- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Top 5 Crypto-Focused ETFs

Crypto Investing

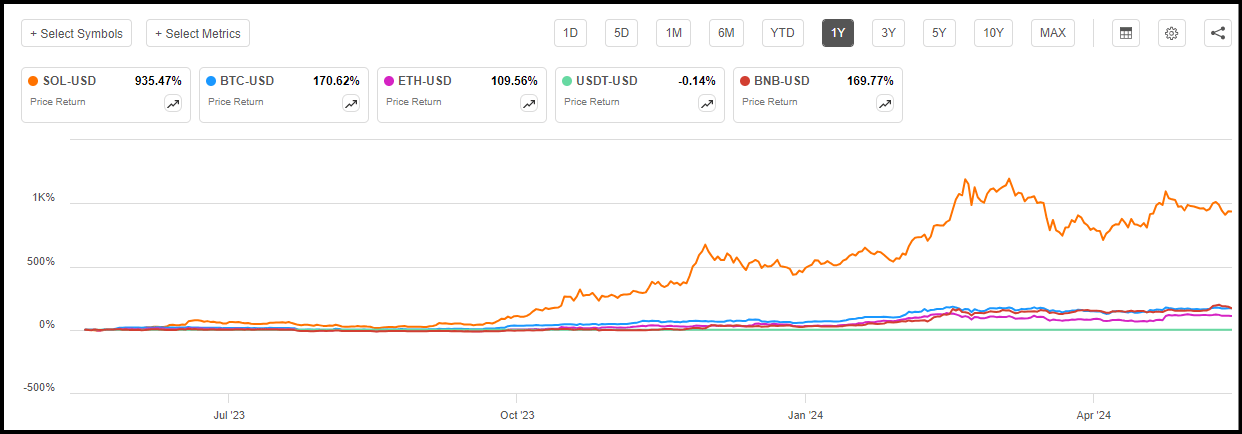

Cryptocurrencies have exploded in the past year, with Bitcoin (BTC-USD) up ~170%, Ethereum (ETH-USD) ~+100%, and Solana (SOL-USD) more than 930%. Digital assets are progressing on the regulatory fronts and have even become hotter topics, particularly in the wake of Robinhood’s $200M acquisition of Bitstamp. Bitstamp is a small crypto exchange competitor behind Binance and Coinbase Global (COIN).

The acquisition of Bitstamp is a major step in growing our crypto business. Bitstamp’s highly trusted and long-standing global exchange has shown resilience through market cycles…Through this strategic combination, we are better positioned to expand our footprint outside of the U.S. and welcome institutional customers to Robinhood," said Johann Kerbrat, general manager of Robinhood Crypto.

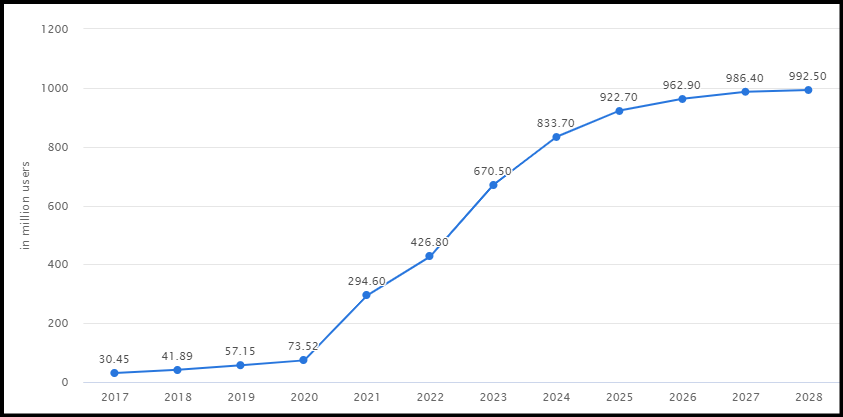

According to Statista Market Insights, the total number of cryptocurrency users worldwide could reach 992.50M by 2028, driven by increasing institutional acceptance and higher usage in cross-border transactions.

Crypto Users Projected to Reach 992.5M by 2028

Crypto User Forecast to 2028 (Statista)

The price of Bitcoin crossed the $1.00 threshold for the first time ever in February of 2011, and nearly ten years ago was worth $580. Bitcoin is now trading at more than $71,800 with a market cap of $1.4T. Bitcoin has about 53% of the crypto market followed by Ether (17%), Tether (USDT-USD) (4.2%), Binance Coin (BNB) (4%), and Solana (3%). Bitcoin and Ether dominate in size, but Solana is the highest-performing cryptocurrency among the digital asset giants in the past year.

