- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Nvidia: AI Will Be An Integral Part Of Our Lives, Not A Short-Lived Hype

Source:Seeking aphla

Editor:BiyaPay Finance

Summary

- Nvidia Corporation’s fundamental growth has driven the strong price appreciation and performance of Nvidia stock over the past several years.

- Market forecasts predict high-growth rates for the AI industry, with the healthcare sector expected to be the biggest beneficiary by 2030.

- I think NVDA stock’s valuation is attractive given what the market is pricing in and what the future growth opportunities are.

The Nvidia Investment Thesis

In early January of this year, I wrote my first article about NVIDIACorporation (NASDAQ:NVDA) with the provocative title: “Nvidia Is Still Misunderstood By A Lot Of Investors.” And in the article, I explained my opinion that artificial intelligence (“AI”) is not a passing hype, but will be an integral part of our lives in the future, and therefore Nvidia stock is attractively valued.

And even today, I still find it funny when people come up with the argument that Nvidia’s sales multiple is so high, when this is a company that generates earnings, and therefore an earnings multiple makes much more sense. Eventually, it is the earnings that matter, and Nvidia is making a lot of them right now.

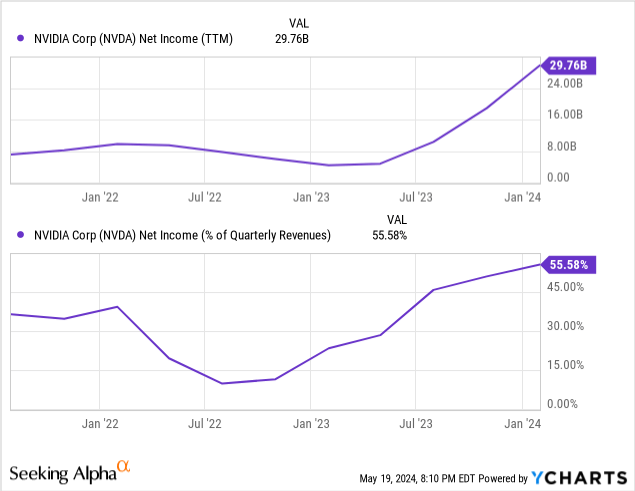

And if we look at net income and net income margin, they both speak a clear language. Both are on a steep upward trajectory, as has been the case with Nvidia stock over the last few years.

Plus, if we look at the market forecasts and Nvidia’s position in terms of market position and competitive advantages, I think the future looks bright, and I think expectations will be exceeded and especially the second half of 2024 will be strong in terms of business. Therefore, I believe that this week’s corporate earnings (released after the close on Wednesday, May 22nd) could surprise to the upside.

What Are The Market Forecasts?

According to PricewaterhouseCoopers, artificial intelligence could contribute up to $16.7 billion by 2030. And this will be achieved primarily through improvements in labor productivity, but also because the personalization and cost of AI offerings are likely to become more affordable over time.

Statista, in partnership with Next Move Strategy Consulting, estimates that the AI market will be around $2 trillion by 2030, and Grand View Research sees the market growing at a CAGR of ~36% from 2024 to 2030. In particular, Grand View Research sees strong advances in the areas of artificial neural networks, generative adversarial networks, and single-shot multi-box detectors, which have driven the adoption of AI.

One negative point they see, however, is the high degree of impact that regulation could have, which could have a big impact on the development of the market. And they see the healthcare sector, with its sub-sectors such as robotic surgery, pre-diagnostics and other automated processes, as the biggest beneficiary by 2030.

All 3 reports agree that the market created by AI offers enormous opportunities for the future and that we can expect high growth rates in the coming years. And nations around the world are recognizing the potential: The world’s fourth-largest economy, Japan, has partnered with Nvidia to build the infrastructure for generative AI in the country.

Do The Results From Companies Also Working With AI Shed Any Light On How Nvidia Might Fare?

The demand for high-bandwidth memory used with Nvidia GPUs for artificial intelligence servers continues to be strong. For example, to meet the greatly increased demand from generative AI, Samsung Electronics (OTCPK:SSNLF) intends to increase its supply of HBM.

SK Hynix is also focusing its capacity on AI memory, indicating that AI memory will continue to be in high demand, as the company stated in its announcement. And it looks like SK Hynix’s HBM is already fully booked until 2025, with the expectation that data centers, where Nvidia is a leader, could face competition as on-device AI applications become something SK Hynix will focus on in the future.

TSMC (TSM) also appears to be at full capacity for the next two years as Nvidia and Advanced Micro Devices Inc (AMD) need to meet their high demand. And sales between January and March were up 16.5% over the same period last year. Which suggests that Nvidia is likely to have good results as well.

However, the most encouraging news for AI investors was that TSMC surprised with a YOY growth rate of 59.6% in April. This means, in my opinion, that Nvidia’s April numbers, which will unfortunately be released later, should also be strong. As a result, I could see Nvidia’s guidance for the next quarter or the full year coming in strong.

