- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

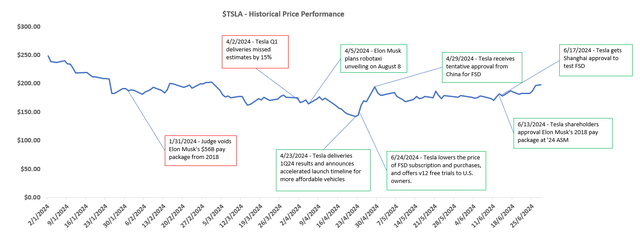

Why Is Tesla Going Higher? Here's What You Need To Know About Q2 Deliveries

Tesla, Inc. (NASDAQ:TSLA) has handily beat expectations on 2Q24 deliveries, albeit a low bar set after repeatedly lowered consensus estimates. The company delivered 443,956 vehicles during the June quarter, which represented a -5% y/y decline and 15% sequential expansion. The results compared to the average Wall Street delivery estimate of about 430,000 vehicles, and were well within expectations that Tesla was in for its second consecutive quarter of delivery declines for the first time. The results also conclude a modest first half of the year for Tesla in terms of automotive sales, which effectively puts the company’s auto unit sales growth prospects for the year – as previously promised with confidence by CEO Elon Musk – at greater risk. The stock’s response to Tesla’s 2Q24 delivery results was also favorable.

This is corroborative of returning investors’ interest towards Tesla’s full self-driving (“FSD”) and robotaxi realization prospects. Recall from our previous coverage’s discussion that Tesla’s stock valuation has long decoupled from vehicle sales. And this decoupling has become especially clear in recent quarters, with auto sales underperformance in 1Q24 overshadowed by investors’ optimism in the robotaxi unveiling event coming August 8.

In addition to the upcoming robotaxi unveiling event, investors are also focused on updates regarding the future of Musk’s pay package. Both of which remain critical to Tesla’s fundamental and valuation outlook. And the debate remains on which is the larger overhang and determinant for the stock’s prospects.

On one hand, reinstatement of the 2018 pay package dictates the future of Tesla with Musk. Meanwhile, on the other hand, realization of FSD and robotaxi monetization is critical to unlocking pent-up valuation upsides to the Stock. Yet, without Musk at the helm, everything else that is currently in the works to drive the stock’s outlook might seemingly become a moot point. This makes FSD and robotaxi optimism largely reliant on whether Musk continues to stay as Tesla’s CEO.

With the final decision on Musk’s 2018 pay package and the robotaxi unveiling event coinciding on a similar timeline, we expect increased volatility to the stock’s performance in early August. This timeline will also mark an inflection for the stock’s near-term performance, in our opinion, with opportunities potentially skewed back to the upside from current levels.

Tesla’s Robotaxi Dreams

The latest delivery results and favorable post-market stock movement corroborates investors’ heightened optimism on the upcoming robotaxi unveiling event. This is consistent with triggers that have recently coincided with the Tesla stock’s upsurge, despite its broader underperformance against the S&P 500 this year. Specifically, the Tesla stock has been primarily sensitive to updates regarding Tesla’s robotaxi and FSD prospects, as well as any news that corresponds to Musk’s position within the company. Meanwhile, tangible fundamental results – such as auto delivery volumes, and top- and bottom-line performance – have played a lesser role in influencing the stock’s performance recently.

Looking ahead, this means the upcoming robotaxi unveiling event slated for August 8 may have big implications for the stock – bypassing even Tesla’s upcoming earnings update scheduled for July 23. Specifically, Musk had confirmed in early April – shortly after releasing disappointing 1Q delivery numbers – that the company will be unveiling its robotaxi at an official event on August 8. And much has been touted over the company’s autonomous mobility ambitions since. They include a reduction in FSD purchase and subscription prices to $8,000 (previously $12,000) and $99 per month (previously $199 per month), respectively, and a 30-day free trial for the technology’s latest version 12.3 to all existing Model S/3/X/Y owners in the U.S.

Although management has largely stayed mum on the run-down of discussion points during the upcoming unveiling event, investors are expecting updates on when Tesla plans to launch its robotaxi – or Cybercab – fleet, and how the company plans to monetize the new venture. For now, Musk has confirmed that Tesla intends to be a fleet operator that combines the essence of both Airbnb (ABNB) and Uber (UBER). Built on its own fleet app and software, Cybercab would consist of both Tesla-owned and individual-owned Tesla vehicles equipped with FSD.

