- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The Fed Can't Stop A Recession

The Federal Reserve has released its latest Monetary Policy statement, saying the central bank will keep interest rates at 5.25% to 5.5%, and according to its summary of economic forecasts, most people believe that interest rates will be cut later this year.

All of this indicates that we are beginning to see early signs of a slowdown in the US economy. Powell has made it clear that as long as they see weakness, they will be willing to cut interest rates.

But can the Fed really avoid a recession?

History shows that once the deleveraging cycle begins, central banks can hardly provide any help to the real economy.

However, the Fed can still contribute to maintaining the market’s upward trend for a longer period of time.

Early Signs Of Recession

The economy is beginning to weaken, and there’s plenty of macro data supporting this.

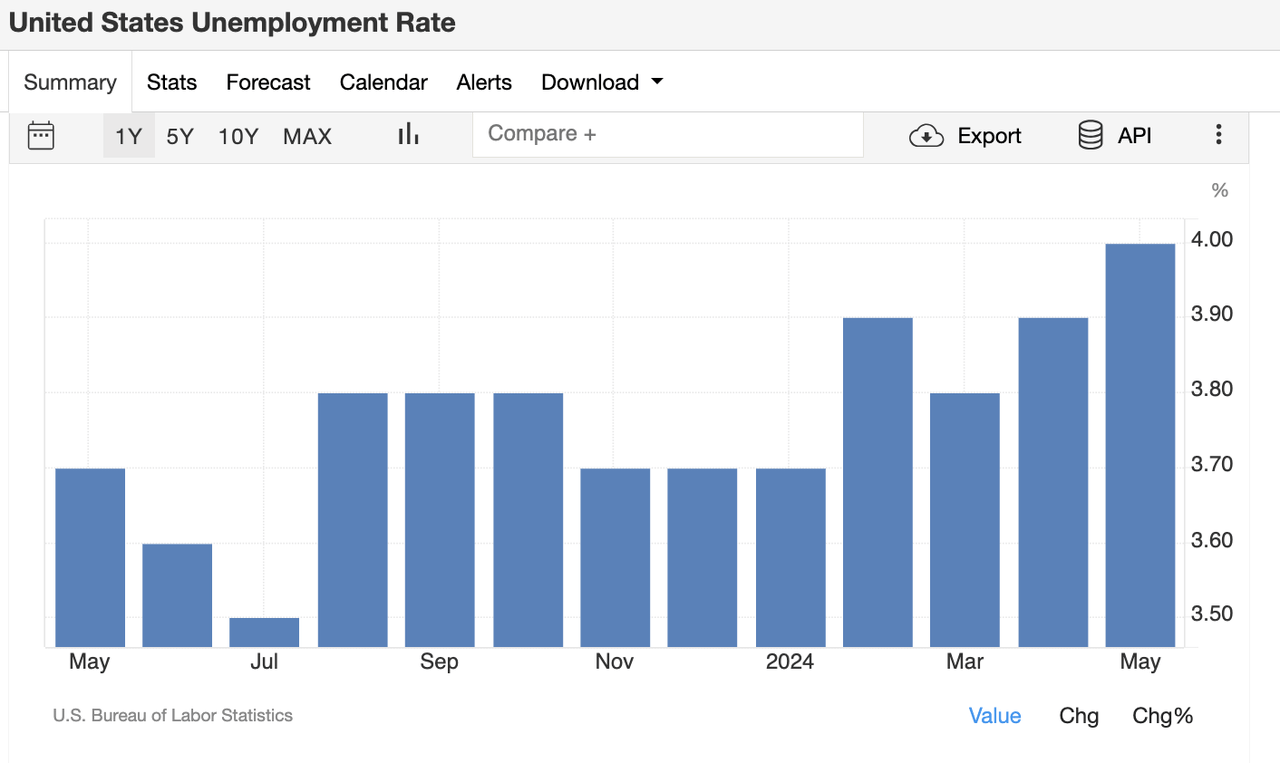

The US unemployment rate has now climbed up to 4.0%, increasing for the third month in a row.

