- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

NVIDIA takes advantage of AI to dominate the world's number one market.

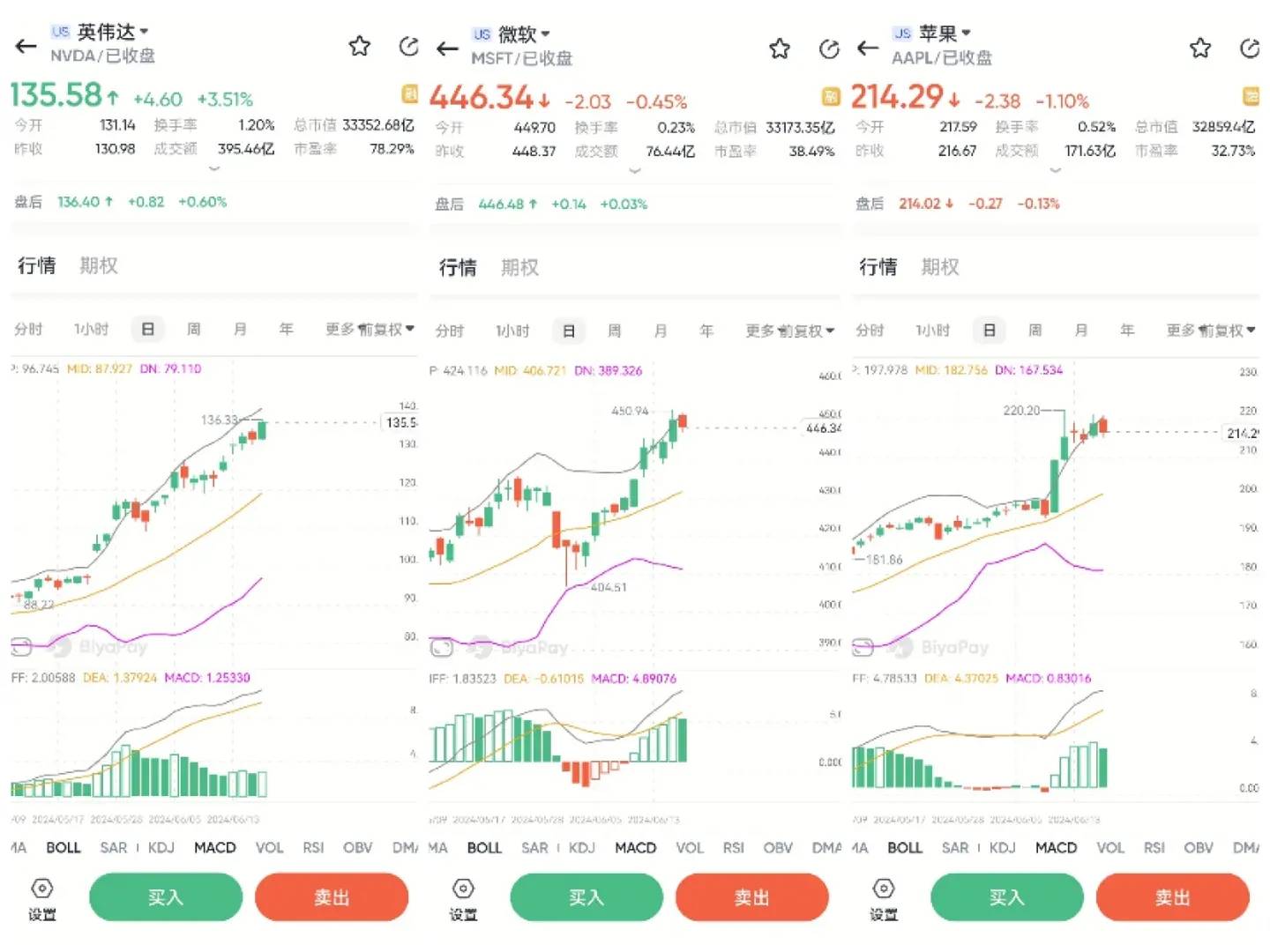

Eastern time on June 18, the closing of the US stock market, Nvidia shares rose 3.51%, to $135.58 and brush a new historical high, the total market value of $3.335 trillion, more than Microsoft and Apple , becoming the world’s highest market value stocks.

