- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

AMD Vs Intel: Challengers To The Throne

Summary

- Nvidia Corporation dominates the AI and GPU market, but Advanced Micro Devices, Inc. and Intel are trying to compete and participate in the AI growth narrative.

- AMD and Intel are in direct competition with each other for the CPU market and are both targeting the data center market.

- AMD has shown improving profitability and aggressive growth expectations, while Intel has a more reasonable valuation and potential for a turnaround.

Thesis Summary

When it comes to AI and GPUs, Nvidia Corporation (NVDA) continues to dominate the market. However, its sector peers keep trying to update their own products to compete with Nvidia and participate in the exponential AI growth narrative.

Nvidia’s closest competitor is Advanced Micro Devices, Inc. (NASDAQ:AMD), which also offers GPUs for Data Centers.

A close second, though this may be a contentious point, is Intel Corporation (INTC), which is not just looking to expand its AI footprint, but also pursuing other avenues of revenue, namely, chip manufacturing.

In today’s article, I look at how these two tech giants measure up against each other. Which is better poised to take on Nvidia? And perhaps more importantly, which is a better investment today?

Business Overview

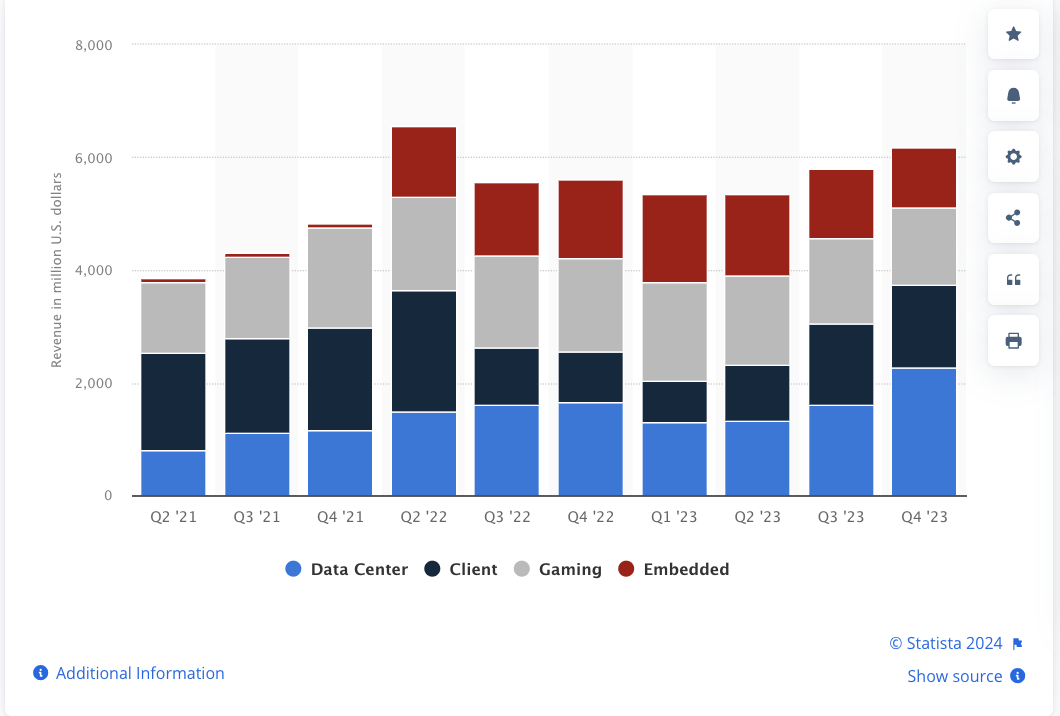

AMD and Intel both have diversified sources of revenue. Here is a breakdown of AMD’s revenue sources:

As we can see, a large chunk of the revenues comes from Data centers, but the fastest growing segment in recent quarters has actually been Client, which refers to revenues from CPUs and components for desktops and electronic devices.

