- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Google's Q2 financial report will be released. Don't miss the current investment opportunity!

Investment argument

Initially, Google (NASDAQ: GOOG ) (NASDAQ: GOOGL ) (NEOE: GOOG: CA ) struggled in the artificial intelligence market after the launch of ChatGPT, as it was overshadowed by competitors such as Microsoft ( MSFT ). However, I believe that with their recent advancements, especially the launch of the Gemma 2 model, the company has turned the future of artificial intelligence around. I think they are either already the market leader or rapidly becoming one.

Gemma 2 was launched in June in two parameter sizes, 9 billion (9B) and 27 billion (27B). Google claims that it provides top-notch performance, surpassing competitors in similar or even larger sizes. In my opinion, Gemma 2 marks Google’s transition from just surviving in the competitive artificial intelligence industry to setting new standards for open models in terms of performance and cost-effectiveness.

Google DeepMind has also launched a new AI training method called JEST , which the company claims can improve performance by 13 times and energy efficiency by 10 times compared to existing methods. The method was launched this month and aims to reduce computing costs and energy consumption, which is crucial for sustainable AI development and its application in e-commerce and global customer support.

I think Google’s move now makes investors feel optimistic. Although their model still cannot be compared with OpenAI’s latest model or Anthropic’s Claude, the company has actively turned to leading artificial intelligence innovation, which clearly shows that they have not only caught up, but now have a leading position in the artificial intelligence market. I will talk about this later, but their market share is also catching up.

Alphabet’s financial performance reflects these technological advancements. As of mid-July, the company’s stock price has soared 27.18% year-to-date , thanks to strong advertising growth and AI integration that maintains its market dominance. Alphabet Quarter 1 results showed a 28% increase in Google Cloud revenue, highlighting the economic impact of its AI advancements.

I think this development supports the bullish outlook for Google’s stock, especially as they are about to release their financial report. The progress of artificial intelligence (using Gemma 2 as an example) indicates that Google still has greater potential for growth, which is a strong reason for me. Before the financial report is released, I am still a strong buyer of Google.

If you agree with my point of view, you can go to BiyaPay and trade on the platform; you can also use it as a professional tool for depositing and depositing US and Hong Kong stocks, recharging digital currency to exchange for US dollars or Hong Kong dollars, withdrawing to your bank account, and then depositing funds to other securities firms to buy stocks. The deposit speed is fast and there is no limit.

Why is it worth continued attention?

Previously, I have introduced how Google has developed from a weak position in the AI field to full speed ahead. At that time, Gemini 1.5 Pro reflected Alphabet’s progress in the AI field. CEO Sundar Pichai described the AI transformation as a “once-in-a-lifetime opportunity” and emphasized the enhancement of AI-driven search, digital advertising, and Cloud Service capabilities.

Alphabet’s Q1 2024 results also showed earnings per share of $1.89, exceeding expectations by 25%, with total revenue of $80.54 billion, a year-on-year increase of 15.41%. Google’s search and digital advertising revenue was $61.66 billion, a year-on-year increase of 13%, while Google Cloud revenue increased by 28% to $9.60 billion.

These gains benefited from the integration of artificial intelligence and Machine Learning technologies, attracting enterprise customers such as Bayer, Cintas, and Walmart. YouTube’s revenue increased by 21% year-on-year, thanks to innovative advertising strategies and the shift of would-be users from TikTok due to regulatory uncertainty. These innovative advertising strategies are also driven by artificial intelligence.

Now, the company is starting to lead from a commercial perspective, especially after launching Gemini 2 later this year .

Deep exploration of artificial intelligence: where is the summer market in 2024?

Like many technology companies in the field of artificial intelligence, Google faces challenges in monetizing its progress in artificial intelligence, especially at the software level of enterprise applications. The difficulty in turning artificial intelligence hype into profit stems from the uncertainty of many artificial intelligence models and the resulting quality changes, which may hinder their adoption in the enterprise environment.

The non-determinism in artificial intelligence models means that given the same input, the model can produce different outputs. This variability, while potentially beneficial for creativity and innovation, is a problem for organizations that require consistent and reliable performance.

For example, non-deterministic output may lead to inconsistent product descriptions, which may confuse customers and damage brand reputation. This unpredictability will affect the consistency and reliability of the output. Many key artificial intelligence use cases involve deployment in high-trust situations.

Alphabet’s efforts to monetize its AI innovations have become more complex due to the challenges of integrating AI solutions into existing enterprise workflows. Enterprises are often unwilling to adopt AI technologies that cannot guarantee certainty and high-quality output, resulting in slow adoption and limited profitability of these innovations.

