- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Demonstrating Resilience in Challenging Times! Walmart's Strong Performance Rebound.

Summary

- Walmart’s latest quarterly performance shows strong resilience, with the international segment performing better than expected.

- The company saw increased sales and improved margins this quarter, with strong growth in its advertising and eCommerce businesses.

- Flipkart, Walmart’s Indian eCommerce platform, showed strong growth and plans to enter the quick commerce space, supported by a recent investment from Google.

Investment Thesis

Walmart’s stock price has increased by approximately 33.3% compared to the same period last year, significantly outperforming the S&P 500 index’s 25.5% gain during the same period, drawing attention. In this article, I discuss the company’s latest quarterly performance. Although the company still has room for improvement in terms of valuation, its resilience in a challenging macroeconomic environment, along with its international segment’s better-than-expected performance, makes it more attractive compared to the past and worthy of focused analysis. If investors are confident in the positive signals released, they may consider investing. One option is to use BiyaPay to search for the WMT stock code for real-time trading. Additionally, for those concerned about deposits and withdrawals, BiyaPay can serve as a professional tool for US and Hong Kong stock transactions, allowing you to convert digital currency to USD or HKD, withdraw to a bank account, and then fund other brokers to buy this growth stock. Compared to other platforms, BiyaPay offers faster transactions and no limits.

WMT Market Trend

A Snapshot of Walmart’s First Quarter Performance

Overall, I believe Walmart had an outstanding quarter. Q1 revenues came in at $159.9 billion, up 5.92% year-over-year, beating analyst estimates by $1.67 billion. Adjusted EPS came in at $0.60, which, although representing a 59% year-over-year decline, still beat analyst estimates by $0.07. Adjusted operating income jumped 13.7% year-over-year due to higher gross margins and significant growth in membership income. Both the advertising and eCommerce businesses showed strong growth, with year-over-year increases of 24% and 21%, respectively. The company also demonstrated its ability to manage inventory in a disciplined manner, with global inventory decreasing by 2.7%, and Walmart US inventory decreasing by 4.2% year-over-year. Management’s guidance was strong yet prudent. For the second quarter, consolidated net sales are expected to increase between 3.5% and 4.5%. Consolidated operating income is expected to grow in the range of 3% to 4.5%, and adjusted EPS is expected to be between $0.62 and $0.65. For the full year, the company now expects all three metrics to come in at the high end or slightly above the company’s prior guidance. Management previously guided FY25 consolidated net sales to increase by 3% to 4%, consolidated adjusted operating income to grow between 4% and 6%, and adjusted EPS to be in the range of $2.23 to $2.37.

Walmart Displays Tremendous Resilience in a Challenging Environment

One key takeaway from Walmart’s first quarter is the strong resilience shown by the company in a challenging macroeconomic environment, successfully attracting higher-income consumers. Over the past year, US consumer pessimism about the economy has increased, as evidenced by the latest consumer sentiment report. Despite this, Walmart was able to deliver strong sales and margins, which can be attributed to its ability to continue attracting higher-income consumers. Management noted during the earnings call that the higher level of convenience offered by the company was attracting more high-income households to shop at Walmart. Walmart’s delivery business, which focuses on high-income households, saw strong growth as the company focused on shortening delivery times without compromising product quality. For instance, in the US segment, 20% of the 4.4 billion items delivered on the same or next day over the past 12 months were delivered within three hours. Management also highlighted during the earnings call that delivery times were getting faster, and delivery costs were decreasing, which subsequently boosted shopper convenience. In addition, the strong growth in Walmart’s membership income further demonstrated the company’s resilience. For example, Sam’s Club US set new records for member counts and membership penetration, with membership income growing by 13%. Memberships in Sam’s China also saw a year-over-year growth of 25%. Finally, Walmart+, the company’s equivalent of Amazon Prime, achieved double-digit growth again and is currently at an all-time high. Given that members tend to shop more and spend more than non-members, maintaining this growth should help the company boost its sales and margins in future quarters. Membership programs, along with other areas such as advertising, also helped boost the company’s operating income. I am particularly impressed by Walmart+, which I believe will allow the company to continue offering a “convenient” shopping experience. Features such as Mobile Scan & Go, currently used by a third of the members and powered by AI, as well as Returns from Home and Early Access to deals, are catalysts to attract more consumers to shop at Walmart. Previously, there were concerns that Walmart could fall victim to the current retail environment. Thanks to improved eCommerce, better product quality, and attractive features through its membership program, the company has successfully navigated these turbulent waters, as evidenced by its stronger-than-expected quarterly performance.

