- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Starbucks and Brown-Forman have become investors' new favorites after plunging 40%?

Source:Seeking alpha

Editor:BiyaPay Finance

The pullback of 2023 appears to be ending, with the US stock market on the verge of a brand-new record high.

Naturally, this brings many investors angst. After all, aren’t corrections healthy?

Yes, absolutely. The average year for stocks, 76% of which are positive, sees a 14% peak decline. That means, in any given year, a 14% decline would be normal, healthy, and average, and not necessarily that another bear market is coming, much less the 65% super crashes that doomsday prophets keep predicting.

This Isn’t A Bubble: It’s Good Earnings

According to data compiled by Bloomberg, the 459 companies in the S&P 500 that have reported this quarter have posted profits on average 8.4% higher than expected. About 79% have beaten profit expectations, compared to 76% last quarter." - Bloomberg

Earnings have been solid this quarter. We’ve experienced the highest quarterly beat average in the last three years. And do you know why? According to Bloomberg, the recent pessimism and “vibessession” might be to thank.

The anticipation of a recession may be contributing to the notable outperformance. Companies are shoring up their bottom line, cutting costs and stockpiling cash to stave off the impacts of an economic slowdown. Earnings revisions also dipped heading into the first quarter, leaving room for more upside potential." - Bloomberg

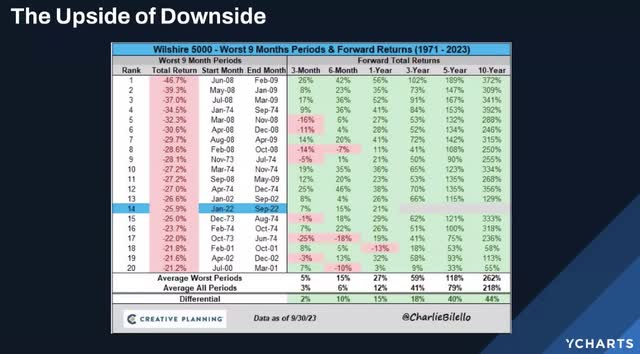

This is similar to how the best stock returns come from periods of maximum pessimism.

The deeper the decline, the better the returns. The average return after a severe bear market is 14% annually over the next decade, 40% more than the market’s 10% historical returns over the last 220 years.

It’s always and forever a market of stocks, not a stock market.

Non-tech stocks are expected to start seeing strong growth as the benefits of all those cost cuttings start to work their way through corporate America.

But there’s always a major risk when stock picking, and that’s why you might be picking one of these companies.

This brings us to today’s companies.

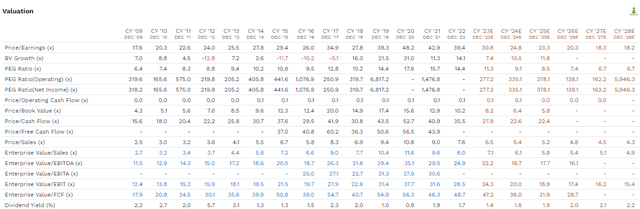

Starbucks (SBUX) and Brown-Forman (BF.B) are legendary dividend blue chips known for exceptional growth and impeccable dividend dependability.

Both are down almost 40% from record highs when the market steadily gains.

Let me quickly explain why Wall Street hates legendary blue chips and why both are likely strong buying opportunities, but only for two kinds of investors.

Starbucks: A Great Company Facing Tough Comps

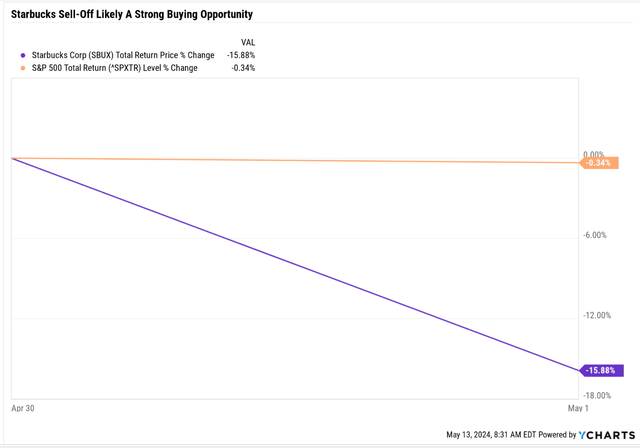

After disappointing earnings, Starbucks fell off a cliff, suffering its third-worst daily return in history.

