- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

"30% Dividend Tax on US Stocks? DRIP Helps Maximize Your Dividend Income, Charles Schwab Users Must

Now, when we talk about investing in US stocks, it has become very convenient. Traditional trading platforms like Tiger Brokers and Interactive Brokers assist you with placing orders, and we have safe and convenient channels for fund transfers (we’ll talk about this later). For newcomers to high-dividend stocks, there’s also the “pre-withheld 30% dividend tax” that no investor wants to give up so much of their investment income. Don’t worry, this article is here to help you solve this 30% dividend tax issue.

Does everyone investing in US stocks have to pay taxes?

If you are a US tax resident (green card holders included), the dividends you receive are taxed between 0%-20%. If the stocks are held for less than a year, capital gains are also included in your personal income tax and calculated at a personal tax rate of “10%-37%” according to US tax laws—the higher your income, the more taxes you pay. If you hold the stocks for more than a year, they are taxed at a favorable rate of 15%.

If you invest in US stocks as a “foreigner,” you will fill out a “W-8 BEN” form when you open an account with a US broker, which represents your status as a foreign tax entity. This means that when you receive dividends from US stocks, the broker will withhold 30% as dividend tax.

Let’s take an example, Suppose you invest in a high-dividend stock, let’s say McDonald’s (MCD), you buy at $100, hold for one year, and sell at $200, during which you receive a total of $10 in dividends. The taxes you would pay are: Capital gains (difference) $200-$100 = $100 (tax-free) Dividends: $10 (before tax) After withholding 30% dividend tax: 10 x (100%-30%) = $7. As a foreign investor investing in US stocks, we can prove our “non-US tax identity” through the “W-8 BEN form.” The advantage is that we don’t have to pay capital gains tax when trading US stocks. No matter how long you hold them, you don’t pay tax on the profit margin, but dividends are still pre-withheld at 30%.

Three Ways to Handle US Dividend Tax

If you’re concerned about this, here are a few ways to avoid it:

Buy ADRs from other countries

The US stock market is the largest in the world, with strong financing capabilities, and many foreign companies also choose to list in the US. These are commonly known as ADRs (American Depositary Receipts). For example, Alibaba is a Chinese company, but it chose to list in the US and raise capital worldwide. Known Chinese company ADRs include,

- Alibaba Group Holding Limited - Ticker: BABA

- Baidu, Inc. - Ticker: BIDU

- JD.com, Inc. - Ticker: JD

- NetEase, Inc. - Ticker: NTES

- Pinduoduo Inc. - Ticker: PDD

- XPeng Inc. - Ticker: XPEV

- Li Auto Inc. - Ticker: LI

- NIO Inc. - Ticker: NIO

- iQIYI, Inc. - Ticker: IQ

- Bilibili Inc. - Ticker: BILI

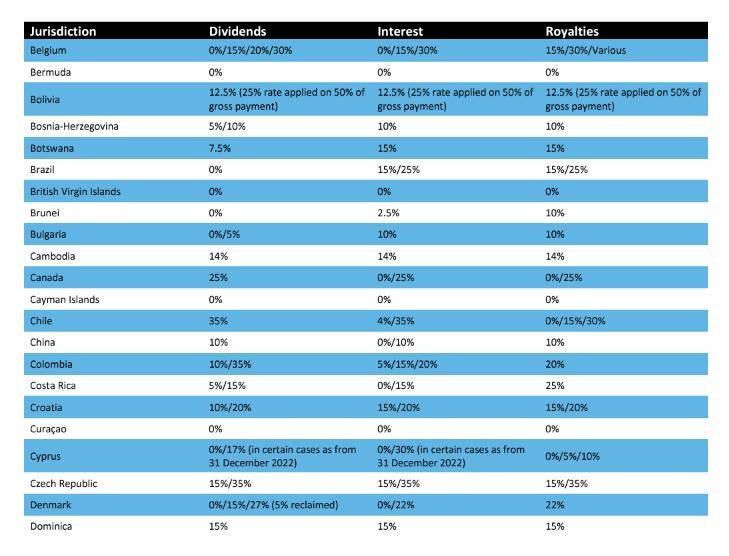

If you buy foreign company stocks listed in the US, these ADRs will charge you dividend tax according to the laws of the company’s original country. Here’s a complete table from Deloitte showing global withholding tax rates for your reference.

Some might say, isn’t the point of investing in US stocks to buy American companies? Choosing non-American stocks seems to defeat the purpose.

