- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

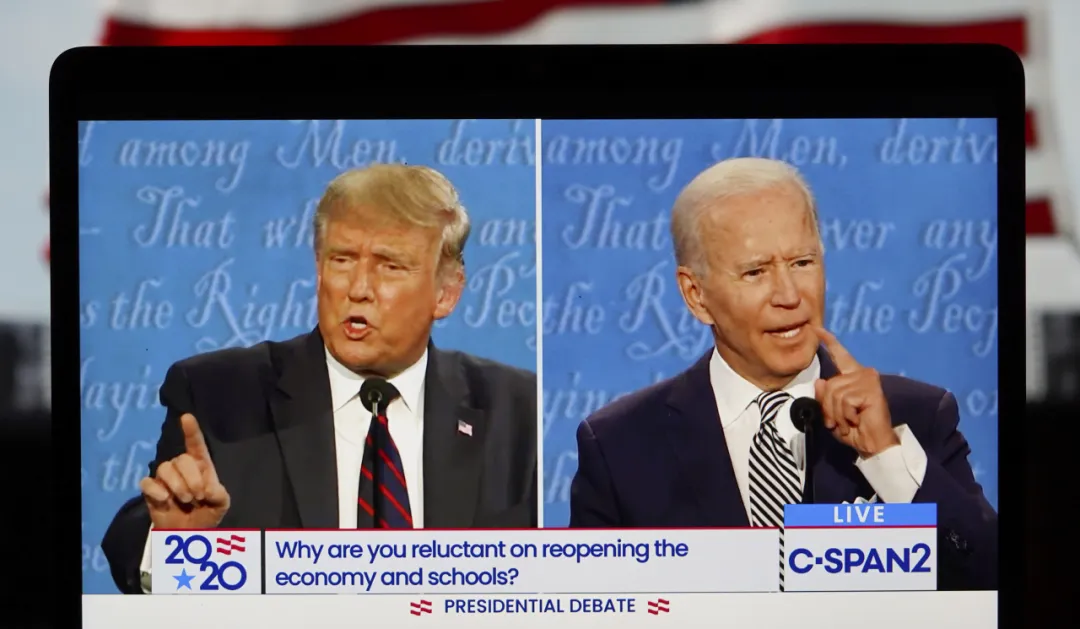

Trump Dominates First TV Debate Against Biden: "Trump Stocks" Rise While "Biden Stocks" Fall, What’s

The quadrennial US presidential election has once again become a showdown between Biden and Trump.

The first presidential debate, hosted by CNN, concluded on June 27, local time. From the audience’s perspective, it was far from a captivating debate with back-and-forth exchanges. Many viewed it as a debacle. Over the 90-minute session, topics veered from the US economy and politics to arguments about who plays better golf…

78-year-old former US President Trump continued his usual self-aggrandizing rhetoric with little new to offer, while 81-year-old current President Biden struggled to present clear, coherent arguments, let alone deliver compelling rebuttals.

CNN’s poll released before the debate (June 26) showed a narrow gap between the two, with Trump at a 49% national average approval rating and Biden at 47%. After the debate, Trump’s support significantly increased, making Biden’s position more precarious. According to Predictlt’s real-time betting data, Trump’s chances of winning the November election rose from 53% before the debate to over 60%. Polymarket’s data showed Trump’s winning odds reaching a historical high of 68%, far exceeding Biden’s 23%.

By these standards, Biden already lost the first debate. Biden’s chief debate coach, Ron Klain, had remarked, “You can lose a debate at any moment, but if you want to win, you must win within the first 30 minutes.” Compared to Trump’s energetic debate performance, Democrats were more concerned about why Biden failed to respond effectively to the obvious flaws in Trump’s statements. Furthermore, Biden sometimes spoke so softly that he seemed to be mumbling, and occasionally he couldn’t complete his sentences. Biden’s campaign team stated he had not fully recovered from a cold.

Due to these factors, the US stock market showed clear differentiation following the Biden-Trump debate. Biden’s unstable performance seemed to boost investor confidence in Trump’s re-election, prompting them to reconsider their investment portfolios, leading to a “barometer” effect on the stock market.

Post-Debate Stock Market “Barometer”: Trump-Related Stocks Surge

After the first round of debates, on Friday, June 28, bank stocks, healthcare management stocks, steel stocks, and other stocks likely to benefit from a successful Trump re-election campaign saw their prices rise, while green energy stocks fell.

For example, United Healthgroup (UNH), a leader in healthcare management, saw its stock rise by 1.3% to $492.31, while Humana (HUM), focused on Medicare Advantage projects, saw its stock rise by 3% to $373.52, reflecting investor optimism towards the healthcare sector.

