- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

BYD vs. Tesla: Who is the Real EV King? Who Will Win Over Investors?

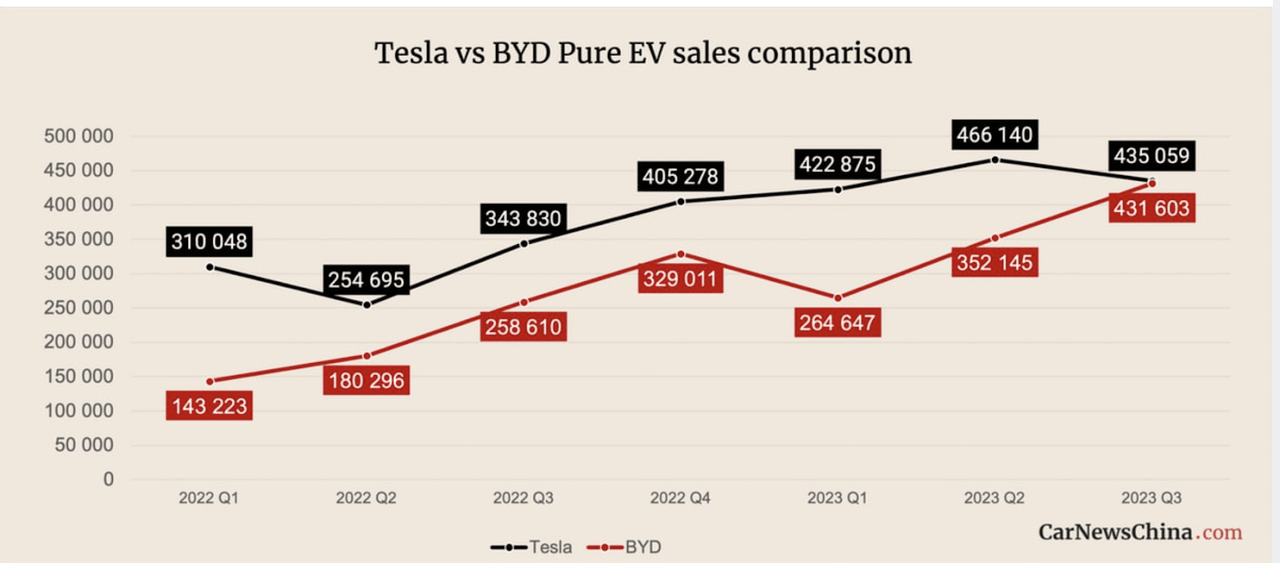

BYD Company Limited (OTCPK:BYDDF)(OTCPK:BYDDY) has almost surpassed Tesla, Inc. (TSLA) in terms of pure electric vehicle (“EV”) sales in Q2.

It’s clear to me that BYD is winning the EV race, but that doesn’t mean it’s a better investment.

On the surface, these two companies look similar, but they are quite different.

BYD is better suited to value investors. Meanwhile, Tesla is still quite cheap based on its historical multiples, and expectations are as low as they have ever been, leaving more room for an upside surprise.

Therefore, I hold a positive attitude towards Tesla. If you also have this tendency but are still in the wait-and-see stage, you can go to BiyaPay, search for the stock codes of the two companies on the platform, monitor market trends, and choose the appropriate time to get on board. Of course, if you have difficulties with deposits and withdrawals, you can also use this platform as a professional tool for depositing and depositing US and Hong Kong stocks. Recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to your bank account, and then deposit to other securities firms to buy stocks. The arrival speed is fast and there is no limit.

Business Overview

Both Tesla and BYD can be described in general terms as EV companies, but there are some pretty significant differences between their products and long-term goals.

