- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The competition between AMD and NVIDIA chips continues. What potential does AMD have to change the c

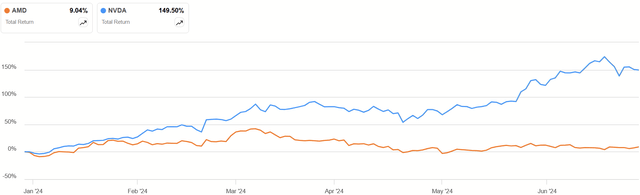

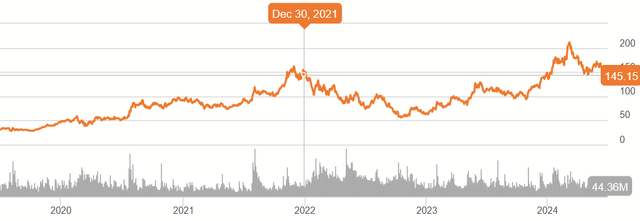

It’s been about a year since the craze of generative AI took off, triggering a spike in the share price of semiconductor companies, whose GPUs naturally feed into that market. The most prominent of the two have been Advanced Micro Devices (NASDAQ:AMD) and NVIDIA Corporation (NVDA), the former being my focus today. While both stocks initially took off, the first half of 2024 hasn’t been as favorable to AMD.

Of course, this doesn’t necessarily say anything about fundamentals. It could just reflect market sentiment. That said, the conventional wisdom seems to be that while Nvidia and AMD are both better chipmakers than Intel Corporation (INTC), Nvidia still beats AMD.

Yet, with a much flatter stock movement, it could even be the case that AMD is attractively priced for what has been a context of rapidly improving fundamentals for both companies.

Financials

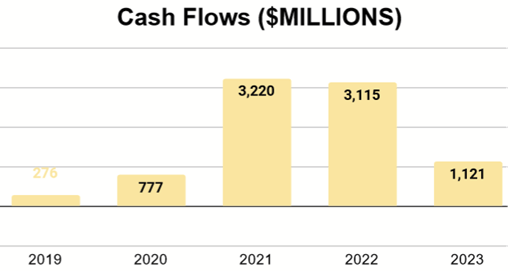

AMD’s free cash flow experienced significant growth over the last five years, with a dip in 2023 after 2022, showing signs of their industry’s cyclicality.

This dip was largely driven by slightly less revenue and an uptick in R&D, which makes sense considering the AI opportunity that opened up that year.

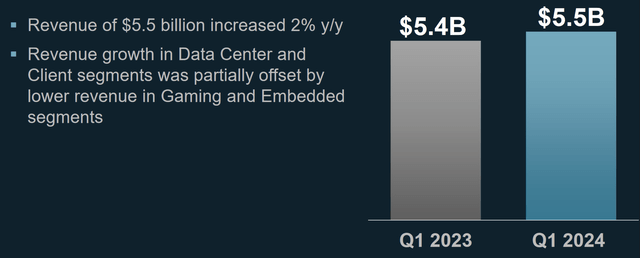

Q1 Results, meanwhile, showed that revenues are on the rise again. It was only a slight increase, but a substantial amount of this came from their Data Center Segment.

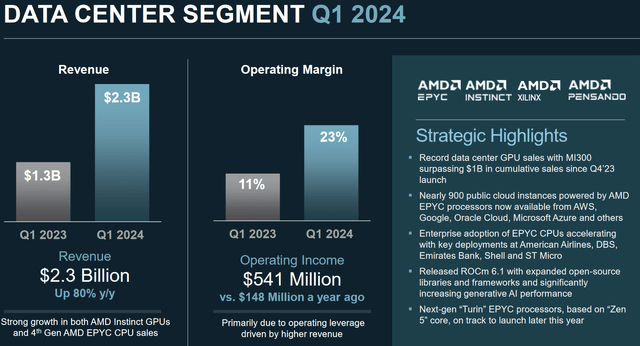

This is a $1 billion difference compared to a year prior. It’s also a segment that shows an improving margin.

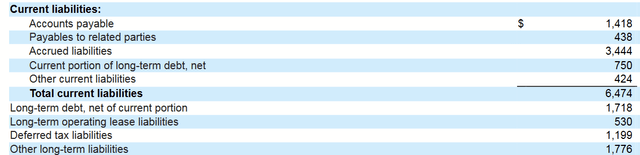

The recent 10-Q shows very little debt, indicating a very lean and healthy balance sheet.

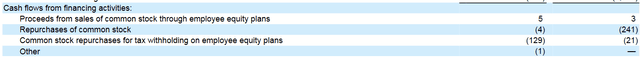

Meanwhile, proper buybacks on the open market (not those related to stock-based compensation) fell to near-zero year-over-year, which I actually find to be a positive (I’ll elaborate later).

