- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

NVIDIA's Surge Followed by Pullback: Dangerous Signals Not to Be Ignored? Can the Stock Rise Again?

NVIDIA (NASDAQ:NVDA) is the dominant semiconductor leader, powering explosive megatrend growth in the great cloud migration and now artificial intelligence. And these truly massive megatrends are not coming to an end anytime soon.

However, there are multiple glaring “red flags” for Nvidia. In this report, we review the business, growth, market size, current valuation, moat and then four massive red flags investors need to consider. We conclude with our strong opinion on investing.

Nvidia Overview: The Leader in GPUs

Nvidia is the industry leader in graphics processing units (GPUs). GPUs were originally used for video gaming (because of their superiority vs. traditional non-parallel processing computer processing units (CPUs)) but have proven invaluable in data centers now processing massive amounts of data from the cloud and recently accelerated dramatically by the compute demands of artificial intelligence (i.e., technological breakthroughs in large language models). When it comes to data centers and AI, Nvidia is the clear and dominant leader.

Business Segments and Growth

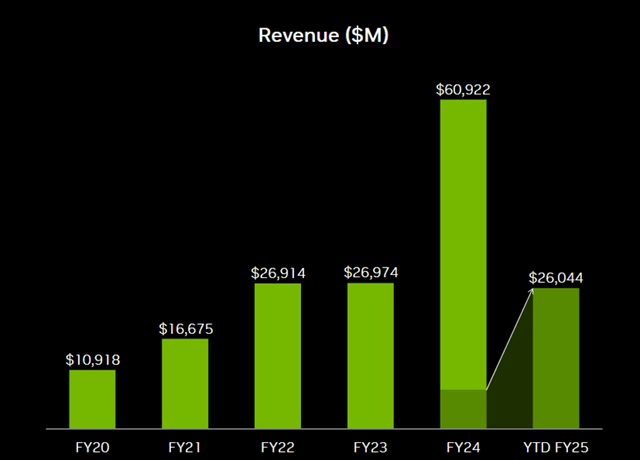

For perspective on Nvidia’s massive recent growth, here’s a look at its revenue growth between fiscal year 2023 and 2024. And then compared to the continuing high growth so far in fiscal year 2025.

Nvidia’s high growth has been so impressive that the company’s valuation (market cap) has exploded to more than $3 trillion, ranking it among the top three US companies (Apple (AAPL) and Microsoft (MSFT) are the other two), and making Nvidia the single largest US company (depending on the day and stock price movements). Incredible, especially for a company that a lot of people on Main Street who have just recently learned about the company for the first time.

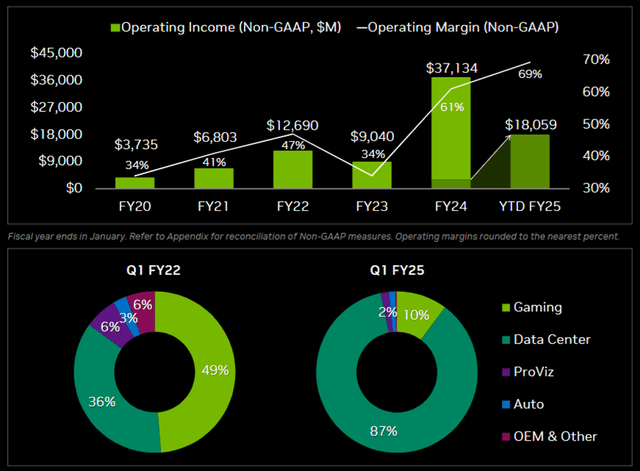

And to add a little more perspective to Nvidia’s growth, you can see operating income per its main business segments, below.

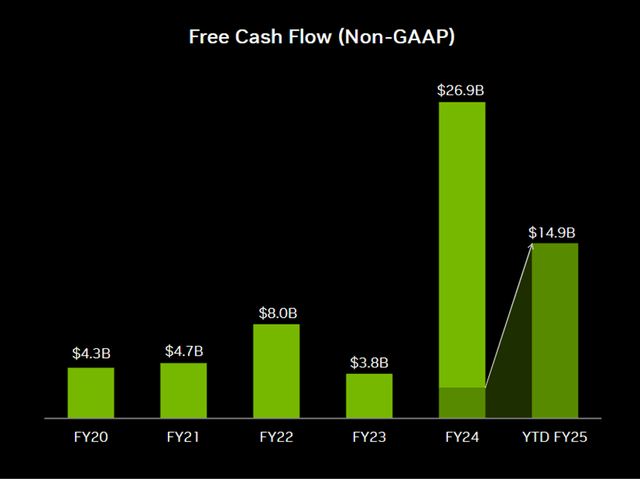

As you can see above, it’s Nvidia’s Data Center segment (i.e., “the cloud”) that’s the largest and that has grown the most rapidly since the first quarter of fiscal year 2022. And perhaps most jaw dropping is Nvidia’s insane growth in free cash flow in the last two years (impressive).

