- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

How to Remit Money Abroad and What Information is Required for International Remittances?

When you need to send funds to a foreign bank account, whether it’s for immigration, studying abroad, starting a business overseas, or simply for travel expenses, the most direct method is likely using your domestic bank’s international wire transfer service. International wire transfers can be arranged online, through banking apps, by phone, at bank branches, and via international remittance companies.

Besides banks, there are many other ways to make international remittances. Specialized institutions like BiyaPay, MoneyGram, and Western Union can help customers quickly transfer funds worldwide, often at lower fees than banks.

Here are some options and methods for international remittances:

How to Make International Remittances

First, let’s understand how to conduct international remittances. Below are different methods for transferring money to foreign bank accounts, from standard bank international transfers to using specialized remittance platforms.

Option 1: Online International Bank Transfer

Firstly, here’s how to conduct an online international wire transfer to a foreign bank account. Follow these steps:

- Find the Wire Transfer Section in Your Online Banking Log in to your online banking account and navigate to the wire transfer section on your bank’s website.

- Enter the Recipient’s Bank Details To complete a SWIFT international transfer, you will need the following information:

- The recipient bank’s name and address.

- The recipient’s name, address, and the type of account they have (checking, current, savings, money market, etc.).

- The recipient’s account number or IBAN.

- The recipient bank’s BIC/SWIFT code.

- The BIC/SWIFT code is like a routing number or postal code in the U.S. It indicates the specific bank where the recipient’s account is held. Your bank may use the recipient’s name and account number or an online BIC/SWIFT code finder to locate the recipient’s BIC/SWIFT code. You can also ask the recipient bank directly for this information.

- Enter the Amount and Currency You Want to Send Continue following the online prompts to enter the amount you wish to send and the currency in which it will be deposited.

- Pay the Transfer Fees Your bank will charge you an initial processing fee, and the recipient bank may also charge a fee.

Option 2: In-Person Bank Transfer

If you prefer to handle transactions in person rather than online, or if your bank requires you to visit a branch, you will need to prepare the following information:

- Prepare the Required Information for International Wire Transfers You will need to provide your account information as well as:

- The recipient bank’s name and address.

- The recipient’s name and address.

- The recipient’s account number or IBAN (International Bank Account Number—used in many countries as a format for bank account numbers).

- The recipient’s BIC/SWIFT code. If you don’t know it, you can use an online SWIFT code finder.

- Determine the Transfer Amount and Target Currency Confirm the currency you are sending, the amount you are sending, or the amount you want to reach the destination bank.

- Pay the International Transfer Fee Your bank will almost certainly charge you a fee. Fees typically range from $40 to $50, and branch payments are usually more expensive than online transfers.

Option 3: Telephone International Transfers

Some banks also offer telephone services, allowing you to make international wire transfers by calling their customer service center.

- Prepare the Required Information for International Wire Transfers You will need to provide your account information as well as:

- The recipient bank’s name and address.

- The recipient’s name and address.

- The recipient’s account number or IBAN.

- The recipient’s BIC/SWIFT code.

- Confirm Payment Details Call the bank and inform the customer service representative of your transfer amount and the currency in which it should be received.

- Pay the International Transfer Fee Telephone transfers are usually as expensive as branch payments—check the fees before you start.

Option 4: Remittance via International Remittance Platforms

Besides banks, you can also choose from numerous independent international remittance platforms.

BiyaPay

BiyaPay handles currency exchange and remittances through an online app. No face-to-face transactions or bank counter operations are needed, allowing for global instant transfers.

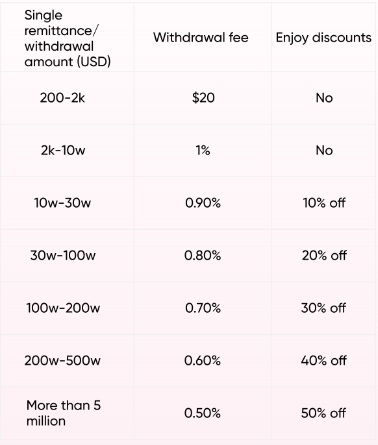

Using BiyaPay, remittance fees are as low as 1%, significantly lower than traditional methods and competitors. Furthermore, if your remittance or withdrawal amount reaches a certain threshold, you can enjoy discounts based on the corresponding range. The specific discounts are as follows:

Here is the process from registration to remittance using BiyaPay (taking USD as an example):

- Real-name Authentication and Binding a USD Bank Account Click the user icon in the top right corner of the app homepage to enter the personal center, complete real-name authentication, and bind your USD bank account.

- Deposit USDT On the app homepage, click “Transfer In,” select “On-chain Deposit,” and deposit USDT.

- Exchange USDT for USD On the app’s “Flash Exchange” page, exchange USDT for USD.

- Withdraw USD to the Bound USD Bank Account On the app homepage, click “Transfer Out,” then “Bank Account Withdrawal,” and withdraw USD to the bound USD bank account.

If you frequently remit money across borders, consider registering for a BiyaPay account. BiyaPay supports the online real-time exchange of over 20 major fiat currencies and more than 200 mainstream digital currencies, enabling local transfers in most countries or regions globally. It allows for same-day remittance and same-day receipt, achieving the goal of personal overseas asset allocation and investment.

It can also be used to purchase personal insurance, financial products, or services like buying Hong Kong and US stocks, with real-time cross-border transfers and more convenient deposits and withdrawals.

What Information and Documents are Needed for International Wire Transfers?

The specific requirements for international wire transfers depend on the bank or payment service you use, as well as the country/region and amount of the transfer.

If you are using a provider for the first time, you typically need to create and verify an account, which means presenting or uploading a photo of some form of ID. Once this is done, you usually need to provide:

- The recipient’s full name

- The recipient’s bank details, including the bank name and account number

- Payment details, including the required currency For higher-value transfers and payments to certain countries, you may also need to provide information about the purpose of the payment and the source of the funds.

Conclusion

International remittances can be complicated, but they are manageable. Refer to this article to weigh your options, considering the features, transfer times, and fees of different remittance methods, so you can choose the one that best meets your needs.

Don’t forget to check out BiyaPay’s low-cost remittance services, which offer short transfer times and extremely low fees without any hidden charges. Therefore, before placing an order, make sure you know the exact amount you will receive. Taking a few minutes to compare and research is definitely worth it.