- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Don’t Use Stock Trading Mindset for Options Trading: Here’s How True Experts Master Options!

Many people say that trading options is a form of gambling, with high risks and high rewards, but this perspective is more common among beginners. For experts, options can actually be a tool for stable profits. So, what differentiates beginners from experts?

The real gap between beginners and experts is not in their investment judgments but in their way of thinking. Many new option traders come from stock trading backgrounds and tend to apply typical stock trading mindsets to options trading, which is the core reason for their repeated failures. In contrast, true option traders have entirely different ways of thinking and methods.

It’s not that these methods are particularly profound, but without guidance, beginners often struggle to grasp them on their own. This can lead to significant financial losses and might even cause them to give up before experiencing the true power of options. Therefore, today I will unveil the mindset of true experts and the comprehensive methods behind it. Although you won’t immediately become an options expert after reading this, it will definitely help you avoid many pitfalls in options trading.

What is the Stock Trading Mindset?

Firstly, beginners habitually use the stock trading mindset to trade options. This approach is straightforward—thinking in terms of bullish or bearish trends, because stocks can only go up or down. For example, being bullish means buying a call, and being bearish means buying a put. Somewhat more advanced traders might consider the time frame for their bullish or bearish outlook.

For instance, you might anticipate a price increase within a week or a month. Taking it a step further, you might predict a specific price range within a certain time frame. For example, you might think Apple can rise from $180 to $200 in the next month and wonder how to maximize your profits using options.

However, all these strategies are still confined to stock trading thinking.

What is the Options Trading Mindset?

True options traders do not only focus on stock prices. They look for trading opportunities from multiple dimensions, such as time volatility and the rate of price changes. All these dimensions are represented by the commonly used Greek letters, each representing a layer of thought.

This might sound complicated, but the trading logic behind these Greek letters is straightforward, though many people don’t think about it this way. Next, I will reveal some core trading logics used by experts. You’ll find that once you understand the trading logic behind these Greek letters, the number of trading opportunities you see will multiply.

The Most Basic Greek Letter: Delta

Let’s start with the most basic Greek letter, delta, which is related to stock price changes. Instead of focusing on its definition, let’s consider how stock price changes affect options trading logic.

Price changes are a familiar concept for novice traders. They use price predictions to determine strike prices and expiration dates. For example, if you expect Tesla to rise from $180 to $200 in the next month, you might buy a $190 call expiring in a month, hoping to profit if the stock reaches $200.

This approach is understandable but represents a typical stock trading mindset. Experts, while also considering price changes, have a different logic.

Most of the time, experts do not care about the exact price increase or how long it takes. They focus on how price changes impact option prices. What does this mean?

For instance, if the stock price increases by one dollar, how much does the option price change? This effect on option prices due to stock price changes is what delta measures.

