- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Alibaba: A Stock Buyback King In The Making

Summary

- Alibaba Group Holding reported healthy results for its last financial year and declared a special dividend, enhancing its value proposition.

- The company saw stronger sales growth and is ramping up stock repurchases, making it more attractive to investors.

- Alibaba’s cloud segment is performing well and the company is investing in AI products, promising long-term growth potential.

Alibaba Group Holdings Limited (NYSE: BABA ) saw its share price rise in April and May, helped by the e-commerce giant reporting healthy results for the last fiscal year. Alibaba also announced a special dividend of $0.0825 per Common Stock share, further strengthening its value proposition.

The sales growth of this e-commerce company is also stronger, and the company is increasing its stock buyback efforts, which may make Alibaba more attractive to investors. I believe that Alibaba’s current integration provides a buying opportunity for long-term investors interested in investing in growing e-commerce companies.

Investment Thesis

My stock rating on Alibaba is a buy , and what supports my investment argument is that as a leading e-commerce platform, it is expected to benefit from an improved consumer environment.

In addition, as Alibaba announced a special dividend and increased share buybacks, the company became more attractive to investors seeking higher returns on capital.

Sales Rebound, Alibaba Cloud, Developing Focus On Share Repurchases

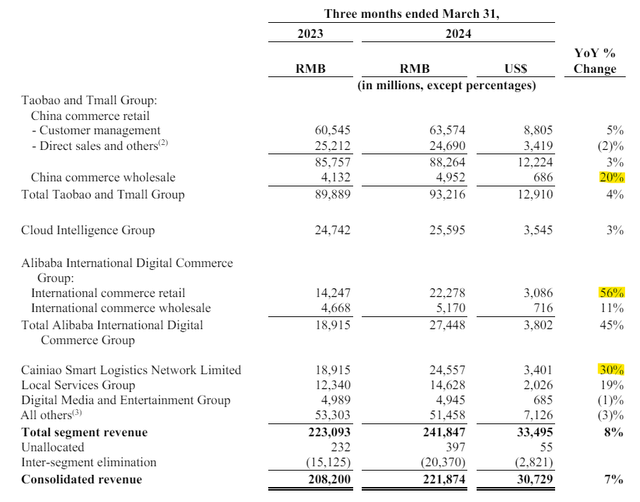

Alibaba Group Holding profited from a rebound in its sales growth in the last quarter.The eCommerce giant’s total segment revenues advanced 7% YoY to $30,729 million which compares against a 5% YoY growth rate in the prior quarter. Driving factors in this stronger sales growth were wholesale, international commerce and logistics.

Moreover, I think that Alibaba Group Holding’s cloud segment makes a particularly compelling value proposition for investors, primarily because they can buy a piece of Alibaba’s cloud business at a much more attractive valuation than they could do, for instance, with Amazon Inc. (AMZN).

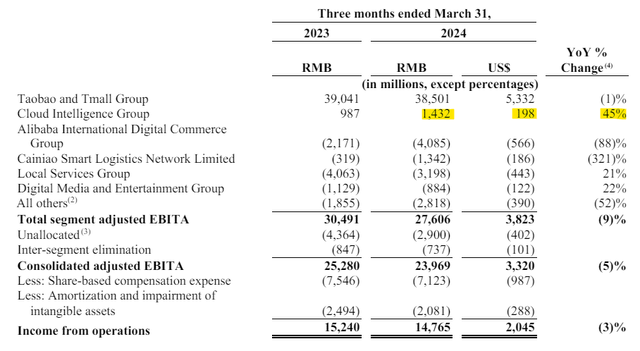

Cloud is doing well for Alibaba, particularly on a profit basis. The cloud segment, which offers Computing, Storage, Data Bases and Networking as core services to Alibaba’s customers saw its profits surge 45% YoY to RMB1, $198 million due to growth in adoption. Cloud was the fastest growing segment, from an operating income angle, in the last financial quarter.

The growth in profits is also a reflection of Alibaba Group Holding making investments in cloud infrastructure a priority, together with aggressive share repurchases. Alibaba cloud and the potential for sustained share repurchases are two aspects that I think enhance the value proposition for the company.

Alibaba Group Holding is particularly aggressively investing into its AI products, such as Machine Learning, Data Intelligence and Analytics, which promise the company long-term growth potential.