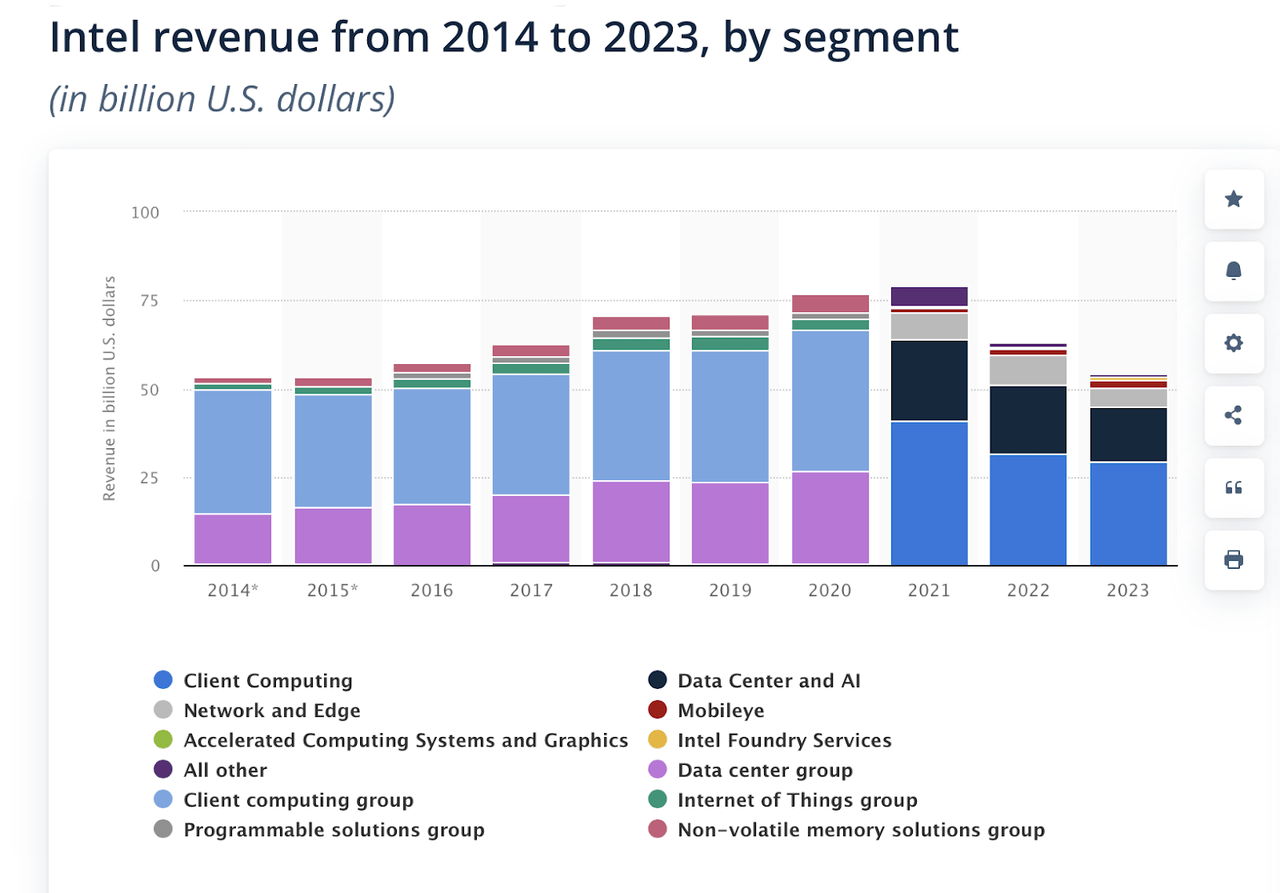

Intel changed the way it subdivided its revenues in 2021. Most of its revenues come from Client, Data Center and AI and Network and Edge.

In this regard, AMD and INTC are in very much direct competition with each other for the CPU market, while both are trying to capture more of the growing data center market.

Intel just released a new processor, the Intel Xeon 6, which it announced will be priced substantially below that of its peers.