Solana Leads Top 5 Cryptocurrencies in 1Y Price Performance (as of 6/10/24)

Top Cryptocurrencies 1Y Performance (SA Premium)

Cryptocurrency-focused ETFs invest directly in the digital assets or indirectly in miners and stocks involved in crypto. Although crypto ETFs have strong momentum, investors should realize they are also highly volatile. The SA Quant Team identified five ETFs that provide investors exposure to a variety of crypto assets. The ETFs have ‘Strong Buy’ ratings and excellent momentum, evidenced by a market-crushing average 1Y price performance of ~+240%. The list includes 2 ETFs ranked outside of the top five to prevent overlaps and ensure breadth of coverage of major digital assets.

1. Valkyrie Bitcoin and Ether Strategy ETF (NASDAQ: BTF**)**

- Assets (AUM): $54.72M

- Quant Rating: Strong Buy

- Quant Ranking in Asset Class (as of 6/10/24): 2 out of 197

- Quant Ranking in Asset Sub Class (as of 6/10/24): 2 out of 21

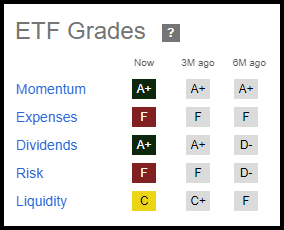

BTF is an actively managed ETF focused on bitcoin and ether futures contracts, up 140% in total returns in the past year, and among the top quant-rated ETFs in both the Alternative asset class and Digital sub class. BTF has a Strong Buy rating driven by excellent Momentum and Dividends ETF Factor Grades.

BTF’s holdings, rebalanced on a monthly basis, are split nearly evenly between Ether and Bitcoin futures contracts. BTF is up ~140% in total return in the past 1Y, crushing the 12% median for an A+ Momentum Grade. BTF 10% dividend yield vs. an ETF median of 2.5%, and annual payout of $2.23, drives an A+ Dividends grade. BTF’s low AUM of $54.72M and average daily dollar volume of less than 1M underpins a ‘C’ in Liquidity. BTF has a 1.24% expense ratio vs. a 0.48% ETF median, resulting in a low mark in Expenses, although its bid/ask spread of 0.21% is not too far above the median of 0.14%. BTF annualized volatility is nearly 50% vs. an ETF median of 12%, and tracking error year 1 is 60% vs. a median of 7%, driving a low Risk grade.

2. Grayscale Digital Large Cap Fund ETF (OTCQX: GDLC)

- Assets (AUM): $582.92M

- Quant Rating: Strong Buy

- Quant Ranking in Asset Class (as of 6/10/24): 6 out of 197

- Quant Ranking in Asset Sub Class (as of 6/10/24): 6 out of 21

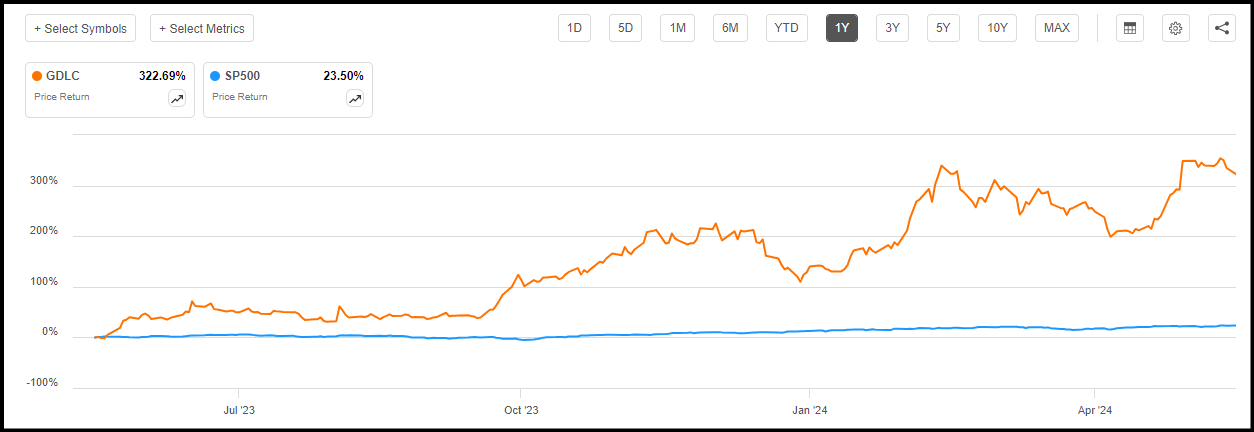

Only three among 2,462 quant-rated ETFs have a higher 1Y price performance than GDLC, which is up a whopping 322% in the past 12 months, driving an ‘A+’ in Momentum.