SBUX was down as much as 20% on earnings day, so what did Wall Street freak out over?

According to some analysts, global comparable store sales for stores open at least one year were “shockingly” bad. They fell 4% globally, with traffic declining by 7% and prices rising by 3% (per average ticket).

Those poor comps would be bad enough in an economy with 3.5% inflation. However, in the last three months, they have fallen by 9% globally, and global traffic has fallen 10%.

You can see why the market might have freaked out, given that Starbucks is famous for its high-priced coffee and affluent and loyal user base.

Compared to analyst expectations, US comps missed about 4% and global comps by 10%.

In China, SBUX’s long-heralded growth engine, comps fell 11%.

A 10% traffic decline in three months is shocking and alarming. In the short term, Starbucks might have run out of growth levels. It’s been using various changes in its loyalty program, menu changes, and price hikes to offset decreased traffic declines.

In other words, in the short term, SBUX has hit the limit on how high it can charge customers.

The Bullish Case On Starbucks

Management has a high-tech solution to its growth woes: It will work with Microsoft (MSFT) and its AI platforms to double the number of loyalty program users to 150 million.

The idea is that loyalty members spend more than non-members, and SBUX envisions a “just-walk out” technology platform in stores.

That’s similar to Amazon’s (AMZN) plans for stores without checkout lanes.

Cost-cutting efficiency is also needed. According to management, $4 billion in additional savings over the next four years could boost operating margins by 12%.

So that’s the grand plan for SBUX’s sixth turnaround. AI-enhanced tech will make for frictionless checkout to drive top-line growth, and AI-enhanced cost-cutting will boost margins from 13% last year to 25%.

That’s a 100% potential boost to margins, according to management.

Great Theory And Great Endorsements

So, a plausible-sounding turnaround plan leveraging technology and AI to double down on what has made Starbucks great in the past while potentially doubling margins.

But how confident should investors be in this plan? After all, three of Starbucks’ five turnarounds were led by founder Howard Schultz, who is no longer on the board.

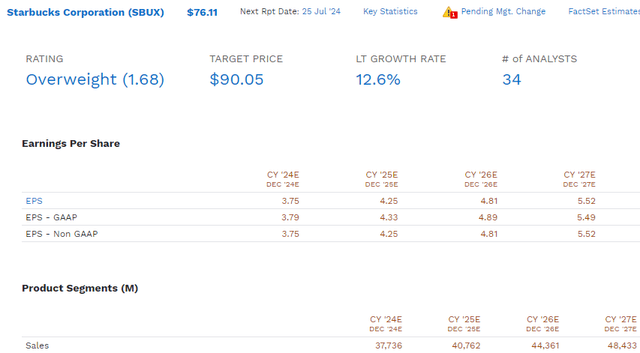

In the pre-earnings, the median long-term growth consensus for SBUX was 14.4%, and now it’s 12.6%, consistent with the last decade’s 12% annual growth rate.

The 3% yield appears to be a very low risk (the dividend safety score falls 5% to 83%, but there’s still approximately a 1% risk of a cut right now).

The consensus payout ratio of 61% for 2024 is only modestly elevated. The balance sheet remains in good shape.

