- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Nvidia's market value soars, surpassing $3 trillion for the first time!

On the evening of June 5, Nvidia (NASDAQ: NVDA), a leading AI company, saw its stock surge over 5% to $1,224.4 per share, reaching a historic high and pushing its market capitalization past $3 trillion. This achievement allowed Nvidia to surpass Apple and become the world’s second most valuable company, just behind Microsoft, making it the third company to reach this milestone.

Nvidia’s Market Capitalization Milestone

Nvidia’s continuous surge in market value is remarkable. A year ago, the company’s market cap was less than $1 trillion, ranking below tech giants like Alphabet, Amazon, Apple, and Microsoft, and only slightly above Meta and Tesla. However, Nvidia’s market cap grew rapidly, crossing the $1 trillion mark by the close of trading on June 13, 2023. By February 23, 2024, it had surpassed $2 trillion, becoming the fastest company to double its market cap from $1 trillion.

Nvidia’s impressive performance report released on May 22 drove its stock price higher. On May 23, Nvidia’s stock price first broke the $1,000 mark, reaching a market cap of $2.5 trillion, less than a year after crossing the $1 trillion milestone. Within days, Nvidia’s market cap surged further, joining the $3 trillion club. This historic achievement highlights Nvidia’s leadership in the global semiconductor and AI sectors and reflects investors’ optimism about the company’s future growth potential.

If you also believe in Nvidia’s growth potential and foresee further breakthroughs, you can visit BiyaPay to search for the NVDA stock code and trade in real-time. For those with concerns about deposits and withdrawals, the platform can also serve as a professional tool for transferring funds into and out of U.S. and Hong Kong stocks. You can convert digital currency to USD or HKD, withdraw to your bank account, then deposit into other brokers to buy this stock. This method offers faster processing times without limits compared to other platforms.

What Drives Nvidia’s New Breakthrough?

Since May 2024, Nvidia’s stock price has seen significant increases, primarily due to the company’s first-quarter financial report that showed exceptional performance. In this quarter, Nvidia achieved $26 billion in revenue, a staggering 262% increase compared to the same period last year. Notably, the adjusted earnings per share reached $6.12, a 461% year-over-year increase. These figures reflect Nvidia’s strong momentum in both technology and market performance, boosting investors’ confidence in the company’s future growth potential.

Now, with a market cap ranking second globally, what other internal advantages, beyond benefiting from the ongoing AI wave, contribute to Nvidia’s development? Let’s briefly analyze the following aspects.

Leading Technological Development

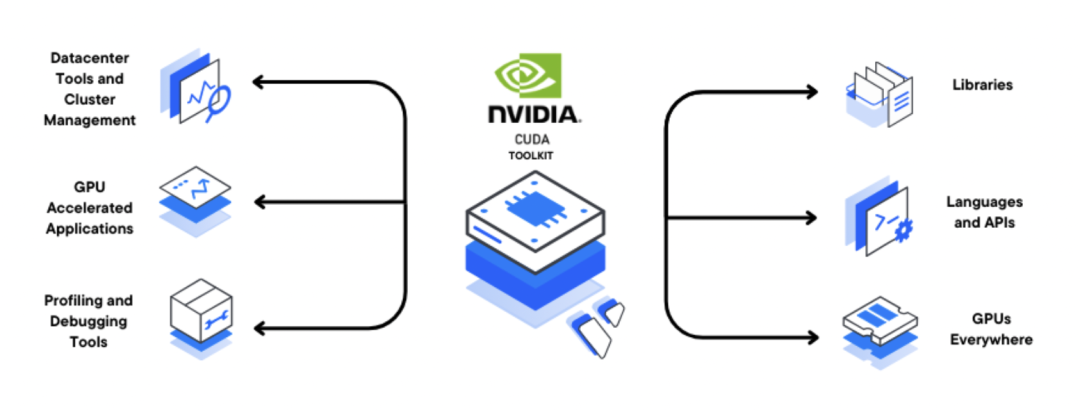

CUDA (Compute Unified Device Architecture) is a parallel computing platform and programming model launched by Nvidia. It serves as a crucial bridge connecting GPU hardware performance with software development needs. After over a decade of development, it has become the de facto standard for GPU programming in the industry. More than 2 million developers, 1,500+ universities, and 1,500+ industry applications worldwide are leveraging the CUDA platform to harness GPU potential. This core technology poses a challenge to all GPU manufacturers, who both fear and depend on it.