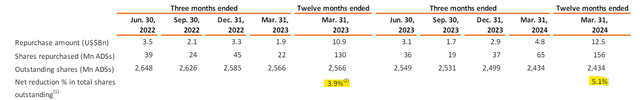

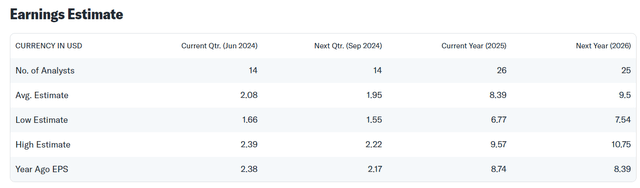

Alibaba Group Holding is getting aggressive when it comes to share repurchases as well which is sound capital allocation, primarily because the eCommerce company’s stock is so cheap (the implied leading earnings multiple is 9.0x).

In just the last quarter, 1Q24, Alibaba Group Holding repurchased $4.8 billion of its shares in the market. The total repurchase amount in the last year was $12.5 billion which is the equivalent of 5.1% of the company’s outstanding shares. Compared to the previous year, Alibaba Group Holding’s share repurchases increased by 15%. The ramped up share repurchases take place as part of Alibaba Group Holding’s plan to buy back $25 billion of its shares until March 2027.

In addition to providing these considerable cash returns to shareowners, Alibaba also announced a special dividend of $0.66 per share. The registration date of this one-time dividend is June 13, 2024. Therefore, investors interested in receiving this special dividend can still purchase the stock in the next two weeks.