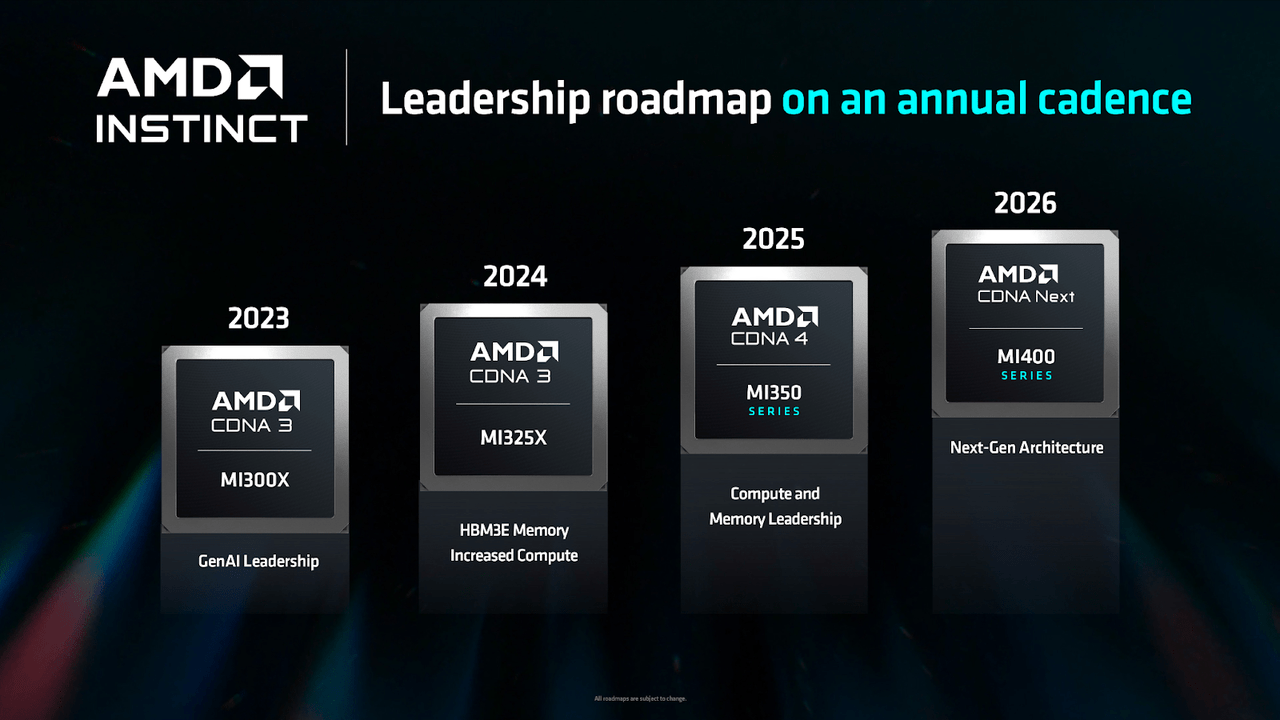

Meanwhile, AMD has now released the X870(E) chipset and the MI325X accelerator, as well as many other updates and a very aggressive product roadmap.

On the other hand, Intel is also trying to enter the fab market, with plans to open fabs in the U.S. and Europe. The company just inked an $11 billion deal for a fab plant in Ireland.

As far as investing goes, a bet on AMD is a much more direct bet against Nvidia. AMD’s technological stack is much closer to Nvidia’s, while Intel has clearly been falling behind.

Intel actually has a much different strategy. Firstly, it is trying to expand into the fab market, and notably, it now seems like it is attempting to make up the difference in AI chips by under-cutting its peers.

Profitability

Next up, let’s compare the past, present and potential future profitability of these two chip stocks.