The recent release of the Blackwell chip is another milestone, accelerating the company’s technological advancements and showcasing Nvidia’s technical advantages over Apple. With its powerful computing capabilities and optimized energy efficiency, the Blackwell chip is particularly suited for high-performance computing and complex machine learning tasks, giving Nvidia an edge over Apple and other competitors.

In terms of technological development, Nvidia has always been at the industry forefront, focusing particularly on technological updates.

On June 2, during a keynote speech, Nvidia CEO Jensen Huang highlighted the company’s annual update pace and introduced a new semiconductor technology roadmap. The new Rubin platform, announced as the successor to Blackwell, will feature new GPUs, new Arm-based CPUs (Vera), NVLink 6, CX9 SuperNIC, and X1600, integrated with advanced networking platforms combining InfiniBand and Ethernet switches.

This strategy demonstrates Nvidia’s commitment to driving technological progress and how the company maintains market leadership by accelerating innovation. By continuously introducing new technologies and products, Nvidia aims to meet the growing global demand for high-performance computing solutions, especially in the AI field.

Dominance in the Gaming Sector and Diversified Expansion

Nvidia has long been dominant in the gaming sector, with its GPUs being the preferred choice for gamers and professional players worldwide. Beyond leading the gaming hardware market, Nvidia has also consolidated its position by introducing innovative gaming technologies and platforms, such as the GeForce Now cloud gaming service.

Simultaneously, Nvidia is expanding its technology into other fields, including networking and automotive industries, further unlocking its growth potential. In the networking industry, Nvidia’s advanced networking solutions are reshaping data center construction, aiming to create more efficient and secure computing environments. These solutions encompass a broad range of technologies, from high-performance NICs, switches, and routers to network management software designed for data centers.

In the automotive industry, Nvidia’s autonomous driving and in-car entertainment systems are gradually becoming standard in major automakers. Electric vehicle manufacturers Lucid (LCID) and IM Motors have already integrated Nvidia Drive Orin platforms into their vehicles.

Upcoming Stock Split 1-for-10

Following the financial report, Nvidia announced a 1-for-10 stock split effective after the close of trading on June 7. This plan is expected to generate a new wave of market reaction. This strategy allows investors who previously could not or did not wish to invest in high-priced stocks to now have the opportunity to purchase Nvidia shares. It not only expands the company’s shareholder base but also enhances the stock’s liquidity in the market, further stimulating trading activity and improving market performance.

A stock split is not just a price management strategy but also an active market response by Nvidia. By doing so, Nvidia successfully expanded its investor base and increased the attractiveness of its stock.

Future Development Challenges

Despite Nvidia’s current robust growth phase, it faces several challenges, including high investor expectations, potential market saturation, supply chain instability, and pressure from strong competitors like AMD and Intel.

Overreliance on the AI chip market could cause Nvidia’s stock price to fluctuate with changes in market demand or technology. To maintain technological and market leadership, Nvidia needs to continue investing heavily in research and development.

Moreover, the application of AI technology might raise public concerns about privacy protection and job losses, potentially affecting market perceptions and sentiments towards companies like Nvidia.

Investment Advice

Nvidia’s surpassing of Apple’s market cap signifies a shift in its position in Silicon Valley, further boosting market confidence. Many investors are betting on the continued rise of this globally valuable chipmaker, expecting significant returns from its sales growth and market dominance.

Nvidia’s growth rides the AI wave, with soaring demand for AI chips driving its continuous innovation and leading technological advancement. Its rise underscores AI’s transformative impact on the market, with its stock price climb indicating a market shift towards AI-driven growth.

In addition, based on the above analysis, Nvidia possesses its own development advantages, making its current leading position unshakable and likely to achieve further breakthroughs. However, it is worth noting that Nvidia also faces challenges mentioned earlier in its development process, so investors should think carefully and make informed investment decisions.