to launch some new, more affordable vehicles in the first half of next year, and it plans to unveil its robotaxi later this year. Thus, the status quo really hasn’t changed in the near term, which is partially why shares may be dipping a bit at the moment.

Based on this situation, investors who have not yet boarded the train should evaluate carefully. It is recommended to go to BiyaPay to monitor the trend of Tesla’s market, continue to pay attention to this stock, and wait for the right time to buy. At that time, it can also be used as a professional tool for depositing and depositing US and Hong Kong stocks, recharging digital currency to exchange for US dollars or Hong Kong dollars, withdrawing to a bank account, and then depositing funds to other securities firms to buy stocks. The arrival speed is fast, there is no limit, and it will not delay the market.

A premium EV valuation

Tesla has always traded at a premium to other automakers based on its growth profile. In the past, investors were hoping for significant revenue growth from increasing deliveries, although now a lot of those hopes are more on the profits associated with autonomous vehicles. In the chart below, you can see how Tesla matches up on a price to expected sales basis for 2026 vs. other EV names as of Tuesday’s close — Lucid (LCID), Vinfast (VFS), Rivian (RIVN), Xpeng (XPEV), BYD (OTCPK:BYDDF), Nio (NIO), and Polestar.

Tesla goes for more than five times the average of the other 7 names, and that’s before looking at traditional automakers like Ford (F) and General Motors (GM) that go for about 0.3 times expected 2026 sales. Currently, Tesla does have the best profit and cash flow situation of the primary EV names, along with a tremendous balance sheet. The stock though is considered expensive by analysts, as the average price target of about $201 currently implies roughly 16% downside from the pre-earnings close.

Final thoughts and recommendation

Overall, it seemed like Tesla’s Q2 report was another “buy the rumor, sell the news” situation for now. With shares having surged in recent months, the stock sold off after earnings per share missed estimates even after taking out extra restructuring costs. Tesla booked a lot of credit revenue, which diminished the revenue beat quality a bit, and just maintaining near term guidance means there wasn’t a positive update on the current situation in the shareholder letter.

Currently, I maintain a hold rating on the stock. Although its stock price has soared and its valuation is still high, it takes time to confirm whether there will be explosive growth in the future and needs to be carefully evaluated. In the coming months, investors should shift their attention to the delivery of the third quarter and the new release date of autonomous driving taxis, looking for suitable buying opportunities.