- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Buying U.S. Treasury Bonds: The Optimal Solution for Current U.S. Stock Investments

How to Purchase U.S. Treasury Bonds via Charles Schwab and Interactive Brokers

Recently, the U.S. Treasury bond market has experienced significant volatility, impacting global financial markets worldwide. Investors might wonder what these bond market fluctuations imply. Why are inflation or Federal Reserve monetary policies linked to Treasury yields?

Investing in U.S. Treasuries is a crucial component of financial planning. To diversify and reduce exposure to individual risks, many include “bonds” in their asset allocation strategies. Not only individual investors but also many national governments hold significant amounts of U.S. Treasury bonds.

Moreover, if the Federal Reserve (FED) stops raising interest rates in 2024, the U.S. might enter a rate-cutting cycle. Recent Federal Open Market Committee (FOMC) meetings have frequently released dovish signals. Once interest rates are cut, the demand for U.S. Treasuries will increase, further driving up their prices.

Purchase Method 1: Brokerage Firms

If you are a U.S. citizen, you can buy directly through Treasury Direct. Non-U.S. citizens can purchase through major brokerage firms, which typically offer “fixed income” sections.

Interactive Brokers (IB)

Purchasing U.S. Treasuries through IB differs from buying through Treasury Direct because IB operates in the secondary market. The advantage of the secondary market is that you don’t have to hold the bonds to maturity; you can resell them. However, brokers may charge commissions, and there can be bid-ask spreads in the secondary market.

Enabling Bond Trading Permissions in Interactive Brokers

All asset trades in IB require applying for trading permissions. Many beginners find this step challenging. Here’s how to set up trading permissions. The same process applies if you later need to enable futures, forex, etc.

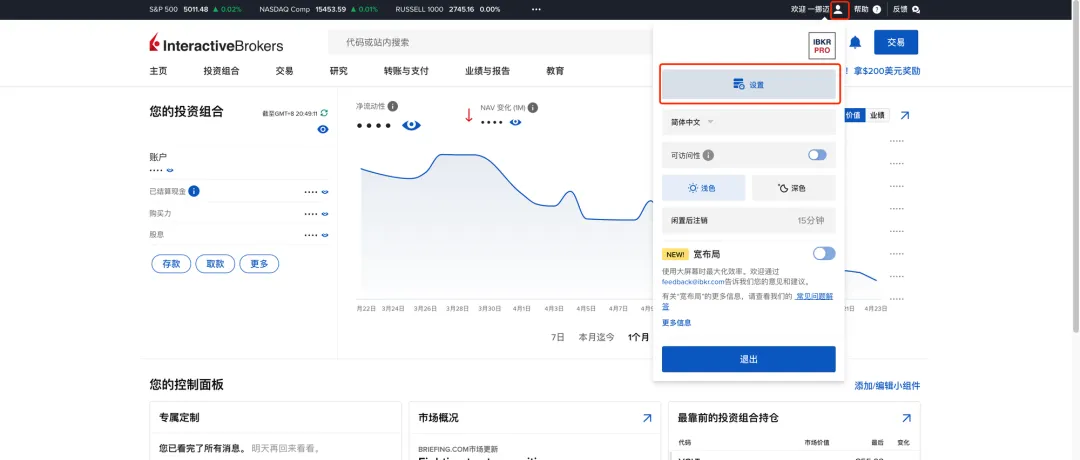

Log into the IB website, click on the “person icon” next to your name in the upper right corner, then go to “Settings.”