Technical Analysis

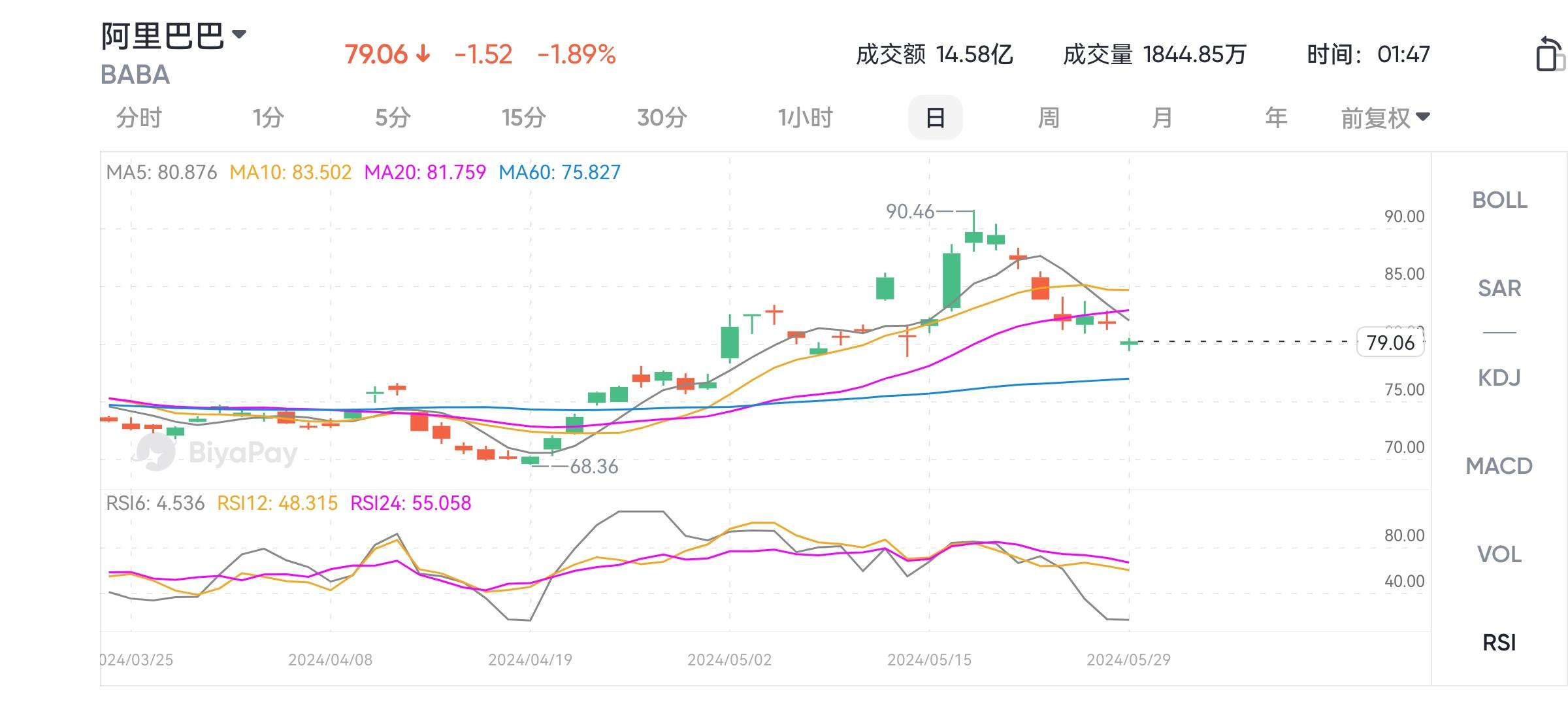

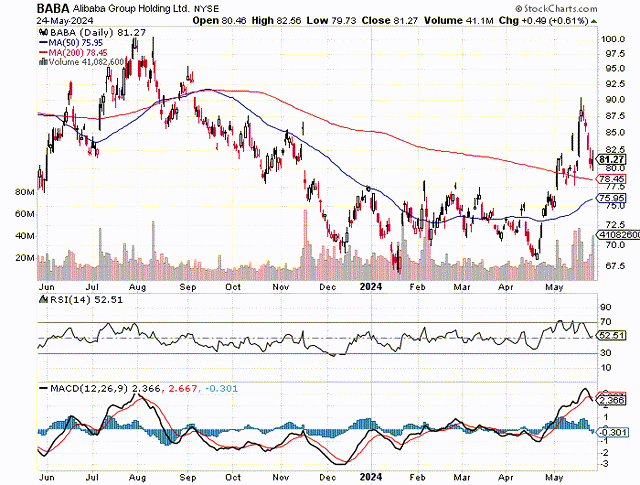

Alibaba Group Holding staged a big breakout in April that lasted well into May 2024. The stock broke through both the 50-day and 200-day moving average lines under escalating volumes which is a very bullish sign. Even though the stock recently lost some of its upside momentum, the 200-day moving average line has not been broken, which helps solidify a bullish chart picture.

I think that the pullback is a good opportunity for investors to scoop up some stock in Alibaba Group Holding, particularly with the business picking up some much-needed momentum in the last quarter.

Alibaba Group Holding’s Exceptional Value Proposition

Alibaba Group Holding has a unique opportunity at its hands to unlock value for shareholders: It is poised to spend $25 billion on its deeply discounted stock. The company’s stock is presently selling for 9.1x leading earnings. The implied YoY profit growth rate is 13% which makes sense to me when taking into account that the eCommerce business is recovering and cloud profits are skyrocketing. Alibaba Group Holding’s eCommerce recovery, profit growth in cloud, special dividend and potent repurchases could drive a re-rating of the stock, in my view.

I think Alibaba could re-rate to a range of $114-124 in the next twelve months which would reflect an earnings multiple of 12-13x. This multiple, in my view, would more accurately reflect Alibaba Group Holding’s progress in cloud and eCommerce and also take account of the fact that the company is set for some serious cash returns to shareholders in the next three years.

Other eCommerce plays like PDD Holdings (PDD) sell for 11.0x leading earnings whereas JD.com (JD) has an 8.3x profit multiple. Though eCom companies are all relatively cheap, I prefer Alibaba Group Holding because it owns a cloud business that is connected to the AI theme and that could develop into a real gem over time if the company can sustain its profit momentum.

Risk

Alibaba Group Holding is going to have to invest a lot of money into artificial intelligence products because clearly this is where the market is heading. Alibaba Group Holding owns large data-gathering domestic eCommerce brands and a cloud service, both of which will use artificial intelligence to improve their product offers and unlock incremental value for the company.

Thus, Alibaba Group Holding is probably going to ramp its expenditures on artificial intelligence products and services that may eat into the company’s short-term profitability.

In the long-run, however, I anticipate Alibaba Group Holding’s investments into AI to pay handsome dividends, particularly in cloud where AI can play a big role in cloud-supported business intelligence and data analytics.

Conclusion

Alibaba Group Holding’s stock staged a nice breakout in April and May, but has presently run a bit out of steam, which may present a buying opportunity for investors that missed the first part of the rally.

Alibaba Group Holding’s faster sales growth in the last quarter, doubling-down on share buybacks and the declaration of a special dividend all serve to fundamentally enhance the value proposition that Alibaba Group Holding is making right now.

Alibaba Group Holding repurchased close to $5 billion worth of its own shares in the last quarter and profits in cloud are skyrocketing.

I think that Alibaba Group Holding is widely underrated as a growth investment and that the risk/reward relationship remains extraordinarily compelling.

Source: Seeking Alpha

Editor: BiyaPay Finance