- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Do foreign investors need to pay taxes when investing in U.S. stocks? How much? To whom? This articl

New investors in U.S. stocks often have a common question: “Do I need to pay taxes to the U.S. on my earnings?”

In fact, there are preferential policies for foreign investors. This article will highlight key points from official tax documents, provide examples, and explain what the W-8BEN form is. Every investor in U.S. stocks should have a detailed understanding of this.

What is the W-8BEN?

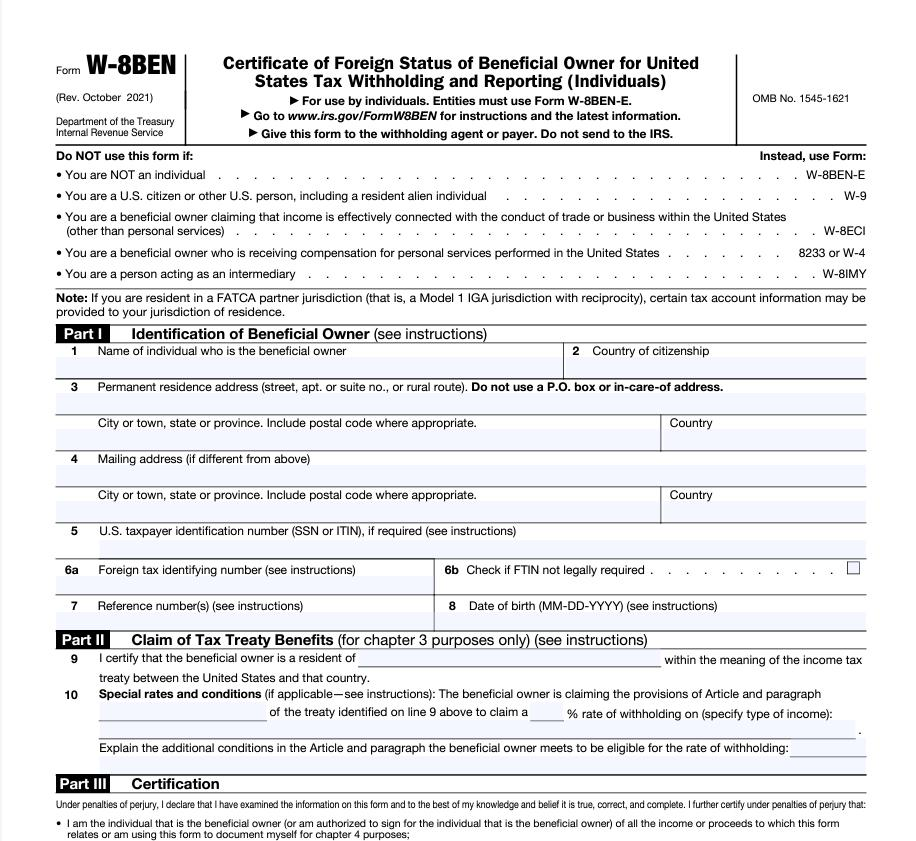

The full name of the W-8BEN is “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting.” It is a form issued by the U.S. Internal Revenue Service ( IRS ) used by non-U.S. residents or non-U.S. companies to prove their foreign beneficial owner status and eligibility for relevant tax treaty benefits when investing in the U.S. or receiving income from the U.S. Simply put, it is a “tax identification form for non-U.S. residents’ income in the U.S.”

Why is it abbreviated as “W-8BEN”? In fact, “W” stands for non-U.S. resident and non-U.S. entity, the number 8 is an internal form type code used by the IRS , and “BEN” stands for “Beneficial.” The image below shows the beginning part of this form.

The W-8BEN form can be found on the IRS official website: https://www.irs.gov/pub/irs-pdf/fw8ben.pdf.

Tax Treaties Between Various Countries and the United States

According to the IRS, any income earned in the United States must be reviewed, regardless of whether you are a U.S. citizen. Non-U.S. residents are still required to pay taxes on certain types of income.