Choose Dividend Growth Stocks

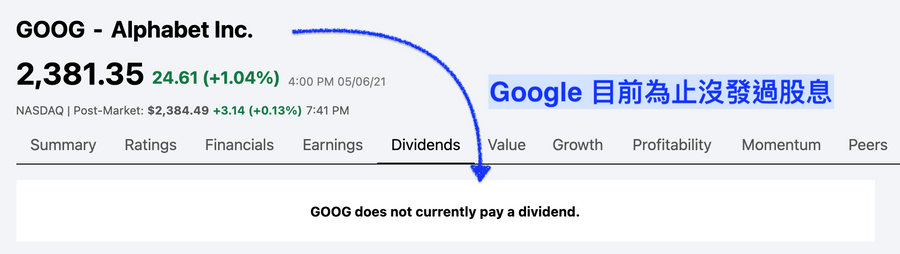

If you want to avoid 30% dividend tax, the most direct way is to avoid high-dividend stocks, which usually don’t distribute dividends. One, “super high-growth companies” like GOOG, META, ADBE, AMZN, etc., these companies usually retain a lot of cash, have high R&D costs, and thus prefer not to distribute cash as dividends.

Two, “poor profitability” companies (such as TSLA, NIO, JD) naturally don’t have money to reward shareholders due to their limited profits, so there are no dividends, and you can only profit from capital gains. It appears that choosing the first type, super high-growth companies, is the better option, at least the stock price is rising. Investing in those dividend growth companies, your dividends will increase over time, and even if taxed, your dividend income will be much more than those stocks without dividend growth. Look at the table below.

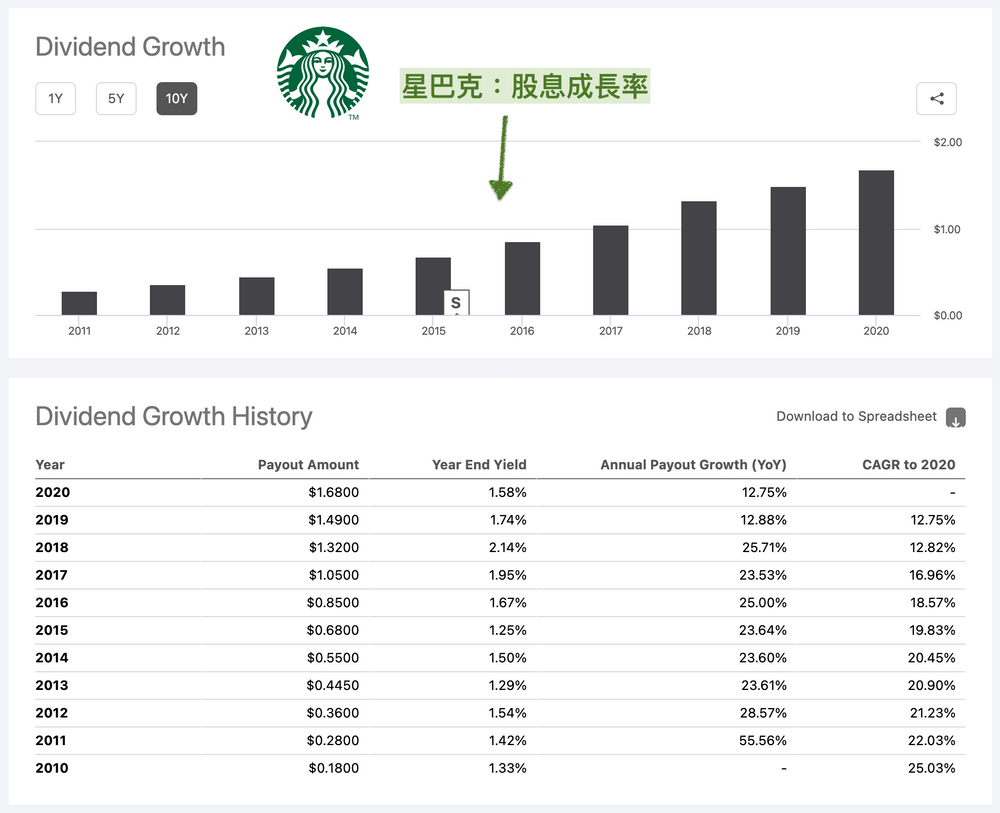

No Dividend Growth (Before Tax) Dividend Growth 10% Per Year (Before Tax) Dividend Growth 10% Per Year (After Tax) Dividends $10 $10 $7 Year 1 Dividend Income $10 $10 $7 Year 10 Dividend Income $10 $25.9 $18.12 This method’s biggest drawback is that it takes a long time to show advantages, depending on whether your investment is for quick gains or to be time’s friend. Taking Starbucks as an example, the dividend grows by about 15%-20% per year.