It is also worth noting that almost all the Magnificent 7 mention NVIDIA in their earnings calls, which underscores the importance of this company. For example, Google (GOOG) mentioned the following:

We offer an industry-leading portfolio of NVIDIA GPUs along with our TPUs. This includes TPU v5p, which is now generally available, and NVIDIA’s latest generation of Blackwell GPUs.

And it seems to me that one of the things that is important is to show the shareholders that you have a good number of Nvidia GPUs so that the shareholders know that you will be competitive in the AI space in the future.

And according to my research, Nvidia is mentioned more often than AMD, but in fairness, AMD is also mentioned in the earnings calls of the major companies. So both seem to have a strong position that other companies see.

Nvidia Stock’s Valuation

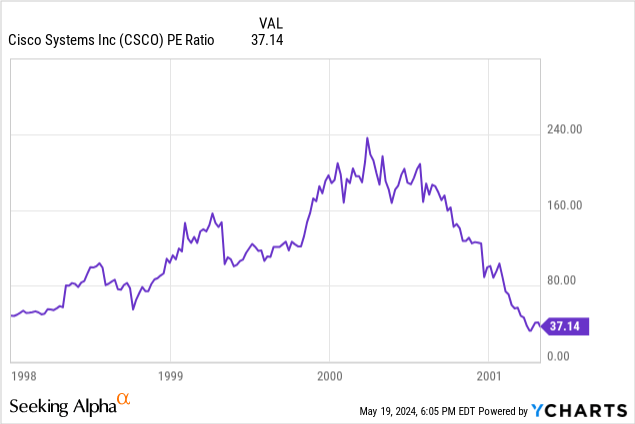

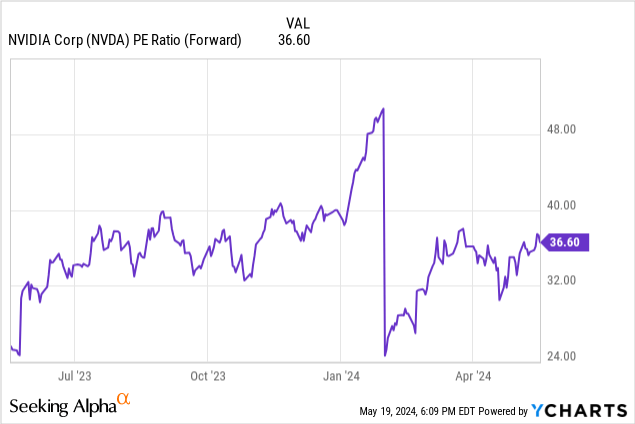

I have often read that Cisco Systems Inc. (CSCO) and the dotcom bubble have been compared to Nvidia, and in my opinion that does not make much sense. Cisco had a P/E ratio of almost 240x before the crash, which means that a lot of the gains were due to multiple expansion, but Nvidia has had a huge explosion in revenue and earnings, which means that the rise is fundamentally driven.

Nvidia’s price-to-earnings ratio has hovered around the same level for the past year, and its current forward multiple of 36x is well below Cisco’s multiple at the time. And with the other companies in the AI space and their manufacturing capacity booked until the end of 2025, I don’t expect Nvidia’s profits to drop anytime soon. Demand still seems to be outstripping supply in some areas of the market.

Given the growth and future growth opportunities, as well as the size of the market, the current multiple seems more than fair.

