- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Robust Demand and Improved High-End Sector Profits Make Delta Air Lines Stock Appealing!

Key Trends in the Aviation Industry

- Demand Side: Strong Post-Pandemic Air Travel Demand:

- Strong Consumer Demand: Air travel continues to be the preferred mode of travel for Americans, with 40% inclined to fly more and only 8% planning to reduce air travel.

- Corporate Travel Recovery: Delta Air Lines reports that corporate clients, particularly in banking, automotive, entertainment, and IT sectors, expect to increase travel in 2024. Small and medium-sized enterprises also anticipate significant growth in business travel next year. These factors should sustain strong air travel demand.

- Robust International Route Demand: Flights from the U.S. to Asia are projected to grow at an annual rate of 14.2% by 2027.

- Economic Growth and Stable Macro Environment: Economists forecast U.S. GDP growth of 2.3% in 2024, with Q4 2023 GDP growth reaching 3.3%, far surpassing the 2% consensus. The inflation rate is expected to be 3.5% in 2024, and January’s unemployment rate is 3.7%, slightly below the 3.8% consensus but unchanged from the previous month. Unemployment is expected to remain stable at 3.9% in 2024, indicating a stable macro environment. Moreover, in the long run, the U.S. air transport market is projected to grow at 1.6-1.7 times the rate of GDP, with airline revenues exceeding GDP growth by over three times.

- High Airline Spending Continues:

- Rising Wage Costs: Most U.S. airlines have recently reached agreements with unions. Southwest Airlines signed a five-year deal with its pilots, resulting in a 50% wage increase over the next five years, potentially costing $12 billion. American Airlines and Emirates have agreements that will increase wages by about 40%, costing $10 billion. While most Delta employees are non-unionized, the company offers competitive wages and profit-sharing.

- Increasing Maintenance Costs: In addition to rising labor costs, airports are demanding higher fees due to significant investments in infrastructure. The Airports Council International (ACI) reports that U.S. airports need over $151 billion in investments over the next five years to maintain infrastructure.

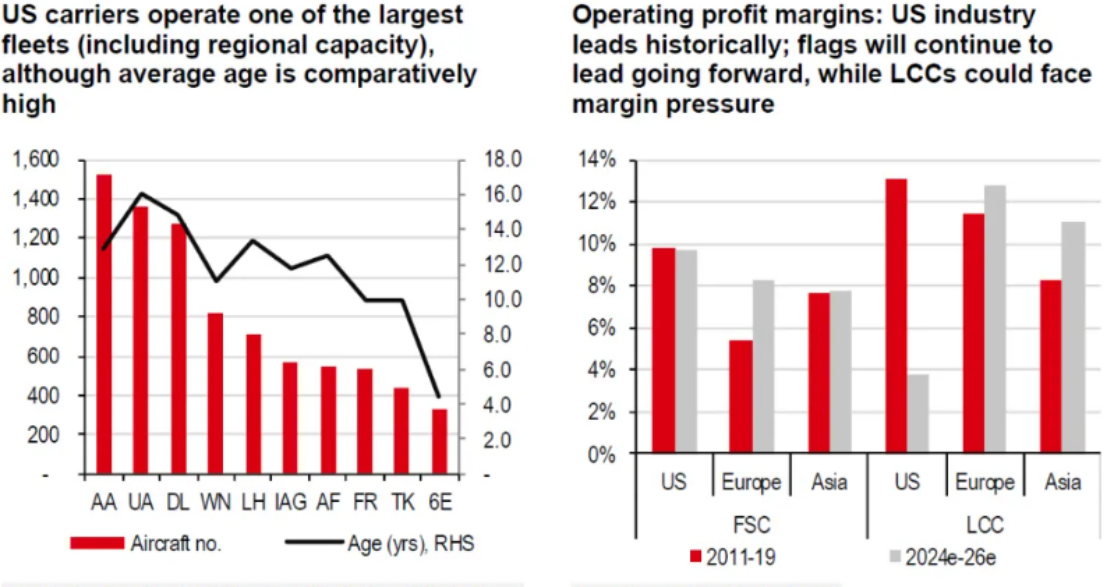

- Higher Profitability for Full-Service Airlines: Full-service airlines (Flags) offer multiple service classes (economy, business, first class), ensuring more stable gross margins compared to low-cost carriers (LCCs) in a high-cost environment. U.S. full-service airlines plan to increase premium seats by 40-70% between 2019 and 2026. For example, Delta aims to have premium seats account for 30% of total seats by 2024, increasing to 35% by 2025, up from 28% in 2019.

Comparing changes in Total Revenue Per Available Seat Mile (TRASM) helps us understand profitability differences among airlines.

Quick Facts: TRASM (Total Revenue Per Available Seat Mile) is a key financial metric in the airline industry, measuring revenue generated per available seat mile. It helps airlines assess revenue efficiency.

TRASM = Total Revenue / (Number of Seats × Number of Flights) / Flight Miles.

CASM (Cost Per Available Seat Mile) measures cost efficiency, representing the average cost to provide services per available seat mile.

CASM = Unit Cost / (Number of Seats × Number of Flights) / Flight Miles.

Full-Service Airlines

Delta Air Lines, Target Price: $72.80

DAL market trend, chart source BiyaPay App.

Reasons for Recommendation:

- Delta boasts a balanced and comprehensive network of routes, services, and partnerships, with a competitive edge on major routes.

- Focusing on the high-end market will yield healthy operating profit margins. Revenue from premium cabins rose from 18% in 2015 to 43% in 2023.

- Delta is the only major airline with a non-unionized workforce. Nevertheless, it offers generous pay and profit-sharing, maintaining strong employee relations and reducing strike risks. Wages account for 24% of net income, the lowest among major airlines.

- Financially, Delta has a robust balance sheet with a Net Debt / EBITDA ratio of 2.7 times, strong free cash flow yield, and an expected annual free cash flow yield (after capital expenditures) of 11.4% over the next four years, alongside healthy profit margins.

Additional Expectations:

As refinery capacity increases in the second half of the year, aviation fuel prices may drop, significantly boosting Delta’s profitability. CFO Dan Janki said, “Growth is normalizing, and we are in an optimization phase, focusing on restoring our most profitable core hubs and improving efficiency.” Like other airlines, Delta has slowed hiring post-pandemic and is focusing on efficiency.

Is It Time to Buy?

Delta’s current stock price is just seven times the midpoint of management’s expected 2025 earnings per share, suggesting the market lacks confidence in Delta’s operational execution and high-end customer momentum.

If consumer spending continues to shift from goods to services, and if Delta’s premium experience gains traction as management expects, the current stock price could be a long-term bargain.

If you, as an investor, are optimistic about Delta, consider monitoring the stock price through traditional brokers like Interactive Brokers, Charles Schwab, and Tiger Brokers, or through new multi-asset trading wallets like BiyaPay, and buy or sell at the right time.

BiyaPay not only allows USDT deposits to trade U.S. and Hong Kong stocks but also supports withdrawing USDT to deposit dollars and Hong Kong dollars to bank accounts, then withdrawing fiat currency to other securities for investment. This method is fast, with no deposit/withdrawal limits, allowing you to stay updated on stock trends.

Of course, investing in airlines carries significant risks. Their cost structure is highly dependent on commodity prices. Additionally, aircraft manufacturers’ productivity and quality control impact cost structures and industry growth. Lastly, the industry is closely tied to economic health. If the economy declines, air travel will decrease, and Delta’s profit expectations will be lowered. However, from a risk/reward perspective, the stock remains attractive before such declines occur.