NVIDIA’s Market Value Growth Process

NVIDIA was founded in 1993 and is an important innovator in the fields of Computer Graphics and AI technology. In 1999, it invented GPU graphics computing (accelerated computing), which greatly promoted the development of the PC gaming market, redefined Computer Graphics technology, and created a new era of modern AI accelerated computing. In recent years, with the help of the Metaverse, cryptocurrency, and artificial intelligence, it has almost unified the AI computing chip market.

Since November 2022, OpenAI has released the AI chatbot ChatGPT, which has quickly become popular worldwide and sparked a competition and craze around AI large models.

A year ago, the company’s market value was far from the $1 trillion threshold, ranking behind tech giants such as Google parent Alphabet, Amazon, Apple, and Microsoft.

However, fast forward to June 13, 2023, and NVIDIA’s market value crossed the important threshold of $1 trillion.

On February 23, 2024, the company’s market value broke through the $2 trillion mark at an astonishing speed, setting a record for the fastest growth from $1 trillion to $2 trillion.

On June 5, NVIDIA’s market value once again achieved a leap, breaking through the $3 trillion mark, and the leap from 2 trillion to 3 trillion took less than four months.

Then, on June 6, NVIDIA’s market value reached a new peak, surpassing Apple to become the world’s second-largest tech giant.

As of the close on June 16th, the stock price has soared by 164.5% this year, and now it has become the “stock king” in one fell swoop.

Nvidia dominates the entire AI field

NVIDIA is now able to successfully top the global market value list, demonstrating the market potential of artificial intelligence technology and the great interest of investors.

Innovation in GPU technology

NVIDIA initially started as a graphics processing unit (GPU) manufacturer, but later discovered the potential of GPUs in processing parallel tasks, especially for AI and Machine Learning algorithms. Through its CUDA technology, it provides developers with a powerful programming platform that enables them to use GPUs for complex mathematical and Big data calculations, which is particularly critical for training Deep Learning pain point algorithms.

Deep learning and AI frameworks

NVIDIA’s efforts in these areas have helped it build Competitive Edge, enhance its competitiveness, and demonstrate its AI strength. In the AI chip market used in data centers , NVIDIA occupies about 80% of the market share.

NVIDIA is not only innovating in hardware, but also launching software libraries including TensorRT, cuDNN, etc. These tools are designed specifically for Deep Learning Performance optimization, helping developers deploy and accelerate their AI models more effectively.

In addition, it actively collaborates with the open source community to support mainstream AI frameworks such as TensorFlow and PyTorch, ensuring that its GPUs can seamlessly integrate these tools.

