- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Supermicro's stock price plummeted and suffered a significant sell-off. Is now an opportunity for in

Summary

- Super Micro Computer’s stock saw a selloff after reaching $1,000 per share, but fundamental analysis shows that a selloff was unjustified.

- Demand for SMCI’s offerings is expected to remain robust due to large investments in AI infrastructure by major tech companies.

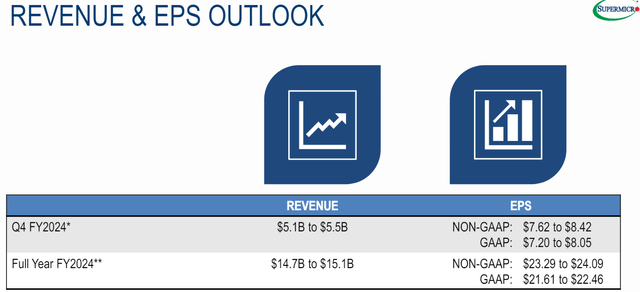

- SMCI’s guidance for the next quarter and full fiscal year indicates strong revenue growth and profitability expansion.

- The discounted cash flow (DCF) analysis conducted by the editor suggests that SMCI stock is more than 70% undervalued.

Introduction

This year, Supermicro’s stock once broke through $1000 per share, but this price became a strong resistance level. The stock price failed to maintain at this psychological level. The previous rise in the stock price was due to multiple factors such as strong industry growth, SMCI’s outstanding performance in the industry, and strategic cooperation with leading semiconductor companies. However, despite these bullish factors further strengthening in the third quarter of the 2024 fiscal year, due to investors’ uncertainty about the sustainability of AI-driven growth, the stock price further fell after the latest financial report was released, and investors began to take profits, causing further selling pressure on the stock.

However, as an investor who only relies on fundamentals, the editor tends to ignore non-fundamental factors in stock price fluctuations. Through analysis, the editor found that the stock still has a significant advantage, and the updated valuation analysis shows that the stock is still very attractive and worth investors’ attention. If investors have investment intentions, they can choose a more credible securities firm for investment. For example, Jiaxin Wealth Management is a globally renowned investment securities firm. By opening an account with Jiaxin Wealth Management, you can get a bank account with the same name. You can deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities for US stock investment. Of course, investors can also search for the SMCI stock code on the platform first, monitor the stock price regularly according to their investment strategy, and choose the appropriate time to buy stocks.

SMCI Market Trend, Chart BiyaPay App

Next, the editor will show you how this conclusion was reached through specific analysis.

Fundamental analysis

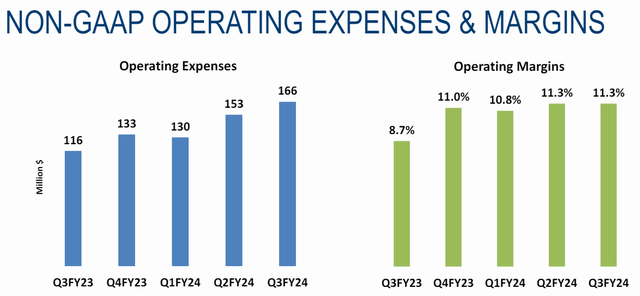

There were seven new articles about SMCI after the fiscal Q3 earnings release, and my peer authors already covered this report in deep details from different perspectives. What I want to indicate is just that the momentum is extremely strong as SMCI tripled its revenue YoY and more than tripled its adjusted EPS. The EPS strength was backed by the improved non-GAAP operating margin, which expanded from 8.7% to 11.3%.

According to the management’s discussion part of the latest 10-Q report, revenue strength was backed by the increased demand from customers for GPU servers, high performance computing (‘HPC’), and rack-scale solutions which are more complex systems. Therefore, the average selling price (‘ASP’) increase also positively affected the top line growth.

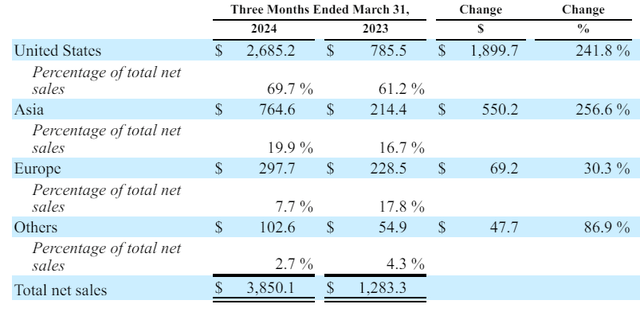

In my opinion, there is also a third important dimension for revenue dynamics, which is disaggregation between geographies. All geographic areas demonstrated stellar YoY revenue growth in fiscal Q3, which is an indication that the AI revolution is a global phenomenon. This suggests that revenue growth may be sustained for a longer period. All of the world’s most powerful economies are determined not to fall behind in the AI race, which is likely to drive demand for SMCI’s solutions for an extended period.