Furthermore, Trump’s affinity for tariffs and the steel industry would also benefit steel companies if he wins. Nucor (NUE) stock rose by 3.3% to $159.18, and Cleveland Cliffs (CLF) stock rose by 3% to $15.45.

Additionally, Trump might take a less aggressive approach to antitrust enforcement, potentially facilitating mergers and acquisitions for companies like Discover Financial Services (DFS) and Capital One Financial (COF). Discover Financial Services, a potential acquisition target, saw its stock rise by 4% to $128.67, while Capital One Financial stock rose by 2.9% to $137.87.

In contrast, solar and other renewable energy stocks showed a downward trend. First Solar (FSLR) stock plummeted by 9% to $225.

Trump has consistently criticized Biden’s green energy subsidy policies. Other losers on Friday included NextEra Energy (NEE), a leading renewable energy company in the utility sector. If Trump is elected president, energy stocks could see a boost, as evidenced by the 0.4% rise in the Energy Select Sector SPDR ETF. The banking sector might also benefit from a more relaxed regulatory environment, helping the Financial Select Sector SPDR ETF, which rose 2% to $53.32.

Furthermore, cryptocurrency stocks could benefit from a Trump victory, as the former president has increasingly emphasized Bitcoin and other digital assets in recent campaign activities to attract new voters. Notable stocks include Coinbase (COIN), Marathon Digital (MARA), Riot Platforms (RIOT), CleanSpark (CLSK), and MicroStrategy (MSTR).

These are the stocks that the market is beginning to focus on, potentially benefiting from the anticipated election results. Investors can monitor these stocks through multi-asset trading wallets like BiyaPay, allowing them to choose the right time for real-time online trading. They can also deposit digital currencies (such as USDT) into the platform and then withdraw fiat currencies to invest in these US stocks, with same-day withdrawal and settlement to avoid missing out on market trends.

It is well known that the market does not favor uncertainty, and elections often bring uncertainty. Some analysts point out that the market seems to lean towards a Trump victory, with the deficit issue remaining a focal point. Others predict that the US presidential election and its results could lead to significant market volatility in the second half of this year.

What Lies Ahead for the US Stock Market After the Election?

In The Conference Board survey, consumers believe that the 2024 election will have little impact on the economy. This year, elections in Mexico, India, and Europe have caused significant turmoil in their respective stock markets. The upcoming US election is no exception. With inflation, interest rates, and geopolitical risks already contributing to high uncertainty in the second half of the year, the added variable of the election significantly increases the potential for stock market volatility.

Market analysis indicates that if Biden is elected, companies in the renewable energy sector, such as solar power, electric vehicle charging stations, and electric vehicle manufacturers, are likely to benefit because Biden and the Democrats support green energy development. The cannabis industry stocks might also perform well since the Democrats are more lenient towards cannabis. However, the financial sector might face challenges, as Biden could strengthen financial regulations, which might not be favorable for bank stocks like JP Morgan, Bank of America, and Goldman Sachs. The pharmaceutical industry, especially drug companies, might also be impacted because Biden advocates for lowering drug prices, which could affect their revenue.

If Trump is elected, companies with substantial business in China, such as Apple, Tesla, Qualcomm, and Broadcom, might face some risks due to the possibility of increased tariffs on Chinese goods or more direct competitive measures. On the other hand, the oil and gas industry might receive support, as the Republican Party generally supports traditional energy sectors, and Trump has promised to lift some restrictions on domestic oil production. Defense contractors and stocks related to Bitcoin might also benefit since the Republicans support increased military spending, and Trump has recently expressed support for cryptocurrencies.

In summary, although the election might intensify market volatility, historical trends suggest that the US stock market typically performs well in election years, although volatility may be higher from September to November. Therefore, investors need not be overly anxious. However, if the election results are delayed, there could be some risks. Many people are choosing to vote by mail, which could extend the counting time. The January 6 Capitol Hill incident showed that tense election situations could lead to violence or disputes, potentially causing short-term market panic. During the 2000 election, when Florida underwent a recount, both the stock and bond markets experienced significant fluctuations, and gold prices rose, reflecting investors’ flight to safety.

Finally, the debate is not only a contest between the two candidates but also a reevaluation by investors of the market’s direction. As the election approaches, market volatility may further increase. Investors need to closely monitor political developments and adjust their investment strategies accordingly. In this dual drama of politics and economics, let us wait and see who ultimately wins the market’s favor.