- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

# NetEase, the dominant player in the gaming field, is its stock price still undervalued? What are t

Source:Seeking aphla

Editor:BiyaPay Finance

Summary

- NetEase Inc. has a large portfolio of mobile games that contribute to over 80% of its revenue.

- The company is diversifying into other industries, such as educational services, to capture market share.

- This article focuses on the fundamentals, the real value versus the current share price, and if NetEase is currently worth investing in.

Mobile gaming has changed the industry ever since its creation. NetEase, Inc. (NASDAQ:NTES) has a large portfolio of mobile games that contribute to over 80% of its revenue. The gaming portion of the business continues to grow every year. NetEase also diversifies into other areas such as educational services with the product Youdao.

Youdao so far has been a mixed bag but does show the company’s willingness to diversify its products and attempt to capture market share in other industries that still fall into the tertiary realm of core competencies. Even if the expansion into other markets such as the Western gaming market fails, the company still maintains a diverse portfolio of mobile games with high-potential value games in the pipeline that will drive continued growth.

When considering these current stories about NetEase, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price. NetEase maintains a solid portfolio of mobile games that generate high revenue and high gross margins. The company is also investing in expansion and continues to grow revenue with its staple of mobile games for many different genres. It’s not all rosy for the company, Regulation continues to be a possible dent to the company’s profits and the investment into the Western market with PC games is not a guaranteed success. Most of the news surrounding the company outside of regulation concerns remains positive and paints a positive outlook for the company.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you to determine if NetEase is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my personal opinion about whether I’m interested in taking a position in this company and why.

Snapshot of the Company

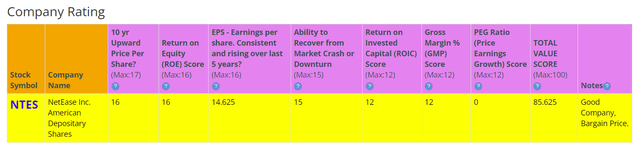

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. NetEase Inc shows a rating score of 85.625 out of 100, which indicates strong fundamentals.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

Fundamentals

The share price has seen a fairly consistent rise over the last 9 years. This makes sense due to the steady revenue growth and continued release of successful mobile games. The company has displayed expertise in the mobile gaming space. I expect growth to continue as the company looks to expand and continues to release mobile games. This upward stock price trend should continue as long as regulations do not crater its stock price. I do not expect other headwinds in changing customer gaming preferences or saturation to impact the company’s trajectory. Overall, the share price average has grown by about 336.89% over the past 10 years, or a Compound Annual Growth Rate of 17.8%. This is an impressive return.

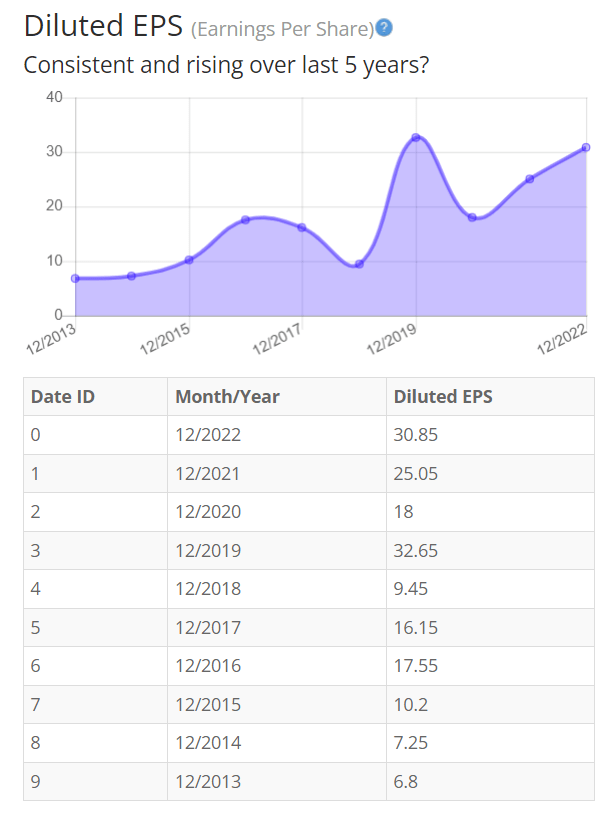

Earnings

Earnings have continued to rise in parallel with the rising stock price. This is driven by the rising revenues and profit of the company. The current EPS would be an all-time high if not for the spike during COVID-19. Aside from regulation, the EPS could decline with new privacy rules driving up user acquisition costs. So far NetEase has not experienced any impact here, but it is something to keep in mind in the short term as privacy remains a big area for government involvement.