Flipkart Could Be a Game Changer

Another significant takeaway from this quarter was the strong growth seen in Walmart’s international business, with the segment achieving strong double-digit growth in sales and profit. This growth was primarily driven by Walmex, China, and Flipkart, the Indian eCommerce platform acquired by Walmart. I want to particularly focus on Flipkart, as I believe there are many positives. The company’s same-day delivery orders, currently available in 20 major cities in India, grew by over 150% during the quarter, demonstrating strong underlying demand. Flipkart also generated positive EBITDA during the quarter, making it two consecutive quarters of positive EBITDA growth. Furthermore, Flipkart, along with Walmex, was a primary driver behind the company’s surge in its international advertising business, which grew 27% year-over-year. Flipkart plans to enter the quick commerce space, involving two- or four-hour deliveries, as early as July, buoyed by strong demand. While the company had held discussions to acquire one of the leading quick commerce firms, Zepto, to fast-track its entry, the talks were unsuccessful. Despite this, given the demand growth seen so far, I believe Flipkart can succeed independently in a space expected to account for nearly $5 billion in gross order value in FY24, according to Goldman Sachs. My conviction that Flipkart can succeed independently was further bolstered by Google’s recent announcement to invest $350 million in the company as part of a $1 billion funding round. This investment will help Flipkart leverage Google’s cloud services and enhance its digital infrastructure further by incorporating AI. According to Statista, revenues in the Indian eCommerce market are expected to grow to $101.4 billion by 2029, at a CAGR of 11.45%. Thanks to Google’s investment and Flipkart’s plans to enter the quick commerce market, the company’s growth prospects are further clarified.

Valuation

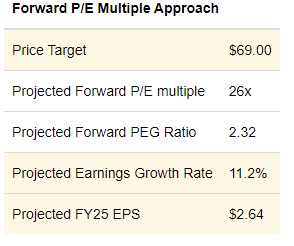

Sources: LSEG Workspace (formerly Refinitiv), WMT’s Q1 Earnings Report, Seeking Alpha, and Author’s Calculations

The company expects adjusted FY25 EPS to now come in at the higher end or slightly above the previous guidance range of $2.23 to $2.37. Given that Q1 adjusted EPS was well above the previous guidance of $0.49 to $0.52, and given the strong performance seen so far across different divisions and demographics despite economic uncertainty, I assume FY25 adjusted EPS of $2.37 for my calculations, the higher end of the company’s guidance. According to LSEG Workspace (formerly Refinitiv), the company currently trades at a forward P/E of 26x, making it relatively cheaper than Costco (forward P/E of 47x) but more expensive than Target (15.1x). The stock is also expensive at current levels, relative to its historical forward P/E multiple of 23.1x. If the company manages to hit $2.37 in adjusted EPS, this would translate to an earnings growth of 24% year-over-year, nearly three times the average of analyst estimates of the company’s long-term earnings growth of 8.1%. Given this growth, I assume a forward P/E of 26x for my calculations instead of its historical multiple. According to Seeking Alpha, Walmart’s forward PEG ratio is 3.49, slightly below its 5-year average of 3.75 but well above the sector median of 2.32. While I don’t believe Walmart will keep generating earnings growth of 24% in FY26, I believe it would be much higher than the 7.5% earnings growth if we assumed a PEG ratio of 3.49. On the other hand, if I assume a PEG ratio of 2.32, the industry median, it would result in an earnings growth of 11.2%, which is a more reasonable estimate, in my opinion, given that I believe trends such as the company’s ability to attract high-income consumers and its rapidly growing advertising business should offset the challenging macro environment. As such, I assume a forward PEG ratio of 2.32 and subsequently an earnings growth of 11.2% for my calculations. At this earnings growth, FY26 EPS is projected to come in at $2.64. A forward P/E of 26x and an EPS of $2.64 would result in a price target of $69, which suggests limited upside of about 6% from current levels.

Risk Factors

Despite consumer confidence breaking a three-month streak of declines in May, consumer sentiment continues to tumble as US consumers remain fearful about persistent inflation. The University of Michigan’s Survey of Consumers for May registered a month-over-month decline of 12.7%, with the one-year inflation outlook jumping to 3.5%, the highest level since November 2023. As such, investors need to be cautious about the sustainability of Walmart’s revenue growth, a point acknowledged by management when they said they are going to “be patient on this performance” and that “we are far from a certain environment around the consumer.” Furthermore, while the company’s planned acquisition of Vizio should provide a better platform to compete with the likes of Amazon in advertising, the acquisition is yet to be completed. The FTC has begun its antitrust inquiry, and the company expects the transaction to be “slightly dilutive” to EPS in the near term. While the company expects the deal to be completed in FY25, the extent of the FTC’s investigation could play a spoilsport to the company’s plans, a factor that investors should consider.

Conclusion

Walmart had a fantastic start to the year, with a focus on convenience allowing it to attract consumers across different categories, translating to better-than-expected top and bottom lines. The resilience shown by the company can be primarily attributed to its ability to continue catering to higher-income households through efficient delivery and attractive features via its Walmart+ membership program. Furthermore, the company’s international business also demonstrated strong growth, driven primarily by Flipkart in India. The Indian subsidiary continues to defy expectations, and Google’s investment should enable it to compete better with local rivals such as Reliance Industries and Amazon. Given the stock’s strong momentum and the company’s resilience in a challenging backdrop, it makes for a strong long-term conviction idea.