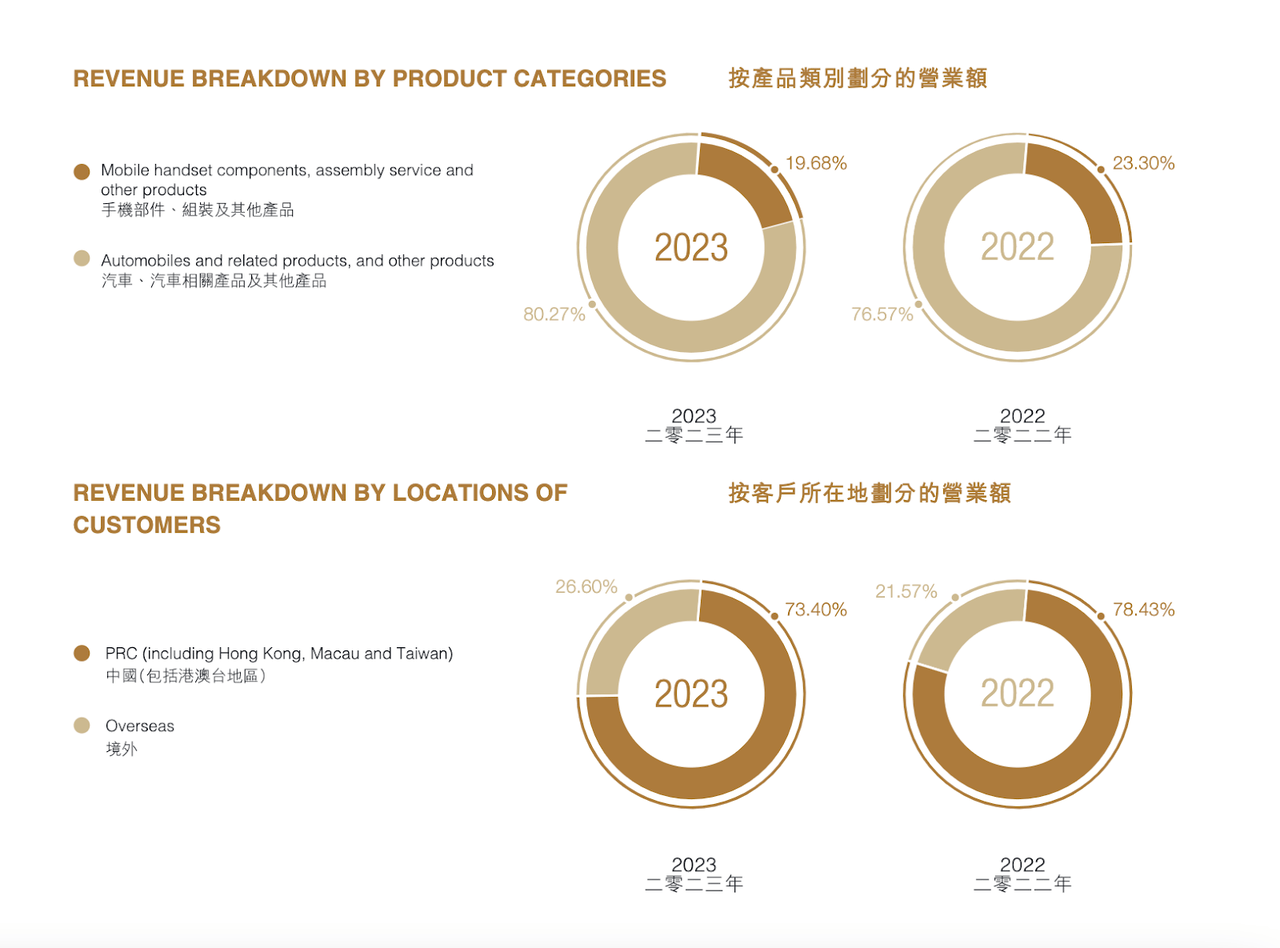

BYD focuses on the production of both EVs and also hybrid cars. The company also produces electronic components for use within cars and outside.

As we can see, almost 20% of revenues in 2023 actually came from this segment, down from 23% in 2022, showing that the EV segment is outpacing the other.