Pressure from investors and the need to fund ongoing research have prompted these organizations to turn to more commercial activities, which sometimes conflict with their basic principles of ethical use of artificial intelligence. Google has taken a rare approach; however, I think this is key.

Freemium model

Google (and Meta (META)) are now adopting the typical Silicon Valley strategy of providing valuable services for free or as part of existing premium (or free) subscriptions to attract users and later capture backend value. This approach is evident in the company’s integration of advanced artificial intelligence capabilities into its G-Suite subscription services to reflect the transformation of its business model. This is undoubtedly a response to competition from artificial intelligence companies such as OpenAI’s ChatGPT.

Google’s Google One AI Premium plan will launch in early 2024 and provide advanced AI features through the Gemini Ultra 1.0 model. According to the company, the model can better handle complex tasks involving text, images, and code, and integrate with Google productivity applications such as Gmail and Google Docs.

I believe that this strategy can familiarize Google’s users with their AI features and make them dependent on these tools, which may increase the likelihood of long-term subscription renewals. This strategy relies on the resources and extensive user networks of companies such as Google and Meta, enabling them to absorb initial costs while establishing an ecosystem that users can rely on.

However, this approach is not without challenges . Google’s consideration of charging for AI search reflects the high cost of generating AI and the need to find sustainable revenue streams.

GPU spending

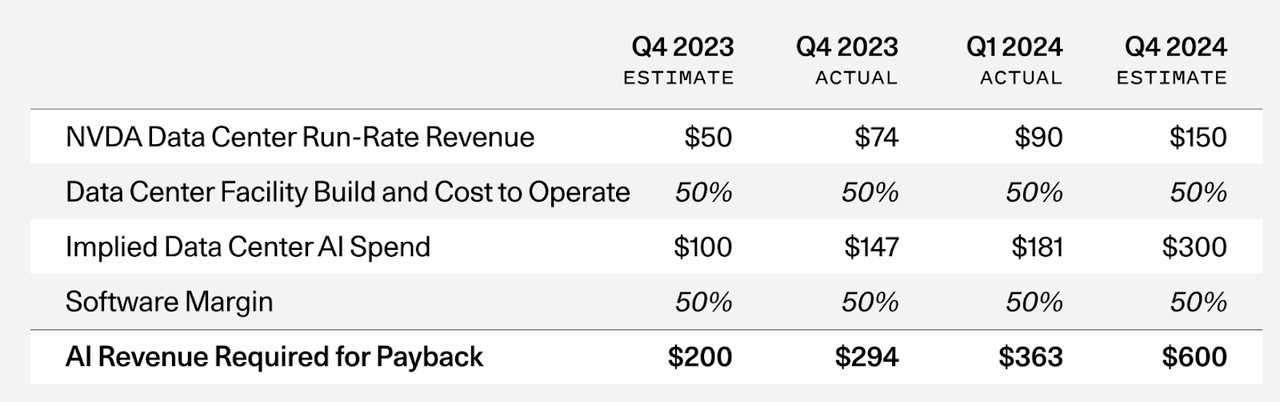

A recent report from venture capital firm Sequoia emphasizes that the artificial intelligence industry needs to invest about $600 billion in software funding to support the necessary upgrades of GPU infrastructure, which is a core component for training and deploying advanced artificial intelligence models. Google is known for its significant investments in the field of artificial intelligence, and with its strong financial resources and freemium artificial intelligence integration methods, Google is expected to make this expenditure worth for money.

The company’s capital expenditure is expected to increase by 33% this year to nearly $43 billion. This investment is necessary because artificial intelligence models, especially those that utilize generative artificial intelligence, require computing power. Google’s infrastructure investment in GPUs is crucial to maintaining its advantage in the field of artificial intelligence and supporting the deployment of advanced artificial intelligence capabilities on its platform.

Google’s artificial intelligence market share

Google’s extensive existing infrastructure and continuous innovation through its current search, cloud, advertising, and YouTube platforms are key factors driving its market strength in the AI market.