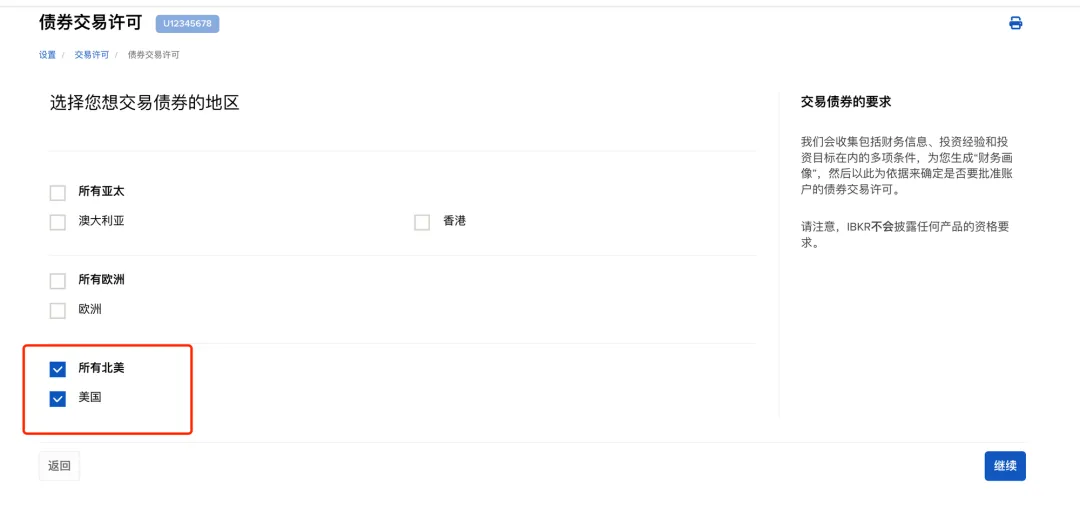

In the “Trading” section, find “Trading Permissions.”

Select “Bonds.”

Check “United States.”

Sign as required and submit.

Now, your account can trade U.S. Treasury bonds.

Buying U.S. Treasuries (Web Version)

Here’s how to purchase using the web version.