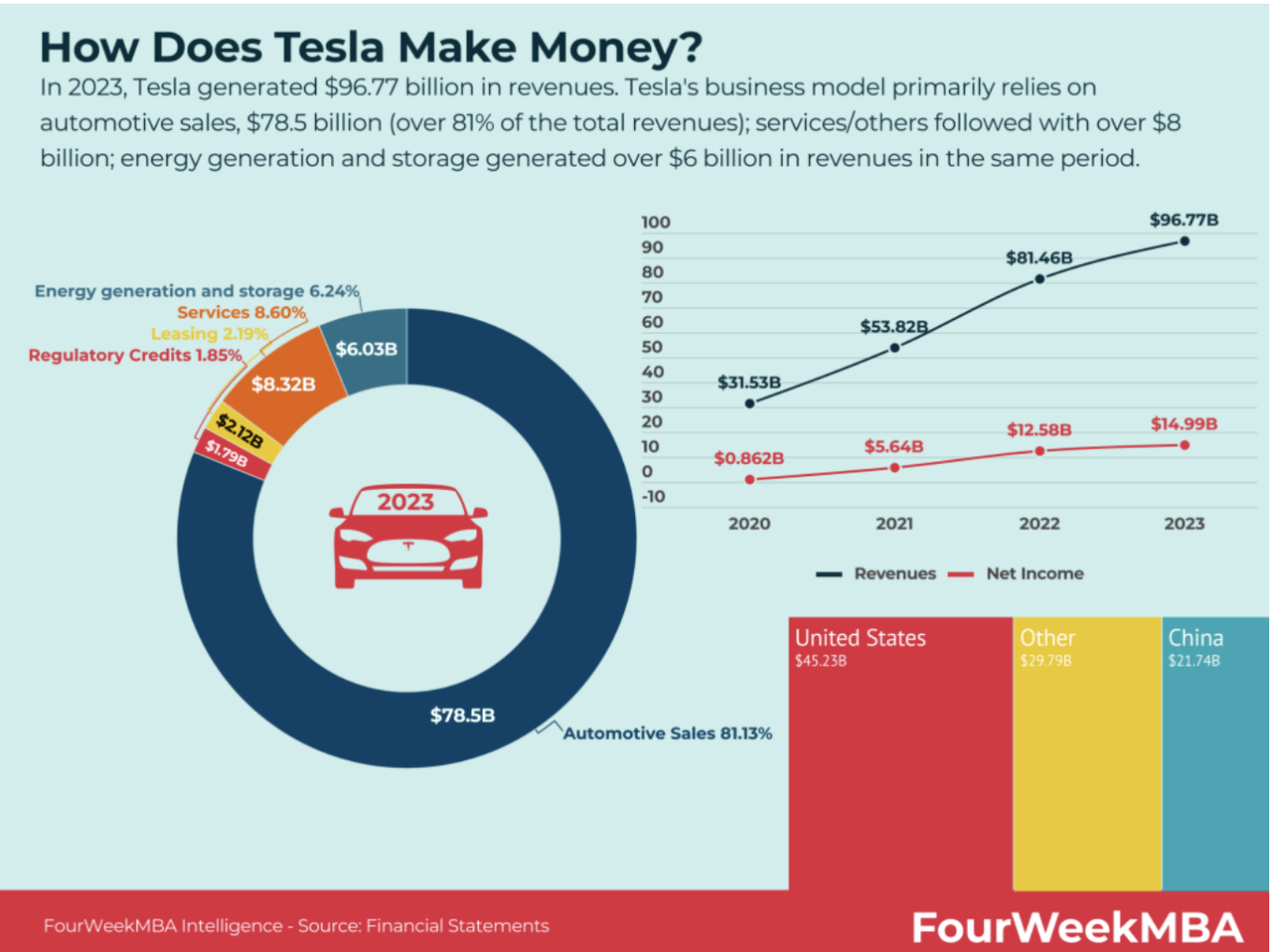

And then, we have Tesla:

Tesla also makes a big majority of its revenues from the sale of EVs, over 81% in 2023. The rest mostly comes from services and energy Generation.

A big difference here is that Tesla’s “other revenues” have been growing much faster than its EV sales.

In fact, with CEO Elon Musk’s recent transition into AI, it seems like selling cars is no longer a priority for Tesla.

Markets value companies on what they are, and what they can be. On a surface level, today, Tesla and BYD are both EV companies, but there’s a big difference in terms of their potential, which may help us explain the gap in the valuation.

But is it justified?

Growth

People had high hopes for the EV industry five years ago, but it is undeniable that adoption has not come as fast as was once expected.

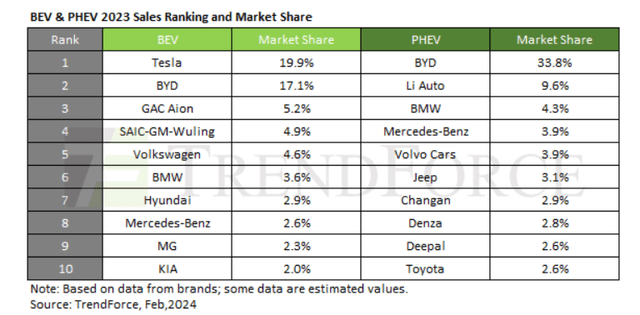

In terms of market share, BYD and Tesla are top of the pack.

Tesla leads in terms of BEV market share, while BYD dominates hybrid cars. However, BYD has been catching up to Tesla even in terms of pure EVs.

This has been happening since 2023, and the latest Q2 results indicate that BYD has finally almost surpassed Tesla. Tesla’s deliveries for Q2 came in at 443,956, while BYD reported sales of 426,000, up 21% QoQ.

BYD dominates the domestic market and is rapidly expanding throughout Asia, and this outstanding performance is expected to continue in the future.