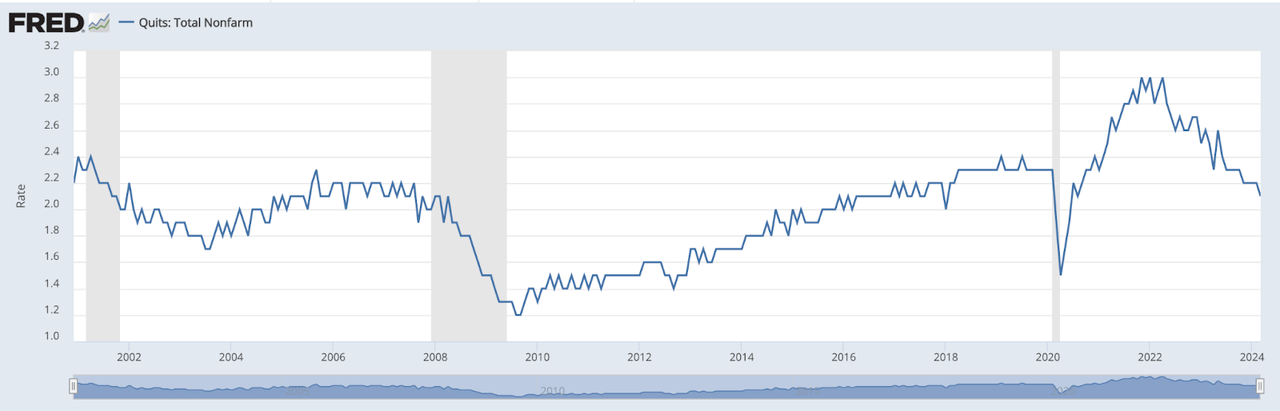

The weakness in the labor market can also be appreciated if we look at total quits.

Employees are clearly a lot less comfortable leaving their jobs with fewer good opportunities out there.

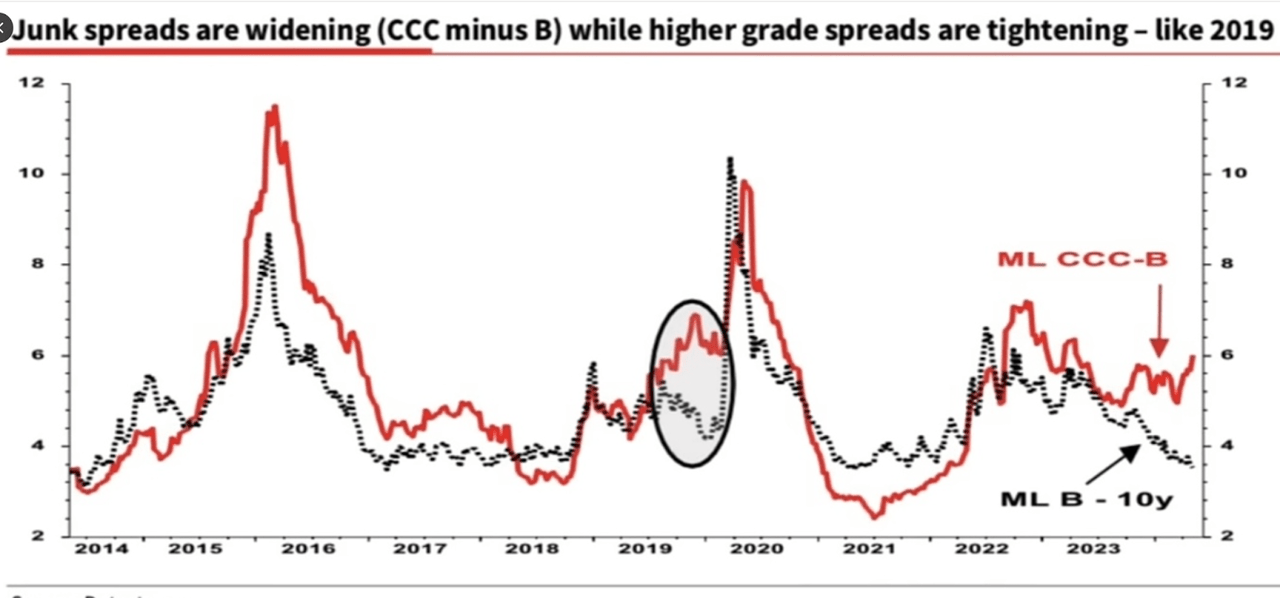

On top of employment, we are also getting some clear signs from credit markets, often a tell-tale sign that something is not quite right.

As we can see in the image above, the spread between the lower grade ML CCC and the ML B bonds is beginning to increase. We saw this exact thing happen back in 2019, just ahead of the COVID market crash.

The consumer is now beginning to feel the squeeze of credit to a much larger extent.