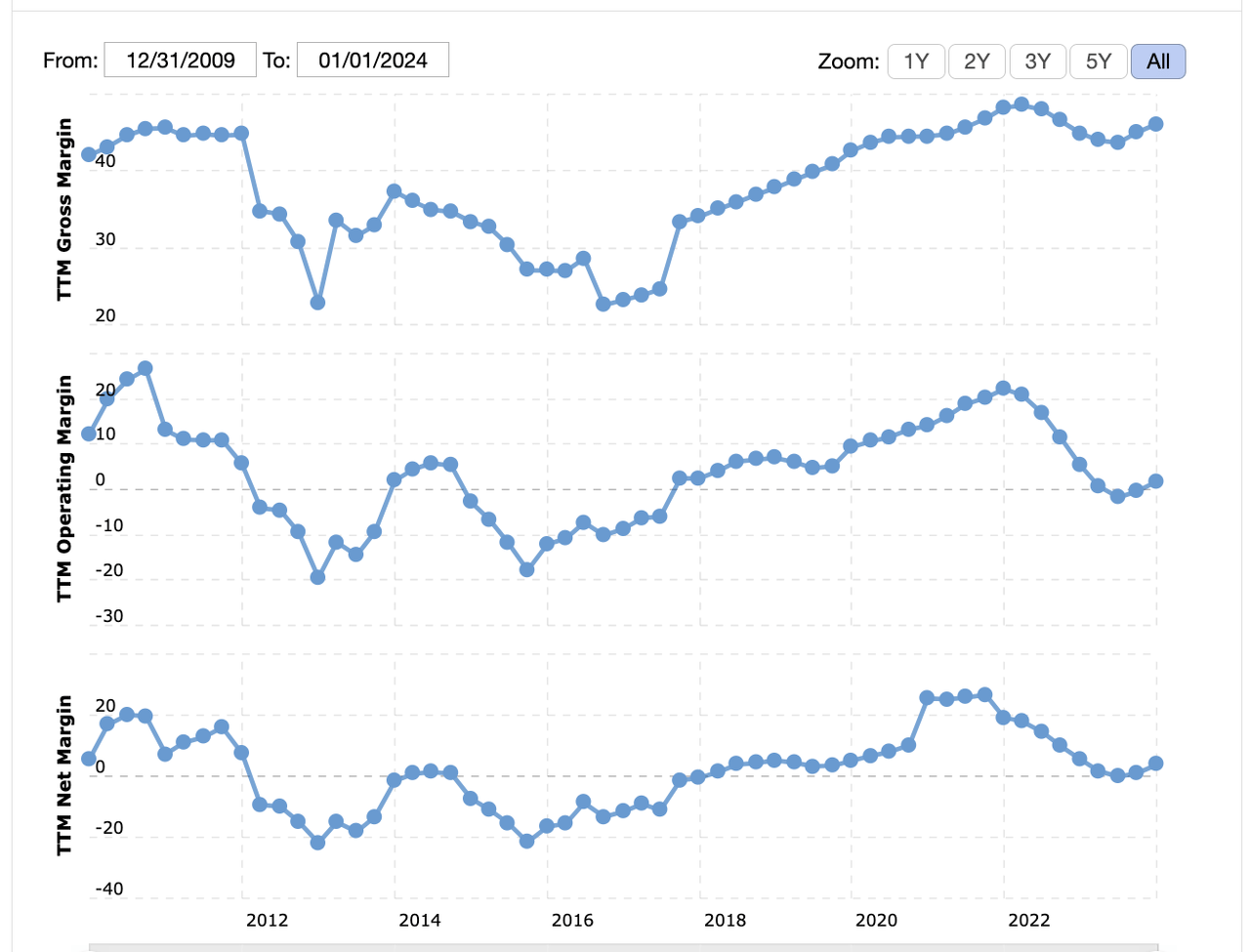

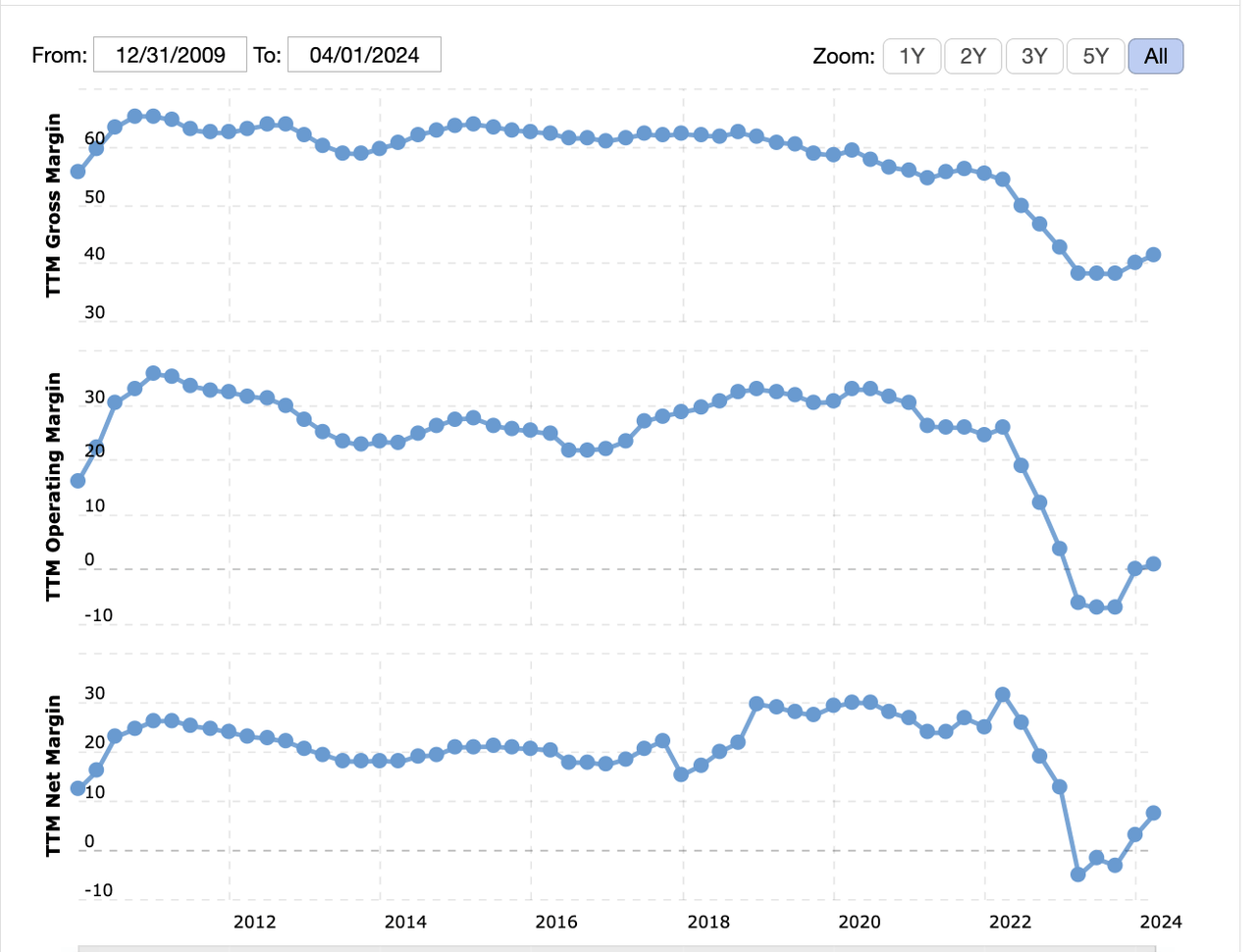

As we can see, AMD has struggled with turning a profit in the past, though it has had a greatly improving trend since 2016, especially if we look at gross margin.