The IRS defines two types of income sources:

- Income Effectively Connected with a U.S. Trade or Business: This includes income from operating a business or providing personal services within the United States (e.g., wages, self-employment income), typically involving foreign individuals providing services within the U.S.

- Fixed or Determinable Annual or Periodic Income (FDAP): This includes non-labor income such as interest, dividends, rents, or royalties. Unless a tax treaty applies, FDAP income is generally taxed at a 30% rate.

The tax rules for different types of income vary. Please continue reading for more details.

Japan-U.S. Tax Treaty

Capital Gains Tax:

- Under the Japan-U.S. Tax Treaty, capital gains from stock transactions by Japanese residents in the U.S. are typically not taxed in the U.S., but must be reported under Japanese tax law.

Dividend Tax:

- Article 10 of the Japan-U.S. Tax Treaty stipulates that dividends paid to Japanese residents are subject to a 10% U.S. withholding tax rate.

U.K.-U.S. Tax Treaty

Capital Gains Tax:

- Under the U.K.-U.S. Tax Treaty, capital gains from stock transactions by U.K. residents in the U.S. are typically not taxed in the U.S., but must be reported under U.K. tax law.

Dividend Tax:

- Article 10 of the U.K.-U.S. Tax Treaty stipulates that dividends paid to U.K. residents are subject to a 15% U.S. withholding tax rate.

Germany-U.S. Tax Treaty

Capital Gains Tax:

- Under the Germany-U.S. Tax Treaty, capital gains from stock transactions by German residents in the U.S. are typically not taxed in the U.S., but must be reported under German tax law.

Dividend Tax:

- Article 10 of the Germany-U.S. Tax Treaty stipulates that dividends paid to German residents are subject to a 15% U.S. withholding tax rate.

Canada-U.S. Tax Treaty

Capital Gains Tax:

- Under the Canada-U.S. Tax Treaty, capital gains from stock transactions by Canadian residents in the U.S. are typically not taxed in the U.S., but must be reported under Canadian tax law.

Dividend Tax:

- Article 10 of the Canada-U.S. Tax Treaty stipulates that dividends paid to Canadian residents are subject to a 15% U.S. withholding tax rate.

China-U.S. Tax Treaty

Capital Gains Tax:

- Under the China-U.S. Tax Treaty, capital gains from stock transactions by Chinese residents in the U.S. are typically not taxed in the U.S., but must be reported under Chinese tax law.

Dividend Tax:

- Article 10 of the China-U.S. Tax Treaty stipulates that dividends paid to Chinese residents are subject to a 10% U.S. withholding tax rate. Investors need to fill out the W-8BEN form to benefit from this preferential tax rate.

Filling Out the W-8BEN Form

The W-8BEN form is crucial for Chinese investors in U.S. stocks, and it should be handled with care. Compared to other regions, mainland Chinese investors benefit from significant tax advantages. Residents of Hong Kong, Macau, and Taiwan are not included in the tax treaty and need to pay a 30% tax. U.S. residents must combine capital gains with their wages for tax purposes.

How to Proceed?