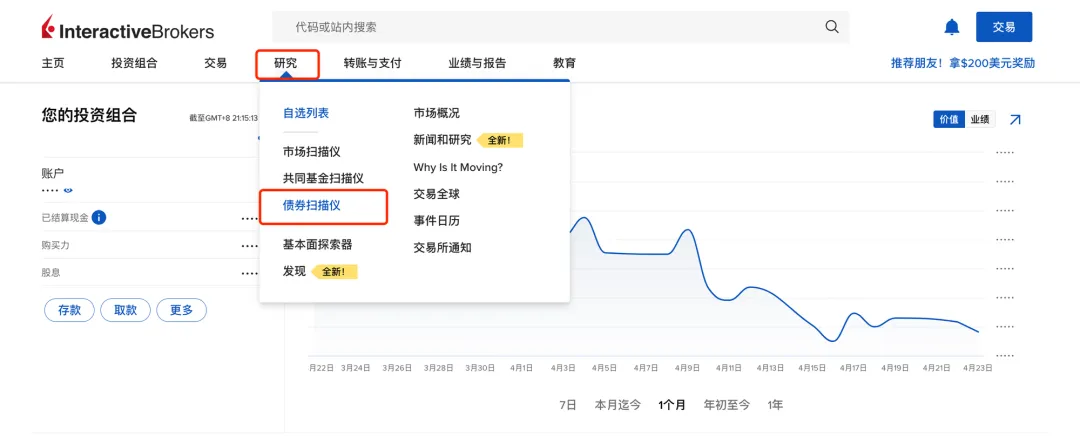

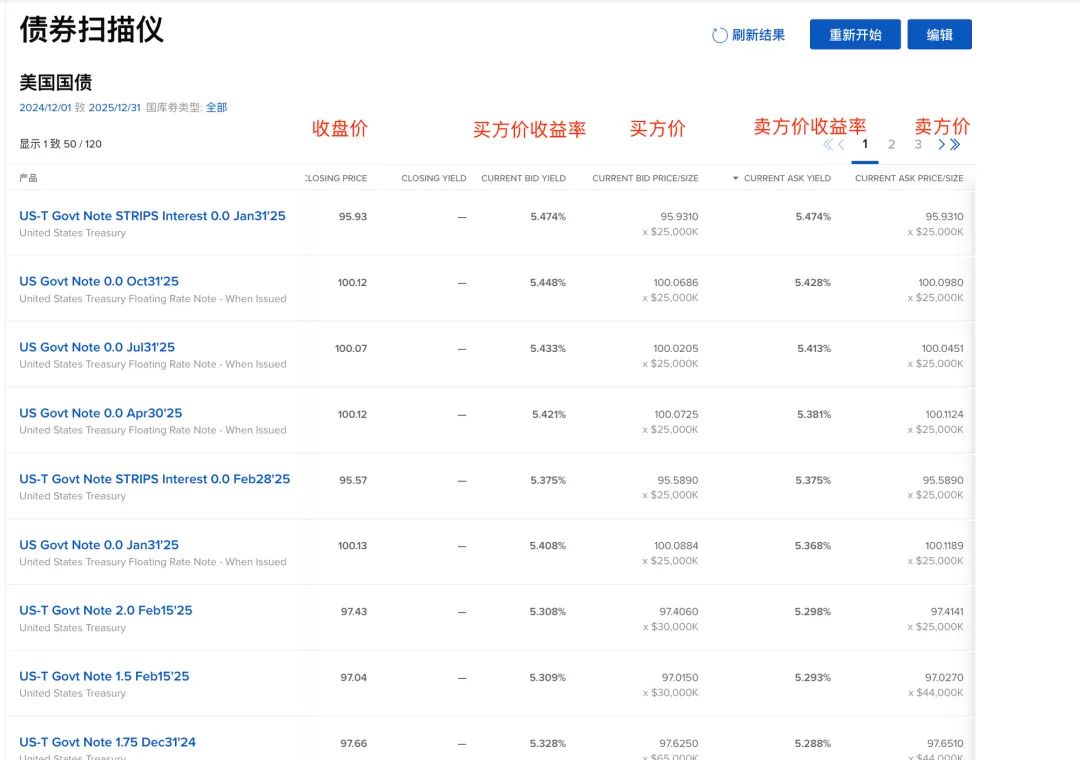

- Open the Bond Scanner: Click on “Research” → “Bond Scanner.”

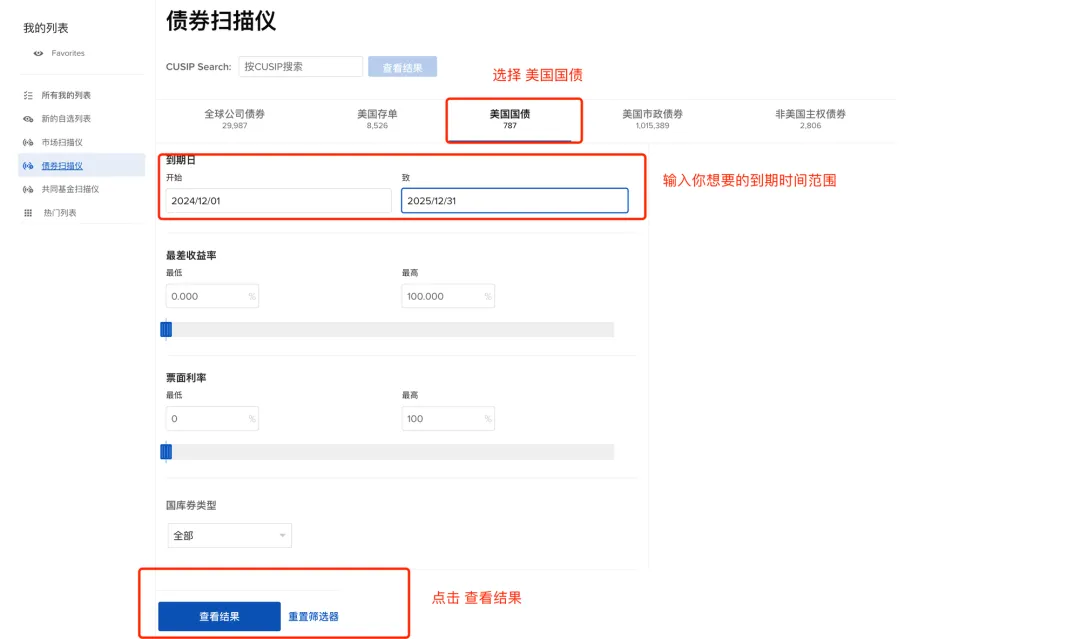

- Select Bonds:

Key Fields on the Page:

- CLOSING PRICE: Closing price

- CURRENT BID PRICE/SIZE: Highest price the buyer is willing to offer at the moment