Meanwhile, Intel is on the opposite side of the spectrum. It has always been highly profitable, but this has changed in the last few years and there has been an overall declining trend since 2012 in gross margin.

Intel’s move to fabs changes things substantially. However, I did analyze Intel recently, concluding that a 30% operating margin was possible.

I’d also expect AMD’s margins to improve from here as it captures some of the high-end GPU market. However, it is clear in my opinion that Intel has a leg up on profitability.

Growth

Now let’s take a brief look at the estimates for growth.

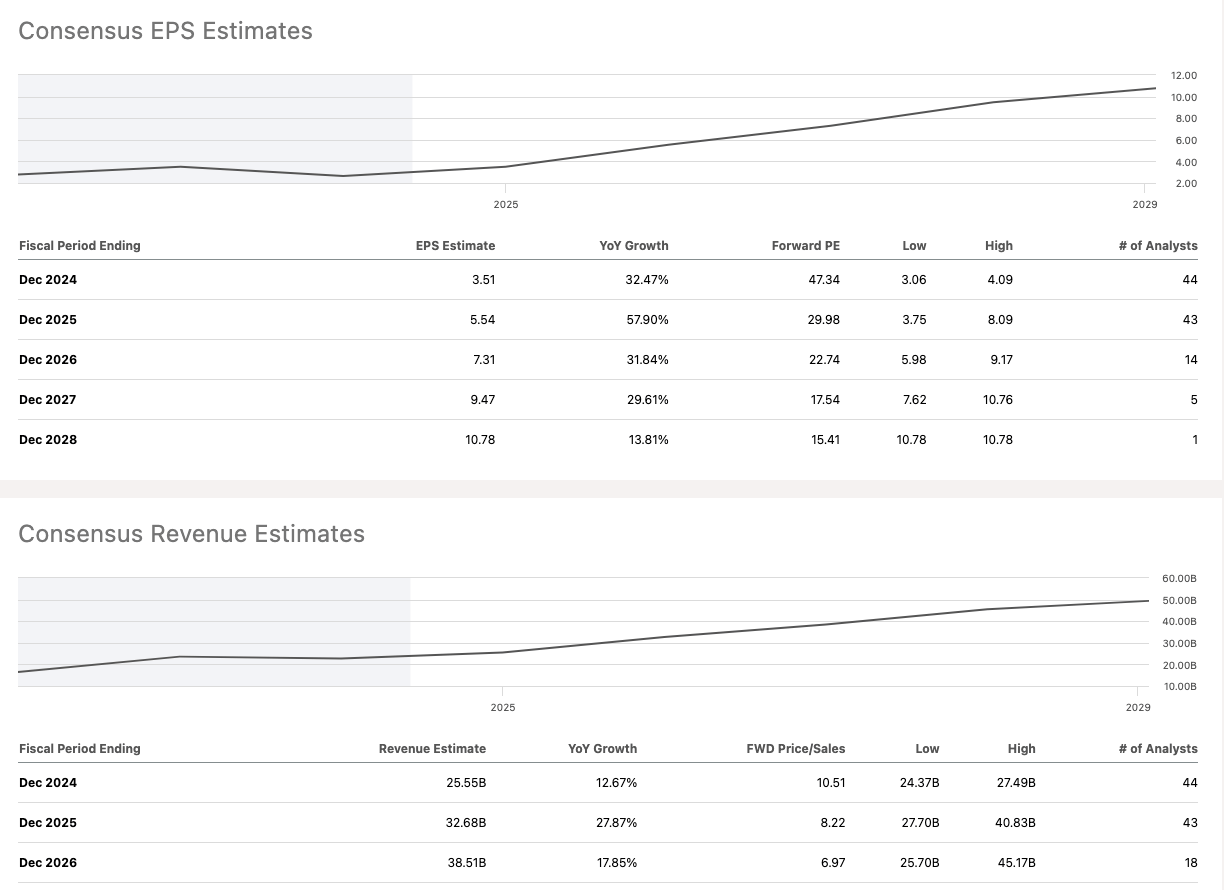

Starting with AMD, we can see analysts have fairly aggressive growth expectations. Revenues are projected to grow over 27% in 2025. Meanwhile, EPS is expected to more than double in the next two years.