This business model also means robotaxi monetization would hinge on FSD uptake, optimizing Tesla’s revenue share of the autonomous mobility strategy. And over the longer-term, considering Tesla’s ongoing discussions with legacy auto OEMs on licensing its technology, there is also potential for inclusion of non-Tesla vehicles into the Cybercab fleet.

This breaks down the autonomous mobility monetization opportunity for Tesla into three main categories :

- FSD uptake from individual Tesla owners,

- Cybercab fleet charges on rides facilitated by individual Tesla owners, Tesla-owned vehicles, as well as non-Tesla vehicles

- licensing FSD technology to non-Tesla OEMs.

Fundamental Considerations

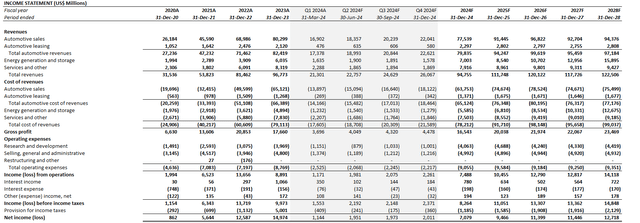

Adjusting our previous forecast for Tesla’s latest 2Q24 delivery numbers, and recent vehicle price changes observed across the core U.S. and Chinese markets, we expect automotive sales of $75.7 billion for 2024, which would represent a -4% y/y decline. Our forecast expects flat full year 2024 vehicle deliveries compared to 2023 based on 1H24 volumes and forward demand considerations.

Specifically, the accelerated launch of new models – including “more affordable” options – as soon as late this year, alongside ongoing macroeconomic uncertainties, is likely to drive a hold out in consumer purchases and impact 2024 auto delivery volumes at Tesla.

Auto delivery volumes are likely to reaccelerate through 2025E, driven primarily by the introduction of more affordable models to better address mass market demand. If you are optimistic about Tesla and want to consider entering the market, you may wish to regularly monitor the stock price at the traditional brokerage Futu or the new multi-asset trading wallet BiyaPay. Among them, BiyaPay can not only recharge USDT to trade US and Hong Kong stocks, but also support recharging USDT to withdraw US dollars and Hong Kong dollars to a bank account, and then withdraw fiat currency to other securities for investment. The account is received quickly and there is no limit limit, avoiding any deposit and withdrawal troubles.

This couples with a reduced ASP going forward, given expectations for a greater shift in automotive sales mix towards the lower priced Tesla models.

Meanwhile, expectations for reacceleration in regulatory credit sales through the remainder of the year driven by reduced EV investments across competing auto OEMs, as well as the robust demand environment for Tesla’s energy generation and storage solutions will be key to offsetting the anticipated automotive sales decline this year. We forecast full year 2024 revenue of $94.8 billion for Tesla, which would represent a y/y decline of -2%.

Price Considerations

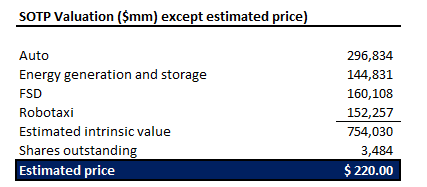

Our updated price target for Tesla, which takes into additional consideration of robotaxi contributions and updated FSD sales prospects, is $220 apiece.

The price is derived using the sum-of-the-parts methodology, which considers the estimated intrinsic value attributable to each of Tesla’s automotive, FSD, robotaxi, and energy generation and storage businesses.

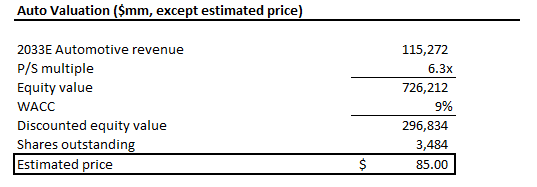

Automotive

We estimate an intrinsic value of $296.8 billion for Tesla’s core auto business. The estimate applies a 6.3x multiple on 2033E automotive sales, which is in line with the average observed across Tesla’s megacap peers with a similar growth profile. This offers a better valuation outlook for Tesla’s automotive business relative to legacy auto OEMs, considering its first-mover advantage in connected electric vehicles, supported by industry-leading manufacturing capabilities and vertically integrated infrastructure. A 9% WACC derived based on Tesla’s capital structure and risk profile is also applied to discount the estimated 2033E value back to 2024.

