- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

NVIDIA Hits $1K; Huang Triumphs. Buy Now?

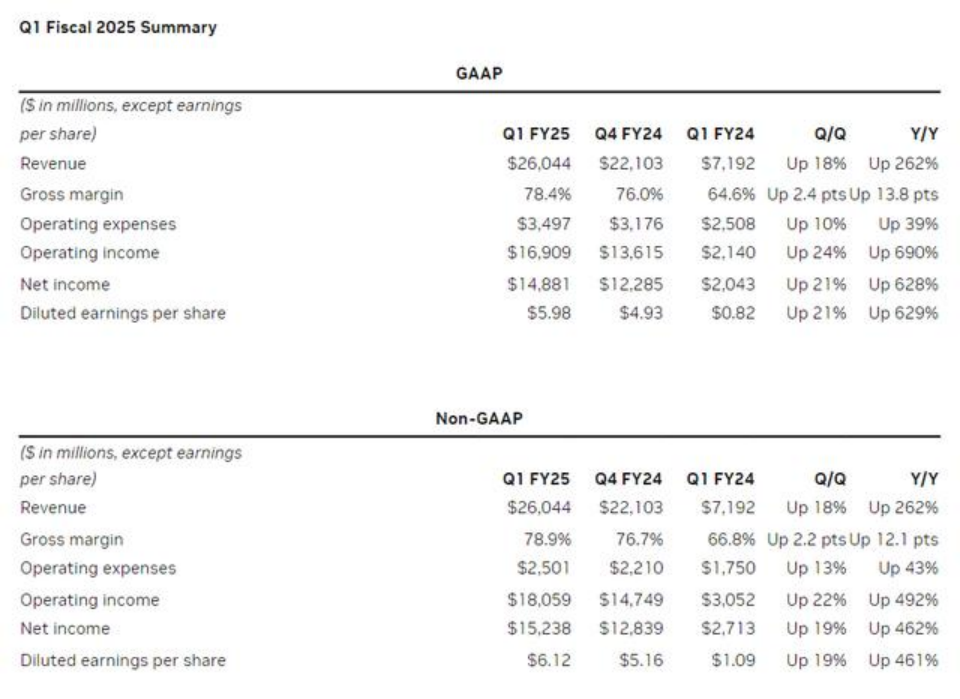

Recently, AI leader NVIDIA released its first-quarter report, greatly exceeding expectations. Last week, NVIDIA announced its financial results for the first quarter of fiscal year 2025, ending April 28. During this period, the company achieved revenues of $26.044 billion, up 262% year-on-year, far exceeding the market’s expected $24.7 billion. Net profit reached $14.881 billion, up 628% year-on-year, higher than the expected $12.9 billion. Non-GAAP diluted earnings per share were $5.98, up 629% year-on-year, exceeding expectations of $5.19. Additionally, the company provided guidance for the next quarter, forecasting sales of $28 billion for the second quarter of fiscal year 2025, with a 2% variance, surpassing the market’s expected $26.6 billion. NVIDIA also announced a quarterly dividend, raising the per-share payout from 4 cents last quarter to 10 cents. Furthermore, NVIDIA announced a 1-for-10 stock split. After the market closes on June 7, shareholders holding NVIDIA common stock will receive nine additional shares, with trading on a split-adjusted basis starting June 10. In the first quarter, NVIDIA repurchased $7.7 billion worth of stock and paid $98 million in dividends.