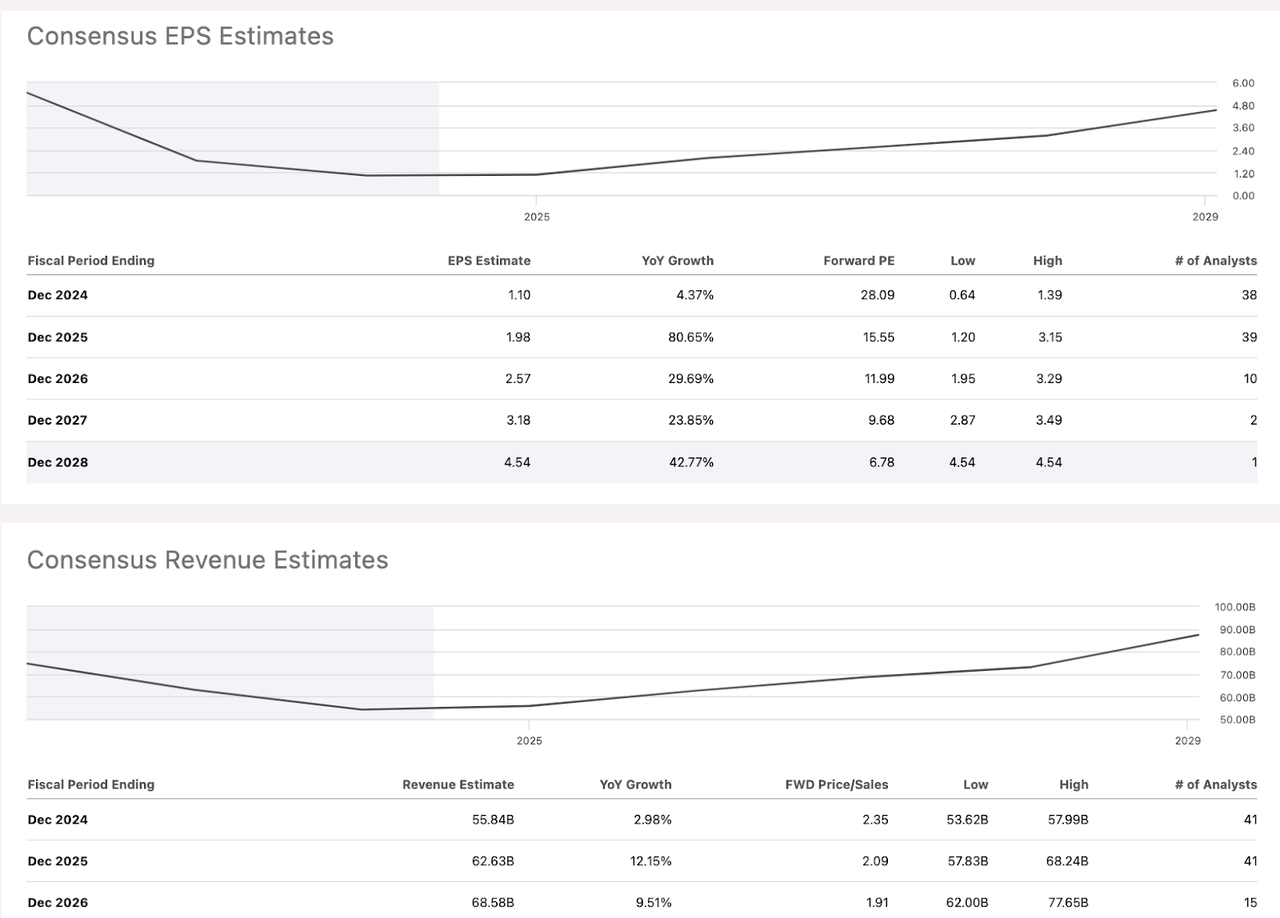

Meanwhile, Intel is looking at bottoming in terms of EPS this year, and then giving us some pretty aggressive growth. More than doubling by 2026. This must be understood in the context of the fact that Intel’s earnings have dropped dramatically in the last three years.

Meanwhile, revenue growth is not stellar, but it should average over 10% in 2025 and 2026.

Both these stocks are projected to do quite well in the next couple of years. AMD, as it takes market share from NVDA, and Intel, as it also attempts to take market share and launches its fab business.

So both of these stocks have good development prospects. If the investor wants to buy this stock, you can go to BiyaPay, search for the stock code on the platform, and trade in real-time online. Of course, if you have difficulties with deposits and withdrawals, you can also use this platform as a professional tool for depositing and depositing US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it to other securities firms to buy this stock. Compared with other platforms, this has a faster arrival speed and no limit.

Valuation

Speaking of pricing, a look at valuation.