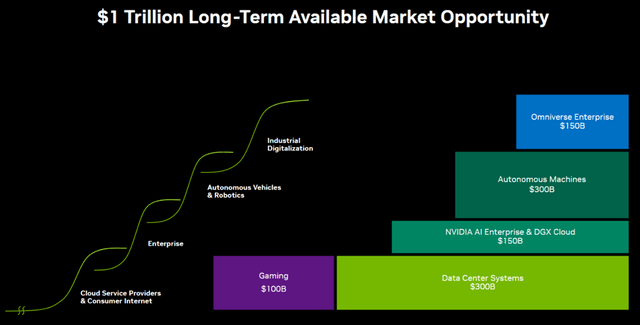

Total Addressable Market (TAM)

And if you’re wondering whether or not Nvidia can keep growing (after its recent historic climb), the answer is a resounding long-term yes —as evidenced by the massive $1 trillion TAM opportunity (see table below).

Nvidia’s total revenue for fiscal year 2024 was a whopping $60.9 billion (see earlier chart), but that amount is exceeded by the opportunity that exists in gaming alone (see chart above), as well as Data Center Systems, Enterprise Cloud, Autonomous Machines and more (all separately, and collectively the potential is even more). Nvidia has the potential to keep growing rapidly for many years into the future.

If you also think that Nvidia has the potential to grow in the long term, but are still in a wait-and-see state due to recent fluctuations, you may want to go to BiyaPay, search for stock codes on the platform, monitor market trends, and choose the right time to get on board. Of course, if you have problems with deposits and withdrawals, you can also use this platform as a professional tool for depositing and depositing US and Hong Kong stocks. Recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to your bank account, and then deposit to other securities firms to buy stocks. The deposit speed is fast and there is no limit.

Valuation

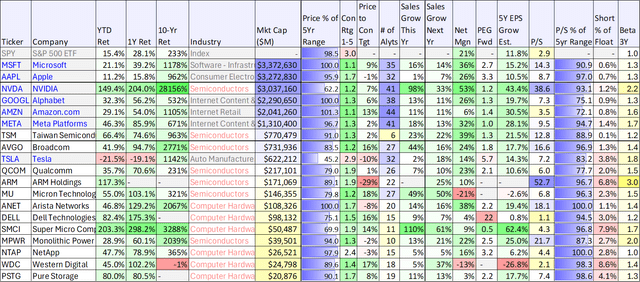

Just because Nvidia’s stock price is up so much, that doesn’t mean the growth is over. To the contrary, Nvidia still trades at a very low valuation, depending on what multiples you look at and who you talk to. For example, as you can see in the table below, Nvidia’s forward PEG ratio (price/earnings to growth) is even lower (more attractive) than other top companies, like Apple, Amazon Google and Microsoft.

Some investors will argue Nvidia is simply too expensive on a traditional price-to-earnings multiple (72.1x P/E, 45.6x Fwd P/E), but Nvidia isn’t exactly your granddad’s blue-chip slow-growth dividend stock (we’re not talking about some boring utility stock here).

Nonetheless, Nvidia does have extraordinary financial health. For example, we saw the powerful free cash flow generation earlier, and the company held $31.4 billion in cash and investments as of last quarter (with only $9.7 billion in total debt, short and long term, combined). And its margins (see earlier chart) are astounding (i.e., a 43% net margins are extremely impressive).

Nvidia’s financial strength will allow it to fund growth, potential acquisitions, and continuing shareholder cash returns (mainly through share repurchases, but the company does also maintain a very minimal dividend too).

Nvidia’s Competitive Advantages (Moat)

Superior GPUs: For starters, Nvidia’s competitive advantage stems from its superior GPUs. Others have attempted to compete on the GPU front mainly AMD as well as Intel , but they have fallen short so far. Big tech companies have also attempted to create in-house chips, but have not yet had much success as compared to Nvidia GPUs.

First-Mover Advantage: Nvidia also has a first mover advantage as developers are familiar with Nvidia, making it harder for new entrants to compete. There are also switching costs associated with alternative chips. Nvidia chips are the gold standard (and basically a necessity) for data centers and AI, and Nvidia chips remain in high demand from industry giants like Microsoft, Meta and Google (more on these customers later). Also, Tesla recently switched from its own internal chips to a massive cluster of Nvidia H100 AI chips for its autonomous-driving initiatives (in a sign of Nvidia’s strong competitive advantage).

Cuda Software: Nvidia developed its Cuda software platform early on, which helps developers build with Nvidia chips. So even if AMD develops a competitive GPU, the switching costs (away from Cuda) for developers would be great and thereby widen Nvidia’s advantage (“moat”) over competitors.

Red Flags (Big Risks)

Despite all of the truly impressive things Nvidia has going on, there are red flags that investors should consider.

Customer Concentration

Have you ever wondered who is spending all the money behind Nvidia’s massive revenue growth? The answer is the only entities that are capable of spending that much—big tech. Big tech is building cloud and AI infrastructure to support the needs of its public and private (government) customers.