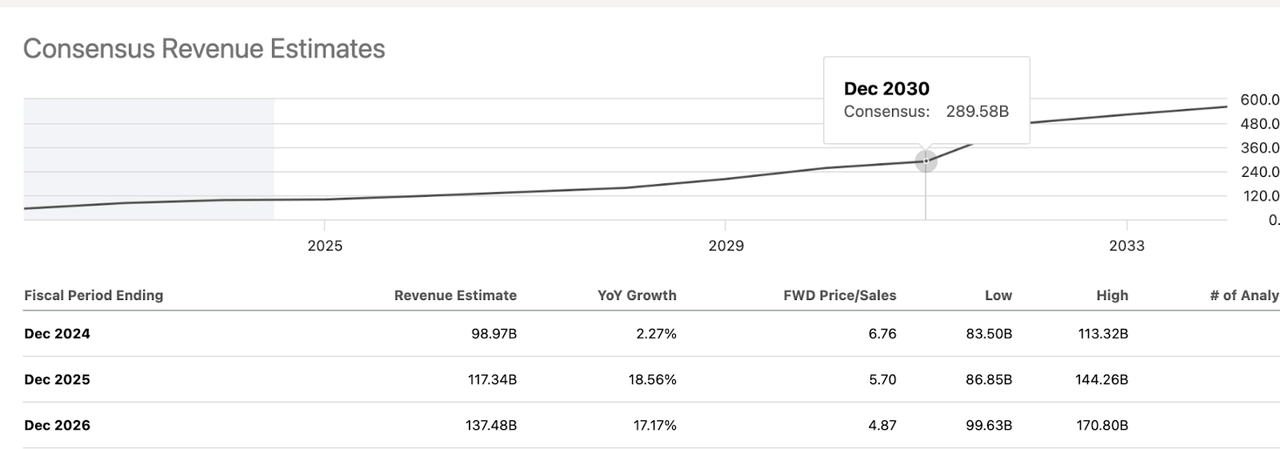

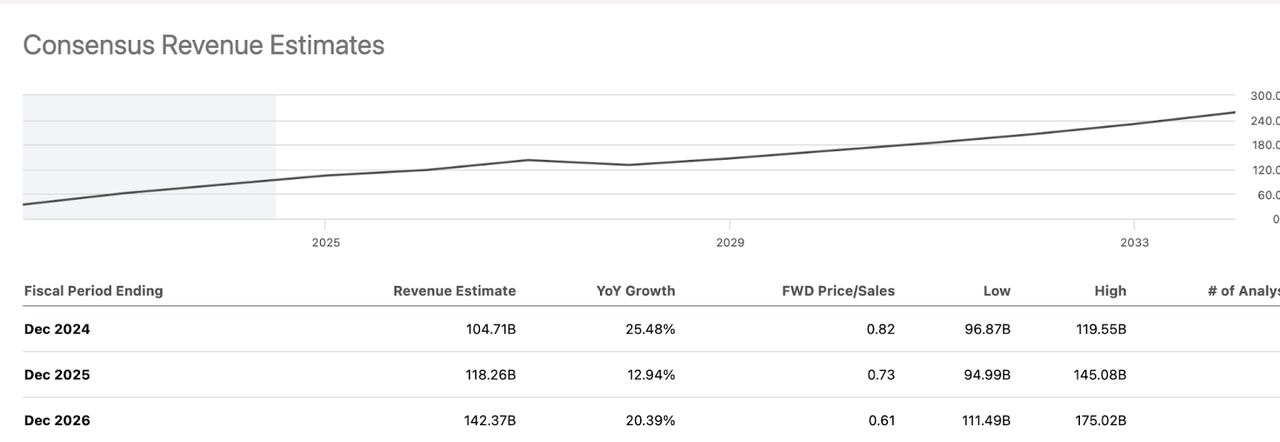

In the first image above, we see Tesla’s revenue estimates, and below we see BYD’s.

Over the next three years, BYD is expected to have much more robust growth, growing at a CAGR close to 20%. Meanwhile, Tesla’s growth is stalling this year, and will only grow around 18% in 2025 and 2026.

BYD is winning the EV race for now.