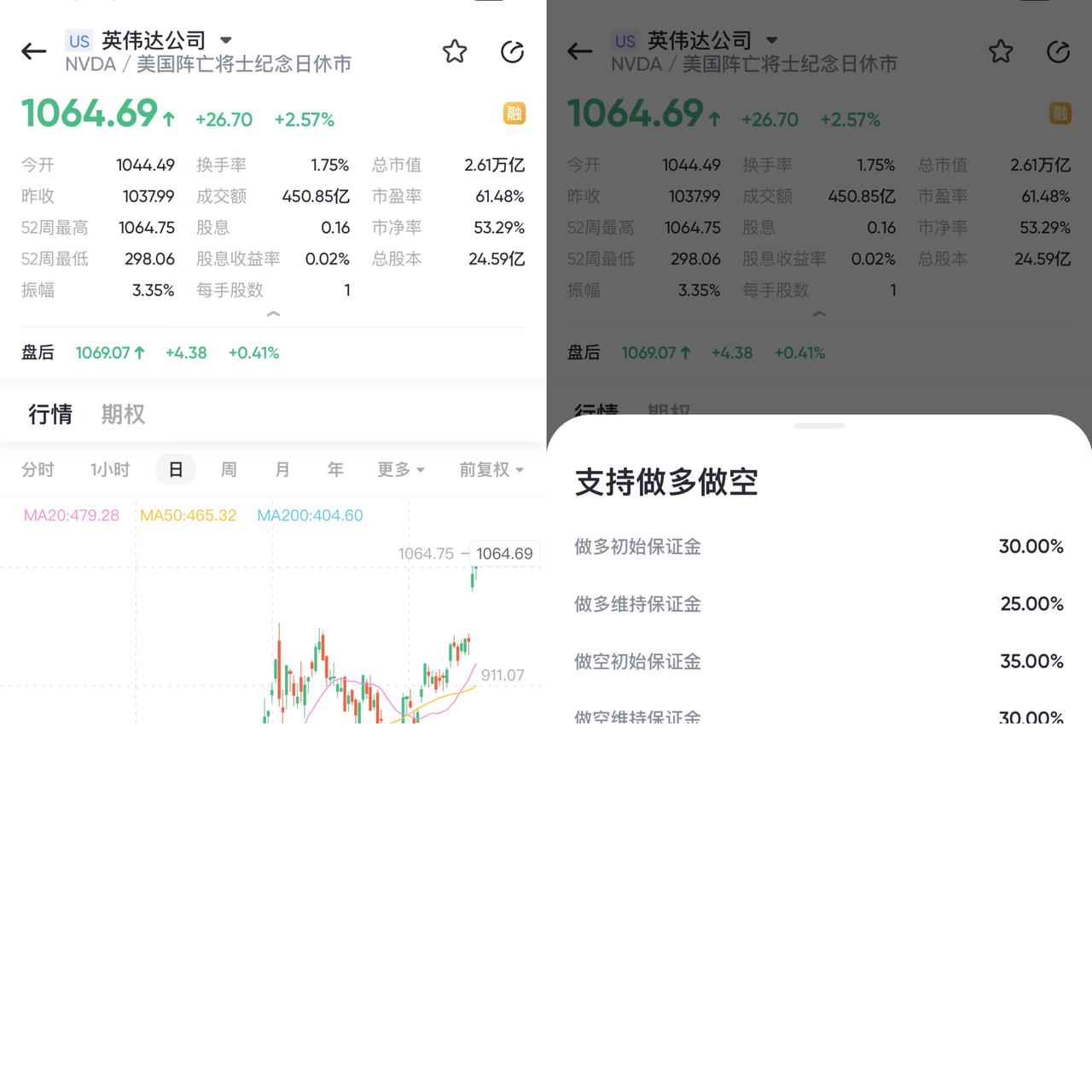

Following the earnings report, NVIDIA’s stock price surged by 9.32%, breaking the $1,000 mark, with a market capitalization reaching $2.61 trillion. This narrows the gap with the highest market cap company, Apple Inc. ($2.91 trillion), to $300 billion. Since the beginning of this year, NVIDIA’s stock price has already increased by nearly 110%.

Following the earnings report, NVIDIA’s stock price surged by 9.32%, breaking the $1,000 mark, with a market capitalization reaching $2.61 trillion. This narrows the gap with the highest market cap company, Apple Inc. ($2.91 trillion), to $300 billion. Since the beginning of this year, NVIDIA’s stock price has already increased by nearly 110%.

NVIDIA: The Investor’s Winner – Is It Too Late to Buy Now?

There’s no denying that investing in NVIDIA (Nvidia) stock has been highly rewarding for long-term shareholders. For years, NVIDIA’s graphics processing units (GPUs) have set the gold standard for serious gamers. However, NVIDIA has adapted its high-end chips to accelerate data transfer speeds within Ethernet networks, making them the go-to choice for data centers and cloud computing. GPUs have also proven their capability in handling artificial intelligence (AI) tasks, with applications spreading rapidly, triggering the recent surge in NVIDIA’s stock.

For investors who have been on the sidelines during NVIDIA’s meteoric rise, what does this mean? Does this market darling still have room to grow, or has the train already left the station? Let’s take a closer look.