- CURRENT BID YIELD: Yield calculated by IB based on the buyer’s offer

- CURRENT ASK PRICE/SIZE: Lowest price the seller is willing to offer at the moment

- CURRENT ASK YIELD: Yield calculated by the system based on the seller’s offer

- Maturity Date: Format MM/DD/YYYY

- CUSIP: Bond identification number

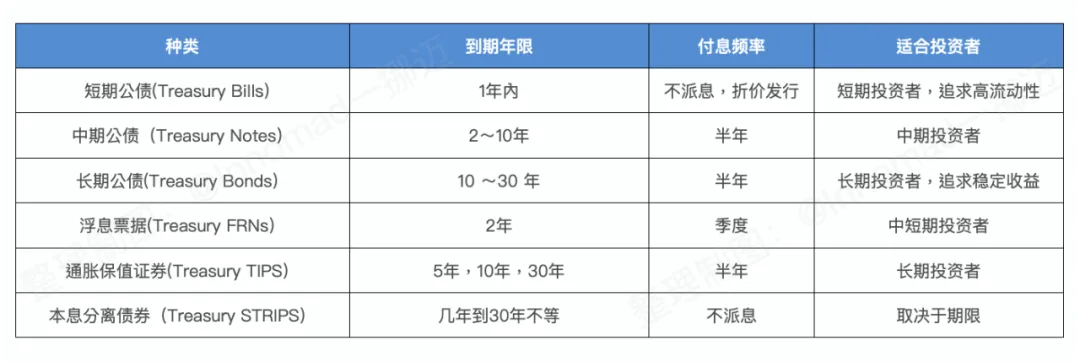

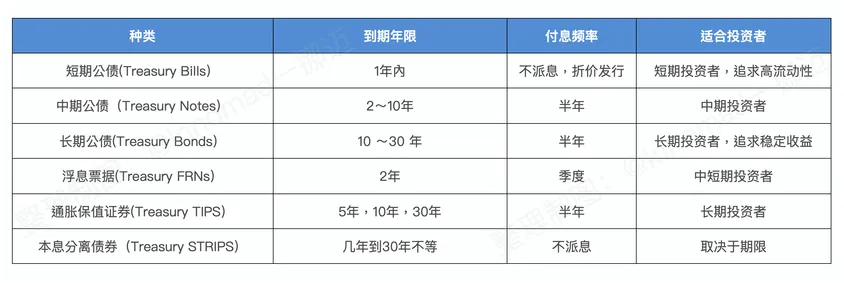

There are several types of U.S. Treasury bonds: Bills, Notes, Bonds, FRNs, TIPS, STRIPS, corresponding to different maturities, as shown in the table below:

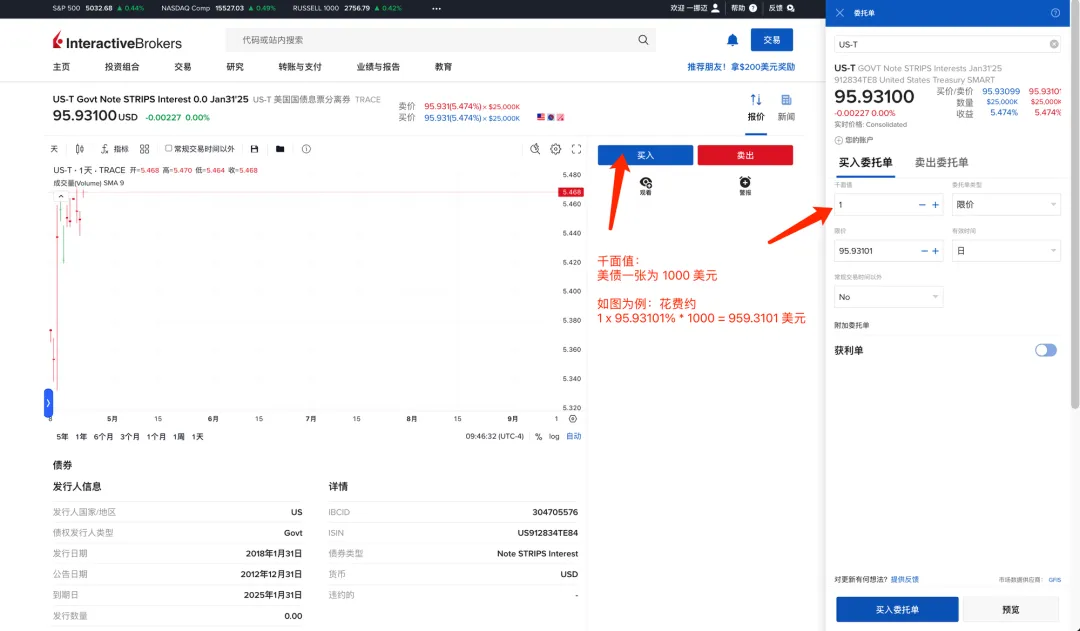

- Purchase Bonds:

After selecting the desired bond, click the “Buy” button in the last column of the specific bond in the filter, or click on the bond’s name in the first column to enter the purchase screen:

IB charges commissions for purchasing U.S. Treasury bonds. The specific commission can be seen in the following image:

Charles Schwab

Charles Schwab is a well-established and reliable broker in the U.S. and a publicly traded company. Its main advantage is the ease of depositing funds, which can be done anytime and anywhere via BiyaPay without any amount limit. The only downside is that the website interface may be less user-friendly.

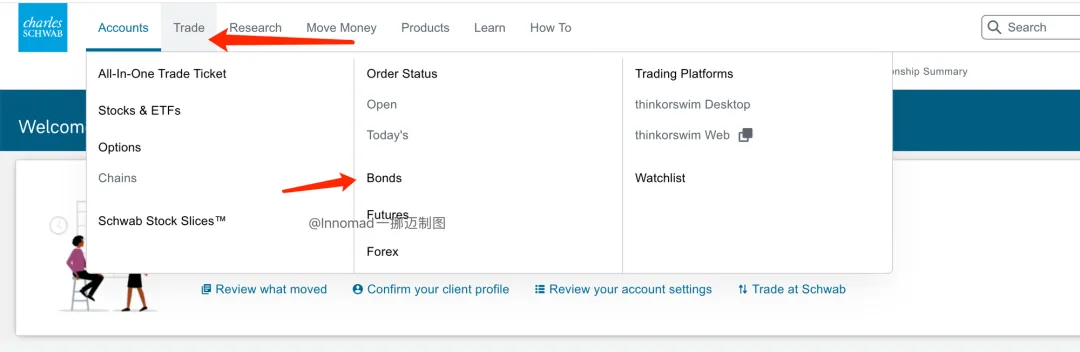

Charles Schwab Bond Purchase Process

Log into the website, click “Trade” on the navigation bar, and select “Bonds” from the expanded panel.

Upon first entering, you need to agree to a terms agreement. Scroll down and agree.