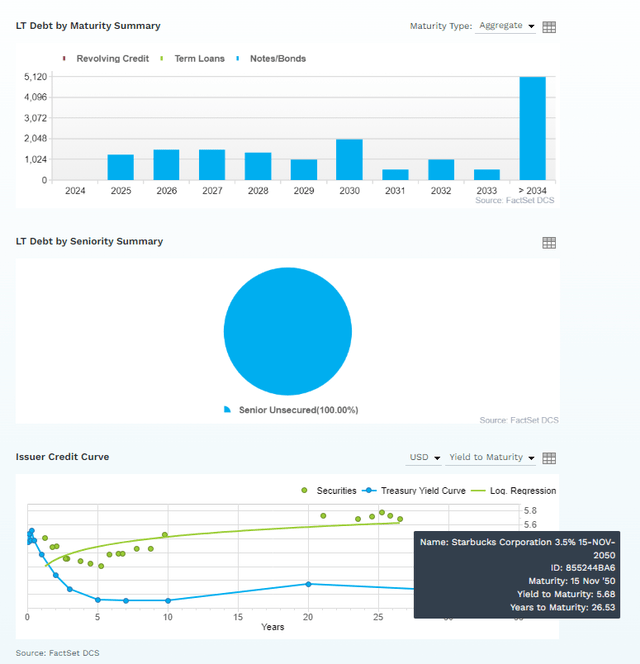

Rating agencies want to see 3X or less net debt/EBITDA for BBB+ stable-rated SBUX, and its current leverage ratio of 2.1 continues to move in the right direction.

The bond market is confident that SBUX will succeed in its turnaround. Its ability to borrow for a quarter century is just 1% above the 10-year Treasury risk-free rate.

SBUX is still generating healthy free cash flows which are expected to remain stable this year, thanks to cost-cutting, and next year hit a new record of $4.25 billion.

The dividend is expected to keep growing dependably, achieving a 17-year dividend growth streak in 2027 and growing at 10% annually for the next three years.If you are also considering investing in the market, it is recommended that you invest through channels that suit you. For example, as an investment platform, I recommend Interactive Brokers, Charles Schwab and BiyaPay. Among them, Interactive Brokers and Charles Schwab are American brokers, but their Chinese service experience is worse. But their transaction fees are really low.

Then there is BiyaPay, which is a wallet-type brokerage, similar to Alipay in mainland China. Online account opening, dual-interface service in Chinese and English. Moreover, their trading options are very rich. Not only can they trade US stocks, but they can also trade Hong Kong stocks, digital currencies, etc. They can be considered a relatively strong company. Moreover, this platform has a unique advantage, which is that it does not require an overseas bank card. You can directly exchange currencies on BiyaPay. Deposits to Jiaxin support both wire transfer and ACH. ACH deposits have zero bank fees. Same-day delivery, which is fast and convenient. .

5-Year Consensus Total Return Potential

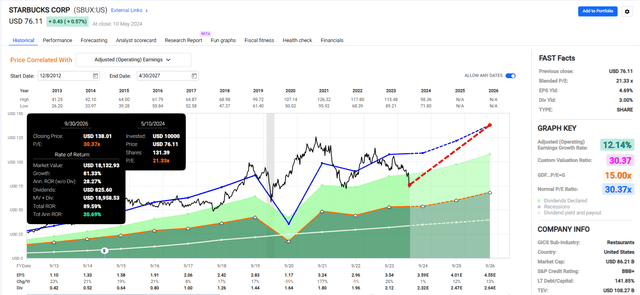

Over the next five years, if SBUX grows as expected, a return to its 10-year average of 30.37X earnings would result in 180% returns or 21% annually.

That’s 100% more total return potential than the S&P 500.

SBUX has grown 12% for the last ten years, similar to the 12.6% future growth the median growth consensus from 34 analysts.

And SBUX, growing 12%, has been valued at 30.4X earnings; that’s an objective fact.

Mind you - there are long periods when SBUX traded above and below its historical market-determined fair value, but about 30X earnings appear to be what hundreds of millions of cumulative investors over a decade have concluded that all of SBUX’s brand power, management quality, and 54% perfect risk management (last year, according to S&P) are worth.

As Ben Graham said, the market is a weighing machine over time, and as long as management can deliver on its turnaround, 15% to 16% long-term total returns and income growth (for DRIP investors) appear to be possible.