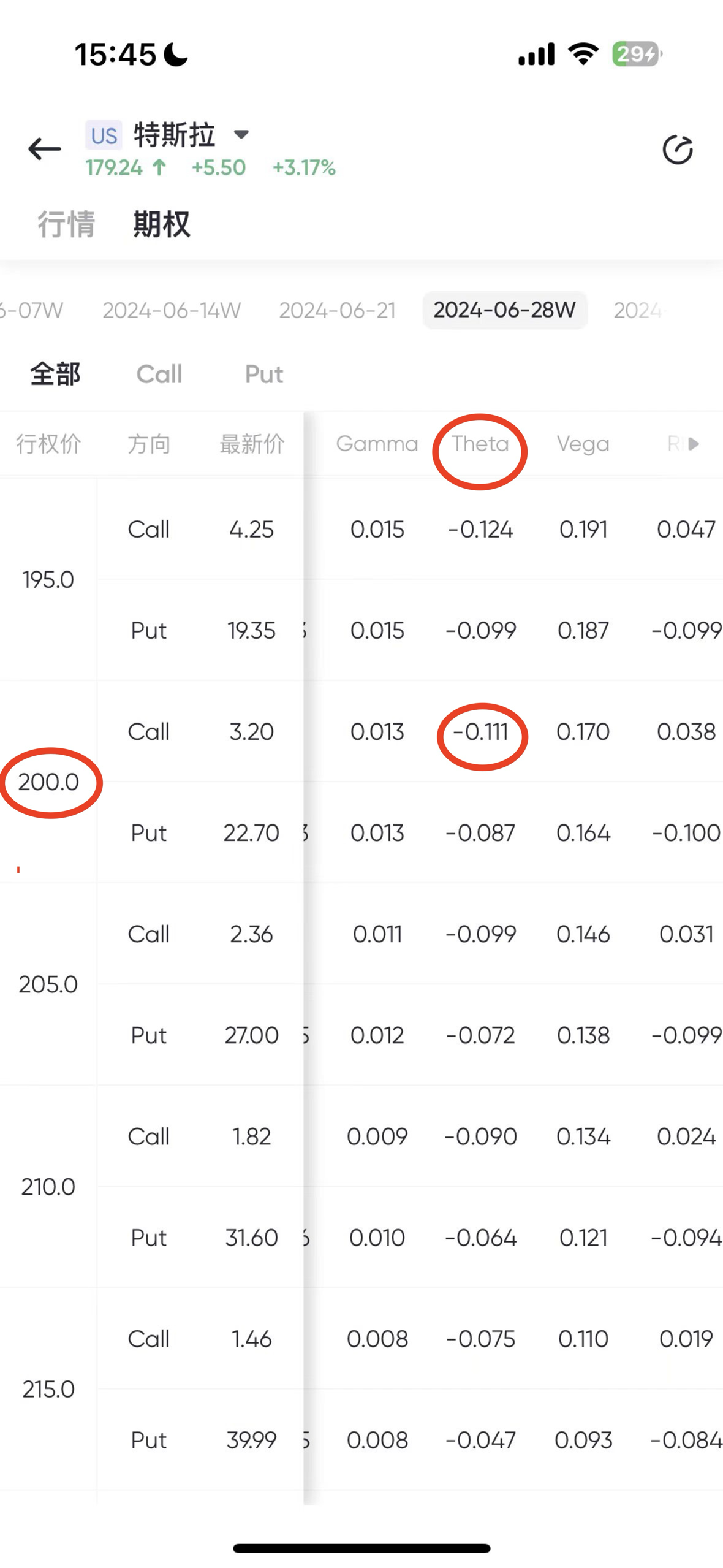

Here’s an example from a Tesla options chain provided by the multi-asset trading wallet BiyaPay, showing the delta values for various strike prices. For instance, a call option with a $200 strike price has a delta of 0.239, meaning if Tesla’s stock price rises by one dollar, the option price increases by $0.239. Similarly, a call with a $195 strike price has a delta of 0.298, indicating a $1 stock price increase would boost the option price by $0.298.

Clearly, delta reflects the strength of our bullish outlook quantitatively. If you are confident about a price increase, you might choose a higher delta option. Of course, while you gain more profit potential, you also assume more risk proportionately. If the stock price drops by one dollar, a $170 call would lose $0.692.

Using delta, we can quantify our bullish outlook and assess the risk we are willing to take.

How to Use Delta for Options Judgments?

With delta, you no longer need to focus on whether the stock price will reach $195 or $200. Instead, you can determine if the delta provides sufficient bullish leverage. Would you prefer a delta of 0.24 or 0.3? This approach simplifies decision-making and enhances your options trading strategy.

Besides delta, another advanced dimension called gamma impacts options prices. However, gamma’s application is more complex and will not be covered today.

The Logic of Making Money with Time: Theta

The highest-level experts often make money using theta, leveraging time to their advantage. These experts earn stable returns over long-term investments by letting time work for them. How does one make time their ally? The logic is simple and can be illustrated with an example.

Options are agreements betting on price movements over a specific period. As time passes, even if the stock price remains unchanged, the value of this agreement declines. This rate of decline is quantified as theta.

Returning to our Tesla options chain, a call with a $200 strike price has a theta of -0.111, meaning its value drops by $11.1 each day due to time decay alone. Similarly, a call with a $195 strike price has a theta of -0.124, translating to a daily value drop of $12.4.

For call buyers, time decay is unfavorable since they lose value daily even if nothing happens. Conversely, for sellers, time decay is advantageous because they earn this daily decay.

Using Theta to Formulate Strategies

A classic strategy leveraging theta is the covered call strategy, where you sell a call option while holding 100 shares of the underlying stock. Notably, beginners and experts approach this strategy differently.

Using Tesla as an example, if a beginner unfamiliar with theta executes a covered call, they might choose a $200 strike price for a call expiring in a month, expecting Tesla’s price not to exceed $200. This way, they keep the premium if the stock stays below the strike price.