Profitability

Now, let’s look at how each of these compares in terms of profitability:

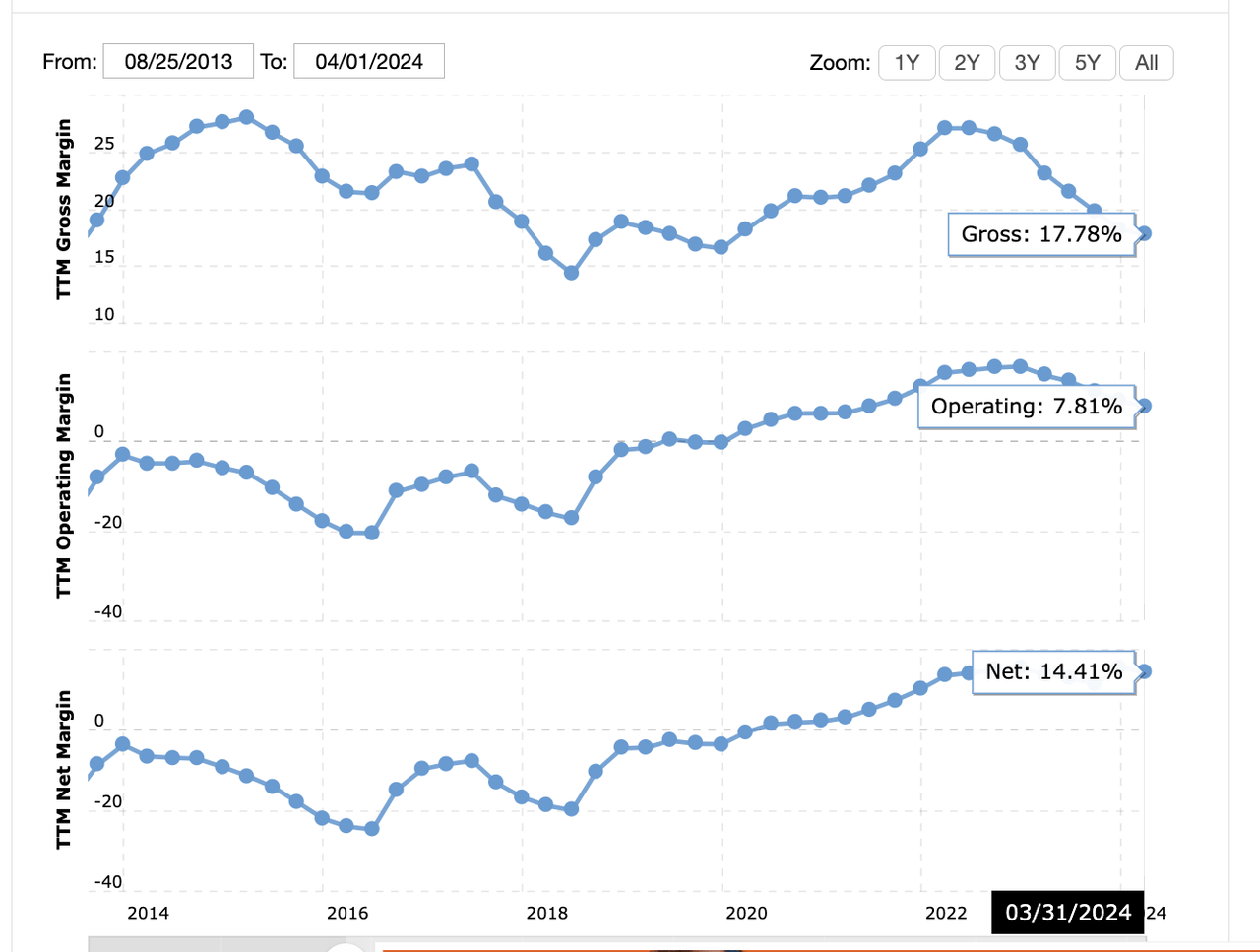

Tesla has done well to increase its profit margins, but they are still fairly low. Net Margin is 14.4%, while operating margins are 7.8%