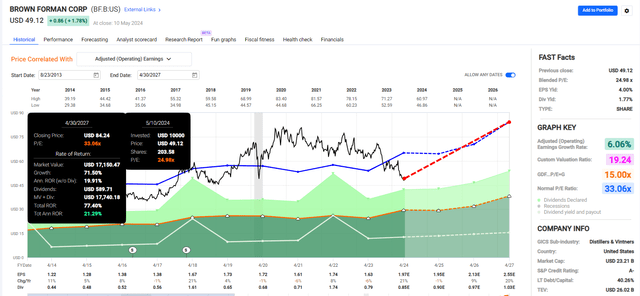

Brown-Forman: Legendary Dividend Aristocrat Finally Worth Buying

Brown-Forman has been raising its dividend for 39 consecutive years, a dividend aristocrat with a recession-resistant business model and an A-rated balance sheet.

It’s over 150 years old and is the leader in Tennessee whiskey and Kentucky bourbon, specifically Jack Daniel’s and Woodford Reserve.

It’s been diversifying into Tequila with Herradura. BF.B is a world leader in North American-inspired premium spirits.

BF.B has been in a bear market since early 2021, the peak for speculative stocks, including SPACs, non-profitable ARKK stocks, and crypto-related names.

Brown-Forman soared to 50X earnings during the pandemic based on the “story” that everyone was trapped at home, swimming in stimulus cash and buying a lot of “comfort” stuff, like whiskey.

That sounds plausible, but look at the EPS growth of BF.B during the pandemic.

- 2020: -1% EPS growth.

- 2021: -6%

- 2022: 8%

- 2023: -6%

- 2024 (consensus): 21%

- 2025 (consensus): -1% (consensus)

- 2026 (consensus): 9%

- 2027 (consensus): 20%

- 2019 to 2027: 5.0% annual EPS growth.

At no point during the Pandemic did BF.B justified its valuation; it was a pure “story,” the same kind of story as Wall Street pricing Rivian (RIVN) at $150 billion in value, 2X that of GM (GM) and Ford (F)… combined when it had no sales.

The Extent Of Brown-Forman’s Bubble: 56% Historical Premium

BF.B peaked at almost 60% historical premium, 6% worse than the S&P’s peak March 2000 tech bubble valuation.

No amount of quality, a strong balance sheet, or a wide moat is worth such a premium. And remember, we’re talking about the company’s historical market-determined fair value.

BF.B has grown 6% over the last decade and has been valued at 33X earnings. I’m not questioning that. Over 10 years, the market is 90% statistically likely to be right about a company’s valuation.

What about fundamentals? Has BF.B been struggling?

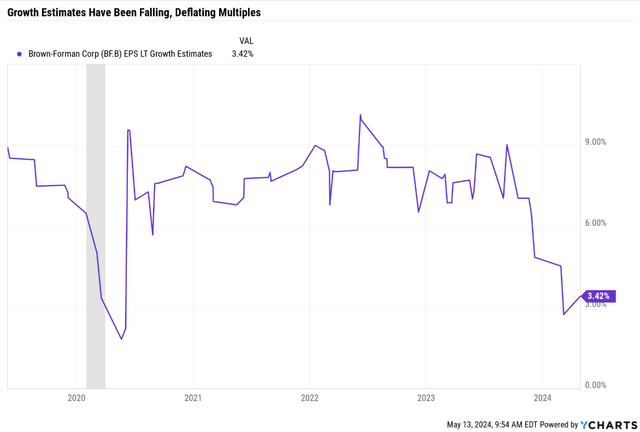

BF.B has been struggling with flat sales caused by increased competition from craft brewers, which took market share during the Pandemic.

Remember all those stimulus checks that were supposed to lead to a boom in whiskey sales?

There was a whiskey boom, but BF.B didn’t get it. They lost market share to the craft brewers that benefited from the $9 trillion stimulus and zero interest rates. When money was free, anyone and their mother could start a craft brewery and get venture capital funding.