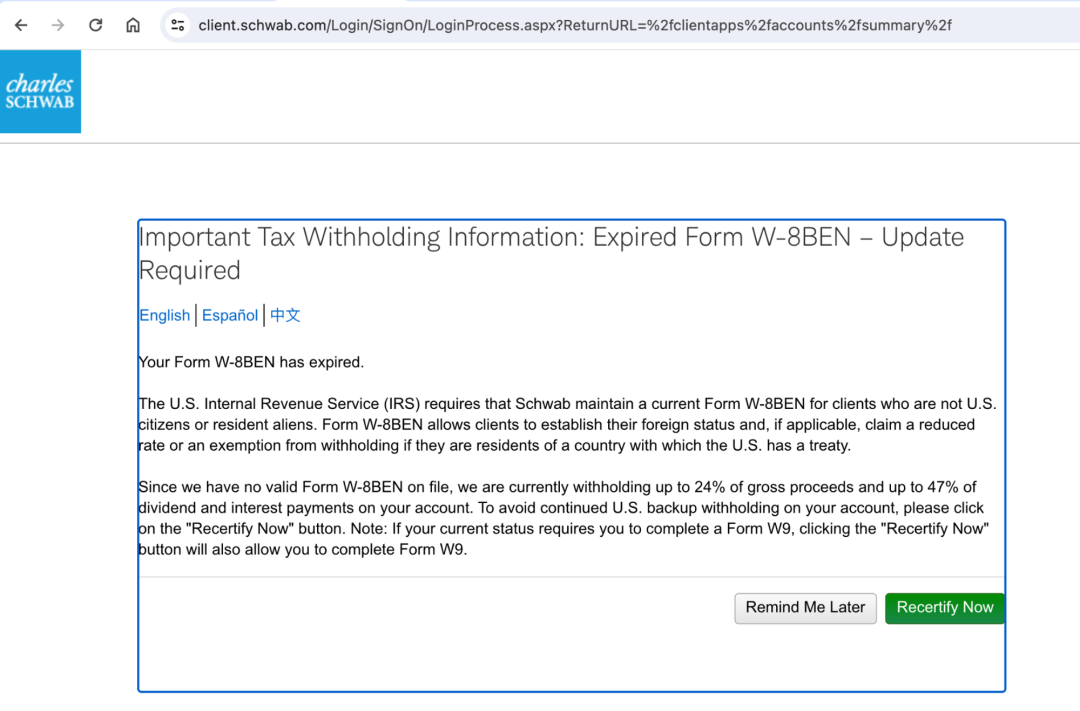

If you are a Charles Schwab user, you will receive an email notification to renew the W-8BEN form before it expires. The renewal process is as follows:

Click the link in the notification email, which will take you to this page:

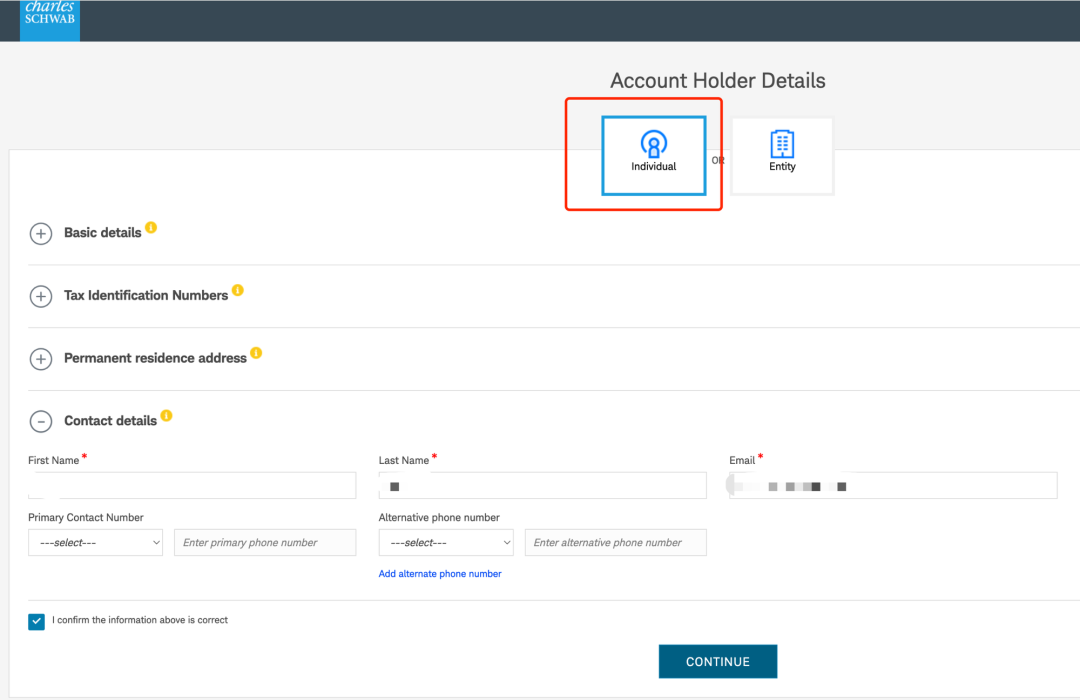

Select “Individual” and verify all personal information. Normally, all information should already be filled in.