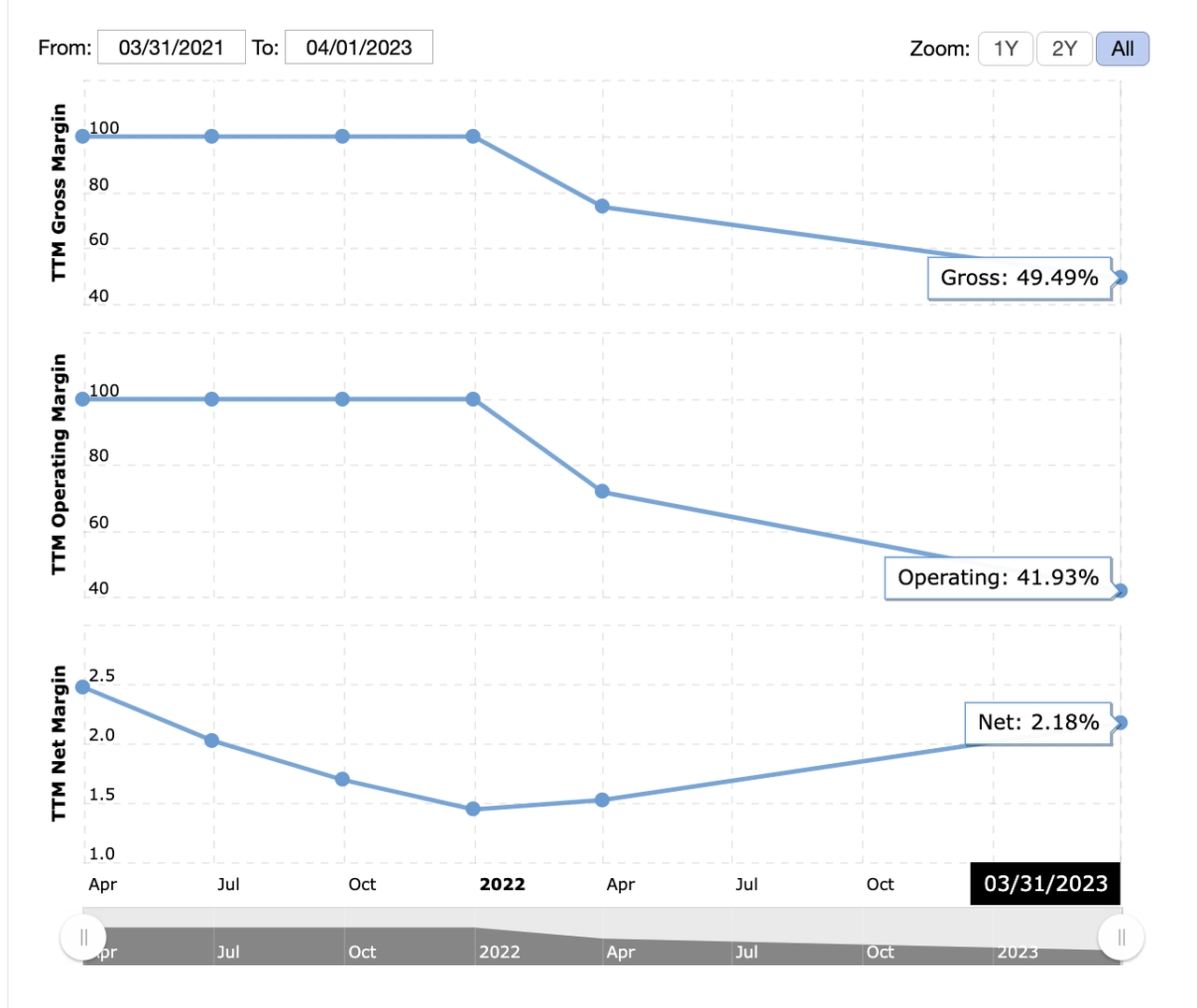

Interestingly, BYD has much higher operating and gross margins, though the net income is lower. Still, it seems like profitability wise, BYD outdoes Tesla.