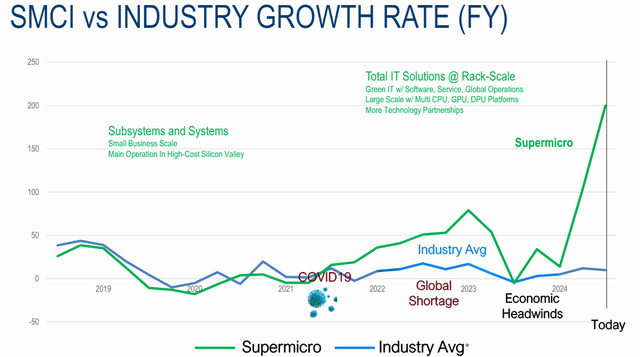

SMCI’s advanced applications, which necessitate optimized rack-scale solutions, are experiencing a surge in demand thanks to the advancements in Generative AI technology. Recent reports indicate that this demand is expected to persist at elevated levels for an extended period because several large players recently announced their multibillion investments in data centers that will leverage AI technology. Recent news suggest that Amazon (AMZN) plans to invest $150 billion in data centers in the next 15 years, meaning that it will on average pour $10 billion annually in AI infrastructure. The second largest project moneywise, according to information from Reuters, is planned by Microsoft (MSFT) and OpenAI, which will be worth a staggering $100 billion. Google (GOOGL) is expected to invest up to $9.5 billion in U.S. data centers in 2024 only. Therefore, I expect the demand for SMCI’s offerings to remain robust. Of course, SMCI is not alone in the space and competitors will definitely try to capture their portion in these projects. However, SMCI has a strong record of outperforming industry growth rate in recent years, which boosts my confidence that the company will be able to effectively absorb the significant data center spending from tech giants.

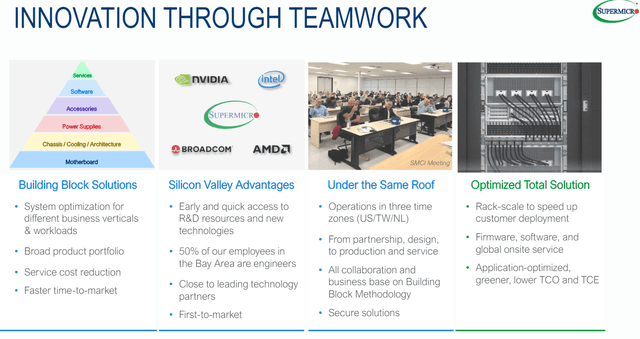

Super Micro maintains deep collaboration with Nvidia to integrate the most powerful AI chipsets into its server solutions. This includes the latest news regarding collaboration with Nvidia GH200 Grace Hopper superchips, where SMCI anticipates being an early market entrant. Moreover, SMCI has announced next-generation AI solutions that integrate the latest Nvidia GB200 Blackwell Superchip. Apart from tailoring its servers to Nvidia’s offerings, SMCI also works closely to partner with other HPC leaders like AMD MI300X, and Intel Gaudi AI accelerators.

As a result, SMIC’s guidance for the next quarter and full fiscal 2024 is strong. A $5.3 billion revenue is a midpoint of the management’s Q4 guidance, which will mean a 143% YoY growth. Midpoint Q4 adjusted EPS guidance is $8.02, indicating a 128% YoY growth and a 20% sequential growth. For the full fiscal 2024 the management expects revenue to be $14.9 billion at the midpoint of the provided range, meaning a 109% YoY growth.

For fiscal 2025, consensus estimates expect revenue to grow by 58% and the adjusted EPS to expand by 42%. This means that there is a high probability that SMCI will remain on its impressive revenue growth and profitability expansion trajectory, a strong bullish sign. As I mentioned, this optimism appears to be fair as the largest tech companies continue pouring tens of billions of dollars into AI infrastructure. My optimism is also backed by analysts of JPMorgan (JPM), forecasting a 43% revenue CAGR for SMCI between 2023 and 2027 as the company is expected to capture up to 15% market share in AI servers.

As I discussed above, there are numerous robust bullish signs that support my optimism. SMCI operates in a wildly hot market where it partners with all the largest semiconductor players, particularly Nvidia, which commands an impressive 80% market share in GPUs. The demand for data centers and high-performance chipsets is poised to remain robust, given all technological giants investing vast amounts in data centers worldwide. SMCI adeptly capitalize on these favorable trends, evident in its exceptional pace of EPS expansion. I think that the set of positive catalysts act as an unstoppable force, which makes me extremely bullish about SMCI.

Valuation analysis

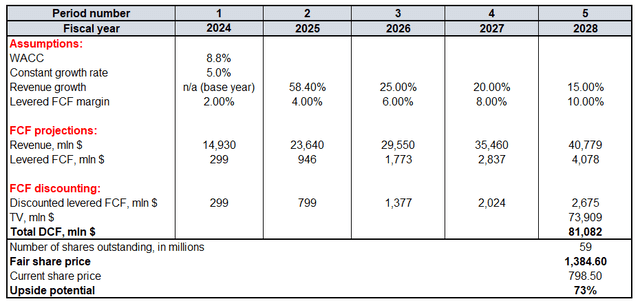

It is difficult to call “cheap” a stock that appreciated by 500% over the last calendar year, but my discounted cash flow analysis (‘DCF’) suggests that there is still a solid upside potential. After the recent pullback, the stock is 73% undervalued, according to my DCF.

