- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

What Is the Cheapest Way to Remit Money Globally? Which Platform Is the Most Cost-Effective?

In today’s era of globalization and increasing international migration, global remittance has become more common. However, users often face high fees and complex processes when transferring money across borders. Therefore, finding the most cost-effective method for remittance is a primary task for many people.

Remittance fees mainly consist of several components, including service fees, exchange rate conversion fees, and possible other hidden costs. Therefore, understanding the fee structure of each platform is crucial when choosing a remittance service.

Major Remittance Platforms

Fee Structure:

- Fixed Fees: Fees are based on the remittance amount, typically ranging from 0.5% to 1.5%, depending on the country and amount.

- Exchange Rate: Wise uses near mid-market rates with no hidden fees. Users can view specific rates and fees before remittance.

Features:

- High Transparency: Wise’s fee structure and exchange rates are completely transparent, allowing users to know the exact cost of each remittance.

- Limited for Large Transfers: Wise may not be ideal for large transfers as fees are percentage-based.

- Limited Coverage: While it covers major regions and popular currencies, it might be inconvenient for businesses dealing with smaller markets or emerging economies.

- Security: Regulated by the UK Financial Conduct Authority (FCA) and other major financial regulatory bodies, ensuring user funds are secure.

Use Case: Suitable for individuals and small businesses needing everyday cross-border remittances, particularly those requiring high transparency and low fees.

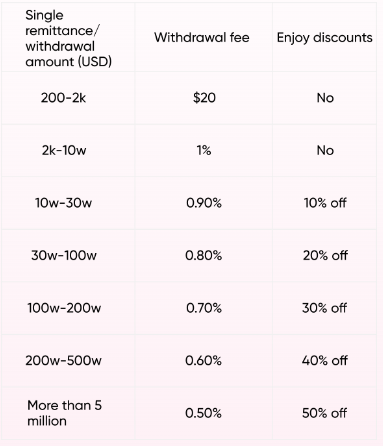

Fee Structure:

- Remittance Fees: Global remittance fees as low as 1%, significantly lower compared to many competitors and traditional methods.

- Amount Discounts: Discounts on withdrawal fees for single transactions reaching certain amounts, up to a 50% fee reduction.

Features:

- Multi-Currency Support: Supports over 20 fiat currencies and more than 200 cryptocurrencies for real-time exchange and remittance.

- Fast and Convenient: Currency exchange and remittance are handled online via app or web without face-to-face transactions or bank counter operations, enabling instant global transfers.

- Low Fees: Compared to traditional remittance methods, BiyaPay’s global remittance fee is 1%, offering a price advantage.

- No Limit on Amount: Unlike traditional methods with limits and policy restrictions, BiyaPay’s decentralized, real-time transfer characteristics allow for unlimited global remittances.

Use Case: Ideal for users needing cross-border remittances and multi-currency transactions, especially those with overseas asset allocation or investment needs. BiyaPay also supports US and Hong Kong stock investments and cryptocurrency trading.

Fee Structure:

- Basic Account: Provides free transfers within monthly limits, with low fees for transfers beyond those limits.

- Premium Accounts: Premium and metal accounts offer higher monthly limits and additional benefits, such as lower fees and more service options.

Features:

- Multi-Currency Accounts: Allows users to hold and manage multiple currencies in one account, facilitating multi-currency transactions.

- Real-Time Exchange Rates: Offers real-time market rates with no exchange rate markups, making remittances more cost-effective.

- Convenience: Users can easily remit and exchange currencies via the mobile app, making operations simple.

Use Case: Suitable for users frequently engaging in multi-currency transactions and cross-border payments, particularly those who travel often or conduct economic activities in different countries.

Fee Structure:

- Express Transfer: Higher fees for transfers completed in minutes. Fees vary based on amount and destination.

- Economy Transfer: Lower fees but requires 3-5 business days for completion. Fees depend on destination and amount.

Features:

- Flexible Options: Users can choose between express and economy transfers based on urgency.

- Wide Coverage: Supports over 170 countries, catering to a wide range of remittance needs.

- Security: Implements stringent security measures to ensure user funds are safe.

Use Case: Suitable for users needing different speed options for remittances, particularly for urgent transfers.

Fee Structure:

- Variable Fees: Based on amount and destination, usually including fixed fees and exchange rate markups. Specific fees can be checked on the Xoom website.

- Fast Delivery: Most remittances are completed within minutes to a few hours.

Features:

- PayPal Integration: Directly linked to PayPal accounts, making it convenient for existing PayPal users to remit.

- Extensive Service Network: Covers over 130 countries, supporting bank transfers, cash pickups, and mobile wallets.

Use Case: Ideal for users with existing PayPal accounts, facilitating easy account transfers and quick remittances.

Fee Structure:

- High Fixed Fees: Vary significantly based on amount and destination. Specific fees can be checked on the Western Union website.

- Exchange Rate Markups: Typically included in the fees.

Features:

- Global Coverage: Operates in over 200 countries and regions with more than 500,000 agent locations worldwide.

- Speed: Many transfers can be completed within minutes.

- Multiple Options: Offers various transfer methods, including cash, bank cards, and bank transfers.

Use Case: Suitable for users needing extensive coverage and multiple transfer options, particularly those requiring cash pickups.

Conclusion

When choosing a global remittance platform, users should consider a combination of factors, including fees, speed, security, and the specific circumstances of the destination country.

Traditional platforms like MoneyGram are suitable for users who prefer conventional service channels. With technological advancements, fintech platforms like BiyaPay offer significant advantages in terms of cost and efficiency. These platforms are ideal for users who need low-cost and high-efficiency remittances. The cost of cross-border remittance is expected to further decrease, providing users with more convenient and economical options.