- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Can Buying a House in the U.S. Lead to a Green Card? These Conditions You Must Know

A U.S. Green Card, or Permanent Resident Card, is a dream for many foreigners who wish to reside and work in the United States long-term. It not only represents legal resident status but also provides a range of benefits and opportunities, such as free employment and the possibility of eventually applying for U.S. citizenship.

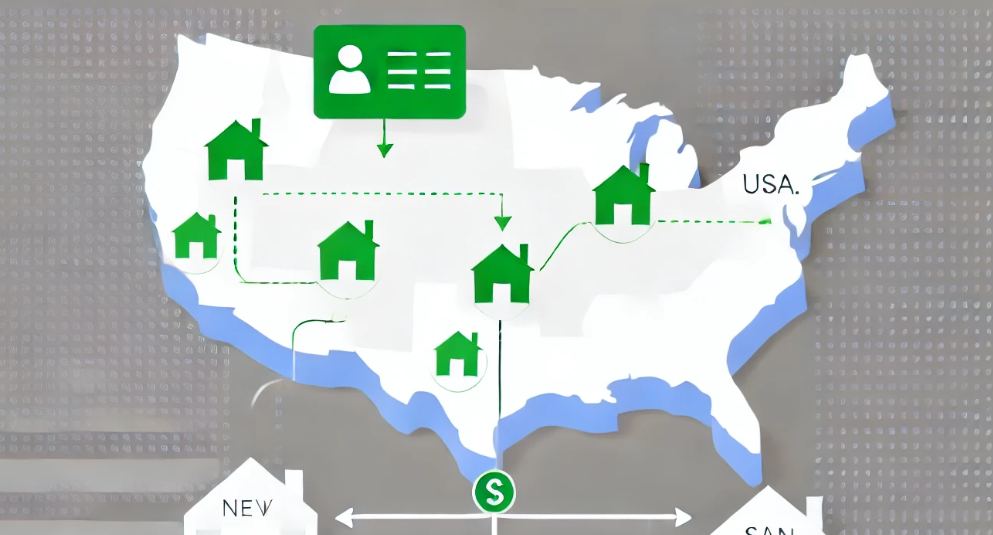

Many people wonder if buying a house in the U.S. can lead to obtaining a Green Card. This article will explore the basic concept of the U.S. Green Card, the relationship between buying a house and obtaining a Green Card, the practical steps to obtain a Green Card through the EB-5 Immigrant Investor Program, and the basic conditions for buying a house in the U.S., helping readers fully understand the key factors and considerations in this process.

Can Buying a House in the U.S. Lead to a Green Card?

A U.S. Green Card, or Permanent Resident Card, allows the holder to live and work in the U.S. permanently. Green Card holders enjoy many rights similar to U.S. citizens, such as employment, education, and welfare, but they cannot vote or hold certain government positions.

Misconceptions About Buying a House and a Green Card

Many people mistakenly believe that buying a house in the U.S. can directly grant them a Green Card. However, purchasing property alone does not directly lead to a Green Card. Buying real estate is just one of many investment options for obtaining a Green Card and does not constitute an independent immigration path.

While buying a house cannot directly obtain a Green Card, it can become part of the process through specific investment immigration programs, such as the EB-5 Immigrant Investor Program.

The Role of Home Buying in the EB-5 Program

The EB-5 Immigrant Investor Program allows foreign investors to apply for a Green Card by making a significant investment in the U.S. and creating jobs.

Buying a house can be part of an investment portfolio, for example, investors can put their funds into real estate development projects. By purchasing property and participating in project construction and management, they can meet the investment and job creation requirements of the EB-5 program.

In this way, buying a house can not only bring investment returns but also become part of the path to obtaining a Green Card. It is important to note that the investment amount and job creation requirements must strictly comply with the EB-5 program regulations, and buying a house is just one part of it.

When making significant investments and transferring funds, choosing a reliable and efficient financial service platform is crucial. BiyaPay, as a leading international remittance platform, provides local transfer services in most regions and countries worldwide, achieving same-day remittance. To help investors complete cross-border transactions and investment operations smoothly, BiyaPay’s remittance fees are as low as 0.5% and support large remittances. Moreover, it supports real-time exchange of digital currencies (such as USDT) into mainstream fiat currencies like the U.S. dollar and British pound, which is very friendly for digital currency traders.

Practical Steps

Choose the right investment project: Look for real estate development projects or other investment opportunities that meet EB-5 requirements.

Prepare investment funds: Ensure the legality of the investment funds and prepare relevant proof documents.

Submit the I-526 application: Work with an immigration lawyer to prepare and submit the I-526 application, detailing the investment plan and source of funds.

Approval process: Wait for USCIS review, which typically takes 12-18 months.

Obtain a temporary Green Card: After the I-526 application is approved, the investor and their family will receive a two-year temporary Green Card.

Submit the I-829 application: During the validity of the temporary Green Card, submit the I-829 application to prove that the investment has been completed and jobs have been created.

Obtain a permanent Green Card: After the I-829 application is approved, the investor and their family will receive a permanent Green Card.

By following these steps, investors can successfully obtain a U.S. Green Card by including home buying as part of their EB-5 investment.

Basic Conditions for Buying a House in the U.S.

Financial Conditions

Sufficient Proof of Funds: Buyers need to demonstrate that they have enough funds to pay for the entire or part of the house purchase. This typically includes bank statements, investment account proof, and other financial documents.

Good Credit Record: Although foreign buyers usually do not need a U.S. credit record, having a good international credit record can help secure better loan terms and interest rates in the U.S.

Housing Budget: Buyers need to consider the total cost of buying a house, including down payment, loan interest, property taxes, insurance fees, and repair and maintenance costs.

Legal Conditions

Legal Residency Status: Buyers need to have legal residency status in the U.S., such as a tourist visa, student visa, work visa, etc. This ensures that buyers will not encounter legal obstacles when purchasing property.

Compliance with Local Laws and Regulations: Buyers need to understand and comply with the relevant laws and regulations of the state and city where the property is located. This includes the purchase contract, tax requirements, and property management regulations.

Conclusion

Buying a house in the U.S. does not directly lead to a Green Card, but through participation in the EB-5 Immigrant Investor Program, buying a house can become part of the path to obtaining a Green Card. Investors need to meet the minimum investment amount and job creation requirements, and buying a house can be one of the investment projects.

I hope this article provides valuable guidance and reference for readers who wish to achieve their immigration goals through buying a house in the U.S., helping them better understand the related processes and requirements to make informed decisions.