- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Microsoft is about to win the battle of artificial intelligence, is now the time to enter?

Summary

- Microsoft is competing with other tech giants to provide the best AI services, and recent stock gains show the market’s interest in AI.

- Microsoft’s Azure cloud computing platform is a major revenue generator, and they are rolling out AI-as-a-service features on it.

- Microsoft is making strategic investments and acquisitions in AI, including acquiring a part of OpenAI and investing in AI companies globally.

- They are also investing globally, looking to secure AI customers from across developed and emerging markets in Asia and elsewhere.

Introduction

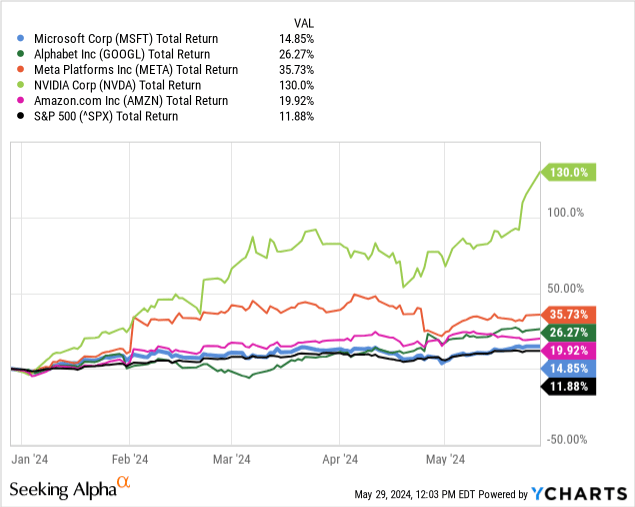

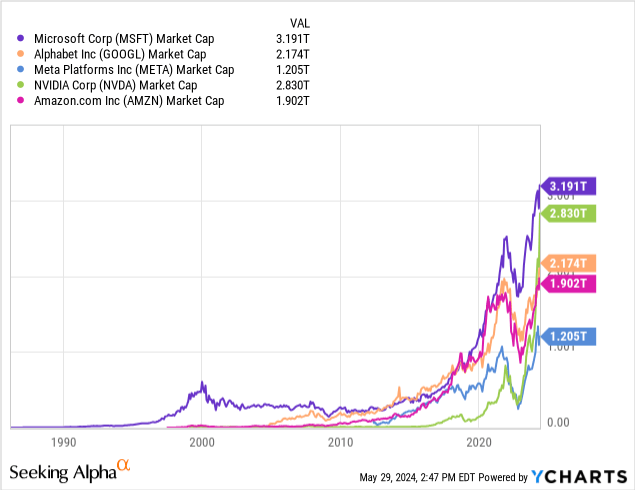

Microsoft Corp (NASDAQ:MSFT) is engaged in a bitter war with its mega-cap tech rivals Alphabet Inc (GOOG/GOOGL), Meta Platforms Inc. (META), NVIDIA Corp (NVDA) and Amazon.com Inc (AMZN) among others to win out on providing the best AI services.

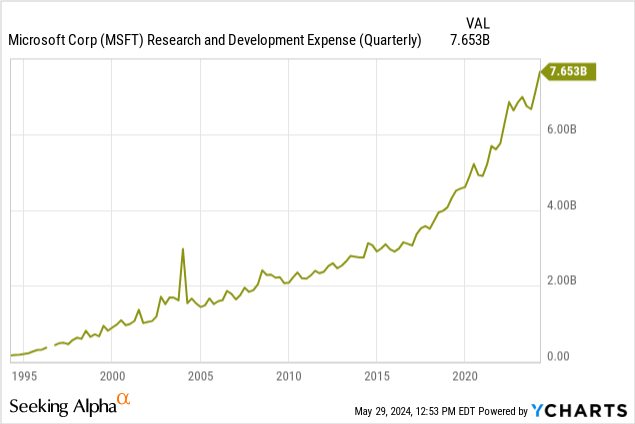

Recent stock gains in all of these names have shown the market’s appetite for these firms’ spending on research and development and acquisitions in the AI space.

To this end, MSFT has done quite a bit of maneuvering to position itself ahead of the others including massive R&D spending, large acquisitions, and strategic partnerships with outside firms. These moves have given MSFT an edge over the others mentioned above, and one that I believe will allow Microsoft to outshine its competitors and roll out its AI services to end-users faster and with greater amounts of success.