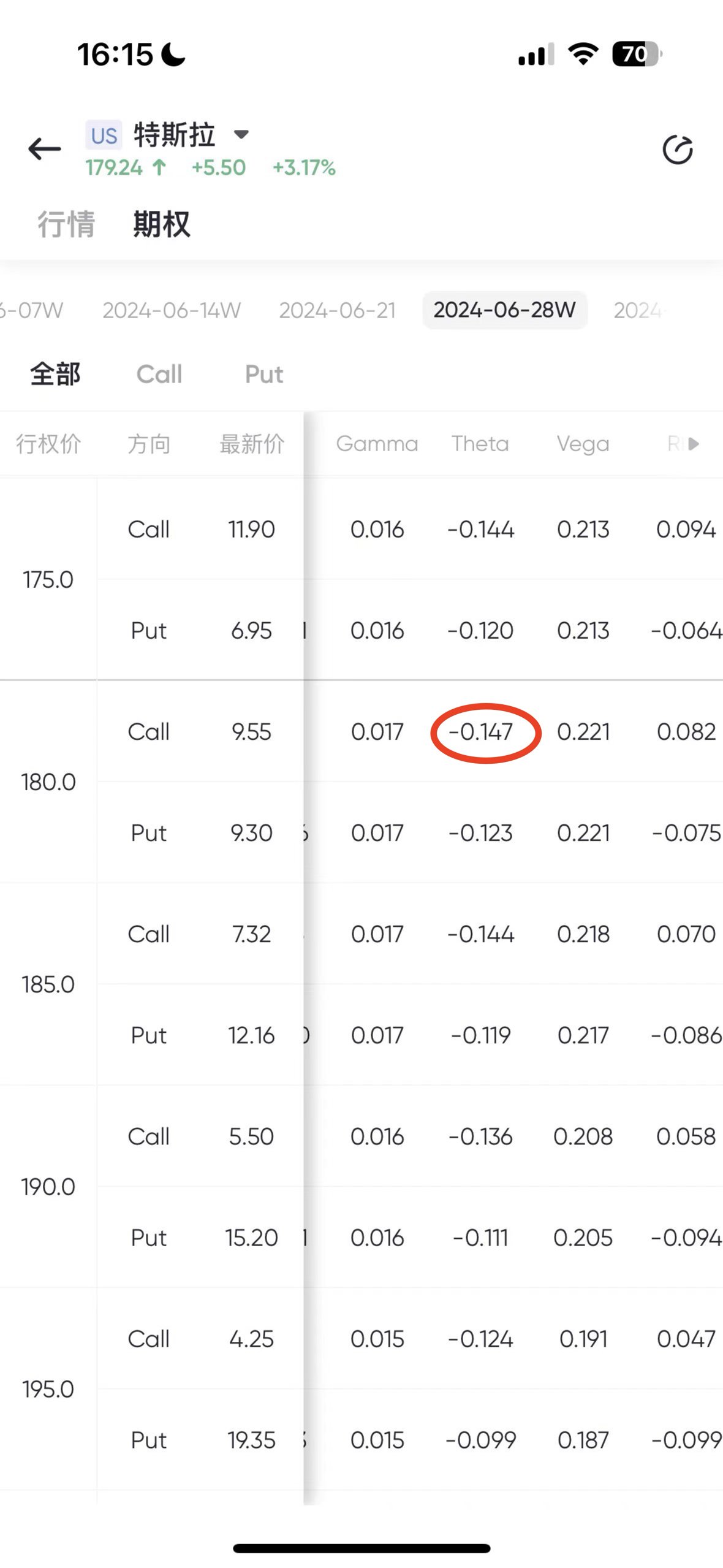

In contrast, experts who understand theta often sell at-the-money (ATM) calls, like a $180 call when Tesla’s price is $179. While this seems illogical to beginners, experts do it to maximize the income from time decay.

Observing the Tesla options chain, you’ll see the highest theta at the $180 strike price, nearly 30% higher than the $200 call. This difference grows with time, and experts exploit this to maximize stable returns from time decay.

Conclusion

In options trading, understanding stock prices, time decay, and volatility—three key factors influencing option prices, collectively known as the three elements of options—is crucial. Experts focus on these elements’ changes during the holding period, unlike beginners who focus on the final stock price at expiration.

Greek letters quantify these changes, allowing experts to evaluate returns and risks comprehensively and adjust their strategies accordingly.

Finally, wishing you a prosperous investment journey and early financial freedom.