Dividend Reinvestment Program (DRIP)

30% dividend tax seems high, but should you really give up on potentially lucrative long-term investment opportunities because of it? If you’re concerned about dividend tax, let me tell you a secret known only to experienced US stock traders—Dividend Reinvestment Plan (referred to as DRIP). Simply put, DRIP helps you automatically buy stocks with your dividends. And it has two main features:

- No transaction fees when buying stocks, no friction costs

- Can purchase fractional shares

For many long-term investors, after the initial deposit, they won’t withdraw frequently, but when dividends are distributed, they gradually receive scattered dividends. If you are American, perhaps you would choose to spend it, but if you are a foreigner, these idle funds can only lie in your account, unable to help you generate interest. Little by little, this affects your investment returns. DRIP solves this problem; it allows even scattered funds to be used to buy less than one share, allowing real compound interest for long-term investments while reducing our management costs.

How to Start DRIP?

Below, using Charles Schwab and BiyaPay as examples, we fully explain how to start this function. The steps are as follows,

- Open BiyaPay, click on ‘Transfer Out’ on the homepage, click on “Withdraw to Bank Account”, choose the currency, enter the withdrawal amount, and proceed to withdraw to the bank account provided by Charles Schwab. Next, just wait for the funds to reach Charles Schwab, which can be on the same day if withdrawn during US business hours.

Important to Note After you open an account with Charles Schwab, they will provide you with two receiving accounts, one bank named: JP Morgan Chase for domestic (US) receipts, and another bank named: Charles Schwab Co. Inc for international receipts. Charles Schwab’s domestic receipt account is suitable for small amounts, do not exceed $40,000 per transaction, BiyaPay will use ACH to transfer the funds. Charles Schwab’s international receipt account can handle transactions over $40,000, BiyaPay will use wire transfer for these.

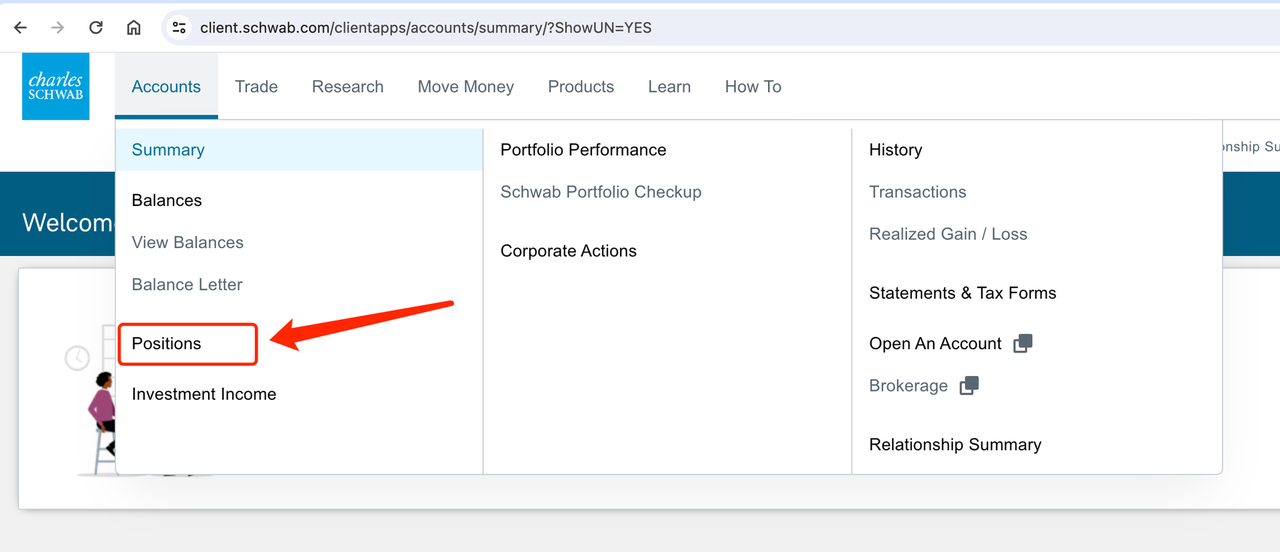

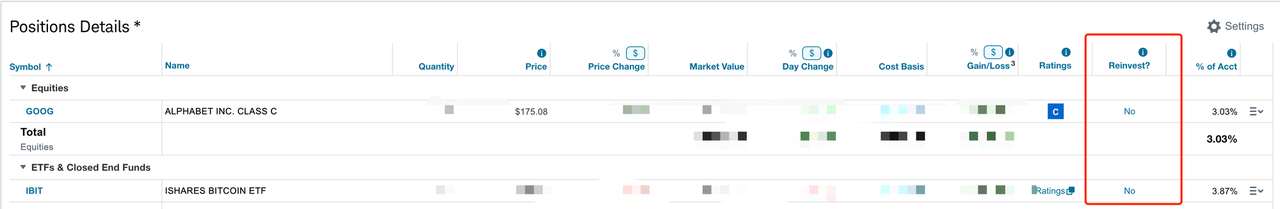

2. After logging into the Charles Schwab website, click Accounts at the top navigation, select Positions, which opens your holdings interface?