Azure Cloud Computing

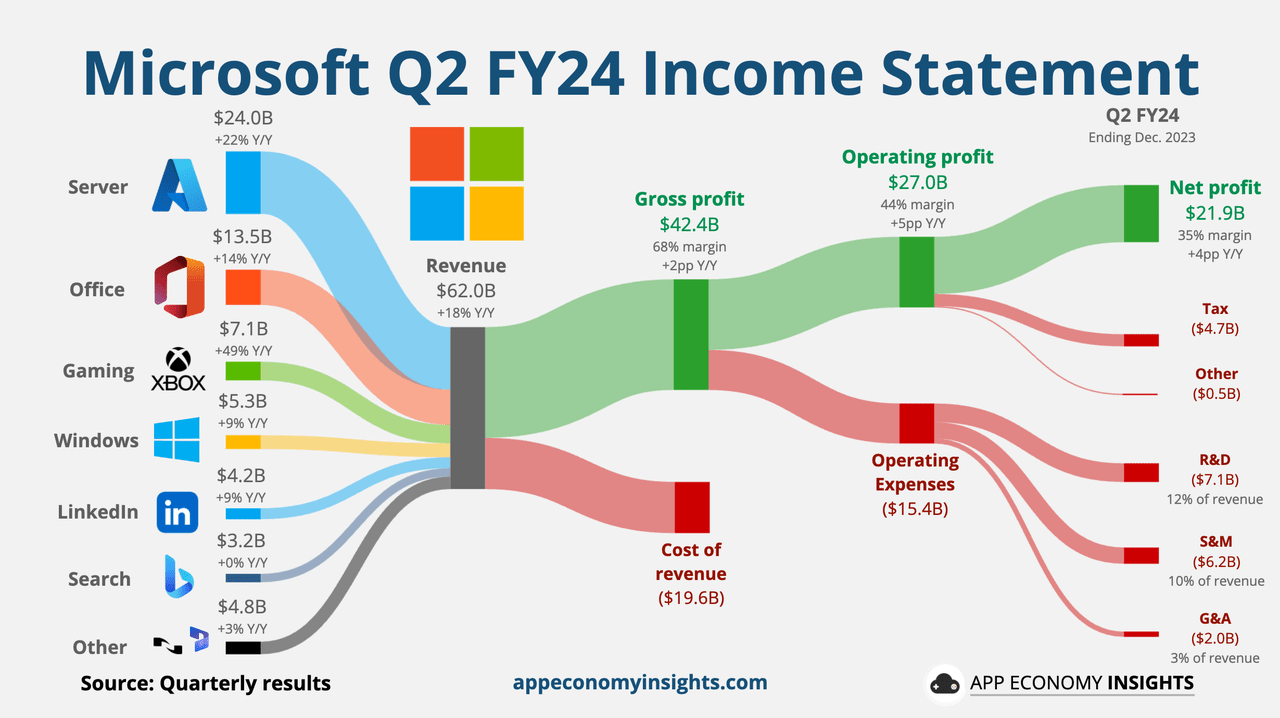

MSFT is already rolling out their AI-as-a-service features on their Azure cloud computing platform, which already stands as one of Microsoft’s largest revenue-generators, dwarfing the next largest generator, Office software.

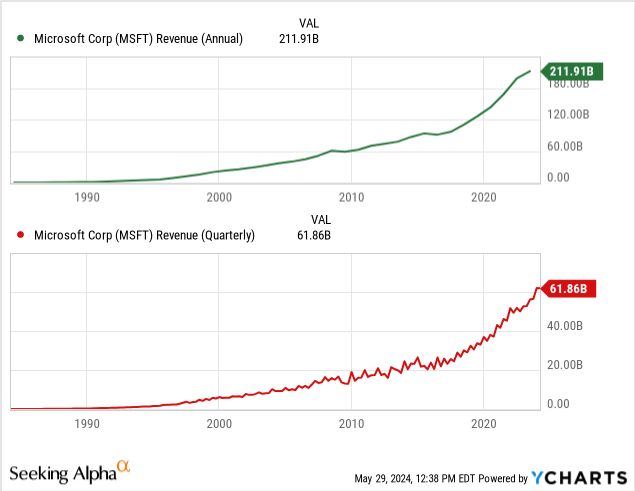

The introduction of data and cloud services via Azure, which launched in 2010, changed MSFT’s revenue trend. See how the pre-2010 trend is far flatter than the post-2010 trend, both in the quarterly and annual revenue figures.

This jump is no coincidence. It was fueled by Azure and MSFT continues to make money hand-over-fist with its cloud computing services.

