- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Xpeng Motors Ushers in the AI Smart Driving Era, Stock Price Soars

On May 21st Beijing time, XPeng Motors (NYSE: XPEV; 09868.HK), which is listed on both the US and Hong Kong stock markets, released its Q1 2024 financial report after the Hong Kong and US stock market hours.

Xiaopeng’s financial report can be said to have saved the stock price of new energy vehicle startups.

Because on the 20th of the previous day, Li Auto released its Q1 2024 financial report and Q2 delivery guidance, which triggered a sharp drop in Li Auto’s US stock price, with a drop of more than 16% at one point during the day. Subsequently, Li Auto’s Hong Kong stock also fell nearly 20% during the day on the 21st.

Due to the impact of Li Auto’s financial report, the stock price of XPeng Motors in the US stock market fell by more than 3% before the release of the financial report. With the release of the financial report, the pre-market stock price of XPeng Motors rose sharply, with a pre-market increase of more than 8%. With the explanation of XPeng Motors’ management during the financial report call, the stock price rose sharply after the opening, with an increase of more than 26%.

However, XPeng Motors’ stock price did not stabilize its early gains that day. After a brief rise and fall in early trading, XPeng Motors closed up 5.92%.

XPEV Market Trend

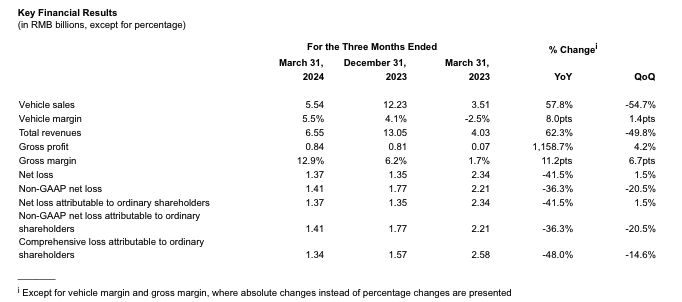

According to the financial report, XPeng Motors’ total revenue this quarter was 6.55 billion yuan, an increase of 62.3% year-on-year compared with 4.03 billion yuan in the same period last year, and its gross profit margin was 12.9%, an increase of 11.2 percentage points year-on-year and 6.7 percentage points month-on-month.

As of March 31, 2024, the total delivery volume of Quarter 1 was 21,821 vehicles, an increase of 19.7% compared to 18,230 vehicles in the same period of 2023.

In addition, XPeng Motors also made an expected report on the delivery volume in the second quarter. It is expected to deliver 29,000-32,000 vehicles in the second quarter, a year-on-year increase of 25% to 37.9%. It is expected that the total revenue in the second quarter will be between 7.50 billion yuan and 8.30 billion yuan, a year-on-year increase of 48.1% to 63.9%.

Through the financial report, it can be seen that in such a fiercely competitive market environment, XPeng Motors still has a positive upward trend in sales, revenue growth, and loss control, which to some extent demonstrates the strong competitiveness of its products and the continuously improving market acceptance.

So, what efforts has XPeng Motors made for this? How did its business model develop?

Collaboration with Volkswagen Boosts Market Competitiveness

On July 23, 2023, Xpeng Motors announced a $700 million investment from Volkswagen, with plans to co-develop electric vehicles in China. Post-transaction, Volkswagen will hold about 4.99% of Xpeng Motors’ shares. This deal set the stage for Xpeng’s strong Q1 2024 financial report, with recurring revenue and profits stemming from R&D services provided to Volkswagen.

Charles Zhang, Vice President of Investment, mentioned that revenue from the partnership with Volkswagen’s platform software has been recorded under services and other income for the first quarter, totaling several hundred million yuan. This revenue is expected to grow each quarter, generating a substantial profit margin for the company.

According to the financial report, services and other income reached 1 billion yuan, marking a 93.1% year-on-year increase and a 22.1% quarter-on-quarter increase. The gross profit margin was 53.9% (compared to 29.6% in the same period in 2023 and 38.2% in Q4 2023). The high gross profit margin from providing platform and technology R&D services to Volkswagen is evident from these changes.

The chairman of Xpeng Motors stated:

“Through our strategic partnership with Volkswagen Group, Xpeng Motors has pioneered the export of our self-developed intelligent technologies. Our leading technologies will gain greater market influence and deliver better financial returns.”

Additionally, Xpeng and Volkswagen have engaged in joint procurement to lower their supply chain costs. This collaboration helps achieve economies of scale and reduce corporate expenses, thereby optimizing the company’s financial expenditures to some extent.

Leading the AI Smart Driving Era with Unlimited Growth Potential

In addition to the favorable backing from Volkswagen, Xpeng Motors is actively leveraging its own strengths, showing immense potential for future growth. With the rapid advancement and widespread adoption of large AI models, smart vehicles are now at the forefront of AI applications. The automotive industry is transitioning from “software-defined vehicles” to “AI-defined vehicles.” Embracing this trend, Xpeng Motors announced the global debut of its AI Tianji system on April 25, marking its comprehensive entry into the AI era.

Xpeng’s AI Driver, part of its AI smart driving initiative, has achieved significant improvements in visual perception and control capabilities, enhancing user experience with AI driving assistance and AI parking. The AI driving assistant, powered by robust autonomous learning, can accurately remember driving routes during manual driving sessions.

Intelligent driving technology is now a crucial aspect of the automotive industry’s development. Chairman and CEO He Xiaopeng stated:

“Our smart driving team plans to expand by 4,000 members in 2024. Xpeng Motors will invest 3.5 billion yuan in intelligent R&D, with annual spending on computational power training exceeding 700 million yuan. Our future products will boast better functionality. I believe our new brand will surpass Xiaomi SU7 in sales in the latter half of this year.”

This highlights Xpeng’s commitment to advancing in the AI smart driving domain, continuously boosting product competitiveness. The new brand is expected to compete directly with established brands like Geely, BYD, and Changan, with promising prospects.

Additionally, Xpeng Motors is actively expanding its global footprint. Following its entry into the German market, the company has been accelerating its internationalization efforts. Recently, Xpeng reached an agreement with Malaysia’s Sime Darby Group to enter the Hong Kong market. The main vehicle models are expected to debut in Hong Kong mid-month, with deliveries starting two quarters later. The company has also partnered with Australia’s TrueEV to penetrate the Australian market.

In Q4 this year, the G6 SUV is set to debut in Australia. By collaborating strategically with various distributors, Xpeng Motors can reach a wider and more diverse customer base, suggesting continued growth in delivery volumes.

Insights on the Investment Market

In summary, Xpeng Motors is currently sustaining its investment in AI research and development and its partnership with Volkswagen. Its revenue and stock price are on an upward trajectory, poised to capture more market share in the future. While heavily investing in R&D, Xpeng is also actively expanding its market share by partnering with various distributors to reach a broader consumer base. As a result, it’s expected that the company’s delivery volumes will continue to rise.