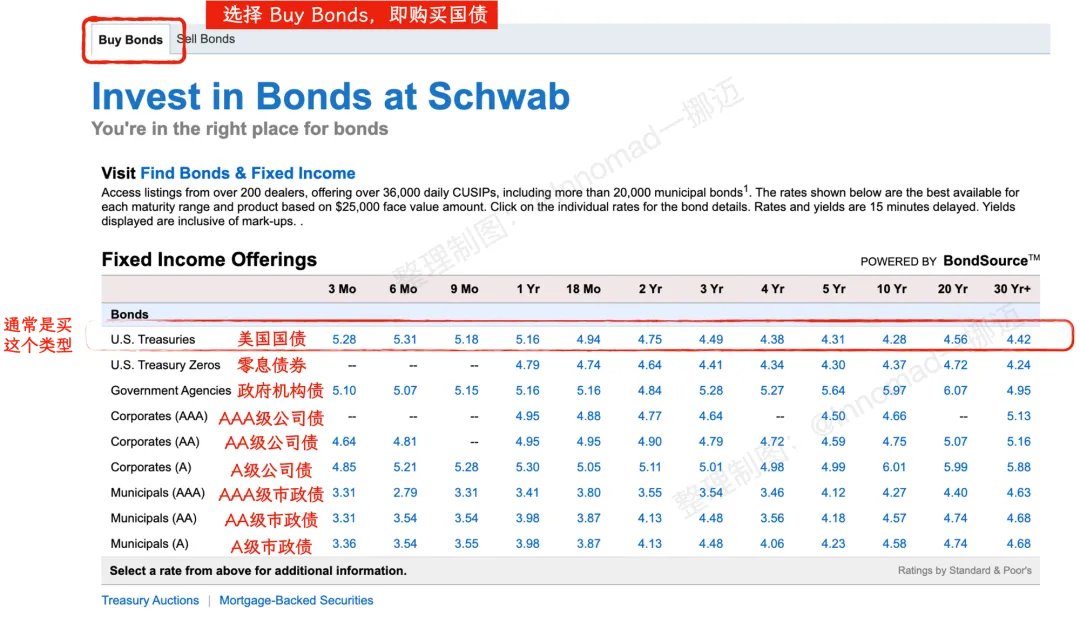

After agreeing to the terms, you will enter the bond selector as shown below.

There are many bonds to choose from, categorized differently from Interactive Brokers but essentially the same products. Schwab further categorizes U.S. Treasuries into U.S. Treasuries and U.S. Treasuries Zeros (which are STRIPS).

-

U.S. Treasuries: Bonds issued by the U.S. government.

-

U.S. Treasuries Zeros: Zero-coupon bonds, typically STRIPS.

-

Government Agency Bonds: Bonds issued by government-sponsored enterprises or the federal government.

-

Corporate Bonds: Bonds issued by companies.

-

Municipal Bonds: Bonds issued by local governments.

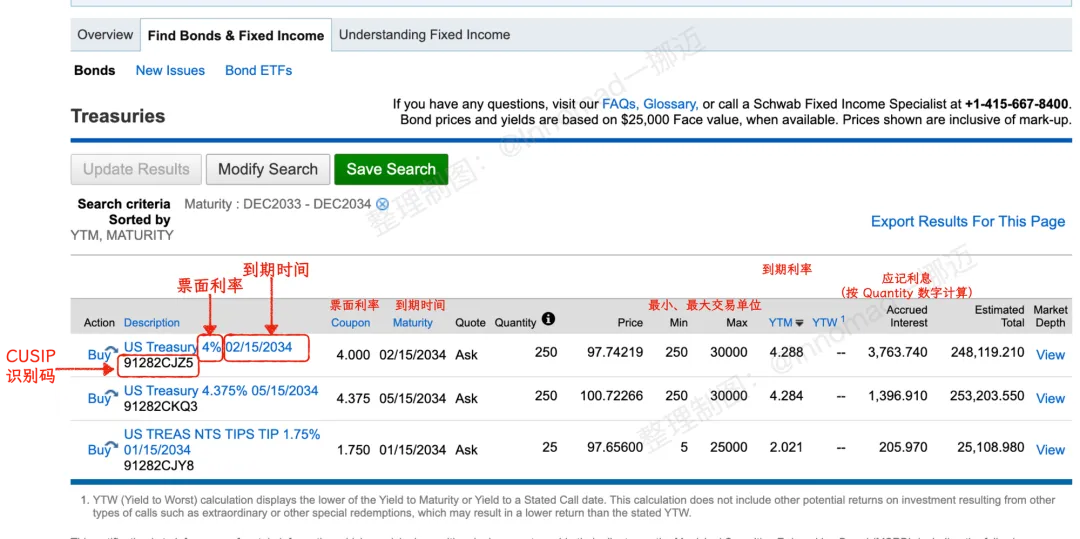

Our main focus is on U.S. Treasuries in the first row. More details on the names and classifications of U.S. Treasuries are shown below:

In the selector, you can see maturity dates ranging from 3 months to 30+ years. Click on the desired maturity date to enter the specific bond list.