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

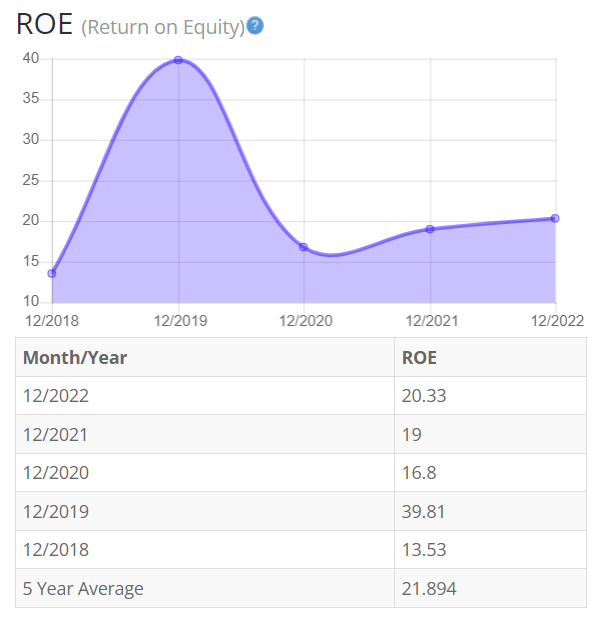

Return on Equity

The return on equity has declined in the last few years. This is driven by increasing retained earnings from profits not being utilized for dividends or investments. It is not ideal to have a company holding on to earnings and not utilizing it to grow, but the company is such a leader in the space, investments may not be needed at this time. I would like to see the company continue to expand and grow its gaming pipeline to improve its ROE. For return on equity (ROE), I look for a 5-year average of 16% or more. So, NetEase Inc exceeds this requirement.

Let’s compare the ROE of this company to its industry. The average ROE of 84 Software Entertainment is 23.26%.

Therefore, NetEase Inc 5-year average of 21.89% is similar to its peers.

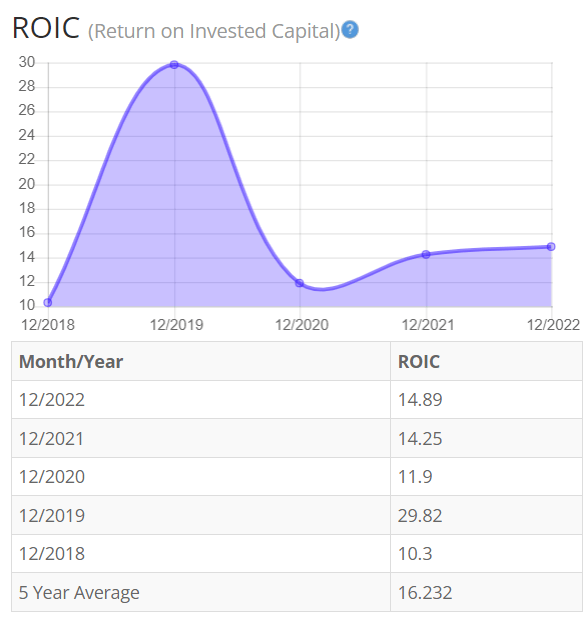

Return on Invested Capital

The return on invested capital has declined from its all-time high. This may look concerning, but when we take into consideration the outlier year of Covid-19, the chart shows an increasing trend. Capital expenditure has seen a steady increase in recent years and the ROIC is still higher compared to previous years when removing the outlier. Overall, I see the ROIC as a good sign for the company and a strong indicator that the company invests well.

For return on invested capital (ROIC), I also look for a 5-year average of 16% or more. So, NetEase Inc exceeds this requirement.