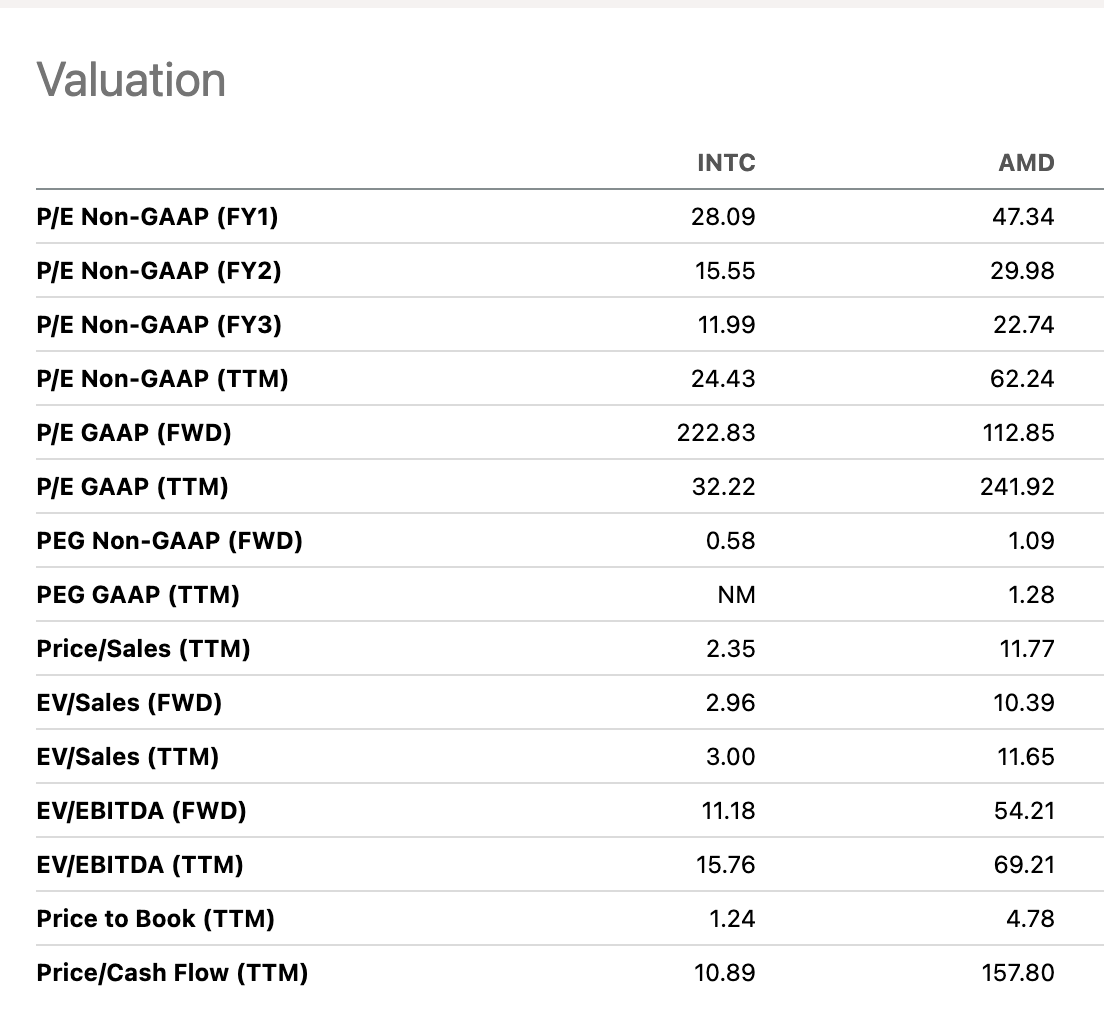

For obvious reasons, Intel is priced much more cheaply than AMD. But is this huge discount justified?

Even if we account for future growth, Intel trades at a much better price. For example, it has a forward PEG of 0.58, half that of AMD. The stock also trades at half the P/E FY1. Most notably for me, Intel actually has a very reasonable 10.89x cash flow.

I understand that the market seems to favor growth over value these days, but this seems like a too-extreme mismatch in my eyes given Intel’s superior profitability and not that inferior, although more uncertain growth expectations.

Technical Analysis

Lastly, a look at the charts for each stock.