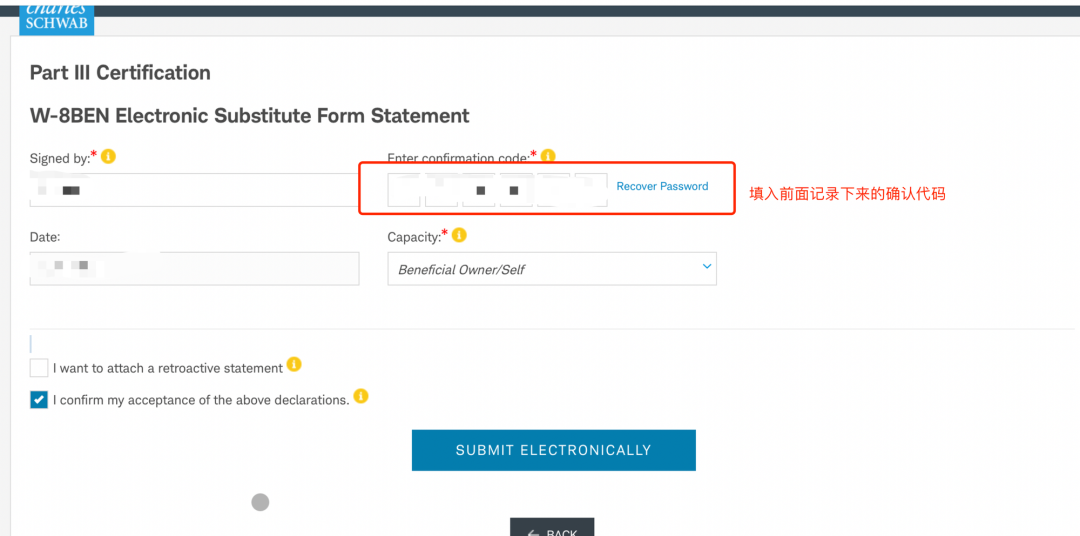

Confirm personal information and click the W-8BEN form checkbox. You will receive a confirmation code; make sure to record it as you will need it in the final step.

