- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

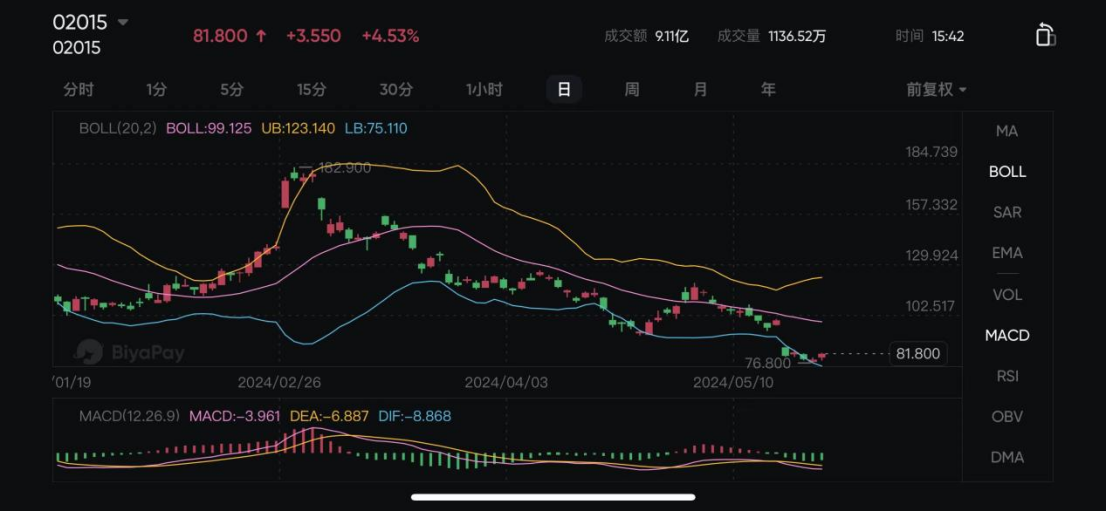

Confident on Ideal's Stock Amid New Energy Slump

Last week, Ideal’s Hong Kong stocks plummeted by 20%. It would be unrealistic to say there were no emotional swings. Shareholders are torn between buying and selling, with tensions running high, especially among those holding Ideal and other new energy vehicle stocks. After thorough reflection, I asked myself two key questions that would determine whether to hold onto and even increase my positions in Ideal.

The first question:

Do I believe in the long-term growth of the new energy vehicle market, and do I think the current stock prices are undervalued?

My answer is a resounding yes. I am highly optimistic about the future of new energy vehicles. I firmly believe that anyone who has test-driven a new energy vehicle will be eager to switch. Ideal has significantly enhanced its vehicle-machine interconnectivity, intelligent cockpits, and smart driving experiences, elevating the overall driving and riding experience and widening the gap with traditional fuel vehicles. For those worried about range anxiety, extended-range options are available. Increasingly, owners are opting for hybrid cars as an initial step into the new energy market, and this year, hybrids and pure electric vehicles might evenly split the market share.

Furthermore, leading new energy vehicle companies have seen their stock prices drop by over 40% this year, with declines of 60-90% from their all-time highs. Tesla’s PE ratio stands at 40, and Ideal’s at 14, both well below historical averages.

The second question:

Can Ideal Secure a Leading Position in the New Energy Vehicle Market and Achieve Long-term Growth?

I have less certainty regarding this second question. The new energy vehicle market is fiercely competitive, with numerous companies battling for supremacy. This year, the price wars have been particularly intense. While Ideal may not be the first company to break through, after evaluating the products from various companies and considering Ideal’s brand strategy and management approach, I believe Ideal is highly likely to emerge as one of the key players.

Nonetheless, I am also attentive to the advancements of other companies. Therefore, I foresee the leading companies in the future being BYDand Ideal. I plan to invest in the stocks of these two companies when the time is right.

Why I Am Firmly Committed to Bottoming Out Ideal’s Stock

Here are the main reasons why I am steadfast in my decision to bottom out Ideal’s stock:

- Company Actions vs. Market Perception: Recently, Ideal has made several controversial decisions, such as laying off about 20% of its workforce, abandoning the launch of pure electric products this year, and pausing its overseas expansion. However, I view these measures as correct and indicative of a quick response to mistakes. Admitting errors in business decisions is tough, but what impresses me most about Ideal is its willingness to correct mistakes without pretense. I won’t delve into these points further as I’ve often discussed them with friends, but fundamentally, I believe these actions benefit the company’s future development and operations, even if they are not readily accepted by the market.

- The Reality of Performance: Ideal is like a top student who suddenly scores poorly, drawing severe criticism from the teacher. This has given great hope to other car companies usually performing poorly. However, when we look at Ideal’s performance this year objectively, it remains the only new energy vehicle company that is profitable with a high single-vehicle gross margin of 20%, and it continues to lead in sales among its peers. Despite intense competition and price wars, Ideal remains a high-margin, high-sales, profitable company, whereas other new energy companies continue to struggle with low margins and low sales, resulting in losses.

Ideal’s position will not falter. This year, it is steadily making strides in capturing the market share of true luxury brands like BBA (BMW, Benz, Audi). Currently, BBA companies can maintain sales through price cuts, but eventually, they will face a significant decline in sales similar to what Japanese car companies are experiencing now. Although Ideal is currently facing both internal and external challenges, its growth remains robust, indicating that the problems it faces are manageable and will not significantly impact its overall development.

Ideal Motors: Paving the Way for New Energy Vehicle Companies

As of May 20, 2024, Ideal Motors released its Q1 2024 financial report. Ideal’s revenue reached 25.6 billion yuan, a 36.4% year-on-year increase. However, net profit fell to 591 million yuan, down 36.7% year-on-year and 38.6% quarter-on-quarter. The company projects Q2 revenue to rise to 31.4 billion yuan, falling short of the market’s forecast of 38.63 billion yuan. Similarly, Q2 delivery estimates range from 105,000 to 110,000 units, also below market expectations.

The combination of revenue growth and profit decline is not a favorable scenario for Ideal. Recently, the company has faced lawsuits and layoff controversies, which may further dampen its stock price. The capital market’s pessimism has significantly undervalued Ideal, with target prices of $53 for US stocks and HKD 205 for Hong Kong stocks, more than double the current price.

The development of any industry is never smooth, but some leading companies inevitably emerge to drive sustainable growth, and the new energy vehicle sector is no different.

The global new energy vehicle industry is currently in a critical growth phase. While the market is booming, competition is fierce. Car companies are focused on finding a sustainable development path that balances user needs, industry demands, and financial stability.

In my view, Ideal has found its own path. In this wave of growth, Ideal has pioneered a route of increasing volume, revenue, and profit, achieving user recognition, meeting industrial demands, and gaining favor with investors. The automotive industry traditionally requires high investment with long return periods, but among global car manufacturers, Ideal stands out as one of the fastest to achieve profitability.

conclusion

Despite the current slump in Ideal’s stock price and its profit decline, the Q1 financial report shows a 36.4% increase in revenue, with its outstanding sales performance remaining strong. Remember, Ideal still ranks first in sales among new energy vehicle companies. The global new energy vehicle industry is now in its golden age of development. While the market is booming, the competition is fierce. I am confident that Ideal will leverage its flexible operational strategies and robust sales capabilities to secure a leading position in the market.