- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Broadcom: Compelling Buy, Thanks To Raised AI Guidance

We previously covered Broadcom (NASDAQ:AVGO) in February 2024, discussing why we had finally upgraded the stock as a Buy, after multiple rounds of Hold rating.

This was attributed to its reasonable FWD valuations compared to its peers and the management’s highly optimistic FY2024 forward guidance, with the consensus already moderately raising their estimates through FY2026.

Since then, AVGO has recorded another +7.5% in stock gains, outperforming the wider market at +5.7% while establishing $1.2K as its floor. Much of the tailwinds are naturally attributed to the accelerating profitable growth reported in FQ1’24 and the raised AI-related sales guidance in FY2024.

The same promising market trend has also been observed by AI market leaders, such as Nvidia (NVDA), Super Micro Computer (SMCI), and c3.ai (AI), as the growing demand for generative AI offerings penetrate through the infrastructure layer to SaaS layer.

Combined with the excellent shareholder returns thus far, we believe that AVGO remains a Buy at every moderate pullback for an improved margin of safety, with us sustaining our bullish investment thesis in this generative AI play since our last article. Reiterate Buy.

AVGO Continues To Be A Compelling Generative AI Play - Thanks To The Raised Guidance

For now, after the highly insightful commentaries and promising forward guidance from multiple generative AI players in the recent Q1’24 earning calls, we believe that the market is awaiting for AVGO’s upcoming earnings call on June 12, 2024 with bated breath.

For example, the clear market leader for AI chips, NVDA, reported an impressive Q1’24 revenues of $26.04B (+17.8% QoQ/ +262.1% YoY) while guiding Q2’24 revenues of $28B (+7.5% QoQ/ +107.4% YoY), smashing consensus estimates of $22.03B and $26.8B, respectively.

With SMCI, a company offering complete server solutions, also reporting robust Q1’24 revenues of $3.85B (+5.1% QoQ/ +200% YoY) while guiding Q2’24 revenues of $5.3B (+37.6% QoQ/ +143.1% YoY), it is apparent there remains “continued demand strength for AI/ML compute and networking products from hyperscaler customers.”

At the same time, we are starting to see generative AI infrastructure growth penetrating into the SaaS layer, as similarly reported by C3.ai in the latest earnings call, with it “exceeding the high-end of both the original guidance and analyst expectations.”

The same has been highlighted by AVGO’s management, with FQ1’24 bringing forth robust networking revenues of $3.3B (+6.4% QoQ/ +43.4% YoY) with the “strong demand for its custom AI accelerators” driving the raised networking revenue guidance of over +35% YoY growth in FY2024.

This is compared to the original guidance of +30% YoY, implying that its offerings remain the top pick for many hyperscalers thus far.

At the same time, AVGO expects FY2024 to bring forth higher AI-related revenues of over $10B, compared to the original guidance of $7.5B offered in the FQ4’23 earnings call and the annualized sum of $6B reported in FQ4’23.

As a result, we believe that the consensus FQ2’24 estimates for AVGO appears to be rather conservative, at revenues of $12B (+0.3% QoQ/ +37.4% YoY), adj EBITDA estimates of $7.05B (-1.3% QoQ/ +24.1% YoY), and adj EPS estimates of $10.84 (-1.3% QoQ/ +5% YoY), with another beat and raise performance very likely.

This is especially since the management has recorded an impressive sixteen consecutive top/ bottom line beats since FQ2’20, as they also reiterate the FY2024 revenue guidance of $50B (+39.6% YoY) and adj EBITDA of $30B (+29.2% YoY).

These developments further underscore why we believe that AVGO remains a compelling generative AI play - thanks to the raised networking guidance in FQ1’24, lending further strength to its key investment thesis.

AVGO Appears To Be Reasonably Valued At Compared To Its Peers

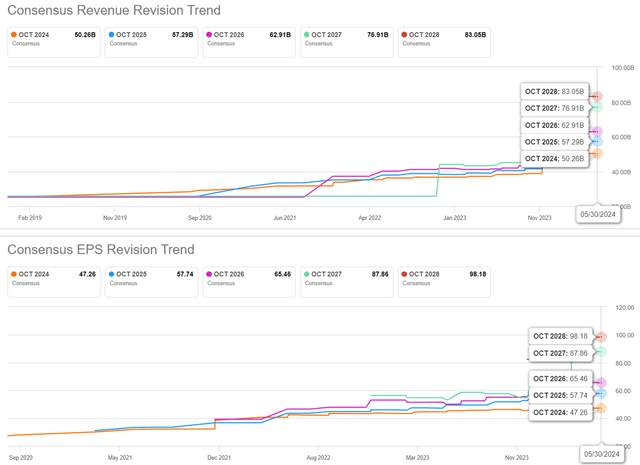

For now, the consensus continue to raise their forward estimates, with AVGO expected to report an accelerated top/ bottom line growth at a CAGR of +20.7%/ +15.7% through FY2026, compared to the previous estimates of +18.6%/ +13.8%, respectively.