Valuation

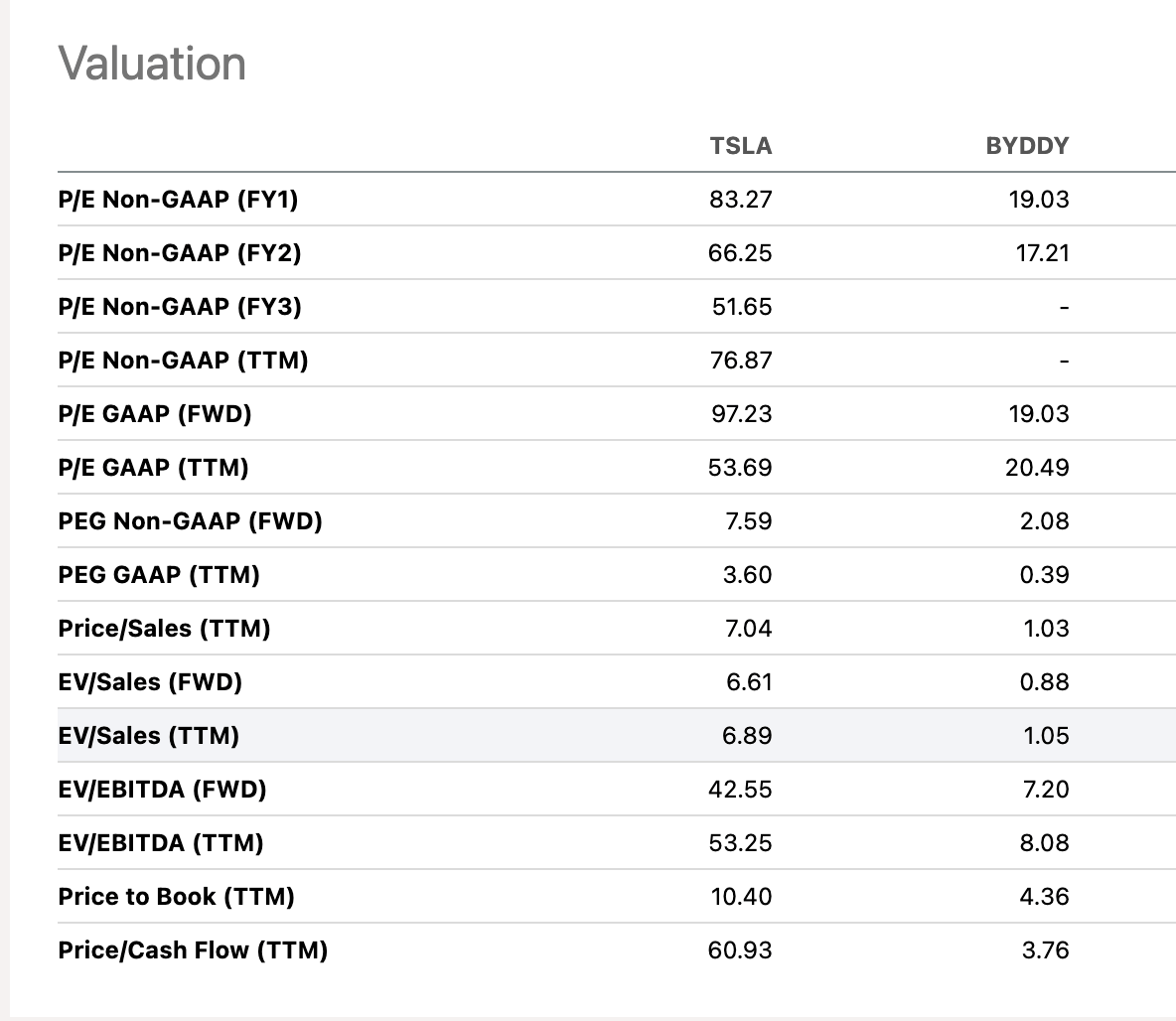

The valuation is perhaps the largest difference between these two companies, and we will have to spend some time explaining why. First, though, a look at the metrics.

Tesla trades at a P/E of 80, four times that of BYD.

You might think this is justified given higher earnings growth potential, but this is not the case. The PEG for Tesla is also much higher than BYD’s, 7.59 vs 2.08.

Most staggering is the difference between their Price/Cash flow. Tesla trades at 60 times cash flow, while BYD trades at a much more reasonable 3.76 ratio.

The difference is quite staggering, and I would say it can be explained due to two factors.

- Tesla has more potential in its “other revenues.”

- Tesla has a more valuable brand.

Tesla’s energy storage revenues have more than doubled recently. Plus, Tesla has a lot more going in terms of developing self-driving technology, and even advanced robotics now through the Optimus.

Lastly, I think that Tesla’s brand, and that of Elon Musk, has a lot more value.

Should You Buy Tesla or BYD?

Ultimately, Tesla and BYD, while they may look similar on the surface, are very different in terms of what they promise. BYD is actually much more of a straight-up value play.