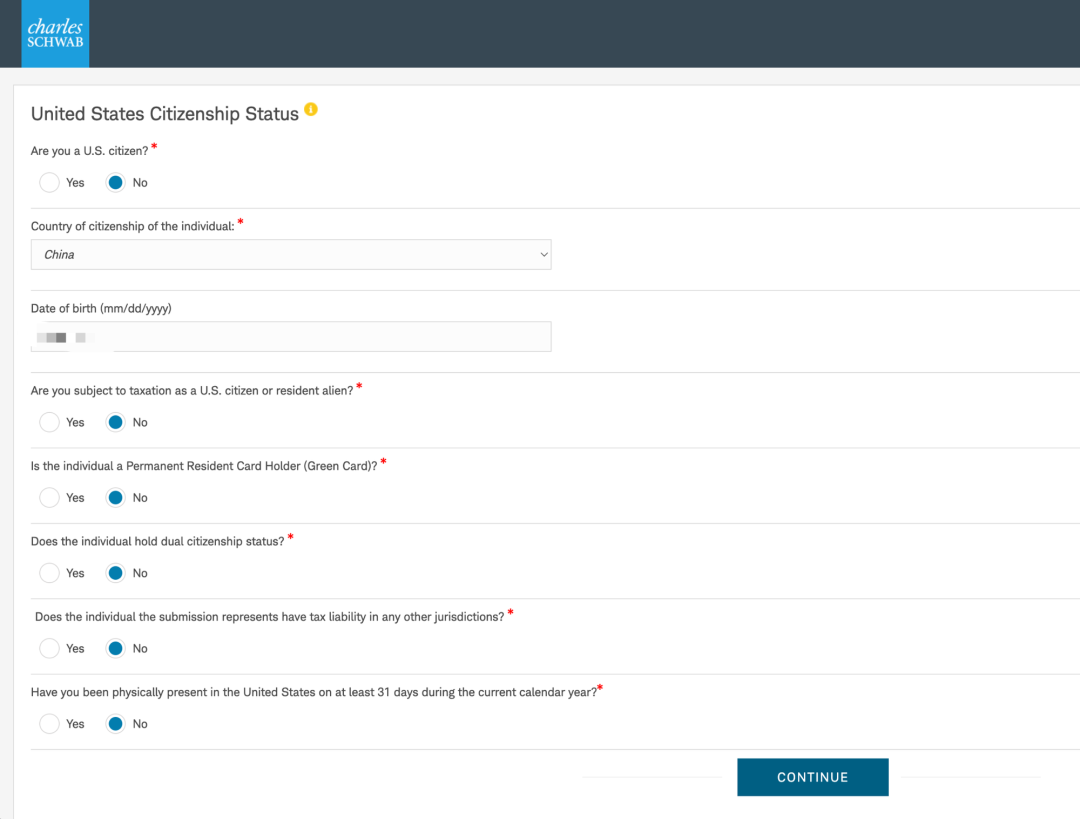

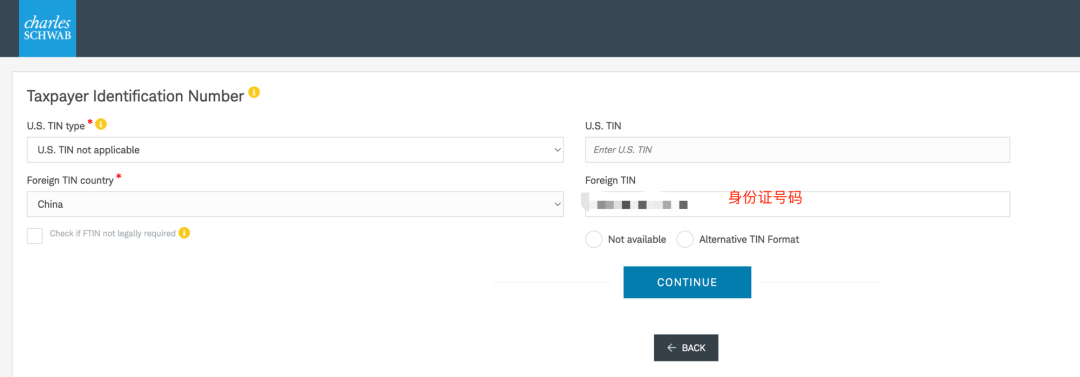

Confirm non-U.S. resident status and provide your tax identification number, usually your ID number unless you have applied for an ITIN.

Enter the confirmation code and click "Submit."

Filling out the form is straightforward. Follow the form’s instructions, and the brokerage platform will typically simplify the process by auto-generating the W-8BEN form through their system. However, there are a few key points to note:

- Provide accurate information and avoid falsehoods.

- The W-8BEN form is valid for three years (expiring on December 31 of the third year, not three years from the signing date). After expiration, you may be subject to a 30% withholding tax.

- If your personal information changes (nationality, country of residence), you need to sign a new form.

Properly completing the W-8BEN form is essential to enjoy tax benefits, so ensure you handle it carefully.

Since TD Ameritrade was merged into Charles Schwab, many new and existing users have transitioned to the Charles Schwab platform for their U.S. stock operations. As a leading global financial services company, Charles Schwab offers comprehensive investment and financial services, known for its robust platform, extensive product line, and high-quality customer service. Regarding the funding issue that users are concerned about, Charles Schwab provides a bank account during the account opening process, allowing users to fund their accounts directly using the BiyaPay platform without needing to use other Hong Kong bank accounts.