The raised estimates are probably attributed to AVGO’s robust multi-year remaining performance obligations of $27.7B (+36.4% QoQ/ +21.4% YoY) in FQ1’24, lending visibility into its long-term top lines.

At the same time, readers must note that the management continues to report growing annualized SaaS revenues of $18.19B (+148% YoY), albeit with deteriorating SaaS gross margin of 81.9% (-9.9 points YoY) with the latter mostly attributed to multiple temporal adjustments from the recent VMWare merger.

Nonetheless, as SaaS revenues increasingly comprise its sales at 37.9% (+17.4 points YoY), we believe that AVGO may very well be at the forefront of the AI race with the acceleration in its SaaS growth likely to boost its future bottom lines as well.

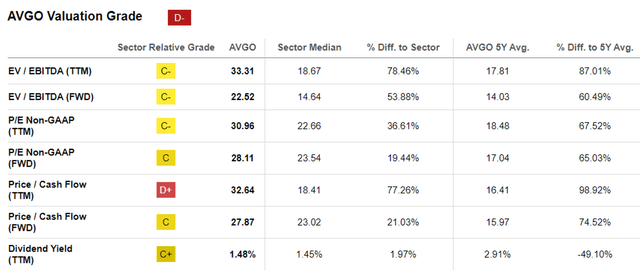

As a result of these developments, we can understand why the market continues to award AVGO with the higher FWD EV/ EBITDA valuations of 22.52x and FWD P/E valuations of 28.11x, compared to the previous article at 20.16x/ 26.95x and the sector median of 14.64x/ 23.54x, respectively.

We believe that the upgrade is reasonable indeed, with AVGO still reasonably valued compared to the premium embedded in its AI chip/ generative AI peers/ primary competitors, such as NVDA at 34.47x/ 40.62x, Advanced Micro Devices (AMD) at 54.45x/ 47.49x, and Intel (INTC) at 11.20x/ 28.24x, respectively.

This is especially since AVGO is expected to report a decent top/ bottom line growth at a CAGR of +20.7%/ +15.7% between FY2023 and FY2026, (or normalized at +15.8%/ +17.5% between FY2019 to FY2026), compared to:

- NVDA at +43.7%/ +46.4% (or normalized at +49.5%/ +61.4%),

- AMD at +19.2%/ +40.3% (or normalized at +28.3%/ +41.6%), and

- INTC at +8.1%/ +34.7% (or normalized at -0.7%/ -8.7%, attributed to the ongoing PC correction/ price cuts), respectively,

implying that AVGO is reasonably valued at FWD P/E valuations of 28.11x compared to its peers given the relative comparison in growth rates.

It goes without saying that the VMWare merger has directly contributed to the deterioration of its balance sheet, with the company now reporting moderating FQ1’24 cash/ equivalents of $11.86B (-16.3% QoQ/ -6.1% YoY) and burgeoning current/ long-term debts of $75.89B (+93.4% QoQ/ +93.2% YoY), implying massive net debts of $64.03B (+155.7% QoQ/ +140.4% YoY).

The same impact has also been observed in AVGO’s FQ1’24 adj EPS of $10.99 (-0.6% QoQ/ +6.3% YoY) on a QoQ basis, as its annualized interest expenses climb drastically to $3.7B (+128% QoQ/ +128% YoY).

However, with extremely rich FQ1’24 adj Free Cash Flow generation of $5.35B (+13.8% QoQ/ +37.1% YoY) and margins of 45% (-6 points QoQ/ +1 YoY), we are not overly concerned indeed, especially since only $13.3B of its long-term debt is due in 2025 with the rest extremely well-laddered through 2051.

Q2 2024 Earnings

Broadcom is a semiconductor and software company with a broad range of offerings. The company posted a double beat and raise with Non-GAAP EPS of $10.96 beating by $0.12 and revenue of $12.5b beating by $480m. The company announced a dividend of $5.25 per share and a ten-for-one stock split effective July 15th, 2024. Meanwhile, the company increased full year sales guidance to $51b, which beat the consensus estimate of $50.28b

Broadcom’s semiconductor solutions segment generated 58% of sales on the quarter, reaching $7.2b. Infrastructure software brought in $5.3b, leading to net revenue of $12.5b. Total sales increased 43% YoY including VMware and 12% excluding VMware. The VMware acquisition began showing in the Q1 results of this year. Sales grew 4.4% from Q1 driven mostly by 17% QoQ growth in the infrastructure software division. The company enjoyed a GAAP gross margin of 63.7%, up 200bps QoQ. Short term acquisition related amortization costs continue to keep gross margin significantly below last year. On a non-GAAP basis, gross margin reached 76.2% growing 60bps YoY and 90bps QoQ.