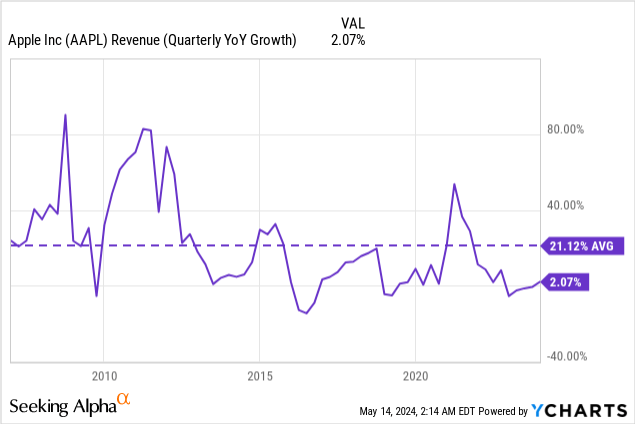

To calculate the upside potential, I have built a DCF model with an 8.8% WACC. For FY 2024 and 2025 I rely on Wall Street revenue estimates provided by Seeking Alpha. Forecasting for longer is always complex, but it is highly likely that above 50% revenue growth is unsustainable as the scale increases. Therefore, I expect a sharp revenue deceleration after 2025. Given the importance of SMCI in the current secular AI shift, I reiterate my 5% constant growth rate for the terminal value (‘TV’) calculation. Some might argue that using a 5% constant growth rate is too optimistic because it is multiple times higher than the U.S. long-term inflation averages. However, I agree with Jensen Huang, Nvidia’s CEO, who called the current stance for AI as the “iPhone moment”. As shown below, Apple (AAPL) demonstrated a 21% revenue CAGR since 2007 when the iPhone was first released. In this context, a 5% constant growth rate looks sound.

The company heavily invests in ramping up production to meet the demand, so I expect the free cash flow (‘FCF’) margin to be razor-thin in 2024, at 2%. However, trends demonstrate that SMCI has been historically quite successful in converting accounting profits into free cash flow. Therefore, I expect the metric to expand rapidly with strong revenue growth, by 200 basis points yearly. According to Seeking Alpha, there are 58.6 million SMCI shares outstanding.

My new target price is $1,385, and it is a substantial upgrade compared to my previous valuation analysis when I arrived at a $1,058 fair value. The stock price upgrade is primarily driven by the more optimistic long-term revenue growth outlook after JPMorgan shared their expected 43% industry CAGR between 2024 and 2027. I want to emphasize that I am conservative in my DCF and use a notably smaller CAGR of 33% between 2024 and 2027.

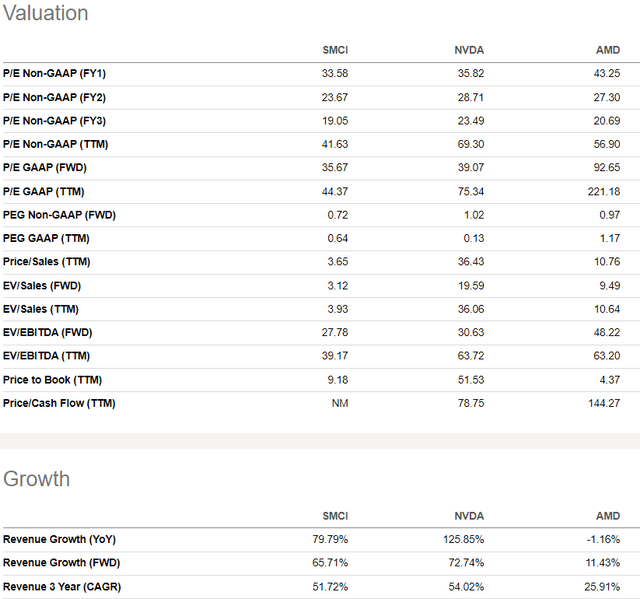

To cross-check the outcome suggested by DCF, I want to look at SMCI’s valuation ratios compared to other semiconductor stocks. Despite these names are not direct competitors to SMCI, AMD (AMD) and Nvidia (NVDA) are also considered to be major AI beneficiaries and these stocks also demonstrated strong rallies since early 2023. As indicated in the below table, SMCI is cheaper compared to both NVDA and AMD across almost all valuation ratios. Moreover, I want to emphasize that AMD’s TTM and FWD revenue growth is not even close to SMCI. Therefore, valuation ratios analysis also suggests that SMCI is undervalued.

Conclusion

SMCI exhibits unstoppable revenue growth momentum, and its profitability is expanding at an exceptionally rapid pace. I am very bullish about the company’s further growth potential as technological giants continue ramping up their data center investments and the company has strong cooperation with Nvidia, the company which leads the AI revolution in semiconductors. Therefore, SMCI is a ‘Strong Buy’, especially at current levels which provide a 73% upside potential.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Finally, a reminder that all investments carry risks, so investors should consider carefully and hopefully everyone will see favorable investment returns!

Source: Seeking Alpha

Editor: BiyaPay Finance