- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

A Beginner's First Strategy: Using Covered Calls to Profit from U.S. Stocks

In the investment community, stories of overnight wealth are often heard, but unfortunately, most retail investors will not be the protagonists of these stories. For most of us retail investors, instead of dreaming of sudden riches, it is better to diligently run, exercise, and strengthen our physical fitness.

Today, I want to introduce you to the covered call, a basic strategy akin to swimming or exercising. It won’t make you rich overnight, but if used well, it can increase your annual return on long-term holdings by an additional 10%-20%. Those who understand will know what this level of long-term return means.

What is a Covered Call?

A covered call refers to selling one call option on a stock while holding 100 shares of that stock (in U.S. stock options, one option contract typically corresponds to 100 shares). It’s important to note that for every call sold, you must hold 100 shares of the stock, hence the term “covered.” This means you are prepared to have the stock taken away if the sold call becomes in-the-money at expiration and the buyer exercises their right.

The key to this strategy is the “covered” aspect. Selling calls without holding the underlying stock is called selling naked calls, which is extremely risky and not advisable for beginners (limited profit, unlimited loss).

A covered call can generate a steady stream of income while you hold the stock. This income won’t be substantial but is relatively stable, provided your stock isn’t highly volatile. This income gradually reduces your holding cost. Compared to day trading, the cost reduction is slower but is a “why not” operation.

How to Implement a Covered Call

The covered call strategy is very beginner-friendly and simple to execute:

- Hold more than 100 shares of the stock, ideally in multiples of 100.

- Sell an out-of-the-money call for every 100 shares you own, choosing a strike price you are willing to sell the stock at.

- Wait for expiration and repeat the process.

Key points to note:

- Do not oversell. For instance, if you hold 150 shares but sell two calls, one of those calls is naked. If the stock price exceeds the strike price of the naked call, you essentially short 100 shares of a rising stock, which is very dangerous.

- Choose a strike price that you are comfortable selling your stock at. If the stock price reaches this level, let the buyer take your stock. Do not fret about missing out on potential gains.

Profit and Loss Analysis

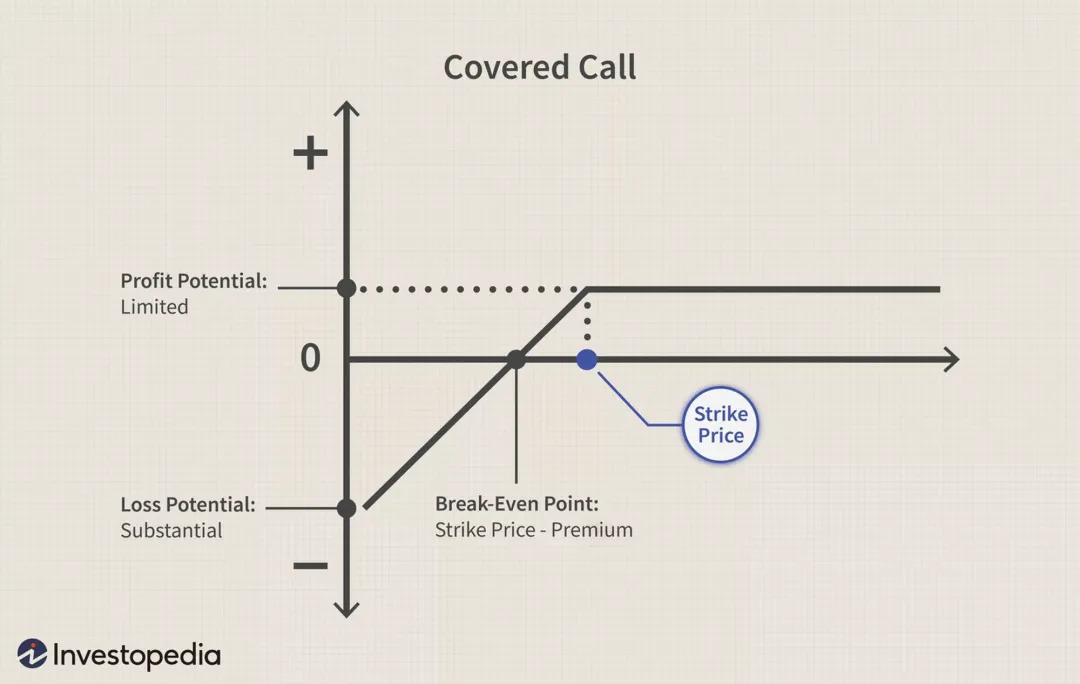

From the profit and loss chart, we can understand several key metrics of this strategy:

- Maximum Profit: The strike price of the sold call minus the cost of the stock plus the premium received from selling the call. This is calculated based on the entire position being closed, thus the maximum profit occurs when the stock price reaches the strike price.

- Maximum Loss: The purchase cost of the stock minus the premium received from selling the call. In extreme cases, if the stock goes to zero, your overall position’s return is just the premium received from the call.

The remaining question is how to choose the “strike price.” For those familiar with options, the Greek letters can guide this choice. For those not familiar, the simplest way is to choose a price you are willing to sell the stock at.

Typically, a covered call is suitable when the stock is moderately rising. If the volatility is too high, the stock might get called away, which is not ideal for long-term holders. If the stock price is falling, the loss from the stock’s decline will far exceed the premium received from selling the call, necessitating other rescue or hedging strategies.

You can also use the delta of the option, where delta can be approximated as the probability of the option expiring in-the-money. For example, a delta of 0.2 suggests a 20% chance of the option being in-the-money at expiration. If you don’t want the stock to be called away, choose calls with lower probabilities.

Practical Example

Let’s illustrate this with an example. Suppose I hold shares of Alibaba (BABA), with the last trading day’s closing price at $80.48. If I sell a call with a strike price of $90 expiring in a week for a premium of $34, there are two scenarios at expiration:

- If BABA’s price does not exceed $90, the buyer won’t exercise the option. Ignoring the stock’s movement, I’ve earned $34 in five days, a 2.13% return.

- If BABA’s price rises above $90, say to $95, the buyer exercises the option. I must sell the stock at $90. My profit calculation: $90 - $80.48 = $9.52 per share * 100 shares = $952 + $34 premium - $500 missed profit = $486 net gain.

After reading the example, you might be dissuaded from using covered calls. While option sellers have limited profit and unlimited risk, don’t forget that they also have a high success rate. Utilizing the high win rate, you can frequently sell calls to earn stable income, offsetting potential stock declines.

In essence, the covered call strategy sacrifices some upside potential for a higher probability of returns. The strike price is effectively your take-profit level. If the stock is called away, do not regret; instead, be pleased as you have achieved your planned profit.

You can execute U.S. options on various platforms like Interactive Brokers, Charles Schwab, Tiger Brokers, and the recently launched BiyaPay, offering U.S. and Hong Kong options trading. Feel free to practice what you’ve learned with these tools.