- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

What is the cheapest way to make cross-border remittances? Which method has the lowest fees?

When you need to send a sum of money to a foreign bank account, the most direct method is likely using your domestic bank’s international wire transfer service. However, besides banks, there are many other ways to make international remittances. Specialized institutions like BiyaPay, MoneyGram, PayPal, and Western Union can help customers transfer funds quickly to various parts of the world, often at lower overall costs than banks.

Below, we introduce several different ways to remit money to overseas bank accounts, helping you understand the related fees of their remittance services. These methods range from international bank transfers through regular banks to sending money to overseas accounts via specialized remittance platforms.

Offline International Bank Wire Transfers

If you prefer handling transactions in person rather than online, or if your bank requires you to visit a branch, you will want to know the fee differences between online and offline remittances. Your bank will almost certainly charge you a fee, usually between $40 and $50. Branch payments are typically more expensive than online transfers.

Online International Bank Transfers

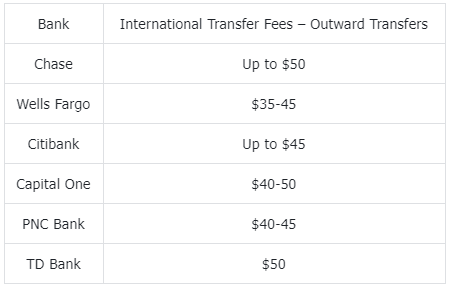

Similar to offline transactions, your bank will charge an initial processing fee for online international bank transfers, usually between $40 and $50. The recipient bank may also charge fees, ranging from $10 to $20. According to mybanktracker, here are the current fees for some major banks in the United States:

Note that while you only need to pay a fee to your bank, one to three intermediary banks and the recipient bank may charge additional fees. These fees can add up, so be prepared. Additionally, contacting the bank by phone for remittances is usually as expensive as paying in person at the branch—check the fees before starting.

Introduction to SWIFT Payments

Bank international wire transfers are usually sent through the Society for Worldwide Interbank Financial Telecommunication (SWIFT). In the SWIFT network, participating banks worldwide work together to transfer funds. Your money usually has to pass through up to three banks rather than going directly to the destination, similar to taking one or two connecting flights to reach your destination. Unfortunately, each bank charges fees, increasing the cost of such payments.

To summarize, here are some key points to remember about SWIFT transfers:

- Despite the name SWIFT, the transfer speed is not fast. It may take 1 to 5 business days.

- A total of 3 to 5 banks will charge you fees, which may be included in the final transfer cost.

- If your money needs to be converted to another currency, consider the potential poor exchange rate and prepare for additional fees.

Remittances Through International Transfer Platforms

In addition to banks, you can also choose from many independent international remittance platforms such as Western Union and BiyaPay. These platforms use different processing methods from banks, resulting in faster transfers. Below is an overview of the features and fee structures of each platform.

BiyaPay

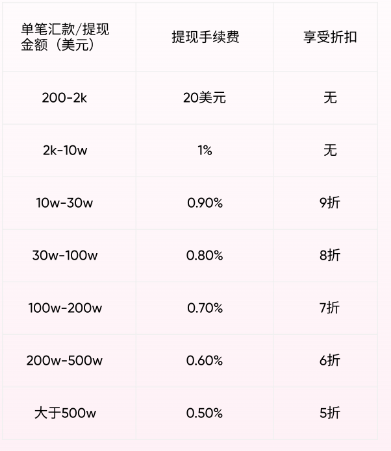

BiyaPay’s currency exchange and remittance services are operated entirely through their online app, eliminating the need for face-to-face transactions or bank counter operations. This allows for instant global transfers. BiyaPay offers remittance fees as low as 1%, which is significantly lower than traditional methods and competitors, with no hidden charges. Furthermore, discounts are available based on the amount of your remittance or withdrawal. Specific discount details are as follows:

BiyaPay completes all global remittances online, supports full-process on-chain tracking, and holds multiple compliance certifications. Currently, BiyaPay has obtained the following:

- U.S. MSB financial services license

- Canadian MSB financial services license

- U.S. SEC RIA license

With comprehensive KYC certification and professionally legal offshore accounts, BiyaPay ensures the safety of user funds. If you frequently make cross-border remittances, consider registering a BiyaPay account. BiyaPay supports real-time online exchange of over 20 major fiat currencies and more than 200 mainstream digital currencies, achieving instant cross-border transfers to most countries or regions, making deposits and withdrawals safer and faster.

Western Union

Western Union covers 200 countries and handles 130 currencies. Their fees depend on the location from which you are sending money, the payment method, and the receiving method. Western Union’s exchange rates include additional charges, and the specific fees will vary based on the amount sent, the location, and the method of payment and receipt. Please refer to your actual transaction for precise fees.

Conclusion

Although the fee structures used by banks and service providers are often complex and confusing, there’s no need to be overly concerned. You need to carefully consider your remittance options, thoroughly check the fees and market exchange rates for the options you are processing, and ask staff about third-party fees to ensure that you do not end up paying unexpected amounts.

Therefore, before submitting your order, be sure to understand the exact amount you will receive. Taking a few minutes to compare and research will certainly be beneficial.