GDLC 1Y Price Performance (as of 6/10/24)

GDLC 1Y Price Performance (SA Premium)

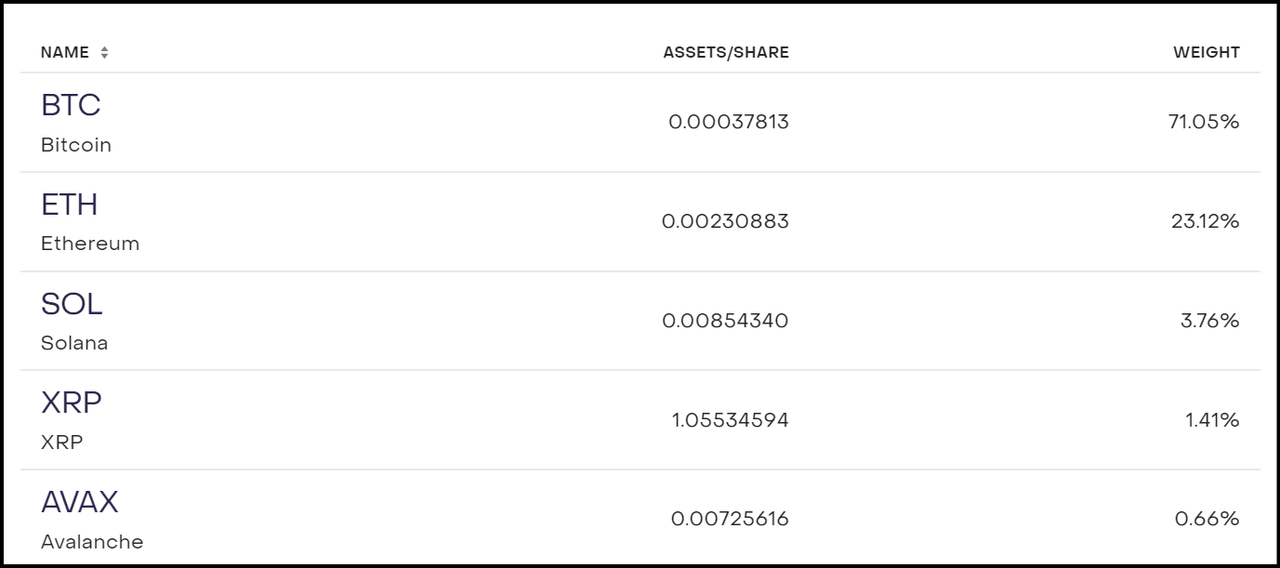

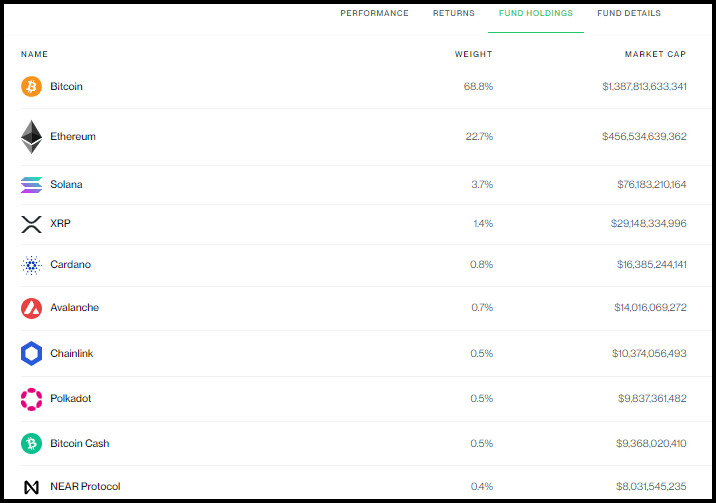

GDLC holdings include BTC (70%), ETH (23%), SOL (4%), Ripple (XRP-USD) (1%), and Avax (AVAX-USD) (0.70%). GDLC has a ‘B’ in Liquidity, driven by an average daily dollar volume of $2.37M. GDLC has an expense ratio of 2.50% and annualized volatility of 71%.