Long-Term Performance Record

Without further investigation, it’s easy to conclude that the opportunity to invest in NVIDIA has already passed. However, investors have repeatedly made this mistake over the years. One key to the company’s sustained success is its ability to find new and innovative ways to leverage its technology. NVIDIA’s early work in machine learning and other AI branches laid the foundation for its current success amid the explosive demand for generative AI. NVIDIA’s secret weapon is its mastery of parallel processing, the ability to run numerous mathematical calculations simultaneously. The company pioneered this technology to create realistic images in video games, but it has proven equally adept in data center and cloud computing applications, offering the raw computing power essential for rigorous AI tasks. More pertinent to the current question is that these markets have potential for further growth, which could push NVIDIA’s stock even higher. The company’s recent financial report provides substantial evidence to support this view. In the first quarter of fiscal 2025, NVIDIA generated a record $26 billion in quarterly revenue, up 262% year-over-year. This result was primarily driven by the data center segment, which includes AI, generating a record $22.6 billion in revenue, up 427%. With diluted earnings per share (EPS) of $5.98 soaring 629%, profits remained robust. For investors worried that this rally might be over, NVIDIA’s outlook should allay their concerns. Management expects second-quarter revenue to hit a record $28 billion, up 107% year-over-year. Management also announced a stock split to make the soaring stock price more affordable. While investors shouldn’t expect triple-digit growth to continue indefinitely, it’s clear that NVIDIA’s growth is far from over.

More Growth Ahead

NVIDIA’s two biggest opportunities are in generative AI and data centers. While the adoption of generative AI is robust, it’s still in its early stages. According to global management consulting firm McKinsey & Company, estimates for this opportunity vary widely, but a conservative view suggests that the generative AI market will grow to $2.6 trillion to $4.4 trillion in the coming years. As the leading supplier of AI processors, NVIDIA stands to benefit from this long-term tailwind. Additionally, the data center industry is undergoing one of the largest upgrade cycles ever. Bank of America analyst Ruplu Bhattacharya estimates that the Indian mobile market will see a compound annual growth rate of 50% over the next three years. NVIDIA controls about 92% of the data center GPU market, indicating a long and profitable road ahead. These two markets should continue to drive NVIDIA’s growth. This helps explain the tremendous future opportunities and why it’s not too late to buy NVIDIA stock, even at historical highs.

What About Valuation?

There’s no denying that NVIDIA’s valuation is indeed high. The company currently has a price-to-earnings (P/E) ratio of 89, but this needs context. NVIDIA has posted triple-digit growth for four consecutive quarters and is projecting further growth for the next quarter. These forward-looking numbers are much more reasonable, as NVIDIA’s forward P/E ratio is 39, although still higher than the S&P 500’s P/E ratio of 27. At first glance, the valuation may seem unreasonable, but it’s not an apples-to-apples comparison. As previously mentioned, NVIDIA has outperformed the S&P 500 by ten times over the past decade, thus earning its premium valuation. Considering NVIDIA’s track record, its dominance in the industry, and the enormous future opportunities, it’s easy to understand why NVIDIA’s stock remains a good buy. As an investor, if you’re looking to buy the stock now, you might consider using traditional brokers like Interactive Brokers, Charles Schwab, and Tiger Brokers, or a new multi-asset trading wallet like BiyaPay. BiyaPay allows you to monitor stock prices regularly and buy or sell stocks at the right time. Additionally, BiyaPay supports depositing USDT for trading U.S. and Hong Kong stocks, as well as withdrawing USD and HKD to bank accounts, and transferring fiat currency to other securities for investment.

Overall, NVIDIA’s growth is unprecedented, but this doesn’t guarantee a smooth road ahead. They will face fierce competition from all sides and need to continuously innovate and expand their business to maintain their market leadership.

Conclusion:

In summary, the latest earnings report further confirms NVIDIA’s leading position in the AI chip sector, solidifying its investment thesis. Recently, we’ve seen a proliferation of AI models, and companies are actively integrating AI more closely with their existing workflows. As long as this trend continues, demand for NVIDIA’s products will not be an issue, and its performance and stock price are likely to keep rising. However, it’s important to note that, given NVIDIA’s recent stellar performance, market expectations are very high. Any signs of a slowdown in future performance could trigger market panic, which investors should be aware of.