True to the Broadcom model, the company has been relentlessly cutting costs post-acquisition. OpEx grew from $2.1b to $4.8b YoY but fell 9% from the $5.3b recorded in Q1 '24. Operating margin boomed accordingly, growing from 17.4% in Q1 to 23.7% in Q2, yet it remains down from 45.9% this quarter last year. The company managed to decrease selling, general and administrative expense from $1.6b to $1.3b QoQ and I expect further cost savings here moving forward. Interest expense more than doubled from last year and naturally pressured net income. The impacts of the VMware acquisition will take a few more quarters to completely filter through, so the market is largely ignoring the -39% YoY decline in GAAP net income. Net income rose 60% from Q1 and Q2 net margin was 17.0%. On a non-GAAP basis, net income reached a record $5.4b marking a 43.2% net margin. This was up QoQ but remains down significantly YoY. Shares outstanding rose 12% YoY with most stock-based comp expense in the R&D segment.

Broadcom has made remarkable progress on the incorporating VMware into its core business to date and the income statement will continue to show the work being done in the coming quarters.

A sizable chunk of $2b in cash was used to pay off long-term debt, which is down from $73.4b in Q1 to $71.6b in Q2. Broadcom’s assets have grown $100b since October 2023 mostly because of major increases in Goodwill and Intangible Assets related to the acquisition. While the income statement is rock solid and clearly moving in the right direction, $70b in debt and a rapidly dwindling cash pile (down from $14b in October 2023 to $9.8b in May 2024), while only earning $2b, represents meaningful risk for Broadcom. If revenues were to begin contracting, interest expense will become a considerable issue for earnings growth in the future. At this time, I do not expect this risk to materialize, but it’s worth monitoring for investors.

Meanwhile, Broadcom’s operations generated $4.6b in cash this quarter, down from $4.8b last quarter and up slightly from $4.5b last year. This was driven by a considerable quarterly change in accounts receivables from $1.7b in Q1 to $(513m) in Q2. Free cash flow came in at $4.5b, representing 36% of sales.

The company did not pursue any stock buybacks this quarter, a welcome sign for investors that would prefer debt repayments to share repurchases at these prices. The company borrowed an additional $30b last quarter and cash paid for interest rose 26% QoQ to $946m.

So, Is AVGO Stock A Buy, Sell, or Hold?

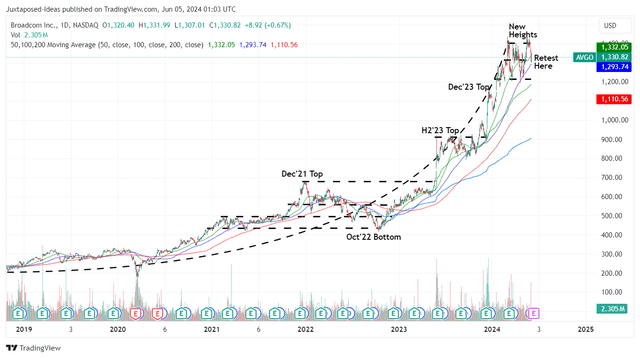

For now, AVGO has established a robust support level at $1.2K and clear resistance level at $1.4K, as the market swings between the bullish generative AI boom and the bearish/ elongated inflationary pain, with the stock likely to trade sideways in the near-term.

For context, we had offered a fair value estimate of $1.13K in our last article, based on the FY2023 adj EPS of $42.25 (+12.2% YoY) and the previous FWD P/E of 26.95x.

However, based on AVGO’s LTM adj EPS of $42.91 (+1.5% from the previous article) and the raised FWD P/E of 28.11x, it appears that the stock is trading at a slight premium to our new fair value estimates of $1.2K.

Based on the raised consensus FY2026 adj EPS estimates from $62.21 in our previous article to $65.46 and the raised FWD P/E of 28.11x, there remains an excellent upside potential of +38.3% to our long-term price target of $1.84K.

Most importantly, AVGO’s rich annualized dividends of $21 can not be ignored, with it allowing long-term investors to consistently re-invest on a quarterly basis while lowering their dollar cost averages.

Based on the current trading range at between $1.2K and $1.4K, interested investors may want to add upon a moderate pullback to the lower end of the range for an improved upside potential, depending on their individual dollar cost averages and portfolio allocations.

Risk Warning

It goes without saying that with elevated P/E valuations come great expectations. This is especially if AVGO reports any earning misses and/ or underwhelming forward guidance, with it likely to bring forth painful corrections.

This is especially since it remains to be seen when NVDA’s sales may eventually slow down, triggering potential pull backs for all other generative AI players such as AVGO.

At the same time, with inflation still sticky and the Fed’s pivot likely to occur only by the Q4’24, we may see a prolonged macroeconomy normalization process, with the stock market likely to remain volatile for a little longer.

Lastly, with the US-China trade war still ongoing, we may see part of AVGO’s China-related FY2023 revenues of $11.53B be at risk, one that we have similarly observed with Micron (MU), Advanced Micro Devices (AMD), and Intel (INTC).

Investors beware.