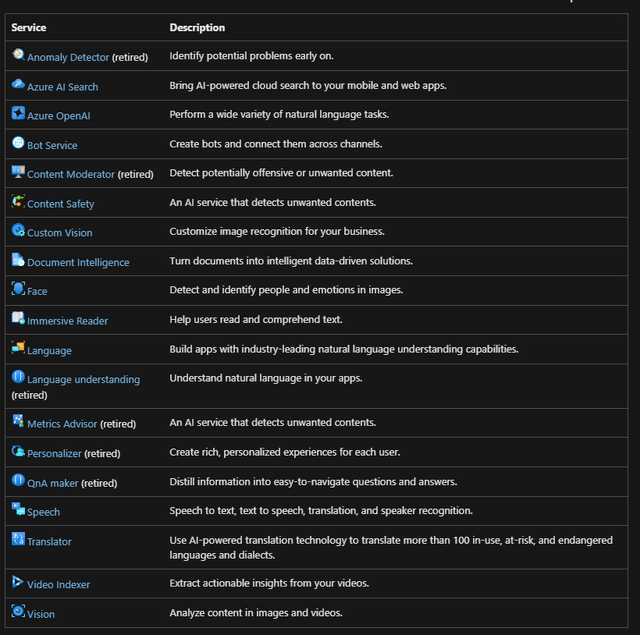

MSFT’s AI offerings are primarily concentrated in its cloud offerings. They have provided several AI services that are now defunct, which are marked in the list below as “retired.” These services are aimed at bringing in new customers who see these tools as useful for their business or workflow, and enticing Amazon Web Services (“AWS”) and Google Cloud Platform (“GCP”) customers to switch over.

Because Azure makes up so much of MSFT’s revenue, it’s vital for them to continue bringing in customers to fuel the growth that’s expected of them from the market.

I believe that MSFT will have no problem bringing in these new customers. They are already making strategic investments across the globe to create new customers for their products.

Strategic Investments

Microsoft made big news when they acquired a large part of OpenAI back in 2019, starting at $1bn. Since then, its investment has grown to over $13B. OpenAI produces the prolific ChatGPT and Dall-E AI, which are the most popular generative AI platforms on the market currently.

Hoping to bridge out to developing and emerging markets with Azure, to capture the wave of companies from Asia and the Middle East moving to Web 2.0 as their economies evolve and digitize, MSFT has made several very large investments in cloud computing and AI in the last few months.

Geographic Investments Around the World

All of these news releases from MSFT themselves are from the last two months.

- $2.9B in Japan to open a research center in Tokyo and train 3M+ people

- $1.5B in the UAE for a stake in AI company G42 and infrastructure

- $1.7B in Indonesia for infrastructure and to train 800,000+ people

- $2.2B in Malaysia for infrastructure and to train 200,000+ people

- $3.3B in Wisconsin, USA to build a manufacturing-focused AI research lab on the University of Wisconsin-Milwaukee campus, build infrastructure, and training 100,000+ people

MSFT’s Venture Capital Fund, M12

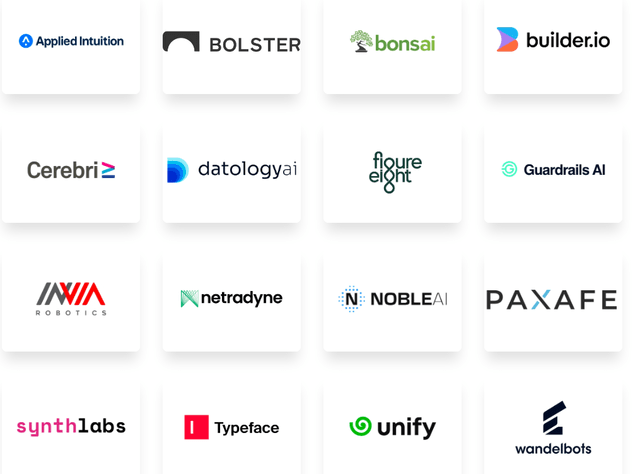

In addition to these investments, Microsoft is taking positions in several private AI companies via its venture capital fund, M12.

Here is a list of large stakes they’ve acquired in AI-focused companies, via their website. There you can also find their cloud infrastructure and other investment focus areas on that site. The list is extensive and I encourage you to take a look for familiar names.

In total, M12 currently has 292 total investments with it taking the lead on 86 of them. Of those, 16 are AI-focused investments, and that is only counting funding rounds that M12 has participated in. MSFT proper also has its own acquisitions and investments in the space.

AI at Scale

One of the things that struck me the most from Microsoft’s last earnings call was when the CEO, Satya Nadella, said this from his prepared remarks:

We’ve moved from talking about AI to applying AI at scale.

Microsoft is seeing themselves as a leader in the space, and this remark is evidence of that. Satya rarely promises what he can’t deliver and has called for reigning in AI for safety.

Scale is also one of the most important aspects for Microsoft to get right with its AI roll-out. We know that training new models and running them can cost hundreds of millions of dollars, so getting something wrong can be a very costly mistake.