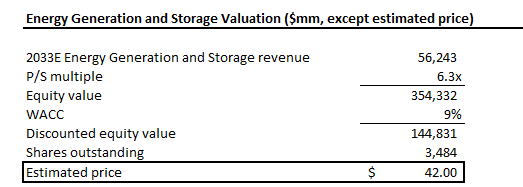

Energy Generation and Storage

We estimate an intrinsic value of $144.8 billion for Tesla’s energy storage and generation business. The valuation estimate assumes a 6.3x sales multiple on 2033E energy storage and generation revenue. The valuation premium attributable to Tesla compared to average multiples observed across the legacy energy generation and storage industry is warranted, in our opinion, given the company’s proprietary technologies in the field and its higher growth outlook. This is consistent with the segment’s accelerating growth observed in recent quarters, which management expects to persist based on improved revenue visibility. A 9% WACC is also applied to discount the estimated 2033E value back to 2024.

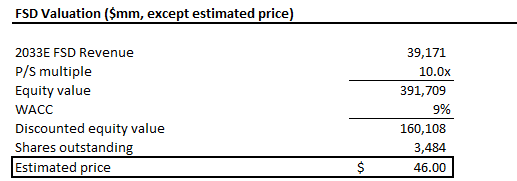

FSD

We estimate an intrinsic value of $160.1 billion for Tesla’s FSD business, which consists of outright license sales and subscriptions to individual car owners, as well as license sales to third-party OEMs. The estimate applies a 10x multiple on estimated 2033E FSD revenue, which is in line with the average observed across high-growth (30%+) software sector peers that exhibit a similar profit margin trajectory. A 9% WACC is also applied to discount the estimated 2033E value back to 2024.

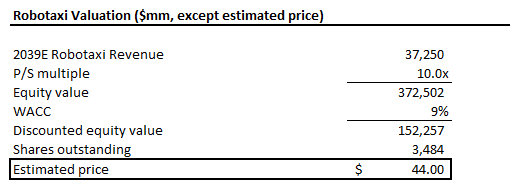

Robotaxi

We estimate an intrinsic value of $152.3 billion for Tesla’s robotaxi / Cybercab business. A 10x multiple is applied on estimated 2039E robotaxi revenue, which is consistent with the methodology applied for Tesla’s FSD operations given their similarly high growth, high margin business model. A 9% WACC is applied to discount the estimated 2033E value for Tesla’s robotaxi operations back to 2024.

Conclusion

The stock’s favorable upsurge following the release of Tesla’s 2Q24 delivery outperformance corroborates the growing pivot of investors’ focus towards its autonomous mobility capabilities instead. A similar trend is likely leading up to Tesla’s 2Q24 earnings update, whereby investors’ expectations for updates related to more affordable models, FSD and robotaxis will likely overshadow anticipated near-term weakness in automotive revenue, and keep the stock resilient at current levels.

Alternatively, we expect the Tesla stock to face an inflection point in early August when the robotaxi unveiling event and the judge’s final decision on Musk’s 2018 pay package takes place. We believe both events will drive near-term volatility for the stock, with further upside from current levels dependent on the ensuing start of productions and follow-up demand environment for the more affordable vehicles exiting 2024.

Specifically, the roll-out of a more affordable vehicle – albeit potentially dilutive to profit margins despite a lower-cost platform – will be key to sustaining Tesla, Inc.’s longer-term growth trajectory. This is because future FSD and robotaxi cash flows currently underpinning the stock’s lofty premium remains heavily dependent on Tesla’s global fleet size. With slowing uptake for Tesla’s existing line-up, incremental market share gains will likely depend on deeper penetration into more price sensitive mass market consumers with a lower priced model than the current Model 3/Y. This would also improve Tesla’s currently stalled appeal in China – one of its core markets – as primarily price sensitive consumers in the region have been showing an increased preference for budget models like those offered by BYD Company (OTCPK:BYDDF, OTCPK:BYDDY).