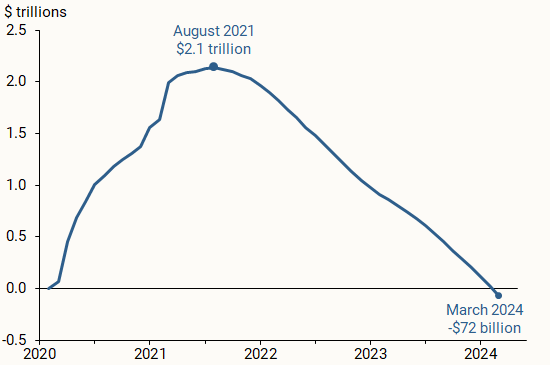

For starters, excess pandemic savings have now been depleted.

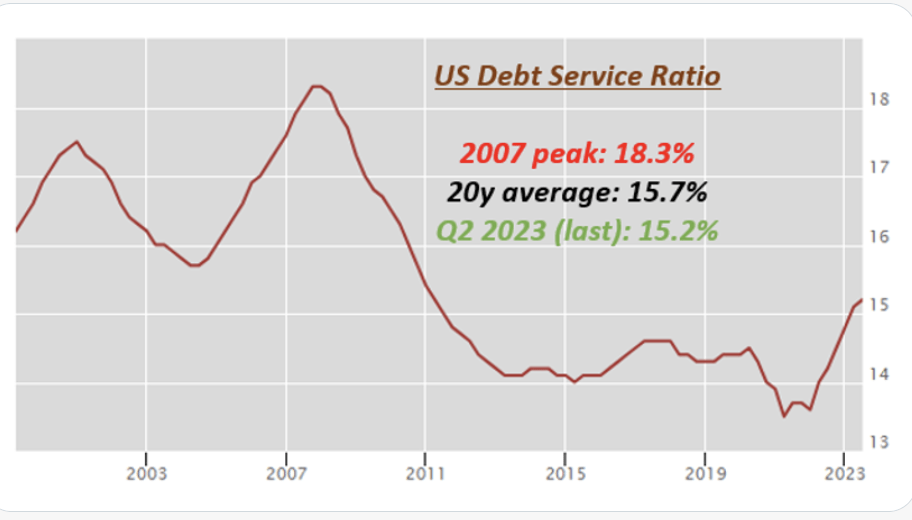

The huge cash buffer that was made available following COVID is no longer there, and this comes at a time when debt service ratios are back above 15%, and this was in Q2 of 2023.

The debt service ratio reflects what percentage of income consumers need to pay off their debt. Back in 2007, this peaked at around 18.3%, Again, thanks to the pandemic stimulus, the ratio was near all-time lows, but has been creeping up in the last two years.