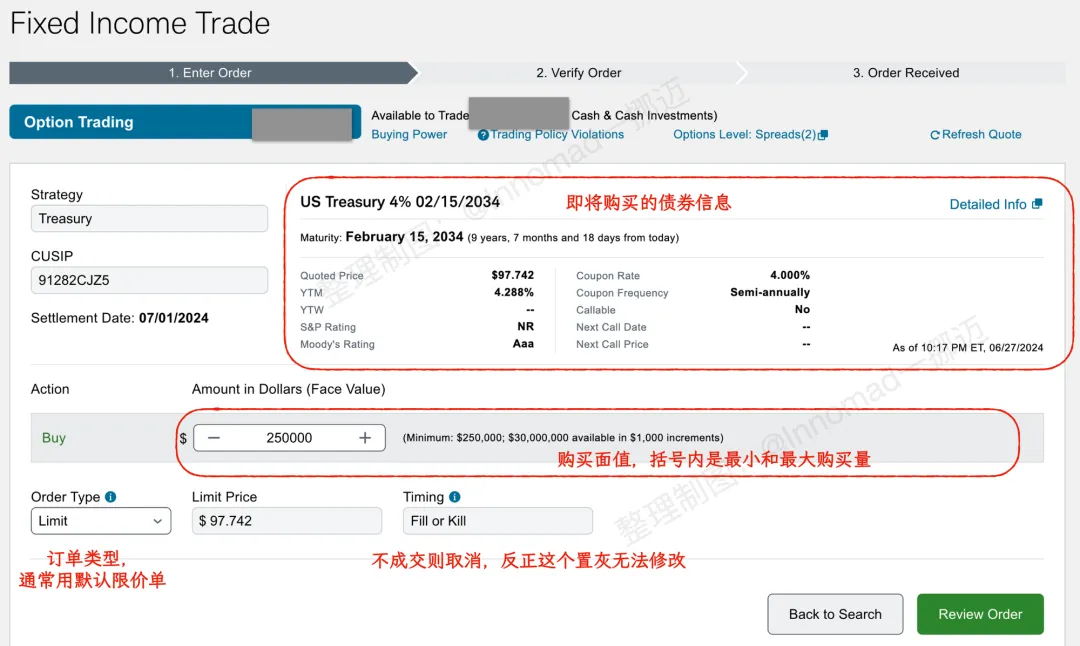

From the names or table fields, you can see the detailed information about the U.S. Treasuries. Focus on the interest rate and maturity date. Also, note the Min and Max fields, indicating the minimum and maximum purchase amounts. For example, if the first bond has “250” as Min, it means the minimum purchase is 250 bonds, equating to a face value of 250 x 1000 = 250,000 USD.

After selecting the bond to purchase, click “Buy” on the left to enter the order page.

Double-check to ensure the correct bond is selected, then fill in the purchase amount and order type. Once everything is correct, click the “Review Order” button on the bottom right. This will prompt another review of the order details. If everything is accurate, click “Place Order” to complete the purchase.

Familiarizing yourself with bond types and parameters makes the actual ordering process relatively simple, as long as you are comfortable navigating the Schwab website interface.

Using Charles Schwab or Interactive Brokers to purchase bonds involves trading in the secondary market, so it is crucial to pay attention to the Yield to Maturity (YTM) and compare market prices.