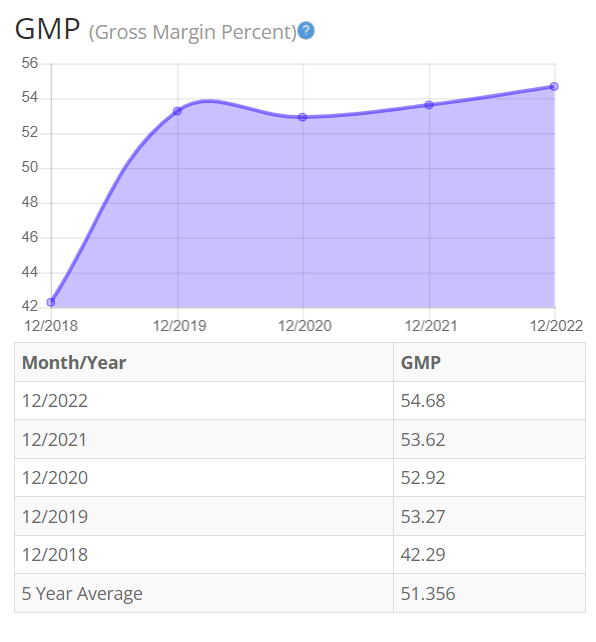

Gross Margin Percent

The gross margin percentage (GMP) has grown in recent years and remains strong. Continued excellence in the gross margin shows an excellent return on NetEase Inc’s profits. Most of the rise of NetEase’s gross margin is driven by self-developed games that remove costs associated with outsourcing talent in development. I expect this to continue as the company looks to maintain its competitive advantage not just in core competency building these games but also in cost.

I typically look for companies with gross margin percent consistently above 30%. So, NetEase Inc is above this criterion.

Financial Stability

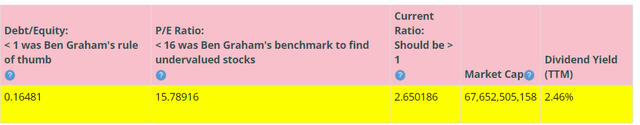

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is less than one. The company shows low long-term debt and the ability to raise more capital if need be.

NetEase’s Current Ratio of 2.65 indicates it can pay off short-term debt with its current assets.

Ideally, we’d want to see a Current Ratio of more than 1, so NetEase exceeds this amount.

NetEase shows a strong balance sheet and all you could want to see for a healthy company. NetEase can call on additional liquidity and continue to pay its debts with its cash reserves if need be. I would like to see some more investment and usage of these cash reserves in the future, especially with a company that seems to have rising success in getting a return on its investments.

NetEase currently pays a dividend of around 2.4%.

This analysis wouldn’t be complete without considering the value of the company vs. share price.

Value Vs. Price

The company’s Price-Earnings Ratio of 15.78 indicates that NetEase Inc is fairly priced when comparing the NetEase Inc Ratio to a long-term market average PE Ratio of 15.

The 10-year and 5-year average PE Ratio of NTES has typically been 24.5 and 26.7, respectively. This indicates that NTES could be currently trading at a low price when comparing to its average historical PE Ratio range.

The Estimated Value of the Stock is $136.30, versus the current stock price of $98.90. This indicates that NetEase Inc is currently selling below its value.

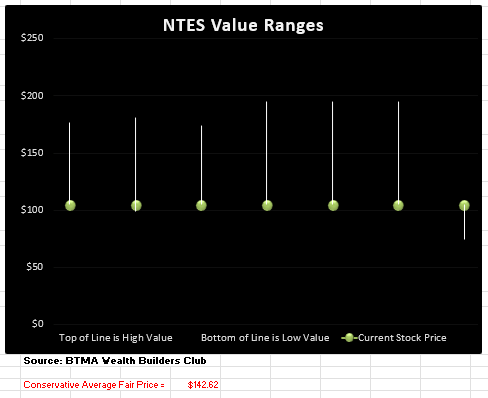

For more detailed valuation purposes, I will be using a diluted EPS of 6.34USD. I’ve used various past averages of growth rates and PE Ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare growth rates of EPS, Book Value, and Total Equity.

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is towards the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this would show an overvalued stock.

According to this valuation analysis, NTES is undervalued in all scenarios except one (valuation based on analysts’ low forward growth).

This analysis shows an average valuation of around $142 per share versus its current price of about $104, this would indicate that NTES is significantly undervalued.

Summarizing the Fundamentals

After analyzing the fundamentals of NetEase Inc, I believe this company is a strong business with healthy fundamentals. The company has rising revenues, gross margin, EPS, and ROIC that would be current highs if not for the COVID-19 spike. One downside is the company not utilizing its large reserves for further investment, which could have grown the company further. This has shown up in NetEase Inc’s declining return on equity. Potential headwinds in privacy, regulation, and saturation in the mobile gaming market could dent the continued rise of NetEase. Overall, I am not concerned in the long term with the success of this company. Its competitive advantage within the mobile gaming space is impressive as it is one of the giants of its industry along with Tencent.