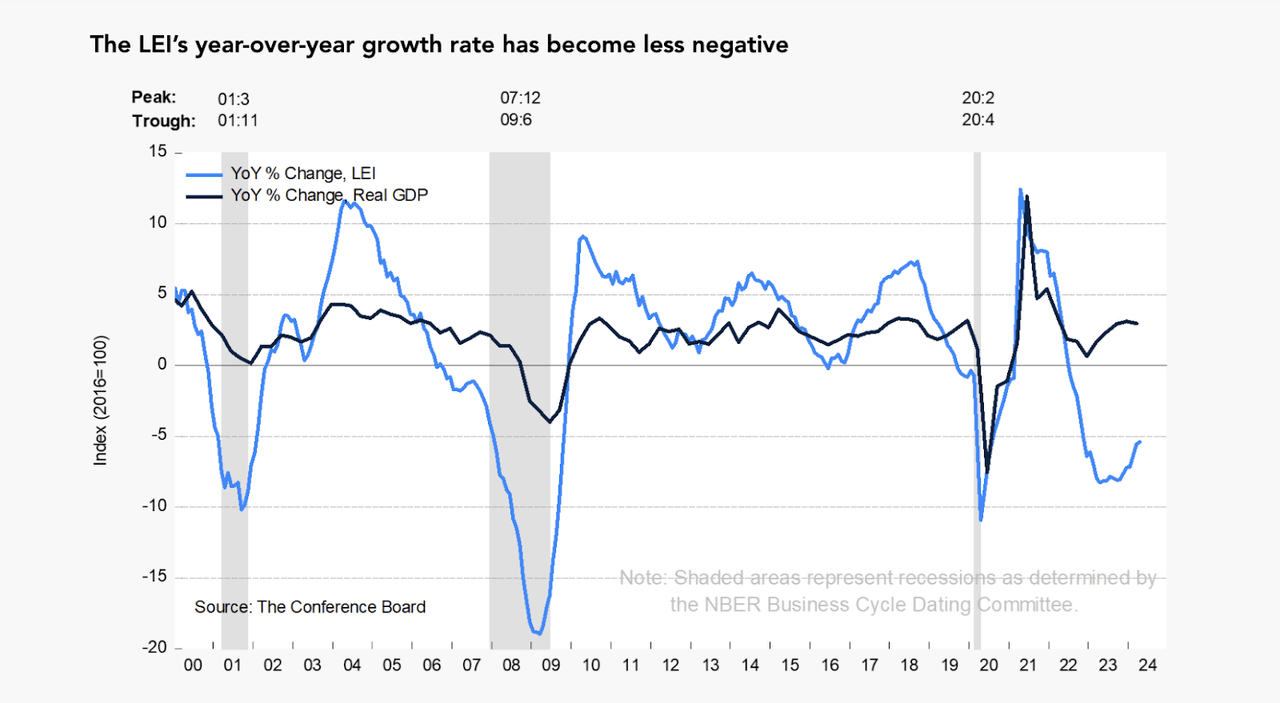

And, lastly, we can see that Real GDP is beginning to turn down again. We have seen weakness in GDP numbers and numerous downwards revisions. The economy is no longer as strong as it was.

Can The Fed Stop A Recession?

This time around, like many other times, it seems like plenty of investors are confident that the Fed can achieve a soft-landing.

Is this realistic?

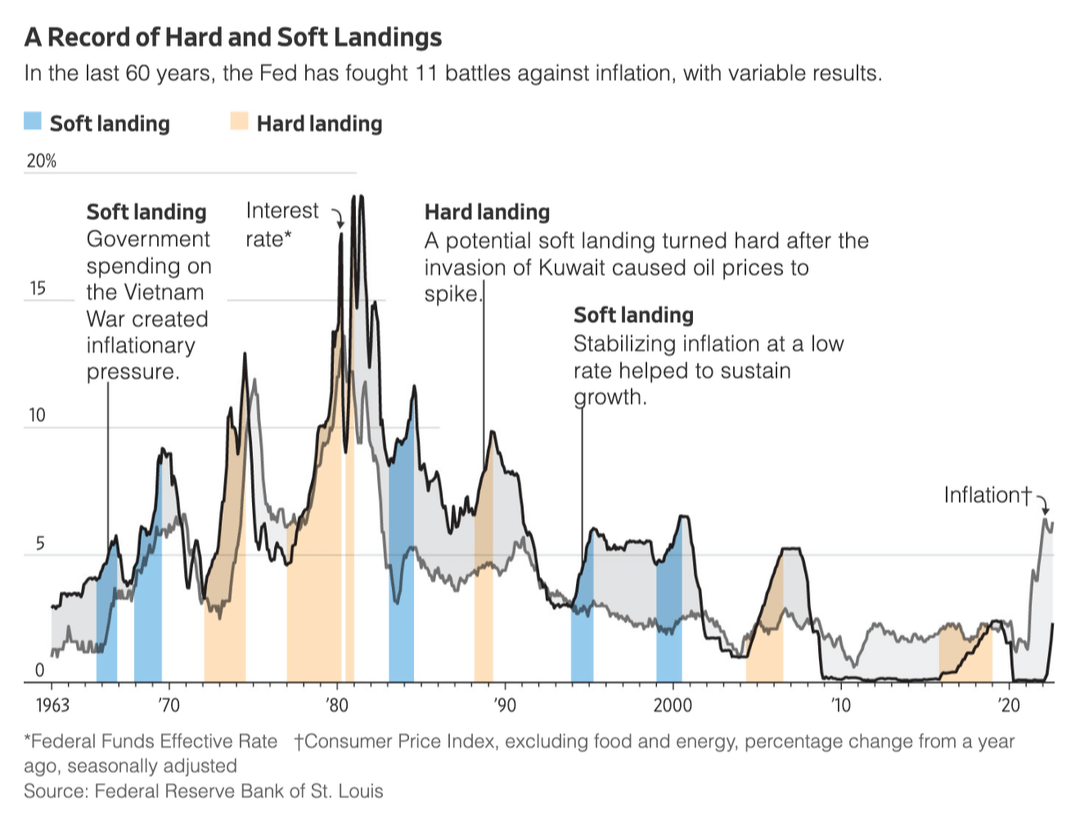

The above research from IWM financial lays out the previous tightening cycles, and whether a soft or hard landing was achieved, though this can be somewhat contended. On the chart above, we can see interest rates and inflation plotted against each other.

In more recent history, 1995 was clearly an instance where a soft landing was achieved, and not unlike to today’s situation.

Inflation was running at 3% and unemployment was close to 6%. The Fed tightened in 1995 and a soft landing was achieved. Markets roared throughout the 1990s on the back of the new age of the Internet narrative. Again, not unlike today’s AI-driven rally.

