- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

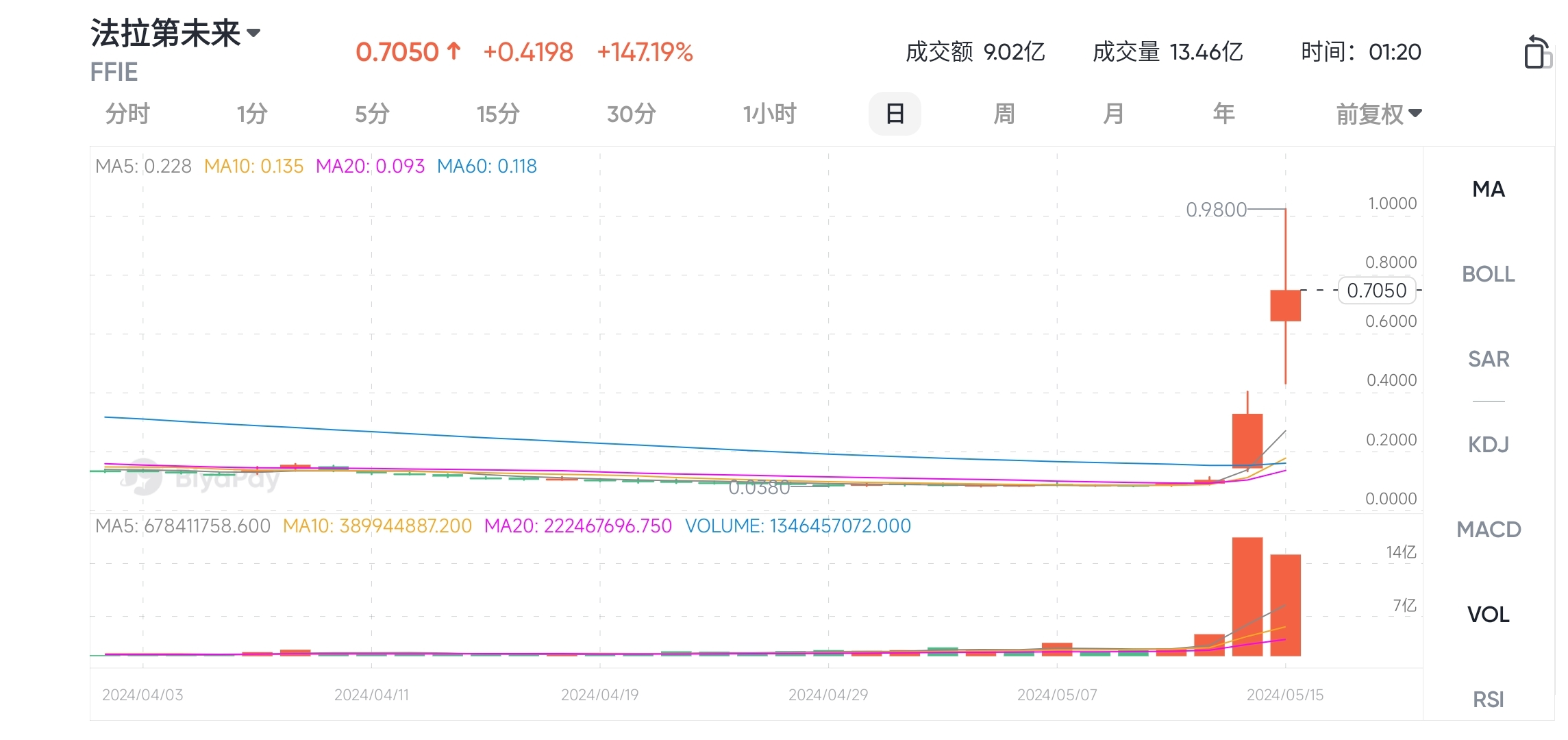

Faraday Future's stock price soared 370%! The reversal only takes a week! Can you still enter the ma

Over the past week, Faraday Future (Faraday Future, stock code: FFIE) experienced significant volatility and a dramatic increase in its stock price.

On May 14th, local time, Faraday Future (FF) shares surged 367.21%, closing at $0.285 per share, making it the second-highest gainer in the US stock market and bringing its market value back to $12.16 million. This marked the highest increase since FF went public.

Interestingly, not long ago, FF was at risk of being delisted by Nasdaq due to its low stock price. Yet, overnight, Faraday Future’s stock price skyrocketed by 367.54%!