GDLC Holdings (Grayscale)

3. Grayscale Bitcoin Trust ETF (NYSEARCA:GBTC)

- Assets (AUM): $19.76B

- Quant Rating: Strong Buy

- Quant Ranking in Asset Class (as of 6/10/24): 3 out of 197

- Quant Ranking in Asset Sub Class (as of 6/10/24): 3 out of 21

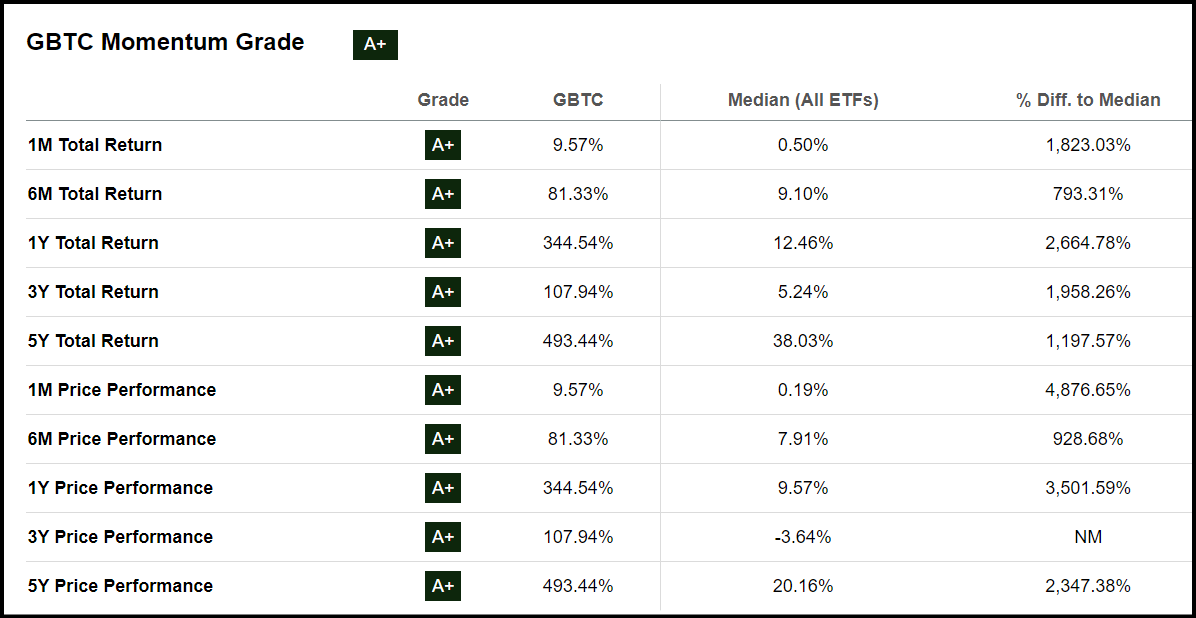

GBTC is the third hottest ETF in price performance over the past year, up more than 340%, solely and passively invested in Bitcoin with an A+ in Momentum. GBTC has returned more than 490% to shareholders in the past five years vs. an ETF median of 38%, and significantly outperformed in returns over the last 6M and 30 days. GBTC’s A+ in Liquidity is driven by an AUM of $19.76B and a daily dollar volume of $620.65M. GBT expense ratio is 1.50%, annualized volatility 58%, and 1Y tracking error 58%.

GBTC Momentum Grade (SA Premium)