In terms of valuation, my analysis shows that the stock is significantly undervalued.

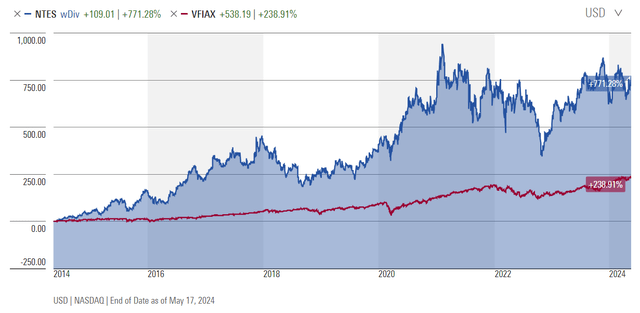

NetEase Inc Vs. The S&P 500

Now, let’s see how NetEase compares versus the US stock market benchmark S&P 500 over the past 10 years. From the chart below, NetEase crushes the overall market in long-term returns. As long as the company keeps on its steady path, this trend should proceed as more mobile games continue to be released. It’s worth noting that the longevity of NetEase games is quite long.

Even in the recent market downturn, NetEase has remained a steady contributor to portfolios over the last few years. These strong returns will continue at least in the short term as long as regulation remains mute.

Forward-Looking Conclusion

Over the next five years, the analysts that follow this company are expecting it to grow earnings at an average annual rate of 2.57%.

However, the average one-year price target for this stock is $132.55, which is about an 26.3% increase in a year.

The Expected Annual Compounding Rate of Return is 13.59%.

If you invest today, with analysts’ forecasts, you might expect about 5% (low growth, including dividend) per year.

Here is an alternative scenario based on NTES’ past earnings growth. During the past 10 and 5-year periods, the average EPS growth rate was about 20% and 6.7%, respectively.

But when considering cash flow growth over the past 10 and 5 years, the average growth has been 19% and 17%, respectively. Therefore, when considering all of these return possibilities, our average annual return could likely be around 13%.

If considering actual past results of NetEase, the story is a bit different. Here are the actual 10 and 5-year return results.

______________

10 Year Return Results if Invested in NTES:

Initial Investment Date: 5/18/2014

End Date: 5/18/2024

Cost per Share: $14.13

End Date Price: $104.97

Total Dividends Received: $9.60

Total Return: 710.83%

Compound Annualized Growth Rate: 23%

_______________

5 Year Return Results if Invested in NTES:

Initial Investment Date: 5/18/2019

End Date: 5/18/2024

Cost per Share: $53.31

End Date Price: $104.97

Total Dividends Received: $7.28

Total Return: 110.56%

Compound Annualized Growth Rate: 16%

From these scenarios, we have produced results from 16% to 23%. I feel that if you’re a long-term patient investor and believer in NetEase, and its existing products (video games, digital media, online education), you could expect NTES to provide you with around at least 13% annual return over the long haul. But for the short-term swing trader or impatient investor, the near future of NTES, might show some volatility as inflation, regulations, and possible restrictions for expanding its games into the USA might arise.

As a comparison, the S&P 500’s average return from 1928 – 2014 is about 10%. So, in a typical scenario with NTES, you could expect to earn a higher long-term return as compared with an S&P 500 index fund. The individual NTES stock obviously doesn’t offer the diversification that the index fund does, but NTES has proven that it is a consistent performer over the long run, and it could provide some diversity outside of the US focused stocks.

Is NetEase Inc Currently Selling at a Bargain Price?

1.Price Earnings less than 16? Yes (15.78)

2.Estimated Value greater than the Current Stock Price? Yes (Value $136.30 >$104.97 Stock Price)

NetEase is a strong contender for any investor’s portfolio in the short and long term. Continued rising revenue and gross margin with expansion plans to continue to grow, are all positive signs the company is healthy and has a potential runway to prosper.

I would like to see the company utilize its retained earnings more to propel the stock to further growth, especially because the company has a good track record of generating return on investments. Aside from that, the company is in a strong position to continue to deliver hefty returns to investors over the long run.

I’m interested in entering a position in this company. I think NTES is solid fundamentally and is a strong incumbent in a growing industry.

I feel that the uncertain risk of restrictions and regulations are outweighed by the benefits of owning this solid and consistently performing cash-heavy company.