According to The Paper, FF stated that this marks a successful start to founder Jia Yueting’s “FF Listing Qualification Defense Battle,” particularly with the nearly 370% increase in stock price, which has given tremendous confidence to both the capital market and the company’s internal team.

Reasons for Stock Price Volatility

In the past week, Faraday Future (FFIE) has experienced significant volatility, with its stock price rising nearly 370% so far. However, there has been no significant positive news from the company to justify this massive increase.

Some might wonder how the stock price could increase so much without any action from the company. The answer lies in the data: FFIE’s short interest ratio reached a staggering 95%, meaning 95% of the stock’s floating shares were sold short.

The likely reason for this phenomenon is the high-profile return of US retail investor Keith Gill. On the second day of his return, a large number of retail investors began targeting meme stocks again.

Among them, GameStop (GME) and AMC Entertainment (AMC) shares continued to soar. After impressive gains of 73% and 77% on Monday, GME and AMC continued to surge by 60% and 32% respectively, achieving their largest gains since June 2021 and January 2021.

However, such increases are typically driven more by collective investor interest and sentiment towards specific stocks rather than fundamental company analysis. It’s akin to choosing a car based on color rather than performance.

In the stock market, although many investors short stocks expecting prices to fall, once the market rebounds, short sellers are forced to buy back stocks to limit losses, driving up the price. However, this market behavior can only cause short-term volatility without substantial positive news, making this increase potentially short-lived.

If you are considering entering the market now, it’s recommended to choose investment channels that suit your risk preference. Investment platforms such as Interactive Brokers, Charles Schwab, and BiyaPay are recommended. Interactive Brokers and Charles Schwab are US brokers, but their Chinese service experience is somewhat lacking, although their trading fees are low.

BiyaPay, on the other hand, is a wallet-type broker similar to Alipay in China. It offers online account opening and bilingual services. Its trading products are diverse, including US stocks, Hong Kong stocks, and cryptocurrencies. BiyaPay is authorized by the US SEC and has a New Zealand FSP securities license, ensuring safe trading.

I am also using the BiyaPay app to trade US stocks because the platform has the advantage of not requiring overseas bank cards. You can exchange currency directly on BiyaPay, and it supports both wire transfer and ACH. ACH has zero bank fees and offers same-day deposit and arrival, focusing on speed and convenience without security concerns.

US Government’s Tariff Policy

On May 14th, the US government announced that the Biden administration would retain tariffs implemented by the previous Trump administration and impose additional tariffs on other Chinese goods. Tariffs on Chinese electric vehicles (EVs) will increase from the current 25% to 100%.

According to Southern Metropolis Daily, Xiang Song Capital’s analyst Chen Meng pointed out that FF is the only Chinese background EV concept stock developing locally in the US and might be the only EV Chinese concept stock not affected by the ban.

These two events happening on the same day could be related.

Company Status

Founder’s Attempt to Become CEO

We now know that the recent rise in Faraday Future’s stock price is due to short squeeze phenomena rather than actual developmental advantages. To maintain this upward trend, Faraday Future must take action in multiple areas to improve market fundamentals and enhance shareholder confidence.

On May 7th, FF founder and Chief Product & User Ecosystem Officer (CPUO) Jia Yueting posted a six-minute video on his social media platform, announcing the commercialization of his personal IP.

In the video, Jia stated that after careful consideration, he decided to co-serve as co-CEO with Matthias, sharing the responsibilities. He plans to commercialize his personal IP to “earn money as quickly as possible, part of which will be used to pay debts and part to support the company’s car-making efforts to maintain basic operations and instill confidence in investors and shareholders.”

The market reacted positively, with Faraday Future’s stock price rising by 5.8% that day. This increase reflected anticipation of Jia Yueting’s return to management, with the belief that his return could positively impact the company’s finances and development.

However, reality took a turn: FF issued a statement that day, clarifying that the information was released in Jia’s personal capacity and was unrelated to the company. Although the company appreciated his service, it had no plans to appoint him as co-CEO.

Electric Vehicle Segment

Faraday Future’s FF91 EV has started deliveries but at a slow pace. The company needs to optimize its production line, improve supply chain management, and expand production capacity to ensure timely delivery to consumers, thereby meeting market demand and boosting market confidence.