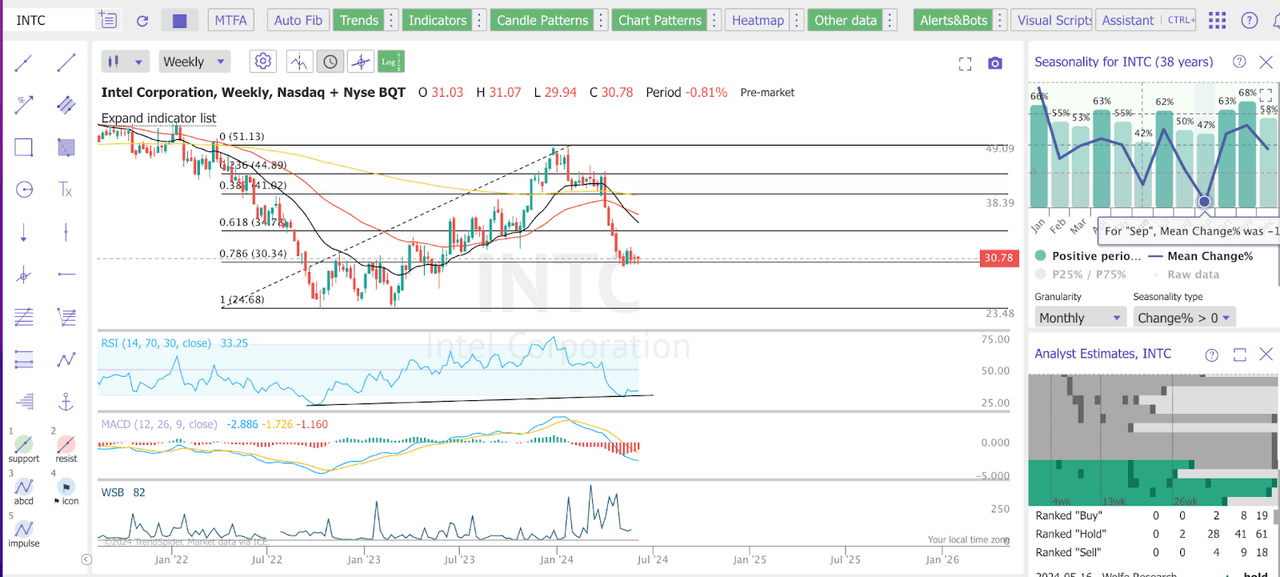

Intel has an apparent downward momentum, with the 10-day EMA crossing below the 50 EMA after the earnings sell-off. We are forming a base at the 78.6% retracement, though, and the RSI has formed a bullish divergence.

Looking at the panes on the right, we can see that June is seasonally not a great month, with a mean reversal of 0.7%, though July sees a mean change of 2.6%.

And in terms of analyst estimates, we have an overwhelming hold consensus, while buy and sell camps are evenly divided.

This chart certainly doesn’t look great, but I am encouraged by the base we are forming at this key fib level.

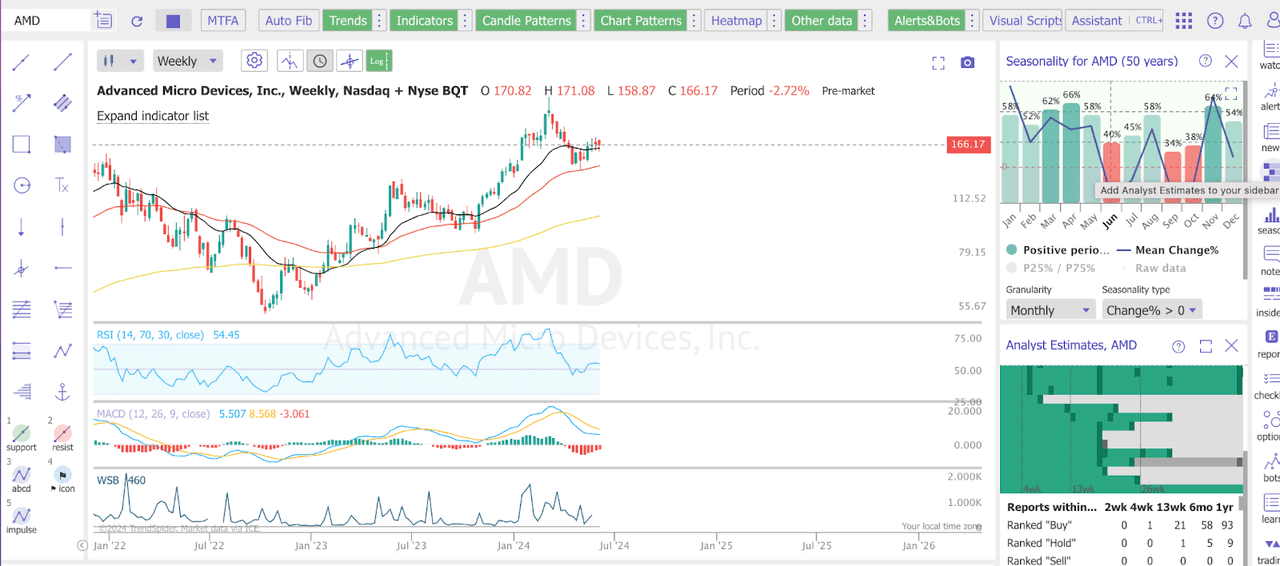

AMD shows great momentum, bouncing off the 50-day EMA. The RSI is neutral, and the weekly MACD is trending up.

Seasonal data shows that June and July are generally bad months for AMD, with the stock’s mean change being around negative 1%.

Lastly, analyst consensus is overwhelmingly in favor of buying this stock.

While we could get a retest of the 50-day EMA, this has some apparent upside momentum, and I would not be surprised to see new highs soon.

Which is a better buy?

Ultimately, determining the better buy depends on one’s own risk profile and investing style. Intel certainly offers a much more reasonable valuation, and the potential turnaround could really surprise the market if executed well, something that, to be fair, Intel hasn’t managed in the last 10 years.

AMD, though, has a much more clear growth-driven narrative and the momentum is going to push this thing higher.

AMD looks better for a short-term trade, no doubt, while I think Intel is better suited for a long-term, more conservative investment approach. At this point, though, I’d rate both a buy.

Source:Seeking Alpha

Editor:BiyaPay Finance