Capital Allocation And ROIC

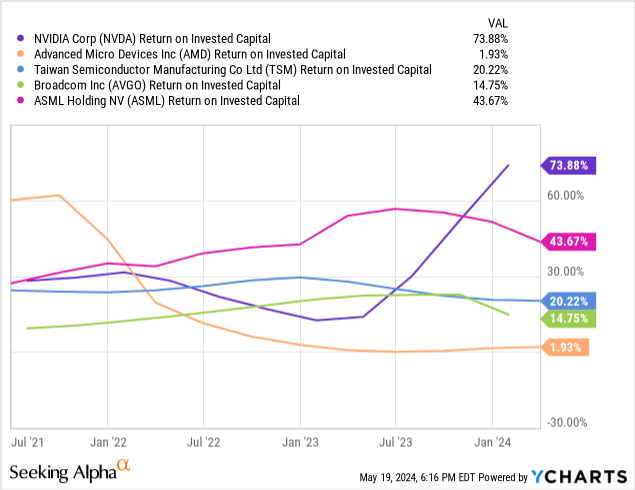

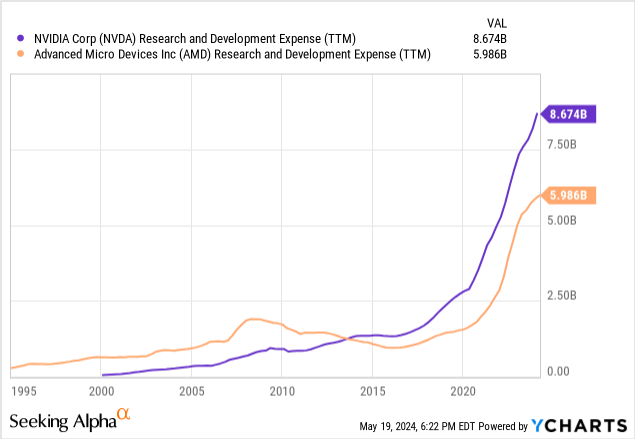

Nvidia’s ROIC is well above the strong competition due to its competitive advantages and its CUDA moat, which currently protects it from AMD. Another advantage, in my opinion, is that Nvidia can invest more in research and development than AMD, which would normally result in Nvidia extending its technological lead.

And not all of AMD’s R&D will be focused on AI or GPUs because they also have to invest in CPUs to maintain their dominance over Intel (INTC). Therefore, I expect Nvidia to maintain its lead for the foreseeable future, as I also expect Nvidia to retain and hire top talent in the AI space. In fact, Nvidia’s Glassdoor employer ratings are excellent, with 98% approving of its CEO and 93% saying they would recommend the company to a friend.

NVDA Stock Reverse DCF

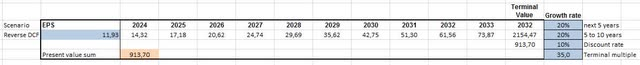

This is based on TTM diluted EPS of $11.93 to see what the market is pricing in via a reverse discounted cash flow (“DCF”).

In contrast to the previous article, the shares have risen slightly more than the underlying earnings, as the market is now pricing in a diluted EPS CAGR of 20% p.a., up from 19% p.a. a few months ago. However, after this week’s results, the diluted TTM is likely to be higher, so the amount priced in will change depending on market reaction.

Historically, however, the historical growth rates are still well above the required 20% per year. And I expect the future CAGR to be above the 20% currently priced in, because growth prospects suggest that historical growth rates may be a good indicator of the future.

The 10-year CAGR is 51.69% and the 5-year CAGR is 48.40%.In this context, the current valuation of the multi-asset trading wallet BiyaPay App is considered acceptable. For those interested in buying, you can search for its code on BiyaPay and trade in real-time online. Additionally, you can deposit digital currency (U) into BiyaPay and then convert it to fiat currency to purchase Nvidia stocks through other securities platforms.

What Are My Expectations For Nvidia Q1 Earnings Results, And What Do I Think Is Important?

I think everyone is aware that Nvidia is going to have a strong year-over-year growth rate, as AI is a hot topic right now and plenty of companies are ramping up in this area. And all the statements on the earnings calls, as well as the quarterly results of other companies, suggest that Nvidia is likely to deliver strong results.

But I think the guidance will be critical because obviously many investor expectations are very elevated. Some are even unrealistically high if you look at what people are expecting on social media. However, I firmly believe that NVIDIA will deliver strong results, but I also believe that the very good results will come in the next quarterly reports.

Foxconn’s (OTCPK:FXCOF) NVL72 liquid cooling rack and Quanta’s NVL36 are expected to make up the majority of the Nvidia GB200 servers that will enter volume production in the second half of 2024. And the GB200 is expected to reach a 70% share by 2025, as its water cooling is expected to reduce power consumption, as energy efficiency has been a criticism of Nvidia’s offerings in the past.

While I think the H100 will have a positive impact on Q1/24 results, the huge impact will probably come from Blackwell in the future because I think Blackwell is far ahead of the competition.

AMD may have a small advantage right now in terms of lower prices, power efficiency, and availability, but when it comes to maximum performance, I think Blackwell has the edge.

But I see both Nvidia and AMD as having an advantage over Intel, and I find both of them interesting, and I think that this AMD vs. NVIDIA thinking is sometimes counterproductive because I think that in the future both of them will find their area where they have advantages, and therefore both of them should be successful in this huge market.

And Intel could also find its niche, since it gets a lot of support and, for example, is supplied by ASML Holding (ASML) with High NA EUV machines that could be very valuable in the future.

Conclusion

So I think Nvidia is very well-positioned going forward because the combination of strong products, high barriers to entry in terms of knowledge, the moat of CUDA, and the focus on KI should protect their profits very well.

So I expect this week’s results to be relatively good, but the guidance for the rest of the year will beat analysts’ estimates because there are a lot of growth drivers in the second half of 2024 and also in 2025. In addition, I believe that the market still underestimates how long and how strongly Nvidia can grow, and therefore I believe that the current valuation is attractive.

The fact that Nvidia is an exceptionally high-quality company with a CEO who is extremely talented at marketing Nvidia is something that I think most people have noticed, and marketing is an important attribute that amplifies the impact of strong products. And for many, the quality of the management team is the most important factor in achieving long-term success, and I think Nvidia can excel here.