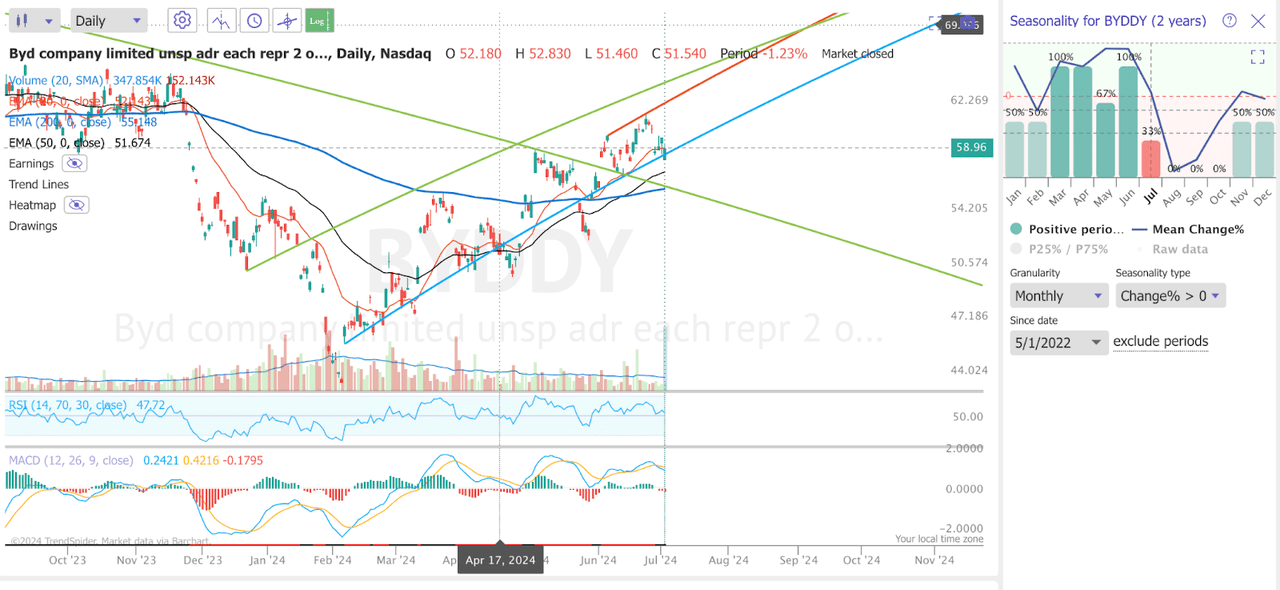

The BYD chart also doesn’t look that promising right now. July has been a negative month for the last two years, and we got a bearish MACD crossover.

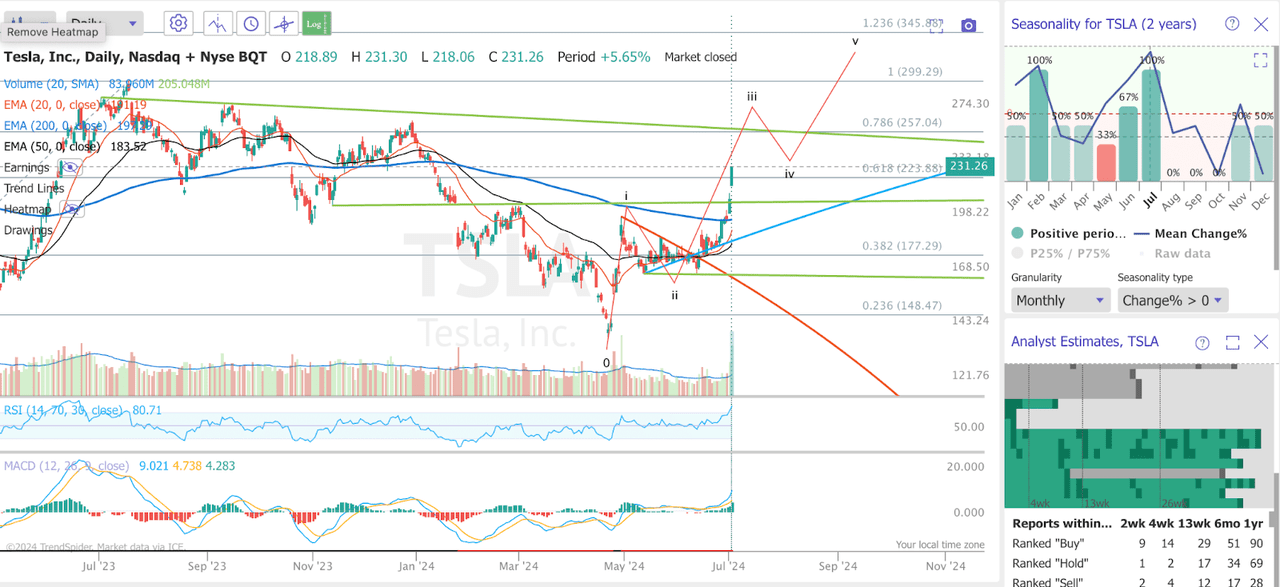

Tesla, on the other hand, while still expensive compared to BYD, holds a lot more promise, and is actually cheap historically.

The chart also looks more compelling. We have seen numerous upgrades in the last month, we have broken above the 200 MA, and we should now be ready to at least target the next key resistance at $250.

Conclusion

In the end, I believe that although BYD is very attractive from a valuation perspective, it may not be the best time to invest now. Tesla is a speculative investment. There is no doubt that its advantage in the electric vehicle race has declined, but due to the stock price decline so far this year and higher market expectations, its stock has greater potential.