AMD’s Strong Suits

One interesting pattern that AMD has been touting recently is what preferences consumers are displaying in regard to their data center needs, as this is also where NVDA has seen significant growth.

Even on the GPU front, AMD has won the confidence of Microsoft Corporation (MSFT), teaming up with them to provide a competitive cloud product.

Due to these reasons, although the future of AI is still uncertain, I expect AMD’s future growth to have a certain degree of certainty. If you have a positive attitude towards AMD’s future and are considering whether to get on board, you can go to BiyaPay, search for AMD stock codes on the platform, monitor market trends, and choose the appropriate time to get on board. Of course, if you have difficulties with deposits and withdrawals, you can also use this platform as a professional tool for depositing and depositing US and Hong Kong stocks. Recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to your bank account, and then deposit to other securities firms to buy this stock. Compared with other platforms, the arrival speed is faster and there is no limit.

Share-Based Compensation and Buybacks

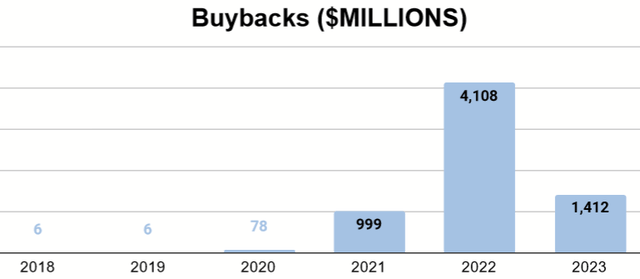

Another thing we need to consider is how the future looks for share-based compensation and buybacks. I mentioned earlier that I thought it was good the buybacks had declined, a problem I highlighted when I covered NVDA.

Long-term returns on individual shares, whatever is true of the whole company, are hurt when shares are repurchased at a premium. Similarly, they are value-additive when repurchased discounted. A common trend I’ve seen across tech stocks, whether they are tied to AI hype or not, are buybacks at high multiples and thus fairly low returns on capital.

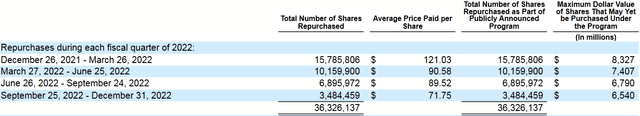

As we can see, buybacks didn’t really take off until free cash flow did, so we only have a few years to use for our own “inferencing” about how AMD will allocate capital going forward. 2022 was a year when free cash flow was about as high as 2021, but the buybacks were far less.

As seen here, 2021 ended on something of a peak and then proceeded to decline through 2022, presenting great buying opportunities.

The repurchases were more concentrated in the upper end of that decline, with very little ultimately used for the lower price. All of these are lower than the current price, and the sharp reduction in buybacks in 2023 and especially in Q1 2024 seem to show that the company has developed a taste for a good price.

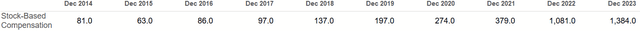

Still, we have to consider the effect of stock-based compensation, or SBC, which has increased every year for the past decade, with 2023’s levels rivaling the total free cash flow. Buybacks in this context effectively turn SBC into an operating expense that simply isn’t reported as such, but nevertheless is felt through the reality of the cash flows.

Valuation

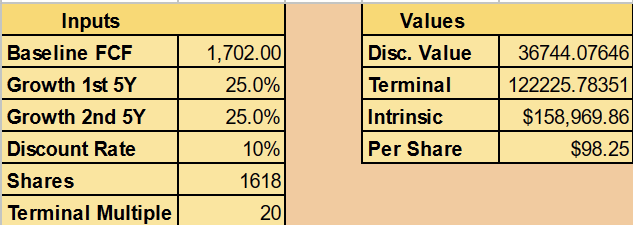

Based on this summary, I’m going to show two valuations, both using a Discounted Cash Flow, or DCF, model. I’ll make the following assumptions:

- $1,702M in annual free cash flow.

- CAGR of 25% for the next decade.

- Terminal multiple of 20.

My FCF figure is the average for 2019-2023, which I think captures the recent patterns with cycles. With the opportunity presented by AI, I think a very high growth rate like 25% is feasible, even as long as a decade. I give a terminal multiple of 20 just to allow for some potential decline as we reach the other side and as perhaps current levels of hype may not exist.

This suggests a fair value per share of about $98. This is priced at a 10% discount rate (typical return of a broad market index), so positive returns are still possible.

Conclusion

With strong financial results and a recent campaign by CFO Jean Hu to clarify where AMD thrives, the company is poised to remain in the game and give Nvidia a run for their money. The main risks to long-term Advanced Micro Devices, Inc. investors aren’t on the operational side, but in the potential for free cash flow lost on stock-based compensation and buybacks. We should continue to observe what kind of appetite the company has for its own shares and if this regime of SBC will continue.