Now that rates are back to normal, BF.B is expected to benefit from its A-rated balance sheet, which gives it almost $800 million in liquidity in an age where its rivals are now desperate to survive.

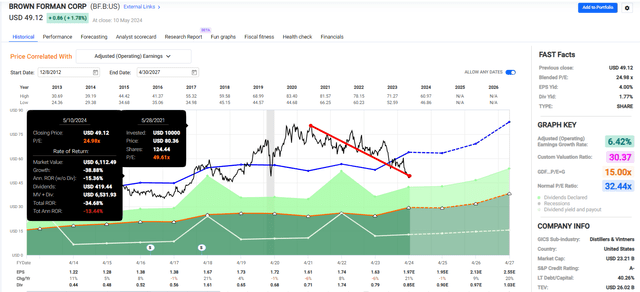

BF.B has a very solid 21% annual return potential… if its return to growth arrives as expected.

The return potential isn’t as impressive over the next five years since BF.B is not a particularly fast-growing company.

Its long-term historical growth rate has been 10% over the last 20 years, and analysts expect about 7% earnings growth in the future.

That means around 8% to 9% long-term total returns, including that 1.8% yield.

BF.B’s dividend is expected to grow 7% annually through 2028, the same as its earnings growth rate.

The safety and quality of this future dividend king are beyond dispute, but potential investors need to understand the catch with Brown-Forman.

Risk To BF.B Thesis

There are two main risks to any spirits company, not just BF.B. The first is that the government can and does change taxation. Remember, the margins on alcohol are legendary, and governments use “sin taxes” to generate revenue.

After the Pandemic debt binge, many governments are desperate to close deficit gaps, and sin taxes like alcohol and tobacco taxes are low-hanging fruit for raising tax revenues.

Second, there was competition from craft brewers, who proliferated like weeds in the soil of “free money forever!” during the Pandemic.

Analysts think that BF.B will be able to increase marketing in the coming years, launch new product lines, and, with less new competition, increase market share.

That, combined with cost-cutting, is expected to drive that impressive 30% EPS growth between 2025 and 2026.

However, you have to understand the tricky nature of spirits. Whiskey and Bourbon take several years to age properly; you can’t just increase and decrease capacity with the flip of a switch.

Companies like BF.B must estimate demand years in advance, which is another reason why the lack of a Pandemic whiskey boom for BF.B should have surprised no one who knows anything about the business.

However, the point is that the big boom in volumes and profits that analysts expect in the coming years are also “baked in” based on decisions management made years ago.

It’s like driving with the rear-view mirror. That’s just the nature of the spirits industry. Any investor must understand this unique risk.

Which brings us to another key risk to keep in mind.

These are the average valuations per year.

BF.B might average 30X earnings but can trade for long periods well above and below that amount.

In other words, BF.B can fall as low as 16X earnings in periods of maximum pessimism, giving it a lot more downside should that expected 30% EPS boom not appear.

That’s something to remember for this legendary dividend aristocrat, which will likely generate only 8% to 9% long-term returns.

Bottom Line: Starbucks And Brown-Forman Are Two Legendary Dividend Blue Chips Worth Buying

Starbucks and Brown-Forman are perfect examples of how it’s always and forever a market of stocks, not a stock market.

Of these two, I like Starbucks more for several reasons.

First, its 3% yield is meaningfully better than the market’s 1.5% and aristocrat’s 2.2%. Most importantly, the growth thesis appears intact, with 12% to 13% long-term dividend growth resulting in 15% to 16% long-term return potential.

In contrast, Brown-Forman is a bit more of a speculative opportunity. Its higher multiple is probably justified, but it relies on management having been right when it locked in future supply several years ago.

In other words, due to the unique nature of its supply chain, Brown-Forman can experience more problems in the next few years.

If I were buying BF.B, I would not be a “buy and hold forever” investor but rather a value investor looking to sell it when it becomes significantly overvalued, as it has several times in recent decades.

Starbucks is a solid dividend growth choice with a clearer path to double-digit growth.