For example, a single customer made up 19% of its total revenue in fiscal year 2024. UBS says it’s Microsoft. And according to the same article, Bloomberg data estimates that is followed by Meta Platforms (META) at 13% of revenue, Amazon at 6% of revenue, and Alphabet at about 6% of revenue too.

Nvidia discloses in its annual report “risk factors”:

We receive a significant amount of our revenue from a limited number of customers…

One indirect customer which primarily purchases our products through system integrators and distributors, including through Customer A, is estimated to have represented approximately 19% of total revenue for fiscal year 2024, Compute and Networking segment.

If any large customers pullback significantly on chip spending, that can have a very negative impact on Nvidia’s business and share price.

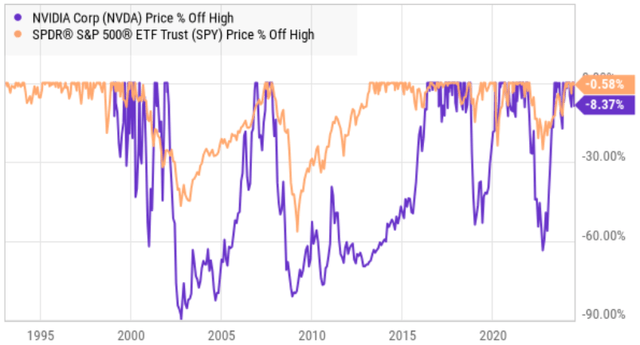

Cyclicality: A History of Big Declines

Despite the market’s current love affair with Nvidia, chip stocks have a history of big price declines. For example, since 2000, Nvidia shares have declined more than 50% four times.

And this most recent upcycle has been driven by big tech customer spending. For example, Meta shares declined after its previous earnings announcement because the market was not pleased with CEO Mark Zuckerberg’s enormous spending on Nvidia chips. Zuckerberg is trying to get ahead of demand, and it seems unreasonable to believe he will continue this massive level of spending (on Nvidia chips) quarter after quarter.

And realistically, there aren’t any other large customers that can step in and fill the future chip purchasing void when big tech takes a break to implement strategies using the Nvidia chips they’ve already purchased. Generally speaking, even 100 large cap companies (say $12 billion market cap each) can’t make up for one Meta ($1.3 trillion market cap).

According to the risk disclosures (emphasis ours) in Nvidia’s annual report:

Failure to estimate customer demand accurately has led and could lead to mismatches between supply and demand. We use third parties to manufacture and assemble our products, and we have long manufacturing lead times. We are not provided guaranteed wafer, component and capacity supply, and our supply deliveries and production may be non-linear within a quarter or year. If our estimates of customer demand are inaccurate, as we have experienced in the past, there could be a significant mismatch between supply and demand. This mismatch has resulted in both product shortages and excess inventory, has varied across our market platforms, and has significantly harmed our financial results.

Tough Financial Comparisons and Growth Assumptions

When Wall Street analysts determine share price targets for high-growth companies, the most impactful factor is their future growth assumptions. Even a small change to these assumptions can have a dramatic impact on their company valuations. According to Nvidia’s annual report:

Our operating results have in the past fluctuated and may in the future fluctuate, and if our operating results are below the expectations of securities analysts or investors, our stock price could decline.

In the quarters ahead, Nvidia will face extremely difficult historical revenue comparisons. As a business, Nvidia still has massive long-term growth, but to believe they can maintain the recent high revenue growth numbers consistently, quarter after quarter, is unrealistic. Wall Street analysts can be pretty smart and clever, but they don’t have working crystal balls. And if Nvidia disappoints, even by just a small amount, as compared to recent historical comparison numbers and estimates, the shares can get very volatile (to the downside) fast.

Macroeconomic Risks

Macroeconomic factors could have a significant negative impact on Nvidia. For example:

- Third-Party Suppliers: Nvidia depends on third-party suppliers and manufacturers, and they cannot control their quantity, quality, and delivery schedules. In fact, most of Nvidia’s chip production is completed by Taiwan Semiconductor (TSM) at their Taiwan-based factories.

- Geopolitics: Nvidia chips are critically important to the functioning of the global economy (to the level that significant disruption poses a national security risk). And any geopolitical disruption (for example, tensions with China over Taiwan) could have a very negative impact on business. As another (smaller) example, recent export control measures blocked the passage of Nvidia products and services into Russia, Belarus, and certain regions of Ukraine.

- AI Restrictions: According to Nvidia’s annual report: “The increasing focus on the risks and strategic importance of AI technologies has resulted in regulatory restrictions that target products and services capable of enabling or facilitating AI and may in the future result in additional restrictions impacting some or all of our product and service offerings.” Potential AI restrictions pose a significant risk to Nvidia.

Conclusion

I believe that at some point in the future, NVIDIA’s stock price will rise significantly. Specifically, its leadership position is too strong, and the major trends of Cloud Services and artificial intelligence are too strong. Despite the risks, NVIDIA’s stock price will rise significantly in the next decade. However, in the short term, the stock price will fluctuate greatly, and you need to consider the relevant risks comprehensively and make reasonable choices based on your own situation.