In 2000, we, of course, had a huge market crash, but the author of this research classifies this as a “soft landing”

Was that a hard landing? Not very. The two (nonconsecutive) quarters of negative GDP growth in 2001 were so small that they left GDP for the year as a whole higher than in 2000. For that reason, I have long called it the “recessionette.” Regardless of terminology, the landing was on the soft side.

Interestingly, while we could argue that a soft landing was achieved in 2000, we also saw a huge market crash due to inflated stock market valuations.

Then we got hard landings in 2007 and 2019, but of course, we have to realize that there are tons of other factors coming into play here.

What does this mean for markets?

Ultimately, though, the “pragmatic investor” worries about a recession only to the extent that it can affect markets.

With the Federal Reserve arguably very close to a rate cut, what does history tell us in that regard?

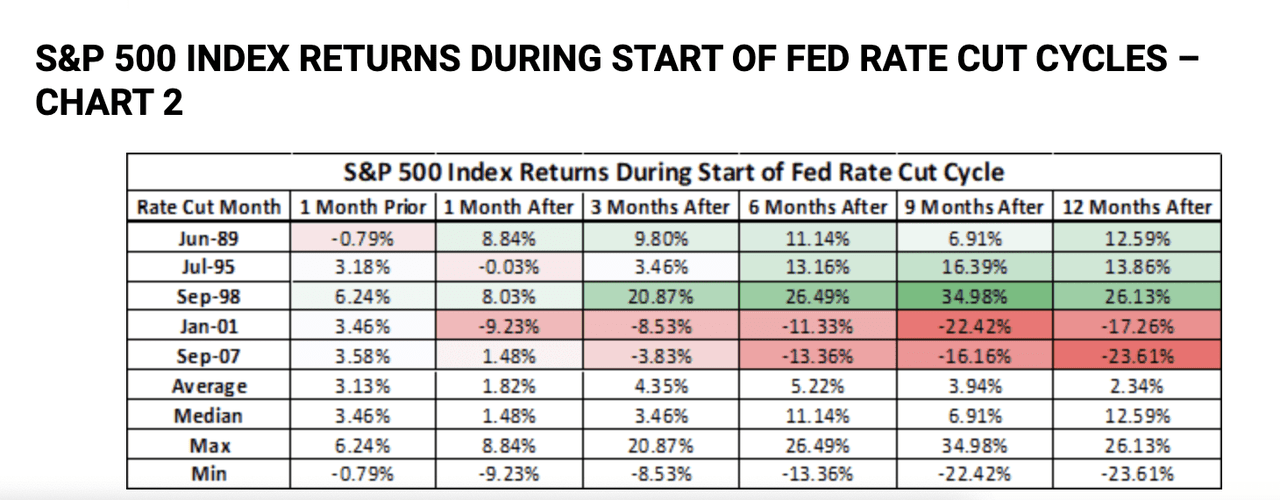

In the past five interest rate cut cycles, three times the market yield was significantly higher than the average level within 12 months after the first rate cut. However, in 2001 and 2007, market losses exceeded the normal level. From a statistical perspective, the average return rate during these periods was 2.34%, but this number does not fully represent the true situation.

The market’s reaction to interest rate cuts may be polarized: on the one hand, interest rate cuts may be seen as a positive signal for achieving a soft landing for the economy and welcomed by the market; on the other hand, interest rate cuts may indicate a deepening of the measured recession or a large-scale market sell-off. However, there are many other factors affecting market performance, so we should avoid oversimplifying market dynamics or confusing the correlation and causality of events.

The market is mainly determined by fundamentals and valuations, which have performed differently in different historical periods. The form of each economic recession is different, and usually different strategies need to be adopted according to specific situations.

Investors who want to enter the market under the current economic recession trend should be more cautious. They should not only pay attention to macro factors such as signals from the Federal Reserve, but also pay attention to various micro factors. If investors want to invest in a certain stock, a reasonable choice is to monitor the target stock market through platforms such as BiyaPay, and then choose the appropriate time to buy or sell the stock, or deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities for US stock investment.

Conclusion

Overall, although the Federal Reserve maintains the current interest rate level and looks forward to possible future rate cuts to alleviate the impact of economic slowdown, the market remains cautious about whether a comprehensive economic recession can be avoided. Multiple key economic indicators, such as rising unemployment, tight credit markets, and declining GDP, indicate potential economic difficulties. Investors need to be extra careful in this environment, closely monitor macroeconomic data and the Fed’s policy trends, and make wise investment decisions.