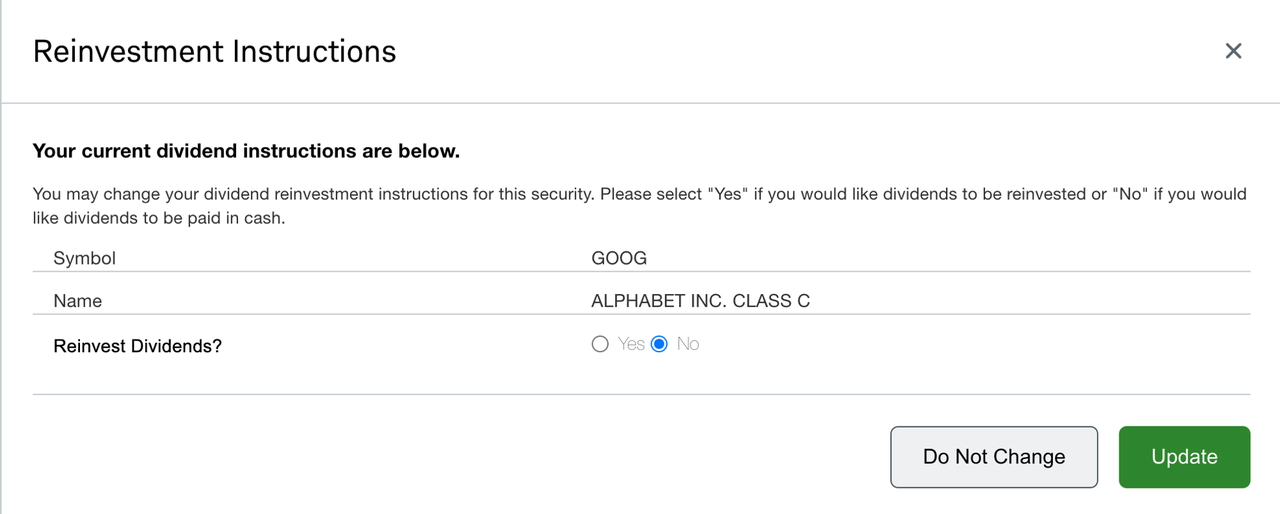

Scroll down to the holding details, and you’ll see a column labeled Reinvest.

Clicking on Yes or No allows you to change the setting.

Note, Charles Schwab currently does not have a global setting; you must activate DRIP individually for each stock. Additionally, ADRs cannot use dividend reinvestment.

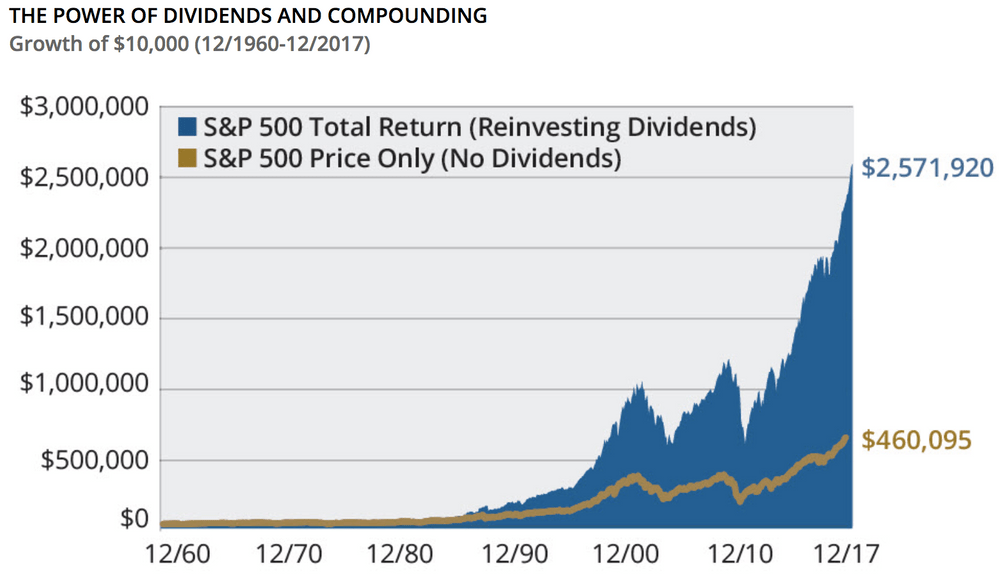

Compounding Effect of Dividend Reinvestment

Suppose we initially invested $100,000 in the S&P 500 index fund. According to data from 1960 to 2017, the broad market index has long-term growth, eventually yielding a total return of $460,095, as shown by the brown line in the graph. If we had turned on DRIP at the start of the investment, as shown by the blue line in the graph, we could have ended up with $2,571,920. The significant difference in total returns, I think, speaks volumes about the power of compound interest with DRIP. So, would you like to turn on your Dividend Reinvestment Plan—DRIP?