Cloud Services and Data centers

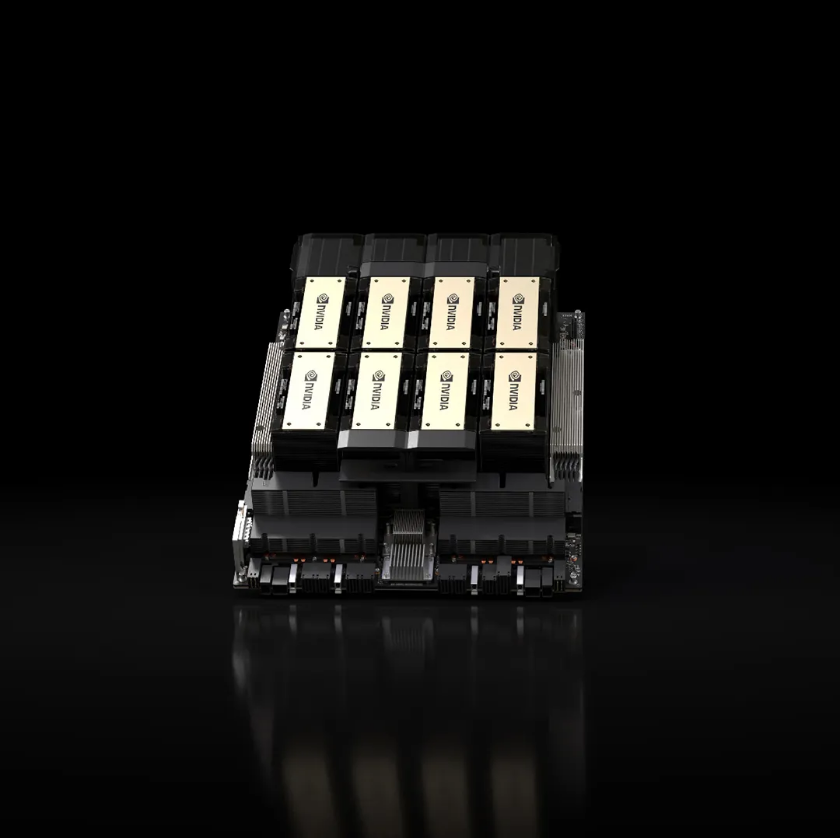

With the rise of Cloud Services, Nvidia has invested heavily in developing GPUs suitable for data centers, such as the Tesla series, as well as products customized for Cloud as a Service, such as Nvidia GRID. These products enable Cloud as a Service providers to provide efficient AI computing services to their customers.

NVIDIA’s DGX system, designed specifically for AI research, provides an integrated solution from hardware to software, further consolidating its leadership position in the Cloud Services and Data center markets.

Industry application and strategic cooperation

NVIDIA sees the potential of AI technology in multiple industries, so it has established partnerships with leading companies in industries such as automotive, medical, and manufacturing. For example, in the field of autonomous driving, it collaborates with car manufacturers such as Tesla and Audi to provide AI solutions for autonomous driving. In the medical field, its Clara platform is helping to improve medical imaging and genetic sequencing analysis.

Stock splitting sparked positive feedback

Last month, as Nvidia released its financial report and announced a 10-to-1 stock split plan, which took effect on January 7th, the stock price continued to rise, the market trading volume significantly increased, and the market value once exceeded $3 trillion, showing a positive response from the market.

However, it is worth noting that despite Nvidia’s rapid market value growth, the company has not yet been included in the Dow Jones Industries Average Index, a benchmark index of 30 stocks that historically includes the most valuable companies in the US.

This stock split plan will increase the likelihood of Nvidia being included in the Dow Jones Index, as the index is a price-weighted index and companies with higher stock prices have a greater influence on the benchmark index. If successfully included, it will further increase the exposure of Nvidia’s stock, attract market attention, and attract more investors to buy.

Future trends

Investors in Nvidia should focus more on the company’s potential than its current profits. Microsoft and Apple both made more than $21 billion in profits in the three months to March. Nvidia made $14.88 billion in profits in its most recent quarter, which ended in April, but that was up more than 600% from the same period last year.

Nvidia’s rise has benefited from its ability to consistently exceed Wall Street expectations. The company’s sales last quarter tripled from the same period last year, reaching $26 billion, and sales are expected to double this quarter.

It sells a wide range of products, from chips to the software needed to build artificial intelligence systems with these chips, to supercomputers. These machines have 35,000 components, are equipped with the company’s GPU, and cost $250,000 or more. The new supercomputer that is about to be launched to the market may cost more than $1 million, indicating that Nvidia is expected to generate higher sales and has great development potential.

The day before NVIDIA’s market value peaked, insiders claimed that NVIDIA’s stock price still has 50% room for growth and believed that NVIDIA’s “real advantage lies in software that complements all hardware advantages”.

Over the past year, Nvidia’s stock price has soared more than 200%, and some analysts believe that the semiconductor giant’s market has not yet come to an end, and its market value is expected to climb to nearly $5 trillion next year.

If you missed the opportunity to get on board during the previous stock split period, now may be an opportunity. You can go to BiyaPay to monitor the trend of NVIDIA’s stock market, choose the appropriate time to get on board, and then conduct online real-time trading. Alternatively, you can use the platform as a professional tool for depositing and depositing US and Hong Kong stocks, recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to your bank account, and then deposit to other securities firms for NVIDIA stock investment. The arrival speed is fast and there is no limit, which can solve the problem of depositing and depositing.

Summary

NVIDIA’s market value ranks first in the world, which is a key milestone event for global Capital Markets. It not only recognizes NVIDIA as an AI giant, but also represents the market’s investment enthusiasm for artificial intelligence, with high investment sentiment.

Based on the previous analysis, it can be found that NVIDIA still has considerable development potential in the future, but as an investor, we should not ignore the risks it faces such as fierce industry competition, large investment in technological change and research and development. We hope that investors can do a good job in threat and risk assessment and make investment choices cautiously.