4. First Trust SkyBridge Crypto Industry and Digital Economy ETF (NYSEARCA: CRPT**)**

- Assets (AUM): $61.86M

- Quant Rating: Strong Buy

- Quant Ranking in Asset Class (as of 6/10/24): 1 out of 197

- Quant Ranking in Asset Sub Class (as of 6/10/24): 1 out of 21

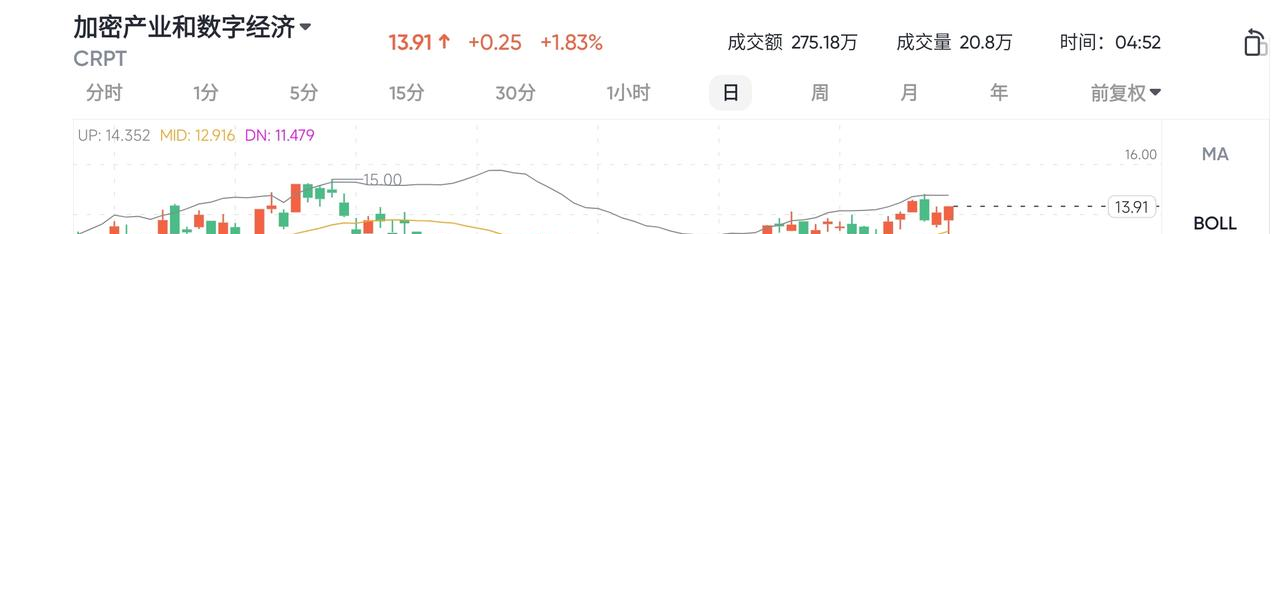

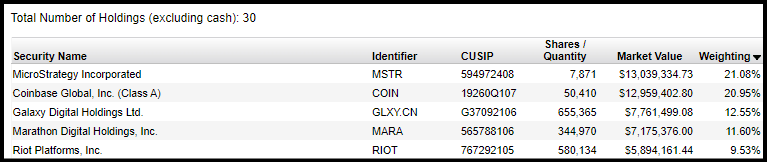

CRPT is the #1 ranked alternative and digital asset ETF, up ~170% in the past 12 months, showcasing an ‘A+’ Momentum Grade. The 30-holding fund focuses on crypto companies and stocks of companies involved in the digital economy. The top ten holdings account for over 90% of the fund value. The top five holdings account for nearly 75% of the fund’s value, including MicroStrategy Incorporated (MSTR), Coinbase Global Inc (COIN), Marathon Digital Holdings Inc. (MARA), Galaxy Digital Holdings Ltd (GLXY), and Riot Platforms, Inc (RIOT). The remaining holdings consist of other crypto, tech, financial, and communication stocks. CRPT has an expense ratio of 0.85%, annualized volatility of 79%, and tracking error 1Y of 93%.

CRPT Top 5 Holdings (First Trust)

5. Bitwise 10 Crypto Index Fund ETF (OTC: BITW)

- Assets (AUM): $1.08B

- Quant Rating: Strong Buy

- Quant Ranking in Asset Class (as of 6/10/24): 7 out of 197

- Quant Ranking in Asset Sub Class (as of 6/10/24): 7 out of 21

BITW, up over 280% in the past 12 months, has 10 holdings with Bitcoin (68.8%) and Ethereum (22.6%) accounting for over 90% of the fund’s value. The other holdings include Solana, XRP, Cardano, Avalanche, Chainlink, Polkadot, Bitcoin Cash, and NEAR Protocol. BITW has a ‘B+’ in Liquidity with a daily dollar volume of $4.05M. BITW has a 2.5% expense ratio, 67% annualized volatility, and 58% tracking error 1Y.

BITW Portfolio Breakdown (Bitwise)

Risks

Risk of loss from investments in crypto-related securities remains significant for individual investors. Crypto-related securities are highly volatile, exceptionally speculative, and operate in an environment of regulatory uncertainty; hence could decline significantly and without warning.

Concluding Summary

Cryptocurrencies have seen explosive growth in the past year, with the total number of users expected to reach more than 992M by 2028 as digital assets become more accepted by institutions and used in cross-border transactions. SA’s Quant Team has identified five crypto-focused ETFs that provide investors with exposure to digital assets through direct investments or investments in companies involved in the digital economy.