Google’s costly mistake is plaguing them currently, with its search overview AI offering up hallucinated results and misinformation, and output information that was dangerous. This has caused a stir publicly and given Google a bad look.

Fair Value

How will AI affect Microsoft’s value? Currently, MSFT is the most valuable company in the world, sitting at nearly $3.2T. This is a massive achievement, but I see more in MSFT’s future.

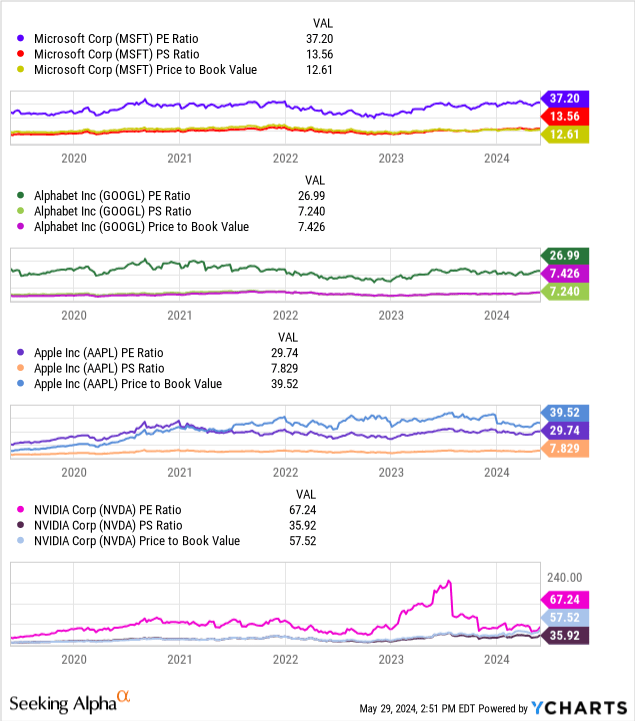

It trades around 37 P/E, 14 P/S, and 13 P/B, which is higher than Google and Apple (bar Apple’s P/B), but less than NVIDIA. Its fundamental ratios are more highly valued than the S&P 500 average, but this is due to Microsoft’s growth trajectory getting steeper. I believe that MSFT’s AI integration and new tools will deliver on those growth goals.

How high MSFT can go is unclear, as we are now in newly charted territory for valuations. US valuations have never been higher than where they are today, and MSFT already has the highest valuation of any company in the world, but that doesn’t mean we are at a ceiling.

Based on the metrics reviewed in the financials section, I believe that we are not at the end yet. There is still room for MSFT to add new and build on existing revenue streams in emerging and developing markets, by taking market share from AWS and GCP, and with new tech breakthroughs in AI with their new AI division.

If you have confidence in the above positive factors and feel that Microsoft can still bring good investment returns, and want to enter the market at this time, you can go to BiyaPay, search for the MSFT stock code on the platform, and trade online in real-time. Of course, if you have difficulties with deposits and withdrawals, you can also use this platform as a professional tool for depositing and depositing US and Hong Kong stocks. Recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to your bank account, and then deposit to other securities firms to buy this stock. Compared with other platforms, this has a faster arrival speed and no limit.

MSFT Market Trend,Chart By Biyapay App

Risks

There are a few major risks to this thesis, primarily:

- The MSFT AI division could fall short, despite all of its major acquisitions . Good companies doesn’t guarantee that they will innovate or accelerate their revenue with these services.

- Google, Apple, Meta, NVDA, or another big firm investing in AI may be able to outspend MSFT, which is not the leading R&D spender among mega-caps (actually, Amazon is).

- Generative AI may have peaked .

- Breakthroughs in AI research, fueled by the spending and acquisitions, could result in very little gains that do not produce enough ROI to make further investment worthwhile.

- Breakthroughs in tech could be squandered by bad products, e.g. the Windows Phone.

- A large market correction could harm MSFT more than some other mega-cap tech, because its valuation is richer than that of some of its peers like Apple and Google and has further to fall before it is in “value” territory.

Conclusion

Microsoft is expected to win the artificial intelligence war, and its deployment has been widely praised compared to Google’s recent search for artificial intelligence mistakes. Microsoft’s growth is not only due to its strategic partnerships abroad, but also to its acquisition and investment in multiple artificial intelligence companies worldwide.

Winning the artificial intelligence war (i.e. having the best artificial intelligence system) will give Microsoft a dominant technology stack related to its Cloud Service Azure. A large part of Microsoft’s revenue comes from Azure, and the increase in customers on this platform directly translates into Microsoft’s revenue and profits.

I have a positive attitude towards Microsoft, but as an investor, you should also consider the corresponding risks it carries. Finally, I wish everyone a good return on investment!

Source: Seeking Alpha

Editor: BiyaPay Finance