In the EV market, technological innovation is key to gaining a competitive edge. Notable automaker Tesla has heavily invested in battery technology and autonomous driving. Faraday Future should strengthen its technological innovations in the following areas:

- Battery Technology: Faraday Future has partnered with LG Chem, adopting a unique fully immersed battery cooling system. This cooling solution maintains the battery at optimal operating temperatures, reduces corrosion risk, increases total energy density, and enhances battery pack performance and lifespan. This innovative technology significantly improves vehicle range and charging efficiency, giving Faraday Future a competitive advantage in battery technology.

- Autonomous Driving Technology: Autonomous driving is a crucial direction for future car development. The company has released the FF 91 2.0 Futurist Alliance, equipped with the latest AI technology and luxurious features, showcasing its potential in technological innovation. Further breakthroughs will help the company gain a competitive edge in the fiercely competitive market.

By improving production and delivery efficiency and strengthening technological innovation, Faraday Future can maintain competitiveness and achieve sustained growth in the competitive market. This not only helps boost the company’s stock price but also enhances market confidence, attracting more investors and consumer attention.

Financial Risks

Maintaining the upward trend in stock prices is not easy, as Faraday Future still faces multiple risks, primarily financial pressure. Faraday Future’s financial risks have always been a concern for shareholders, especially with the recent delisting warning, further raising doubts about the company’s future development.

According to the latest financial report, the company currently has only $61.8 million in cash reserves, while it lost $78 million in the previous quarter. This imbalance is not good news for investors, and it is not the first time Faraday Future’s financial capabilities have been questioned.

Historically, Faraday Future’s financial situation has been turbulent. Initially relying on founder Jia Yueting’s pledge of LeEco shares, the Nevada factory project later failed due to financial issues.

In 2018, Faraday Future received investment from Evergrande Health, but the partnership soured within two months, resulting in a court battle. Subsequently, Faraday Future underwent massive layoffs, and co-founders left the company, leading to a bleak situation.

In March 2019, The9 Limited decided to invest and establish a joint venture with Faraday Future, but the market rejected the invitation, causing The9’s stock to drop by 20%. In October of the same year, Jia Yueting filed for personal bankruptcy in the US.

In 2021, Faraday Future faced scrutiny when J Capital Research published a 28-page report, questioning the company’s financial stability and business model, dubbing it a “money-sucking black hole.”

In December 2023, Nasdaq notified Faraday Future that its stock had closed below $1.00 for 30 consecutive trading days, not meeting listing requirements, and set a deadline for June 2024 to rectify the situation.

On April 18, 2024, Nasdaq notified Faraday Future again for violating listing rules, requiring a rectification plan within 60 days. On April 24, Nasdaq decided to delist Faraday Future. In response, Faraday Future stated that it had overcome many challenges and would not fall at this stage, deciding to request a hearing before May 1, 2024 (the latest allowed date) to appeal the delisting decision. During this period, the company’s securities will continue to be listed on the Nasdaq Capital Market.

Despite its resilient history, Faraday Future must demonstrate progress to gain shareholder and market confidence and avoid delisting.

Final Thoughts

In conclusion, while Faraday Future has recently experienced significant stock price volatility, it still holds long-term development potential, having weathered many challenges. The recent rise in stock price is mainly due to short squeeze phenomena, reflecting investor sentiment to some extent. The company has shown efforts and advantages in technological innovation and market expansion.

In terms of technology, an article in “Automotive Trends” highlighted some future specifications of Faraday Future’s electric vehicles: at specific energy levels, its performance will be 15% higher than Tesla’s Model S. Faraday Future’s collaboration with LG Chem to develop high-density batteries and the introduction of a fully immersed battery cooling system are technological breakthroughs expected to enhance vehicle range and charging efficiency, bolstering market competitiveness.

However, the Biden administration’s tariff policy, increasing tariffs on Chinese electric vehicles, negatively impacts the stock price. Higher tariffs mean more expensive imports of Chinese EVs, potentially weakening Faraday Future’s competitiveness in the US market.

Nevertheless, Faraday Future has unique advantages. As a US-based Chinese-background EV company, its primary production and sales activities are in the US, relatively avoiding direct impacts from the new tariff policy.

Jia Yueting stated that under US law, FF can help Chinese automakers and supply chains quickly enter the US market, reducing trial-and-error and time costs, and hopes to cooperate with Chinese automakers.

Overall, while Faraday Future faces significant short-term risks, particularly financial and delisting risks, its efforts in technological innovation and market expansion lay a solid foundation for future development. If the company can effectively respond to market and policy changes, FFIE’s stock price may achieve sustained growth.

Investors should closely monitor the company’s developments and market performance to make informed investment decisions, keeping in mind that investments carry risks and should be approached cautiously.