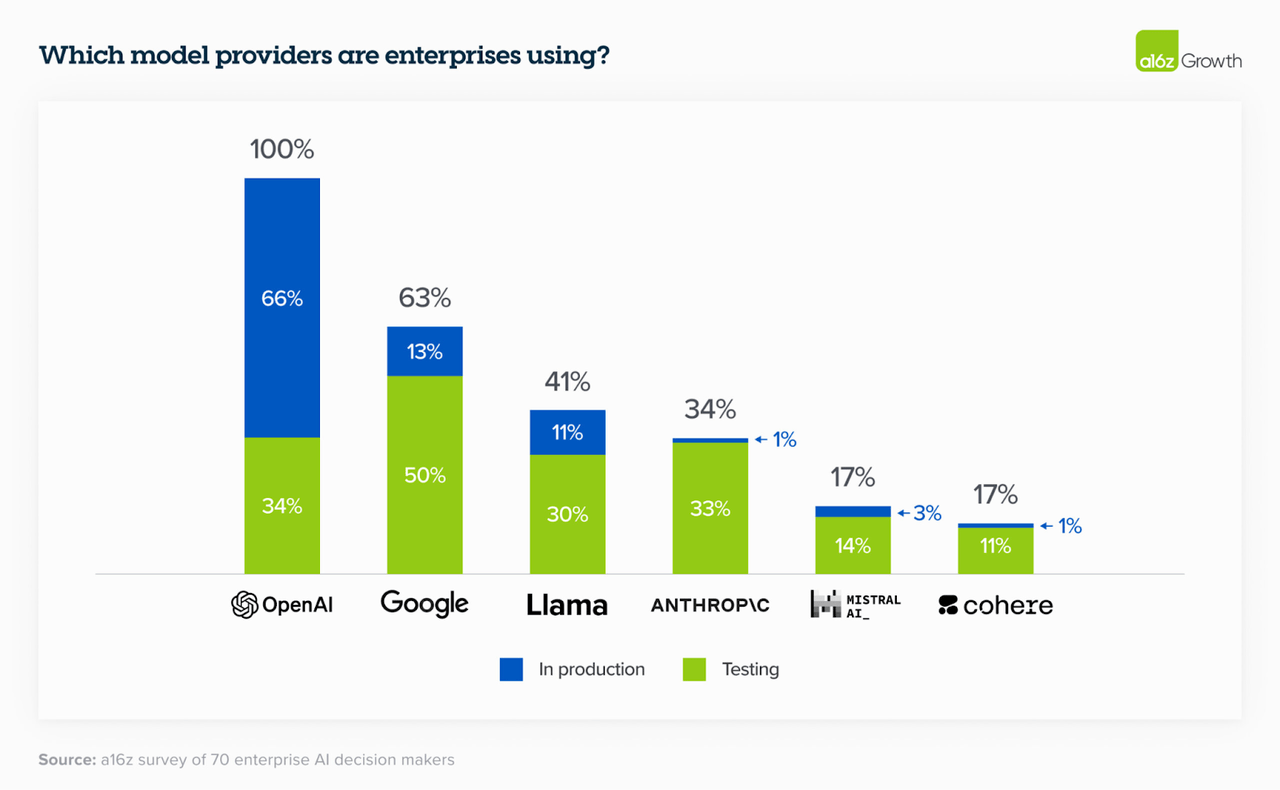

Google is one of the top model providers for enterprise users. Although Open AI dominates in production models, accounting for 66%, while Google only accounts for 13%, the latter leads Open AI by 50% in testing models, while Open AI only accounts for 34%. Google has huge growth opportunities .

My expected income

I think Alphabet will announce Q2 2024 earnings per share of $1.84 and revenue of $84.30 billion on Tuesday (July 23), which is in line with analysts’ consensus expectations. This represents a year-on-year growth of 27.66%, highlighting the company’s strong performance in the face of ongoing market challenges. This growth is driven by the parent company’s diversified revenue streams and strategic investments in artificial intelligence and Cloud as a Service. The company’s traditional search department is working hard. Their cloud department is also accelerating. Now they have a unique artificial intelligence strategy, which also helps.

Google’s strong profitability metrics further support the positive EPS outlook. The company’s Net Profit margin is 25.90% , higher than the industry median of 3.22%, demonstrating Alphabet’s outstanding Operational Efficiency and profitability. My earnings per share expectations for the quarter are in line with Wall Street’s.

In addition, their return on equity (ROE) is as high as 29.76%, far higher than the industry median of 3.23%, indicating effective management and substantial returns for shareholders. As an innovator, I believe that Google and its management are effective capital allocators.

At Google’s next earnings call, I will focus on qualitative cases where the company collaborates with customers to create powerful artificial intelligence use cases that demonstrate the practical and scalable applications of its technology. Google’s efforts in artificial intelligence have led to partnerships and practical applications in many industries. I look forward to more cases like this being highlighted.