Purchase Method 2: U.S. Treasury ETFs

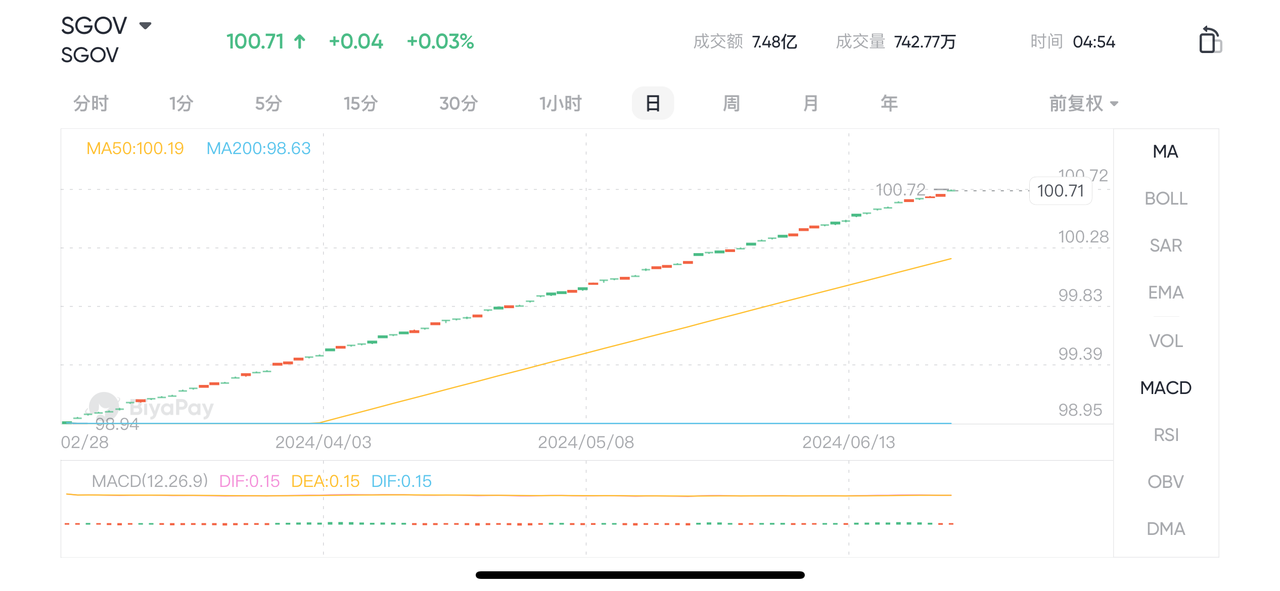

There are many ETFs related to U.S. Treasuries, which can be bought through the aforementioned U.S. stock trading brokers just like any other stocks or ETFs. ETFs have no minimum purchase requirement, making them ideal for beginners or small accounts with limited funds. Additionally, U.S. and Hong Kong stock trading platforms like BiyaPay allow for direct trading (as shown below).

However, it is essential to note that ETFs differ from directly holding bonds. An ETF is a fund that holds, trades, and allocates bonds on your behalf. ETFs may contain bonds with various maturities and discount rates, and they may even hold some cash. ETFs also charge management fees, although these fees are generally low.

Common Bond ETFs

Below are some relatively popular/common bond ETFs based on my research.

Comprehensive ETFs

BND: Tracks the Barclays Capital U.S. Aggregate Bond Index

AGG: Tracks the Barclays Capital U.S. Aggregate Bond Index

BSV: Short-term bonds (U.S. government bonds, corporate bonds, and non-U.S. bonds)

BIV: Intermediate-term bonds (U.S. government bonds, corporate bonds, and non-U.S. bonds)

BLV: Long-term bonds (U.S. government bonds, corporate bonds, and non-U.S. bonds)

Long-term Bonds

TLT: iShares 20+ Year Treasury Bond ETF

VGLT: Vanguard Long-Term Treasury ETF

EDV: Vanguard Extended Duration Treasury ETF

Short to Medium-term Bonds

SGOV: iShares 0-3 Month Treasury Bond ETF

SHV: iShares Short Treasury Bond ETF (1-12 months)

SHY: iShares 1-3 Year Treasury Bond ETF

IEI: iShares 3-7 Year Treasury Bond ETF

IEF: iShares 7-10 Year Treasury Bond ETF

Floating Rate Bonds

FLOT: iShares Floating Rate Bond ETF (tracks Bloomberg US Floating Rate Notes <5 Y)

USFR: WisdomTree U.S. Treasury Floating Rate Bond ETF (tracks Bloomberg U.S. Treasury Floating Rate Bond Index)

Inverse and Leveraged ETFs

TBF: ProShares Short 20+ Year Treasury

UBT: ProShares Ultra 20+ Year Treasury (2x leverage)

TBT: ProShares UltraShort 20+ Year Treasury (2x leverage)

TMF: Direxion Daily 20+ Year Treasury Bull 3x Shares

TMV: Direxion Daily 20+ Year Treasury Bear 3x Shares

With the knowledge above, you should have a good understanding of how to purchase U.S. Treasuries and which types of U.S. Treasuries and Treasury ETFs to buy. Best of luck on your investment journey. See you next time!