For example, at the Google Cloud Next '24 event, many high-profile organizations showcased how they are leveraging Google’s AI solutions. For example, Best Buy ( BBY ) is using Google’s Gemini AI to launch a generative AI virtual assistant to solve product issues, manage subscriptions, and enhance Client Server in-store and online.

To summarize my expectations, I am looking for more examples of companies adopting the Google artificial intelligence freemium model in their businesses and demonstrating how this model can help them become an advantage in their respective businesses. The freemium model provides basic services for free while providing advanced features for a fee. Artificial intelligence enhances this model to drive customer engagement and revenue growth. Google’s approach integrates artificial intelligence into its core products so that users can take advantage of their Gemini artificial intelligence assistant and artificial intelligence features, which can be used in services such as Gmail and Google Docs through Google One premium subscriptions. I think this is key.

Valuation

Google has provided reasons to re-evaluate its valuation metrics, especially the PEG non-GAAP forward ratio, which is currently 1.32 , -11.51% lower than the industry median of 1.49. Considering the strong EPS growth demonstrated by Alphabet, this valuation seems unreasonable. Specifically, Alphabet’s EPS growth rate (FWD) is as high as 23.76% , more than 214% higher than the industry median of 7.56%. This indicates that the market may underestimate Alphabet’s EPS growth potential.

In addition, as I mentioned before, the company’s Common Stock Return on Equity (ROE) further improved its financial performance, reaching 29.76% , 791% higher than the industry median of 3.34%. I think this shows that Alphabet can efficiently profit from its equity stake and outperform its peers in the industry. A strong capital allocator is a strong shareowner management team.

Given these indicators, I believe Alphabet deserves a premium valuation. If its PEG ratio is adjusted to be 30% higher than the industry median (to reflect some of the amazing EPS growth), rather than the current discount, the PEG ratio would be about 1.95.

To quantify this, if we take the industry median PEG as a benchmark and apply a 30% premium, the implied upside potential for Alphabet’s stock price would be considerable, or about 47.72% higher. The company has achieved real growth. I think they have real upside potential from now on.

Risk

The landmark Anti-Trust trial against Google, which ended on May 2 , was a challenge to the tech giant’s business conduct. The trial focused on allegations that Google maintained a monopoly on online search and search ads through anti-competitive tactics. At the heart of the case was Google’s practice of paying companies like Apple ( AAPL ) and Mozilla billions of dollars to become the default search engine on their devices and browsers.

The Justice Department and the Alliance of State Attorneys General argue that these payments unfairly stifle competition and prevent competitors such as Microsoft’s Bing and privacy-focused DuckDuckGo from gaining a foothold in the market. The government claims that in 2021 alone, Google spent $26.30 billion, 18 billion of which went to Apple, to ensure its dominance and suppress potential competitors.

During the trial, Google defended its actions, stating that its dominant position stems from the excellent quality of its search engine, not any illegal behavior. Excellent products and business models are not illegal in the US. This is the result of efficient capitalism.

Therefore, Google’s dominance in search spending remains crucial to its business model. According to reports , due to its reach and effectiveness in search ads, Google remains the preferred destination for ad spending. The company’s search ads business generates $175 billion in revenue annually and is an important source of its revenue. It was reported at the beginning of this year that ad spending grew by 17%.

I believe that Google has great potential in the coming years to monopolize the growing artificial intelligence market. Their leadership in the field of artificial intelligence was recognized in the 2024 Gartner Cloud Artificial Intelligence Developer Service Magic Quadrant. This is consistent with their products in the field of artificial intelligence.

Conclusion

Initially, I thought it would be difficult for Google to find its position in the AI market because it was often overshadowed by competitors. However, with their recent progress, especially the launch of the Gemma 2 model, the company has turned the AI landscape around. This development marks Google’s transition from just surviving in the fiercely competitive AI industry to setting new standards for open models in terms of performance and cost-effectiveness. A16’s recent market share data also proves this.

Meanwhile, over the past six months, the main risks of Google’s business model have dissipated, while the opportunities brought by its strategic progress are expanding. I believe this evolution indicates that despite the recent sell-off in technology stocks, Google’s stock price still has greater room for appreciation. The positive factors are increasing, and the negative factors are decreasing.

Alphabet’s financial performance reflects these technological advancements, with stronger advertising growth and Google Cloud revenue growing by 28% in Quarter 1 of 2024. I believe the stock is still worth a strong buy.